13 April 2025

A more uncertain macro environment is generally a good time for stock pickers. As risk premiums rise, the market starts offering more attractively valued companies. However, the most recent indicators may not be helpful in estimating true profitability, as higher tariffs, changes in supply chains, and possibly weaker consumer demand may pressure corporate profitability in the future. What looked as bargains under the old regime may suddenly turn expensive with the new tariffs (which also keep changing).

This week, I ran several screens trying to look for hugely discounted stocks (close to Ben Graham’s net nets) with high cash relative to the market cap. I found a few compelling ideas in Europe that I will share next week. I also searched for companies with high insider buying.

Here are 10 UK mid- and small-caps in which directors and executives actively bought shares. Historically, this has been a strong signal, as various studies, including the latest paper by Tweedy, Browne, have shown.

A more uncertain macro environment is generally a good time for stock pickers. As risk premiums rise, the market starts offering more attractively valued companies. However, the most recent indicators may not be helpful in estimating true profitability, as higher tariffs, changes in supply chains, and possibly weaker consumer demand may pressure corporate profitability in the future. What looked as bargains under the old regime may suddenly turn expensive with the new tariffs (which also keep changing).

This week, I ran several screens trying to look for hugely discounted stocks (close to Ben Graham’s net nets) with high cash relative to the market cap. I found a few compelling ideas in Europe that I will share next week. I also searched for companies with high insider buying.

Here are 10 UK mid- and small-caps in which directors and executives actively bought shares. Historically, this has been a strong signal, as various studies, including the latest paper by Tweedy, Browne, have shown.

VISTRY

Summary Financials

Ticker: VTY (LSE UK)

Share price: £5.39

Mkt Cap: £1.8bn

EV: £2.1bn

P/E (NTM): 9.1x

EV/EBIT (NTM): 5.7x

Dividend yield: 0%

Share price: £5.39

Mkt Cap: £1.8bn

EV: £2.1bn

P/E (NTM): 9.1x

EV/EBIT (NTM): 5.7x

Dividend yield: 0%

Overview

Vistry Group PLC is a traditional UK homebuilder that has been transitioning towards a capital‐light model, focusing more on strategic partnerships and service-based solutions reducing its exposure to the cyclical nature of property development, with revenue increasingly driven by management contracts, service fees, and long-term collaborative ventures with local authorities and independent developers.

Formerly known as Bovis Homes Group PLC until January 2020, the company has a long heritage dating back to 1885 and is based in West Malling.

However, the company has recently issued several profit warnings caused by increased material and construction costs, labour shortages, and supply chain disruptions. These have pressured margins and slowed down sales volumes in a softer housing market.

The company has conducted independent and internal reviews of the issues and has implemented new requirements around processes and controls. The company also removed the role of the COO, with more business heads reporting directly to the CEO.

Formerly known as Bovis Homes Group PLC until January 2020, the company has a long heritage dating back to 1885 and is based in West Malling.

- The company is targeting a 40% return on capital employed (ROCE) as part of its shift to a capital‐light, high‐returns model.

- It is aiming to sustain an adjusted operating margin of at least 12%.

- Vistry expects average revenue growth in the medium term to be between 5% and 8% per annum.

- On the balance sheet front, the Group is focusing on reducing net debt to achieve a net cash position by 31 December 2026.

- Vistry plans to return £1bn to shareholders by completing the current projects and disposing of its land bank. In September 2024, the company announced a £130 million buyback programme.

However, the company has recently issued several profit warnings caused by increased material and construction costs, labour shortages, and supply chain disruptions. These have pressured margins and slowed down sales volumes in a softer housing market.

The company has conducted independent and internal reviews of the issues and has implemented new requirements around processes and controls. The company also removed the role of the COO, with more business heads reporting directly to the CEO.

