16 March 2025

“ - Do you hold any stocks?”

“ - Of course not. You don’t know what Trump says tomorrow. Markets may be down just on one phrase.”

This is not a theoretical conversation. It was actually me talking to an old friend. I think my friend’s answer (who, by the way, spent most of his 20+ year career as a market analyst) summarises the concerns of many other investors.

But even more interesting is that our conversation did not occur this year or even last year. We spoke back in the summer of 2018. Interestingly enough, my friend has been right more than once since. That year, stocks performed quite poorly. The S&P 500 closed the year with a loss of 4.3% for the first time in a decade. Since our conversation, the index was off almost 20% by the end of 2018.

The market went down again in 2020.

But today, even after dropping again this year, the S&P 500 is at 5,639, more than 100% above the level of the summer of 2018.

S&P 500 historical performance

“ - Of course not. You don’t know what Trump says tomorrow. Markets may be down just on one phrase.”

This is not a theoretical conversation. It was actually me talking to an old friend. I think my friend’s answer (who, by the way, spent most of his 20+ year career as a market analyst) summarises the concerns of many other investors.

But even more interesting is that our conversation did not occur this year or even last year. We spoke back in the summer of 2018. Interestingly enough, my friend has been right more than once since. That year, stocks performed quite poorly. The S&P 500 closed the year with a loss of 4.3% for the first time in a decade. Since our conversation, the index was off almost 20% by the end of 2018.

The market went down again in 2020.

But today, even after dropping again this year, the S&P 500 is at 5,639, more than 100% above the level of the summer of 2018.

S&P 500 historical performance

Source: Google Finance

I periodically recall that conversation as a humble experience and a reminder of the power of long-term thinking.

But this is not a post on the virtue of long-term passive investing.

Like you, I keep thinking about where the next opportunity is and what changes I should make to my portfolio in light of the latest developments.

I found focusing on bottom-up fundamentals usually more helpful than making decisions based on broad worldviews. Going into 2025, the HVG portfolio did not have any of the Mag7 stocks, with an unusually high weight of the UK and European stocks. This was not a macro call. What attracted me to that region was widespread pessimism and attractive valuation.

The only explicit macro call was probably holding a few insurance stocks (one was sold during 2024) as beneficiaries of higher inflation.

I still think there is a wide gap between many European companies operating globally while trading at discounted prices due to perceived exposure to a weak European market. Many of these companies, especially in the UK, have become much more focused on shareholder returns manifestsing in growing buybacks, portfolio optimisation, takeover activity and other efforts.

As for specific ideas, this week, I looked at some European companies with a growing disconnect between the share price and underlying earnings. I often find that whenever the share price materially deviates from profits, it usually creates some interesting opportunities. Occasionally, it is just the case of an expensive stock becoming more reasonably valued (de-rating). More often, the share price drop is triggered by a more negative future outlook. As long as the expectations are too pessimistic or extrapolated too far into the future, this divergence could become an attractive opportunity.

Below, I have summarised seven cases which drew my attention (four of them are exclusive to Premium Members only).

But this is not a post on the virtue of long-term passive investing.

Like you, I keep thinking about where the next opportunity is and what changes I should make to my portfolio in light of the latest developments.

I found focusing on bottom-up fundamentals usually more helpful than making decisions based on broad worldviews. Going into 2025, the HVG portfolio did not have any of the Mag7 stocks, with an unusually high weight of the UK and European stocks. This was not a macro call. What attracted me to that region was widespread pessimism and attractive valuation.

The only explicit macro call was probably holding a few insurance stocks (one was sold during 2024) as beneficiaries of higher inflation.

I still think there is a wide gap between many European companies operating globally while trading at discounted prices due to perceived exposure to a weak European market. Many of these companies, especially in the UK, have become much more focused on shareholder returns manifestsing in growing buybacks, portfolio optimisation, takeover activity and other efforts.

As for specific ideas, this week, I looked at some European companies with a growing disconnect between the share price and underlying earnings. I often find that whenever the share price materially deviates from profits, it usually creates some interesting opportunities. Occasionally, it is just the case of an expensive stock becoming more reasonably valued (de-rating). More often, the share price drop is triggered by a more negative future outlook. As long as the expectations are too pessimistic or extrapolated too far into the future, this divergence could become an attractive opportunity.

Below, I have summarised seven cases which drew my attention (four of them are exclusive to Premium Members only).

