15 June 2025

I had a great trip to Denmark this week, spending three days at the Nordic Value conference, organised by Ole Soeberg. The weather was slightly disappointing, but we were there for ideas, not the beach.

All 35 participants had to present one stock idea.

My pitch was on Trustpilot, a risky endeavour at a value conference. Trustpilot trades at 59x P/E, based on consensus 2026 estimates. You can see all of my slides here (the link is accessible to Premium subscribers).

However, value investing is not just about cheap companies. It is first and foremost about buying businesses at prices below intrinsic value and having a margin of safety. It is often about contrarian thinking, too.

More importantly, in the case of Trustpilot, its earnings are under-reported. It operates a high-quality business model. It is currently priced significantly below its intrinsic value, requiring a contrarian approach to spot the opportunity.

I explain this in more detail below.

All 35 participants had to present one stock idea.

My pitch was on Trustpilot, a risky endeavour at a value conference. Trustpilot trades at 59x P/E, based on consensus 2026 estimates. You can see all of my slides here (the link is accessible to Premium subscribers).

However, value investing is not just about cheap companies. It is first and foremost about buying businesses at prices below intrinsic value and having a margin of safety. It is often about contrarian thinking, too.

More importantly, in the case of Trustpilot, its earnings are under-reported. It operates a high-quality business model. It is currently priced significantly below its intrinsic value, requiring a contrarian approach to spot the opportunity.

I explain this in more detail below.

An outstanding business model

Trustpilot is an open consumer review platform, founded in 2007 by a young Danish entrepreneur, Peter Muhlmann.

The company is a unique business with strong network effects, capital light, widening moat, and subsidised marketing (i.e. businesses pay Trustpilot to use its logo in their ad campaigns.

The company is a unique business with strong network effects, capital light, widening moat, and subsidised marketing (i.e. businesses pay Trustpilot to use its logo in their ad campaigns.

