2 April 2023

In this post, I introduce a new format: Monthly Stock Idea Lab

Every week, I come across a dozen stocks that look initially interesting. I find them by reading the financial press, other investor blogs and letters, annual reports, listening to podcasts, speaking to fellow investors, doing periodical screens, and other sources.

I filter them to keep just one or two with the best risk/reward profiles. By the end of the month, I have between 5 to 10 stocks that I add to my watchlist. I wait for a better price or a stronger conviction depending on a particular case, before deciding to invest in a company. In most cases, a stronger conviction usually comes from a deep dive that I do later or if I address the critical issue behind the share price drop.

In case you have not read them, here are my three posts on this subject:

In most cases, these stocks remain on the watchlist, but the knowledge compounds over time.

Here is the list of seven exciting stocks for March 2023. To be clear, these are work-in-progress ideas that have passed some initial filters. These are not investment recommendations. More work is needed on each of them.

I. [Available to subscribers only. Please SUBSCRIBE to receive the full details by email in the future.]

II. [Available to subscribers only. Please SUBSCRIBE to receive the full details by email in the future.]

III. [Available to subscribers only. Please SUBSCRIBE to receive the full details by email in the future.]

IV. [Available to subscribers only. Please SUBSCRIBE to receive the full details by email in the future.]

V. [Available to subscribers only. Please SUBSCRIBE to receive the full details by email in the future.]

VI. Charles Schwab

VII. Barrick Gold (h/t to a long-term subscriber)

I filter them to keep just one or two with the best risk/reward profiles. By the end of the month, I have between 5 to 10 stocks that I add to my watchlist. I wait for a better price or a stronger conviction depending on a particular case, before deciding to invest in a company. In most cases, a stronger conviction usually comes from a deep dive that I do later or if I address the critical issue behind the share price drop.

In case you have not read them, here are my three posts on this subject:

- A New Investment Opportunity? My First Five Questions (Part 1) - Link

- How to Analyse a New Investment Opportunity (Part 2) - Link

- Investment Checklist: My Key Points of Focus - Link

In most cases, these stocks remain on the watchlist, but the knowledge compounds over time.

Here is the list of seven exciting stocks for March 2023. To be clear, these are work-in-progress ideas that have passed some initial filters. These are not investment recommendations. More work is needed on each of them.