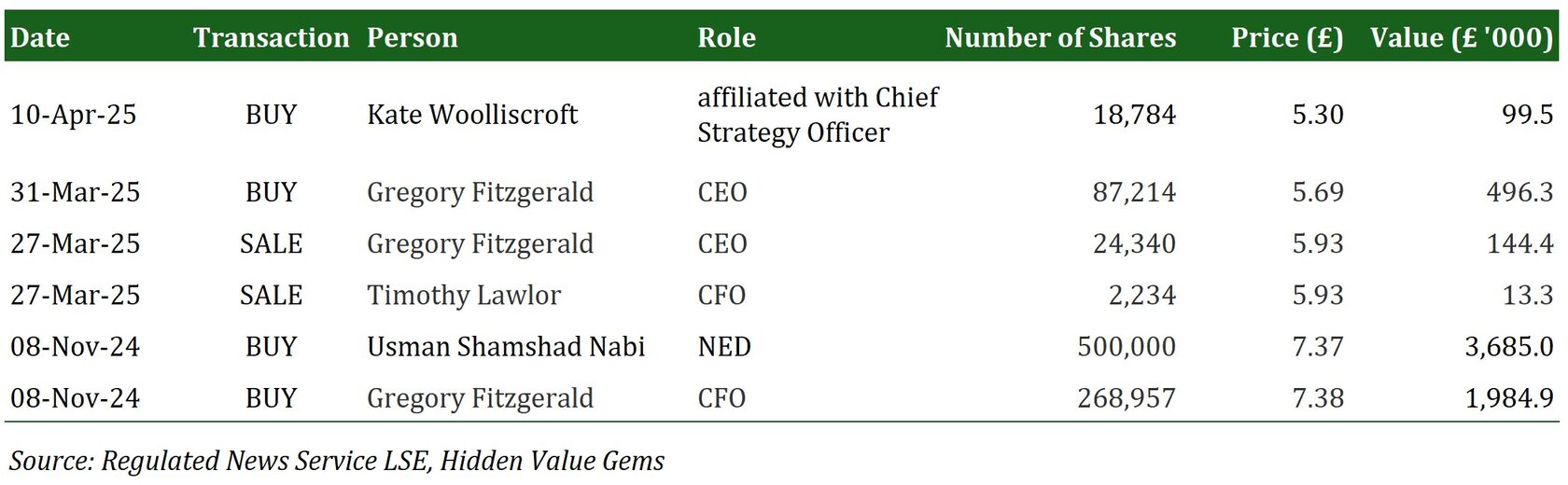

Insider Transactions

Conduit Holdings

Summary Financials

Ticker: CRE (LSE UK)

Share price: £3.45

Mkt Cap: £541.6mn

EV: £292.7mn

P/E (NTM): 6.8x

EV/EBIT (NTM): 3.4x

Dividend yield: 10.4%

Share price: £3.45

Mkt Cap: £541.6mn

EV: £292.7mn

P/E (NTM): 6.8x

EV/EBIT (NTM): 3.4x

Dividend yield: 10.4%

Overview

Conduit Holdings Limited, through its subsidiary, offers reinsurance products around the globe in three main areas: Property, Casualty, and Specialty. On the Property side, they cover both catastrophe and non-catastrophe risks. In Casualty, they handle things like directors and officers, financial institutions, general, professional, transactional liability and medical malpractice.

Meanwhile, their Specialty division covers a wide range—from aviation and energy to engineering, construction, environmental risks, renewables, marine, and even political violence and terrorism, plus coverage for whole accounts, specie and fine art, war, and event-capped QS above XL lines.

Founded in 2020 and based in Pembroke, Bermuda, they’re dedicated to offering tailored reinsurance solutions worldwide.

The company was severely hit by the Californian wildfires, with management expecting preliminary ultimate loss across all divisions at $100-140mn, net of reinsurance recoveries and reinstatement premiums.

Meanwhile, their Specialty division covers a wide range—from aviation and energy to engineering, construction, environmental risks, renewables, marine, and even political violence and terrorism, plus coverage for whole accounts, specie and fine art, war, and event-capped QS above XL lines.

Founded in 2020 and based in Pembroke, Bermuda, they’re dedicated to offering tailored reinsurance solutions worldwide.

The company was severely hit by the Californian wildfires, with management expecting preliminary ultimate loss across all divisions at $100-140mn, net of reinsurance recoveries and reinstatement premiums.