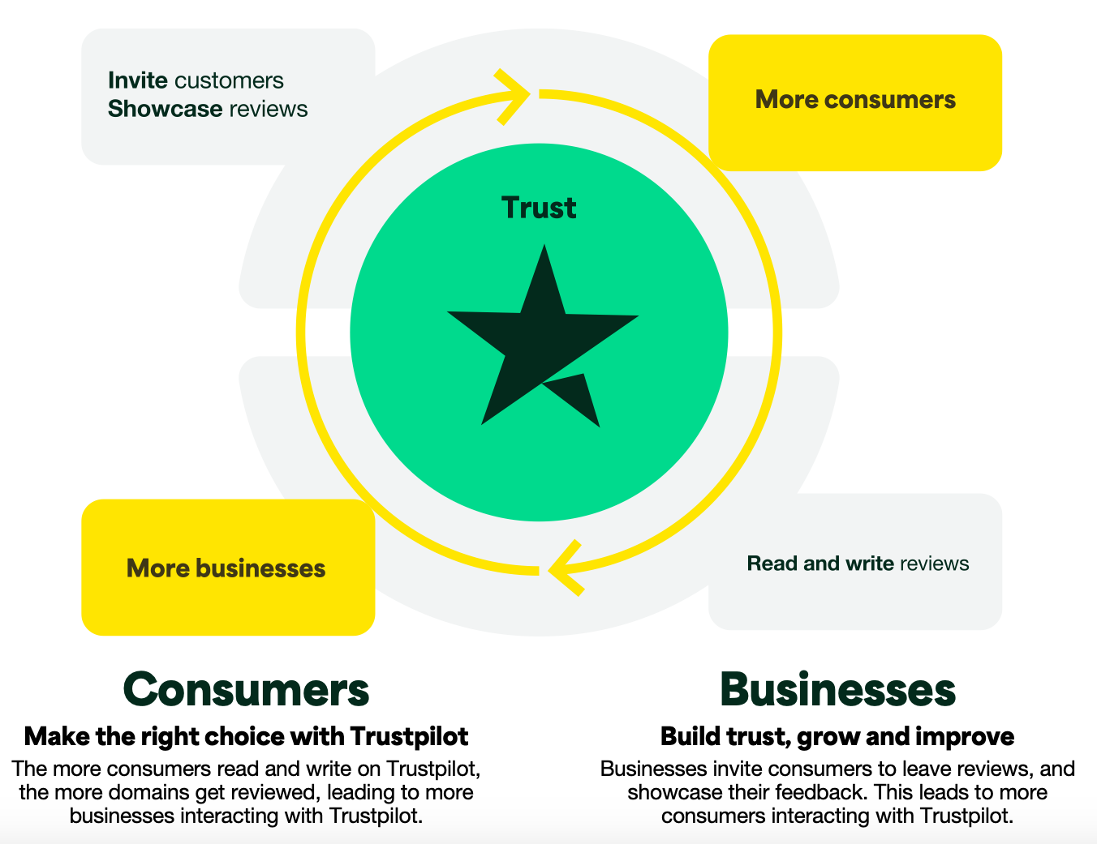

Network effects

Everyone can leave a review if they purchased a product or dealt with a particular business. The more people leave reviews, the more relevant they become, impacting consumer decisions. This attracts businesses to respond and to invite other consumers to leave reviews, keeping the flywheel in motion.

Source: Trustpilot Investor Relations Presentation 2025

Capital light

Most operations require little incremental capital. Consumers leave reviews because Trustpilot is one of the largest open platforms (after Google) and a market leader in certain countries (e.g., the UK). Trustpilot does not pay consumers to leave reviews, so the costs for new content are essentially zero.

As a typical SaaS company, Trustpilot benefits from upfront customer payments and working capital inflows. The company has no bank debt and a cash position of $69mn.

As a typical SaaS company, Trustpilot benefits from upfront customer payments and working capital inflows. The company has no bank debt and a cash position of $69mn.

Moat

Trustpilot's size and brand value ultimately become its competitive moat, as consumers would not trust unverified reviews left on a new platform. At the end of 2024, Trustpilot had 301 million cumulative reviews, comparable to Yelp (308 million), although the latter has predominantly US-based businesses (mostly in the Restaurant sector). Reviews on Trustpilot cannot be incentivised, and all reviews are shown to visitors, increasing their credibility in consumers' eyes.

Just like with rating agencies or Big 4 accounting firms, there could be only a few global leaders, even though writing a credit research report or conducting an audit is technically not a very complex or unique operation. Given the time these leading companies have been in the business, newcomers will struggle to challenge their positions even if they can provide the same service at a lower cost.

Just like with rating agencies or Big 4 accounting firms, there could be only a few global leaders, even though writing a credit research report or conducting an audit is technically not a very complex or unique operation. Given the time these leading companies have been in the business, newcomers will struggle to challenge their positions even if they can provide the same service at a lower cost.

Getting paid for being promoted

Customer acquisition costs and brand marketing are often significant expense items for businesses. Trustpilot is unique because businesses pay Trustpilot if they want to use its logo in their ad campaigns or on their websites. And the more companies want to use that logo, the more they must pay Trustpilot. In other words, the more they display the Trustpilot logo to consumers, the more money Trustpilot collects.

As its brand strengthens, other businesses become more willing to sign a contract with Trustpilot.

As its brand strengthens, other businesses become more willing to sign a contract with Trustpilot.

Why businesses pay Trustpilot

Ratings impact consumer choice. 89% of UK consumers say that ratings and reviews influence their choice. 56% of UK consumers would not buy from a brand that has a poor Trustpilot score (2 stars or less).

Usually, a frustrated consumer is the first to leave a review, which lowers a company’s rating. The only way for such a company to improve is to invite all customers, including those who are happy with the product, to leave a review and ‘dilute’ the negative ones. A free plan allows businesses to send only 50 invitations in one month.

Trustpilot logo increases conversion rates. UK consumers are 6x more likely to click a Trustpilot co-branded ad with the Trustpilot logo and stars.

A quick payback and high ROI. According to several studies, businesses that choose a premium plan with Truspilot often achieve a six-month payback and an ROI of 400%+.

Trustpilot reviews increase a business’s web ranking. Smaller companies that want to improve their presence on the Internet benefit from a higher ranking in Google, as Trustpilot reviews often come on top (Trustpilot has a strategic agreement with Google).