I. [Available to subscribers only. Please SUBSCRIBE to receive the full details by email in the future.]

II. [Available to subscribers only. Please SUBSCRIBE to receive the full details by email in the future.]

III. [Available to subscribers only. Please SUBSCRIBE to receive the full details by email in the future.]

IV. [Available to subscribers only. Please SUBSCRIBE to receive the full details by email in the future.]

V. [Available to subscribers only. Please SUBSCRIBE to receive the full details by email in the future.]

VI. Charles Schwab

VII. Barrick Gold (h/t to a long-term subscriber)

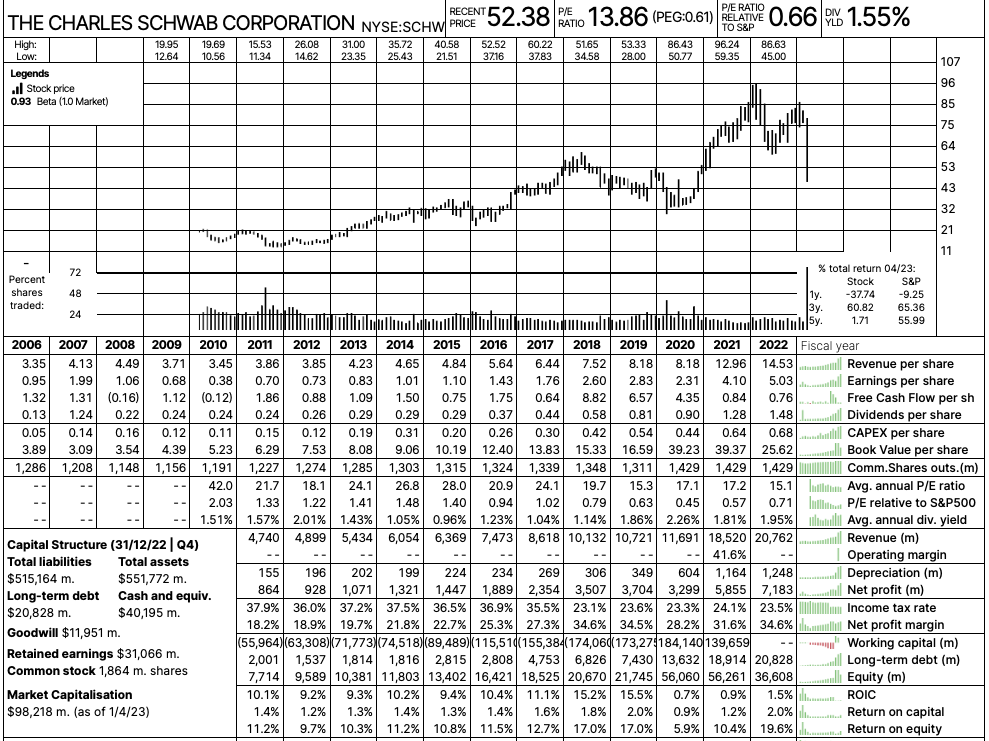

VI. Charles Schwab

Ticker: SCHW US

Share price: $52.4

Mkt Cap: $95.6bn

Share price: $52.4

Mkt Cap: $95.6bn

Charles Schwab is the leading retail broker in the US, which has been in business for almost 50 years. Its current CEO, Walt Bettinger, has been with the company since 1995 and owns 2.6mn shares of Schwab. The founder of the company, Mr Schwab, remains its chairman and owns 6.1% of the company.

Charles Schwab has generated tremendous value for its shareholders (18% annual return, not including dividends) over the past 34 years. During 2002-2022, it has achieved a 21% EPS CAGR, having operated across various cycles and under different macro conditions.

Charles Schwab has generated tremendous value for its shareholders (18% annual return, not including dividends) over the past 34 years. During 2002-2022, it has achieved a 21% EPS CAGR, having operated across various cycles and under different macro conditions.

It is known for one of the best customer services and constant innovations to offer the best products. In 2019, it announced a merger with one of its key competitors, TD Ameritrade.

$SCHW share price is down 40% as its bond portfolio is facing severe mark-to-market losses.

It earned $3.9 EPS last year and is expected to generate $4.4 EPS in 2023, which puts it under 12x on current PE, based on consensus estimates.

As the company stated in its latest 10-K:

$SCHW share price is down 40% as its bond portfolio is facing severe mark-to-market losses.

It earned $3.9 EPS last year and is expected to generate $4.4 EPS in 2023, which puts it under 12x on current PE, based on consensus estimates.

As the company stated in its latest 10-K:

“ to access new Federal Home Loan Bank advances or roll over existing advances, our banking subsidiaries must maintain positive tangible capital, as defined by the Federal Housing Finance Agency. Larger unrealised losses on our available for sale (AFS) portfolio due to higher market interest rates could negatively impact our tangible capital.”

Its Tier 1 leverage ratio was 7.2% at the end of 2022 (7.3% for the banking subsidiary).

At the end of 2022, the company had $15.6bn unrealised losses arising from the difference between the book value of Held-to-maturity securities and their market value. Its total equity was $36.6bn.

So the two key questions are:

At first glance, the company should be able to avoid raising new capital because:

One way to improve the liquidity position for Charles Schwab is to slow down new loans and investments and let the incoming interest accumulate on its balance sheet.

Moreover, it has successfully navigated previous crises, including in 1987, 2000 and 2008. In his autobiography, Invested, Schwab discusses in detail previous episodes.

As long as the company can maintain enough liquidity, its mid-term outlook looks strong. The broker benefits from higher interest rates as it can focus more on clients’ cash balances (low rates during the past decade were a significant headwind). Besides, the full integration with TD Ameritrade will be completed by 2024, which should positively impact its operations.

At the end of 2022, the company had $15.6bn unrealised losses arising from the difference between the book value of Held-to-maturity securities and their market value. Its total equity was $36.6bn.

So the two key questions are:

- Whether the company will need to raise new capital to fight the deposit outflow (most of it is going into money-market funds and other high-yield products offered by Charles Schwab itself).

- How much its earnings will compress as the company replace cheap deposit funding with more high-cost options.

At first glance, the company should be able to avoid raising new capital because:

- Under the newly established Bank Term Funding Programme (BTFP), it can exchange US Treasuries, agency debt and mortgage-backed securities, and other qualifying securities at par for 1-year loans from the Fed. In other words, instead of selling bonds at market prices below book value, Charles Schwab can sell them to the Fed at nominal value.