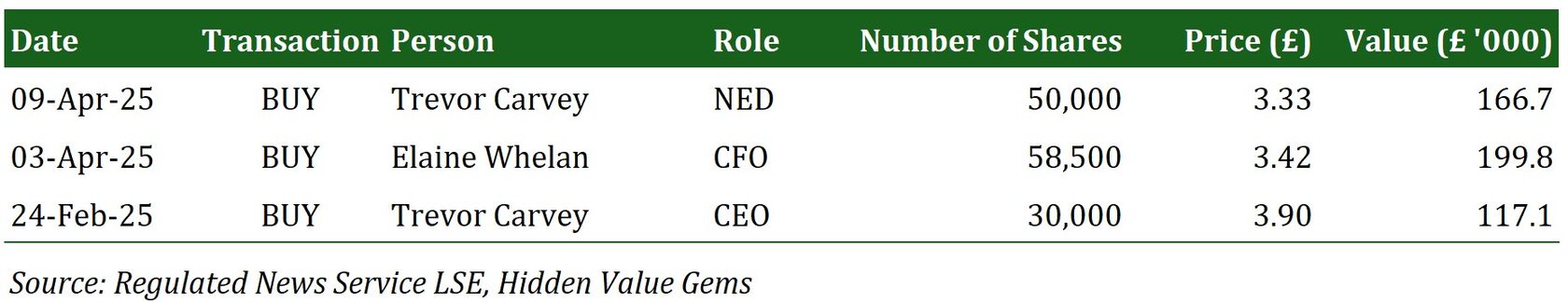

Insider Transactions

Anpario

Summary Financials

Ticker: ANP (AIM UK)

Share price: £3.85

Mkt Cap: £78.7mn

EV: £68.2mn

P/E (NTM): 12.6x

EV/EBIT (NTM): 11.3x

Dividend yield: 2.9%

Share price: £3.85

Mkt Cap: £78.7mn

EV: £68.2mn

P/E (NTM): 12.6x

EV/EBIT (NTM): 11.3x

Dividend yield: 2.9%

Overview

Anpario plc is a UK-based manufacturer specialising in natural, sustainable feed additives for animal health, nutrition and biosecurity. The company focuses on intestinal health and offers solutions for poultry, ruminants, swine, aquaculture and feed milling. Its product portfolio spans health and performance (e.g., Orego-Stim, pHorce, Salkil, Optomega, Genex), toxin management (e.g., Anpro, Anpro Advance), feed quality (e.g., Salgard, Mastercube, Moldgard, Oxigard, Feedzyme) and hygiene and insect control (e.g., Mitex, Clean & Dry, Credence). Anpario’s technologies are marketed in over 80 countries through an established network that includes several wholly owned subsidiaries.

Additional points

- The company has zero debt and a net cash position of £10.5mn (13% of the Mkt Cap).

- The company has increased its dividends at a 10% compound annual rate since 2024. On top of regular dividends, the company returns cash to shareholders via buybacks. In 2023, Anpario bought back £9mn worth of shares via a Tender Offer.

- Richard Edwards has been the CEO of Anpario since 2006.

- Recent results (FY-24) have been strong with a 16% LfL sales growth, improvement in gross margin to 46.9% (from 45% in 2023). EBITDA and EPS increased by 57% and 83%, respectively.

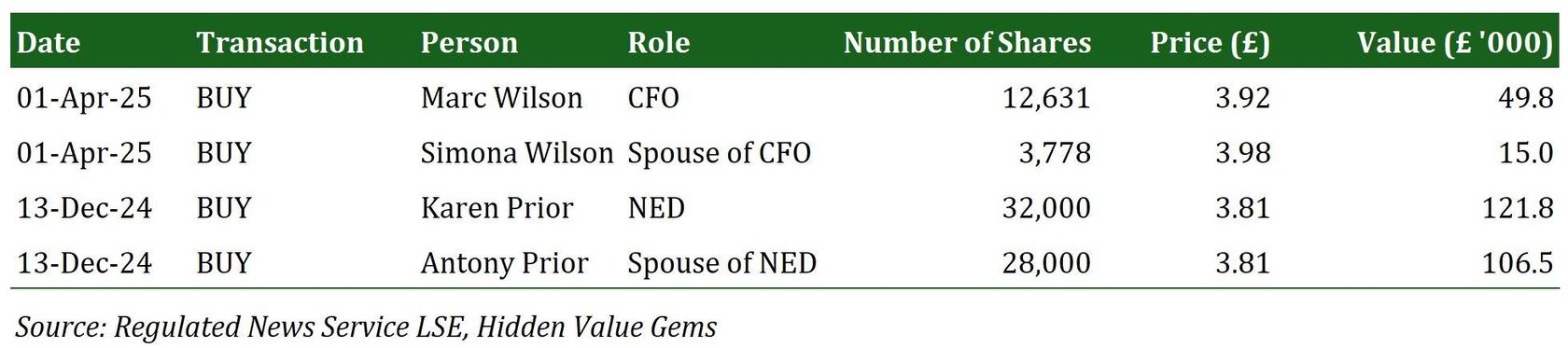

Insider Transactions

Premium Members can continue reading the rest of the article below. Please consider upgrading to Premium Subscription if you want to see the full content of this article.