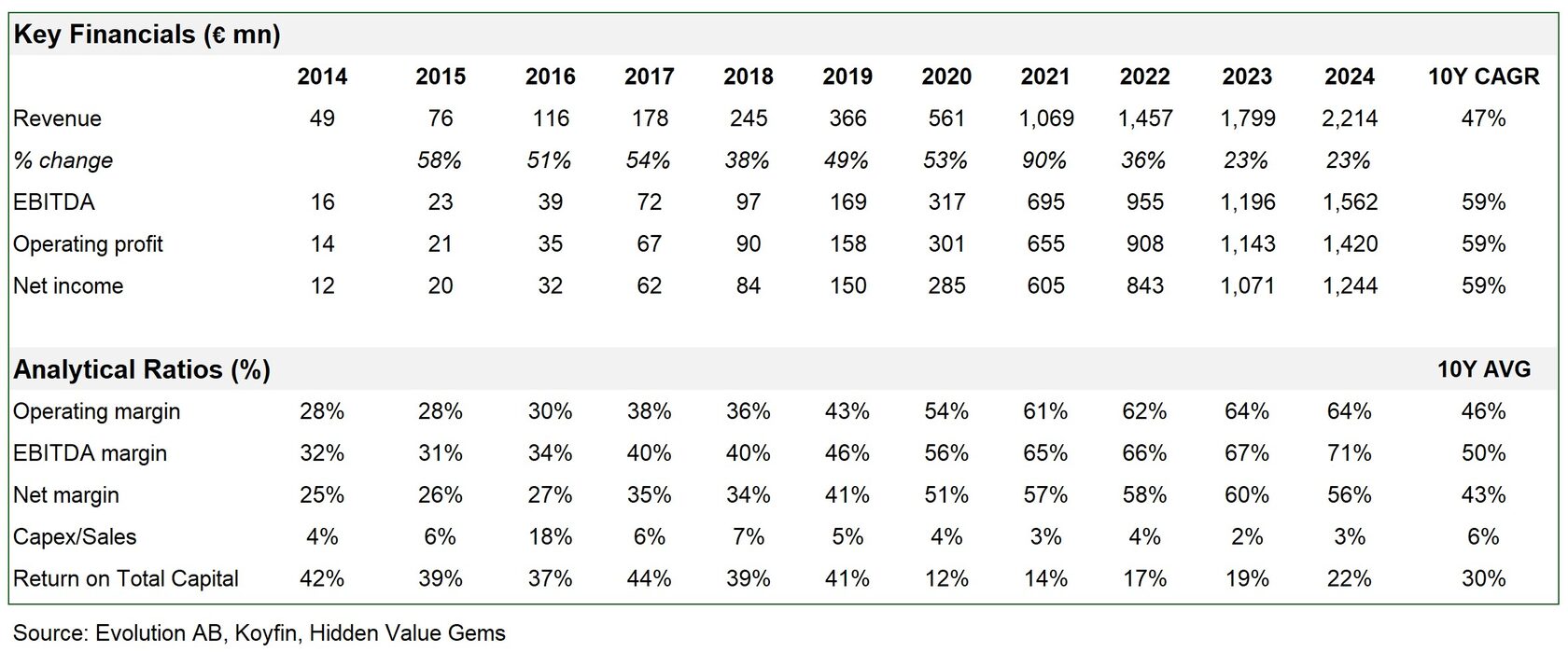

Evolution AB

Ticker: EVO SS

Market Cap: €14.9bn

Net Cash: €857mn

EV: €14bn

P/E: 12.5x

EV/EBIT: 10.2x

Market Cap: €14.9bn

Net Cash: €857mn

EV: €14bn

P/E: 12.5x

EV/EBIT: 10.2x

Source: Koyfin

Evolution has been widely covered on various blogs. The company has been one of the pioneers of online live casinos and is now a market leader with outstanding software that it licenses to gaming operators. Its dominant market positions and value offered to the operated results in explosive growth (47% 10-year revenue GAGR) and record-breaking profit margins (10-year EBITDA margin averaged 50%, rising closer to 70% last year).

The stock has rarely been cheap, trading in the 20-40x P/E range until 2022.

However, recently, the company started to face three major headwinds.

Firstly, there have been adverse regulatory developments. In 2021, a short-seller's report claimed that Evolution's products are used by operators in regions where gambling is prohibited. The New Jersey gaming regulator launched an investigation after that, but in 2024, dropped the case as it "found no evidence that Evolution sanctioned, promoted, permitted, or otherwise materially benefitted from its content offered by operators in" restricted markets.