The stats supporting these statements are based on several studies by Forrester, London Research, Kantar and others.

Usually, a frustrated consumer is the first to leave a review, which lowers a company’s rating. The only way for such a company to improve is to invite all customers, including those who are happy with the product, to leave a review and ‘dilute’ the negative ones. A free plan allows businesses to send only 50 invitations in one month.

Trustpilot logo increases conversion rates. UK consumers are 6x more likely to click a Trustpilot co-branded ad with the Trustpilot logo and stars.

A quick payback and high ROI. According to several studies, businesses that choose a premium plan with Truspilot often achieve a six-month payback and an ROI of 400%+.

Trustpilot reviews increase a business’s web ranking. Smaller companies that want to improve their presence on the Internet benefit from a higher ranking in Google, as Trustpilot reviews often come on top (Trustpilot has a strategic agreement with Google).

The stats supporting these statements are based on several studies by Forrester, London Research, Kantar and others.

Why the opportunity exists

Trustpilot was listed at 265p during the post-COVID mania, surging past 400p in less than six months.

It is listed in London, a market known for low P/E stocks. The stock does not appeal to many domestic investors, who tend to favour income and dividend yields..

It is not well-known in the US yet. US-listed companies with user-generated content, such as Yelp and Tripadvisor, have a disappointing history and low valuations.

Trustpilot is very expensive on headline multiples (c. 59x and 30x P/E and EV/EBITDA on 2026 consensus estimates). It is neither the fastest-growing SaaS company nor the highest-earning in that sub-industry.

The market does not appreciate the inflexion in profitability that is taking place. Trustpilot increased its G&A personnel by over 50% in 2019-2021, ahead of the IPO. It has also increased the number of IT personnel to automate more services, including detecting fake reviews and offering businesses more insights into their performance.

Neither of these categories should grow significantly in the future.

It is listed in London, a market known for low P/E stocks. The stock does not appeal to many domestic investors, who tend to favour income and dividend yields..

It is not well-known in the US yet. US-listed companies with user-generated content, such as Yelp and Tripadvisor, have a disappointing history and low valuations.

Trustpilot is very expensive on headline multiples (c. 59x and 30x P/E and EV/EBITDA on 2026 consensus estimates). It is neither the fastest-growing SaaS company nor the highest-earning in that sub-industry.

The market does not appreciate the inflexion in profitability that is taking place. Trustpilot increased its G&A personnel by over 50% in 2019-2021, ahead of the IPO. It has also increased the number of IT personnel to automate more services, including detecting fake reviews and offering businesses more insights into their performance.

Neither of these categories should grow significantly in the future.