- It generates $100bn of cash flow from its cash assets on hand as well as net new assets it plans to realise over the next twelve months.

- Charles Schwab estimates that it has over $8bn in potential retail CD issuances per month.

- The company also estimates it has over $300bn of incremental capacity with the Federal Home Loan Bank (FHLB).

One way to improve the liquidity position for Charles Schwab is to slow down new loans and investments and let the incoming interest accumulate on its balance sheet.

Moreover, it has successfully navigated previous crises, including in 1987, 2000 and 2008. In his autobiography, Invested, Schwab discusses in detail previous episodes.

As long as the company can maintain enough liquidity, its mid-term outlook looks strong. The broker benefits from higher interest rates as it can focus more on clients’ cash balances (low rates during the past decade were a significant headwind). Besides, the full integration with TD Ameritrade will be completed by 2024, which should positively impact its operations.

VII. Barrick Gold

Ticker: GOLD US

Share price: $18.6

Mkt Cap: $32.6bn

EV: $32.9bn

Share price: $18.6

Mkt Cap: $32.6bn

EV: $32.9bn

This idea was flagged by a long-term subscriber to this blog, who preferred to remain anonymous.

Here is his summary:

I have briefly looked at the company, and here are my thoughts.

Barrick is probably the world’s best operator of gold assets, the largest gold producer in the US and one of the leading producers globally. It has the largest portfolio of tier-1 gold assets in the world.

The company has returned c. 5% cash to shareholders via dividends and buybacks with plans to increase distributions in the future. Importantly, the company has paid back almost $4bn of net debt since 2019 and now has essentially a zero net debt position.

At spot prices, it generates around $4bn of FCF (including $850m dividends from equity investments), on my estimates. With a market cap of $32.5bn, Barrick’s FCF yield is about 12.5%, on my back-of-the-envelope estimates.

There are two main reasons to own Barrick:

1. Hedge against inflation and financial instability.

2. Growing copper production (c. 25% of the business in the future).

Bear in mind that gold stocks have historically traded at a 2-3% FCF yield, as investors were happy to hold them as an option on future growth in gold prices/inflation. Today, inflation is rising, and gold prices have started to move higher (up over 20% since October 2022).

Here is his summary:

- Great gold mining assets

- Growth copper assets

- A very well-run company able to grow its asset base

- Strong financial position with the capacity to buyback shares

- Will benefit once oil price comes down

- The current price is cheap and protects the portfolio against additional inflation

I have briefly looked at the company, and here are my thoughts.

Barrick is probably the world’s best operator of gold assets, the largest gold producer in the US and one of the leading producers globally. It has the largest portfolio of tier-1 gold assets in the world.

The company has returned c. 5% cash to shareholders via dividends and buybacks with plans to increase distributions in the future. Importantly, the company has paid back almost $4bn of net debt since 2019 and now has essentially a zero net debt position.

At spot prices, it generates around $4bn of FCF (including $850m dividends from equity investments), on my estimates. With a market cap of $32.5bn, Barrick’s FCF yield is about 12.5%, on my back-of-the-envelope estimates.

There are two main reasons to own Barrick:

1. Hedge against inflation and financial instability.

2. Growing copper production (c. 25% of the business in the future).

Bear in mind that gold stocks have historically traded at a 2-3% FCF yield, as investors were happy to hold them as an option on future growth in gold prices/inflation. Today, inflation is rising, and gold prices have started to move higher (up over 20% since October 2022).

The reader has summarised his views in the following way:

“The company is essentially stronger than in 2019 as their reserves are higher for both gold and copper, and the price of gold is much higher. Yet, its share price, having reached $30 in 2020, is now back to 2019 level ($15-18).

In the Worst case, the stock will trade laterally with a decent dividend yield supported by their buyback if gold comes down towards $1,300-1,500/oz.

The Best case is a 75%-100% upside if gold and copper stay at today's levels, supported by the downward price of oil cost and cheaper energy sourcing from renewables.

I am grateful to the subscriber for sharing his recent investment idea (he asked me not to reveal his name).

Thank you for reading this article. It would be great to hear your feedback on any of these names. Feel free to drop an email to ideas AT hiddenvaluegems.com.

Did you find it helpful? If you want to read my next article in full and right when it comes out, please subscribe to my Newsletter.