However, the UK Gambling Commission launched a new investigation in December 2024 based on new allegations that Evolution gaming products were accessible via several unlicensed operators in the UK.

Evolution has traditionally emphasised that it deals only with licenced operators and cannot control their further steps. Management confirmed that it is fully cooperating with the UK Commission without providing guidance on the timing or possible outcome.

The second more recent headwind is related to the cyber attacks in Asian markets that led to a slowdown in the company's growth. These attacks led to the hijacking of the gaming streams that allow operators to broadcast Evolution games without paying Evolution its fees.

While the Asian revenue essentially flatlined during 2024 at c. €200mn per quarter, the overall sales of Evolution in 2023 grew at a respectable 23% YoY rate.

At its latest earnings call on 30 January 2025, management commented that it expected to resolve the cyberattack issues in the next two quarters.

Finally, the company faced a series of strikes in Georgia, where it runs its second-largest studio, as local media reported poor working conditions there. The strikes have now ended.

On the back of these developments, Evolution stock has moved from being highly expensive closer to a bargain, trading at 12.5x forward P/E and a net cash position. The company has launched a €500mn buyback to be completed in 2025 in addition to a €2.8 per share dividend for 2024, with a combined shareholder yield of 7.3%. The company spent €678mn on share repurchases in 2024 and €559mn on dividends (€2.65 per share).

We will have a detailed presentation and discussion of Evolution's investment case and its risks with final conclusions at our upcoming meeting (online) with Premium Members on 20 March.

The stock has rarely been cheap, trading in the 20-40x P/E range until 2022.

However, recently, the company started to face three major headwinds.

Firstly, there have been adverse regulatory developments. In 2021, a short-seller's report claimed that Evolution's products are used by operators in regions where gambling is prohibited. The New Jersey gaming regulator launched an investigation after that, but in 2024, dropped the case as it "found no evidence that Evolution sanctioned, promoted, permitted, or otherwise materially benefitted from its content offered by operators in" restricted markets.

However, the UK Gambling Commission launched a new investigation in December 2024 based on new allegations that Evolution gaming products were accessible via several unlicensed operators in the UK.

Evolution has traditionally emphasised that it deals only with licenced operators and cannot control their further steps. Management confirmed that it is fully cooperating with the UK Commission without providing guidance on the timing or possible outcome.

The second more recent headwind is related to the cyber attacks in Asian markets that led to a slowdown in the company's growth. These attacks led to the hijacking of the gaming streams that allow operators to broadcast Evolution games without paying Evolution its fees.

While the Asian revenue essentially flatlined during 2024 at c. €200mn per quarter, the overall sales of Evolution in 2023 grew at a respectable 23% YoY rate.

At its latest earnings call on 30 January 2025, management commented that it expected to resolve the cyberattack issues in the next two quarters.

Finally, the company faced a series of strikes in Georgia, where it runs its second-largest studio, as local media reported poor working conditions there. The strikes have now ended.

On the back of these developments, Evolution stock has moved from being highly expensive closer to a bargain, trading at 12.5x forward P/E and a net cash position. The company has launched a €500mn buyback to be completed in 2025 in addition to a €2.8 per share dividend for 2024, with a combined shareholder yield of 7.3%. The company spent €678mn on share repurchases in 2024 and €559mn on dividends (€2.65 per share).

We will have a detailed presentation and discussion of Evolution's investment case and its risks with final conclusions at our upcoming meeting (online) with Premium Members on 20 March.