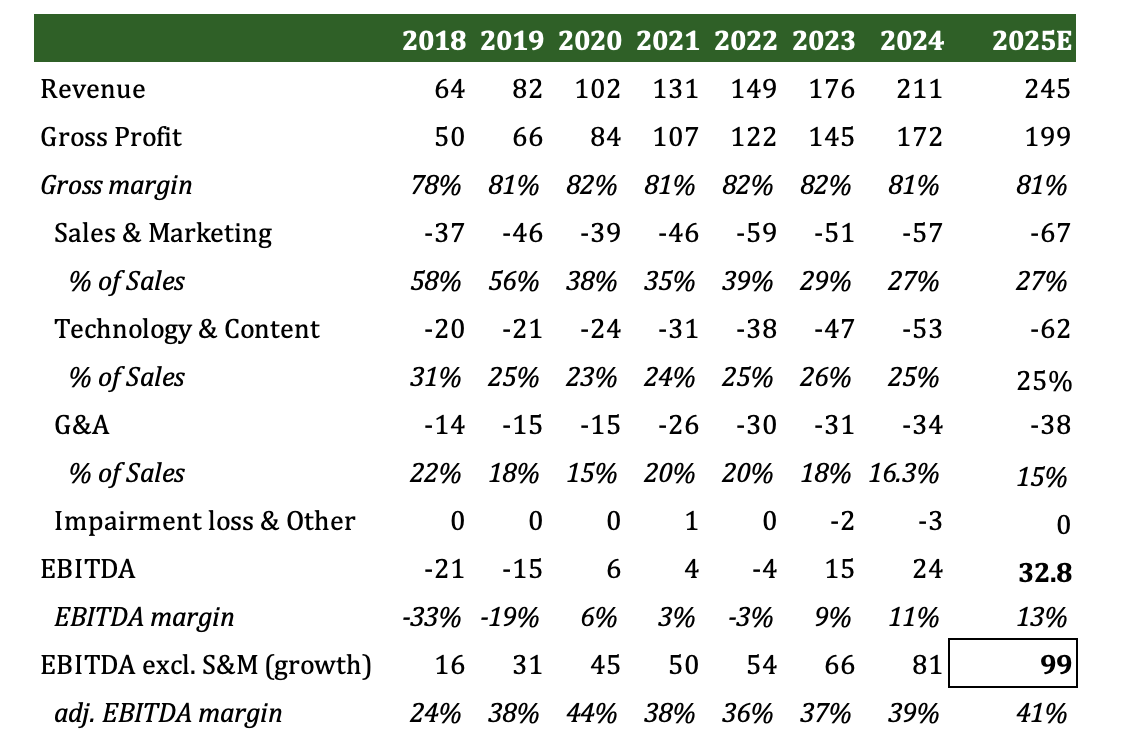

Source: Trustpilot financial reports; Hidden Value Gems

I believe consensus estimates are conservative, with Sales growth expected at 16.7% and 16.8% in 2025 and 2026, respectively. My own estimates suggest growth could be 18-19% in 2025 and potentially over 20% in 2026.

I explain my arguments about the inflexion point in Trustpilot’s profitability in the last section of this article.

I explain my arguments about the inflexion point in Trustpilot’s profitability in the last section of this article.

How much is it worth?

Sell-side analysts usually use the EV/Sales multiple to value Trustpilot. The company trades at 4.6x compared to a sector average of 7.1x, although the range is quite wide.

Such an approach fails to differentiate companies at different growth phases and profitability profiles. I suggest using three other methods, all of which point to significant upside in its shares.

Such an approach fails to differentiate companies at different growth phases and profitability profiles. I suggest using three other methods, all of which point to significant upside in its shares.

Replacement costs

The first approach is to estimate how much it would take a competitor to build an alternative platform with the same characteristics (web traffic, number of reviews, brand recognition, etc.).

I use three metrics: 1) Costs to generate the same amount of traffic (64mn monthly visitors); Costs to generate the same amount of reviews (Trustpilot had 301mn cumulative reviews at the end of 2024); and 3) Costs to achieve 140bn annual ad impressions (on TV, outdoor and online).

The costs to achieve such metrics can vary, as visitors' quality may differ. So the values shown below are very approximate. However, the point is that the current Mkt Cap of Trustpilot (£947mn) is significantly lower than the potential costs to build the same platform from scratch ($2-4bn).

I use three metrics: 1) Costs to generate the same amount of traffic (64mn monthly visitors); Costs to generate the same amount of reviews (Trustpilot had 301mn cumulative reviews at the end of 2024); and 3) Costs to achieve 140bn annual ad impressions (on TV, outdoor and online).

The costs to achieve such metrics can vary, as visitors' quality may differ. So the values shown below are very approximate. However, the point is that the current Mkt Cap of Trustpilot (£947mn) is significantly lower than the potential costs to build the same platform from scratch ($2-4bn).

Normalised earnings

Trustpilot is significantly under-earning. As a software company, it does not require any physical assets to run the business. Traditionally, companies report annual expenses in the P&L that reduce profits, while long-term investments in assets that will be used in operations for several years are reported in the Cashflow statement.

A business with physical assets may report $100mn earnings and reinvest all of them back in the business (by expanding its asset base). This would lead to zero FCF, but not zero value. The business may still be worth 15x earnings ($1.5bn) and probably more if incremental investments generate high returns.

Trustpilot's major ‘growth’ investment is its investment in customers, which are reported as Sales & Marketing expenses in the P&L, not in the Cashflow statement.

Even though such expenses are made within 12 months and lower reported profits in the period, they help acquire customers who, on average, stay almost 7 years.

Treating such Marketing expenses as ‘growth’ investments can reveal the true underlying profitability of the business in a more steady state.

Trustpilot generates 81% gross margin (contract revenue less customer service costs and related IT expenses).

Sales & Marketing account for 27% of Revenue (down from 58% in 2018).

Trustpilot’s EBITDA margin for 2024 came in at 11%.

If Marketing & Sales expenses are treated as ‘growth’ investments and added back to earnings, its EBITDA margin would have been 38% in 2024.

Below are my estimates for 2025. Management guides 200 basis points expansion in EBITDA margin (which is likely conservative). Adding 27% marketing spend leads to 41% margin ($99mn).

A business with physical assets may report $100mn earnings and reinvest all of them back in the business (by expanding its asset base). This would lead to zero FCF, but not zero value. The business may still be worth 15x earnings ($1.5bn) and probably more if incremental investments generate high returns.

Trustpilot's major ‘growth’ investment is its investment in customers, which are reported as Sales & Marketing expenses in the P&L, not in the Cashflow statement.

Even though such expenses are made within 12 months and lower reported profits in the period, they help acquire customers who, on average, stay almost 7 years.

Treating such Marketing expenses as ‘growth’ investments can reveal the true underlying profitability of the business in a more steady state.

Trustpilot generates 81% gross margin (contract revenue less customer service costs and related IT expenses).

Sales & Marketing account for 27% of Revenue (down from 58% in 2018).

Trustpilot’s EBITDA margin for 2024 came in at 11%.

If Marketing & Sales expenses are treated as ‘growth’ investments and added back to earnings, its EBITDA margin would have been 38% in 2024.

Below are my estimates for 2025. Management guides 200 basis points expansion in EBITDA margin (which is likely conservative). Adding 27% marketing spend leads to 41% margin ($99mn).

Source: Trustpilot financial reports; Hidden Value Gems

With an EV of $1.2bn, Trustpilot trades at 12x current EV/EBITDA (excluding ‘growth’ investments).

This looks low for a business of that scale and quality.

With an EV of $1.2bn, Trustpilot trades at 12x current EV/EBITDA (excluding ‘growth’ investments).

This looks low for a business of that scale and quality.

Valuation over the mid term (Trusptilot 2030)

Value investors usually shun away from projections made far into the future. However, it all depends on the type of business.

I would argue that valuation based on the past 12-month earnings or book value could be irrelevant for a low-quality, highly levered business.

Trustpilot has a unique business model with high barriers to entry and strong network effects. It requires minimum capital to grow. It offers clear value for businesses, consumers and regulators.

I am confident that Trustpilot will become an even bigger platform with stronger margins in the future.

The company targets over 15% annual sales growth and an EBITDA margin exceeding 30% over the medium term. Given the recent success in the US and the company’s pivot towards enterprise customers, I think the business can grow at a higher rate (20%). At such a rate, its revenue could reach $610mn by 2030, with a potential EBITDA of $183m.

The company carries out an annual buyback, which I expect to be 2-3% accretive annually. Assuming a 10- 15x EV/EBITDA valuation range, Trustpilot’s shares could reach a £ 372- 593p range. At the current price of c. 230p, this implies a future annual return of c. 13-27%.

I would argue that valuation based on the past 12-month earnings or book value could be irrelevant for a low-quality, highly levered business.

Trustpilot has a unique business model with high barriers to entry and strong network effects. It requires minimum capital to grow. It offers clear value for businesses, consumers and regulators.

I am confident that Trustpilot will become an even bigger platform with stronger margins in the future.

The company targets over 15% annual sales growth and an EBITDA margin exceeding 30% over the medium term. Given the recent success in the US and the company’s pivot towards enterprise customers, I think the business can grow at a higher rate (20%). At such a rate, its revenue could reach $610mn by 2030, with a potential EBITDA of $183m.

The company carries out an annual buyback, which I expect to be 2-3% accretive annually. Assuming a 10- 15x EV/EBITDA valuation range, Trustpilot’s shares could reach a £ 372- 593p range. At the current price of c. 230p, this implies a future annual return of c. 13-27%.

Source: Hidden Value Gems

Why Now?

A number of positive developments point to an acceleration of growth, upside to margins, and more shareholder returns.