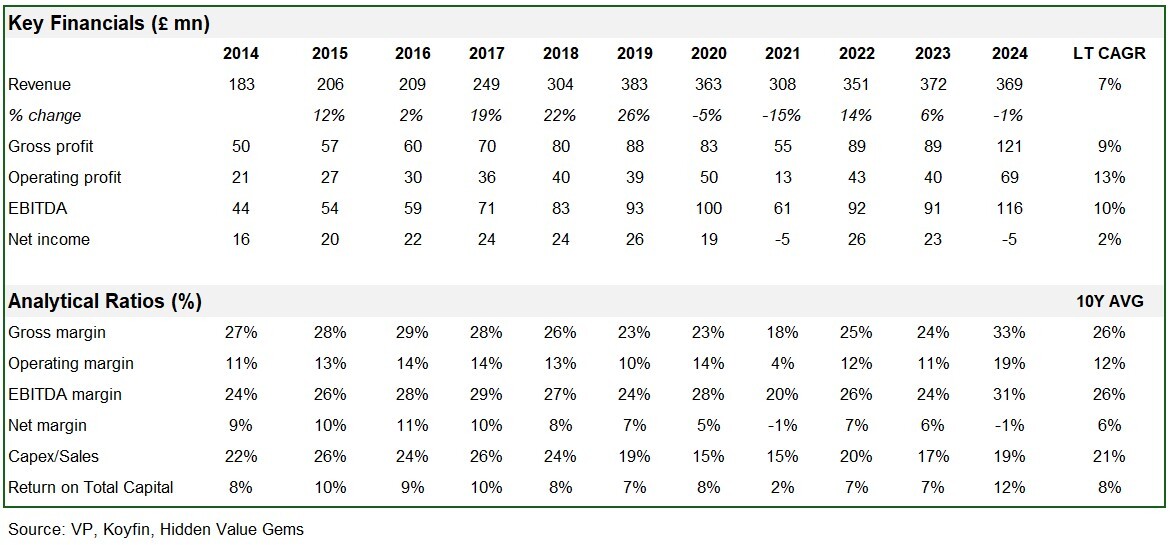

Vp Plc

Ticker: VP LN

Market Cap: £209.14mn

Net Debt: £169mn

EV: £378.14

P/E: 7.6x

EV/EBIT: 8.8x

Market Cap: £209.14mn

Net Debt: £169mn

EV: £378.14

P/E: 7.6x

EV/EBIT: 8.8x

Source: Koyfin

Vp Plc is a UK-based equipment rental company, a smaller version of Ashtead Group and United Rentals. The company has been in business for over 70 years and has generated a consistent 14-15% ROE and ROCE (pre-tax) over the past 10 years. It has also paid dividends every year for the past 30 years.

In April 2022, Vp started a formal sale process but ended the process in August of the same year, having not received attractive offers. The stock price peaked in 2021 at over £10, then corrected to £8.2 in early April 2022 and is now down 48% since its 2021 peak and 34% below the 1 April 2022 price.

In the past two years, the company changed its top management, appointing a new CEO, Anna Bielby, and a new CFO, Keith Winstanley. Ms Bielby has a financial background, having worked at PwC before several CFO roles, including at Vp.

In January and February this year, the company's chairman and largest shareholder, Jeremy Pilkington, purchased over 294k shares at £5.6-6.0 for a total of £1.5mn. Jeremy Pilkington's Ackers P Investment Company holds a 50.3% interest in Vp.

The stock currently trades at 7.6x forward P/E.

While there could be obvious reasons for the correction in the US industrial sector, Vp has practically zero direct exposure to that market. In FY-24, the majority of its revenue came from the UK (65%), followed by Europe, Asia and Australia (10% each). With infrastructure (rail, water), construction and energy being its largest sectors, the company should benefit from the upcoming investments.

The company's leverage (excl. lease liabilities) is at 1.5x.

The company's CEO appeared on the Investors' Chronicle podcast this week, which you can listen to here.

In April 2022, Vp started a formal sale process but ended the process in August of the same year, having not received attractive offers. The stock price peaked in 2021 at over £10, then corrected to £8.2 in early April 2022 and is now down 48% since its 2021 peak and 34% below the 1 April 2022 price.

In the past two years, the company changed its top management, appointing a new CEO, Anna Bielby, and a new CFO, Keith Winstanley. Ms Bielby has a financial background, having worked at PwC before several CFO roles, including at Vp.

In January and February this year, the company's chairman and largest shareholder, Jeremy Pilkington, purchased over 294k shares at £5.6-6.0 for a total of £1.5mn. Jeremy Pilkington's Ackers P Investment Company holds a 50.3% interest in Vp.

The stock currently trades at 7.6x forward P/E.

While there could be obvious reasons for the correction in the US industrial sector, Vp has practically zero direct exposure to that market. In FY-24, the majority of its revenue came from the UK (65%), followed by Europe, Asia and Australia (10% each). With infrastructure (rail, water), construction and energy being its largest sectors, the company should benefit from the upcoming investments.

The company's leverage (excl. lease liabilities) is at 1.5x.

The company's CEO appeared on the Investors' Chronicle podcast this week, which you can listen to here.

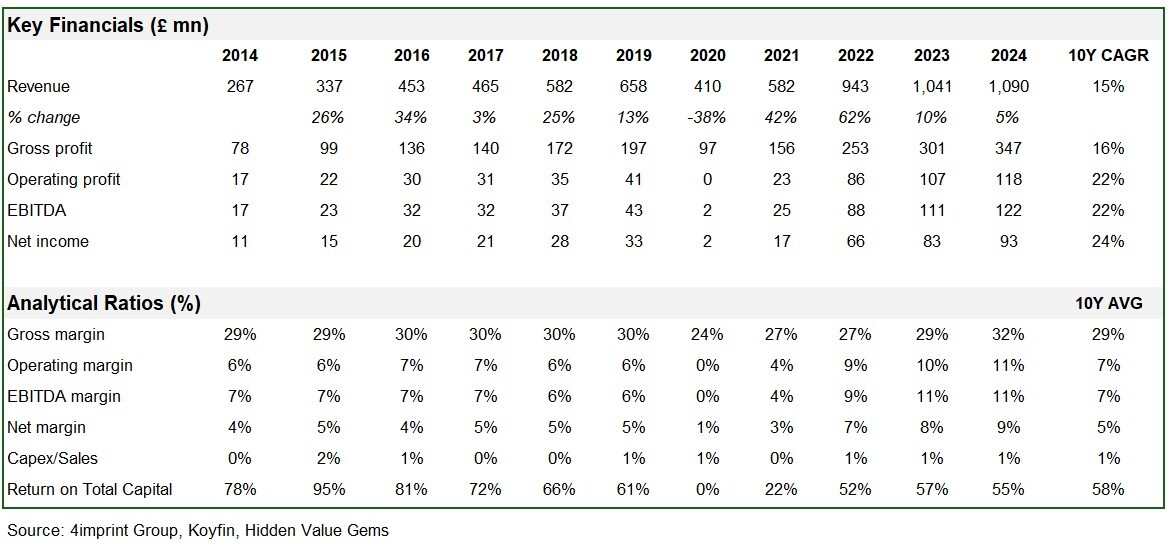

4imprint Group Plc

Ticker: FOUR LN

Market Cap: £1.12bn

Net Cash: £132mn

EV: £988mn

P/E: 13.1x

EV/EBIT: 9x

Market Cap: £1.12bn

Net Cash: £132mn

EV: £988mn

P/E: 13.1x

EV/EBIT: 9x

Source: Koyfin

While 4imprint is listed in the UK, its primary market is the US, where it is the leading supplier of promotional merchandise (mugs, bags, apparel, and other items with corporate logos). The promotional products market in North America is valued at approximately $27 billion and is served by an estimated 26,000 distributors. With its c. 5% market share, 4imprint is the most prominent player in this highly fragmented industry.

Over its 40-year history, 4imprint has moved away from vertical integration to a capital-light 'drop-ship' model, disposing of its printing facilities. It has focused on direct sales marketing, which does not rely on key account managers or large corporate clients. On the supply side, 4imprint uses a vast network of partners to fulfil orders.

Consequently, the business requires little cash for capex or working capital with FCF/ Net income ratio close to 100%. The company has a net cash position ($147.6mn) with no bank debt and only lease liabilities.

Unlike some other businesses discussed here, 4imprint is quite cyclical, as evidenced by sharp sales declines and reported losses during the 2008 great financial crisis and the 2020 pandemic. So, the short-term correction in the stock looks reasonable in this context.

It is valued at a forward P/E of 13.1x and has delivered 12.6% annual compound sales growth (in USD) over the past 10 years.

Over its 40-year history, 4imprint has moved away from vertical integration to a capital-light 'drop-ship' model, disposing of its printing facilities. It has focused on direct sales marketing, which does not rely on key account managers or large corporate clients. On the supply side, 4imprint uses a vast network of partners to fulfil orders.

Consequently, the business requires little cash for capex or working capital with FCF/ Net income ratio close to 100%. The company has a net cash position ($147.6mn) with no bank debt and only lease liabilities.

Unlike some other businesses discussed here, 4imprint is quite cyclical, as evidenced by sharp sales declines and reported losses during the 2008 great financial crisis and the 2020 pandemic. So, the short-term correction in the stock looks reasonable in this context.

It is valued at a forward P/E of 13.1x and has delivered 12.6% annual compound sales growth (in USD) over the past 10 years.