9 March 2025

You are reading the 12 ediiton of Investment Notes, a free weekly publication focused on stock ideas, tools, and other valuable content to enhance your investment journey - all rooted in timeless value investing principles.

This week, we highlight four interesting US mid cap ideas that won the 6th Annual Applied Value Investing Stock Pitch Challenge at Columbia Business School. We also share our thoughts on the two HVG portfolio companies following release of strong annual results.

This week, we highlight four interesting US mid cap ideas that won the 6th Annual Applied Value Investing Stock Pitch Challenge at Columbia Business School. We also share our thoughts on the two HVG portfolio companies following release of strong annual results.

Four Investment Ideas

The information below summarises four investment ideas of the Columbia Business School students that won the 6th Annual Applied Value Investing Stock Pitch Challenge. This information does not represent the views of Hidden Value Gems and is not intended to provide investment advice (see Disclaimer here).

AO Smith ($AOS)

By Morgan Zhang (Columbia Business School)

- Ticker: AOS (NYSE)

- Share Price: $67

- Market Cap: $9.5bn

- Net Cash: $83mn

- EV: $9.4bn

AO Smith is the largest manufacturer of water heaters in North America, with a 37% market share in the residential space and 54% in the commercial space.

Source: Koyfin

Why it is interesting?

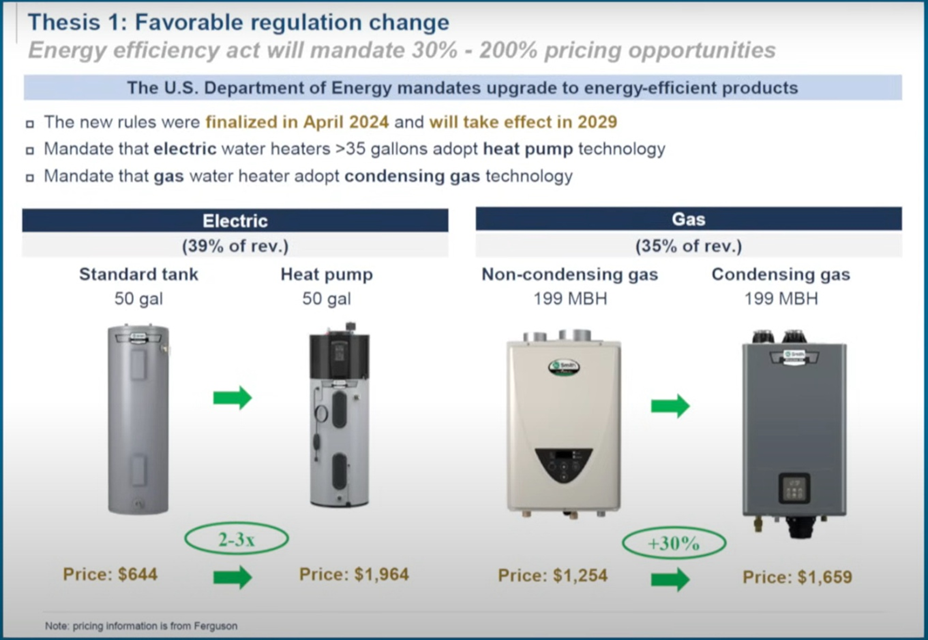

1. AO Smith is a business with an underappreciated, significant regulatory catalyst. The 2029 US Department of Energy regulations mandating more efficient water heaters are poised to deliver a substantial revenue uplift.

2. AO Smith benefits from a dominant market position in a stable oligopoly, granting them significant pricing power. Their consistent annual price increases (6-8% realised since 2010), outstripping cost inflation, demonstrate a durable moat.

3. Furthermore, the 85% replacement-driven demand offers resilience.

4. Management's commitment to returning capital (5% annually via dividends and buybacks) and the consistently high ROIC (around 30%) underscore the quality of this business.

5. Potential gross margin expansion from pricing power and steel deflation adds to the attractiveness.

2. AO Smith benefits from a dominant market position in a stable oligopoly, granting them significant pricing power. Their consistent annual price increases (6-8% realised since 2010), outstripping cost inflation, demonstrate a durable moat.

3. Furthermore, the 85% replacement-driven demand offers resilience.

4. Management's commitment to returning capital (5% annually via dividends and buybacks) and the consistently high ROIC (around 30%) underscore the quality of this business.

5. Potential gross margin expansion from pricing power and steel deflation adds to the attractiveness.

Valuation

Based on the potential earnings uplift from the regulatory changes and the consistent growth driven by pricing and modest volume expansion (1-2% annually), a target price of $136 by 2028 is justifiable, applying a target multiple of 20x earnings. This implies a compelling Internal Rate of Return (IRR) of 20% over the investment horizon. The projected return is underpinned by the regulatory impact, recurring growth, margin expansion, and shareholder returns.

Risks

- Higher Than Expected Regulatory Workaround: If workaround strategies are more effective than anticipated (>50%), the revenue boost will be smaller.

- Economic Cyclicality: A significant economic downturn could still impact overall volumes, particularly in the new construction segment (15% of revenue).

- Raw Material Price Spikes: Unexpected surges in steel prices could pressure margins.

- Increased Competition: Changes in the competitive landscape could erode pricing power.

- Technological Disruption: Long-term shifts in water heating technology could pose a threat.

- Reliance on Plumber Influence: Any weakening of their strong relationships with plumbers could be detrimental.

- Regulatory Implementation Uncertainty: The 2029 regulations could face delays or amendments.

CNH Industrial ($CNH)

By Mario Stefanidis (Columbia Business School)

- Ticker: CNH (NYSE)

- Share Price: $12.3

- Market Cap: $15.3bn

- Net Debt (Industrial): $2.4bn

- EV: $17.7bn

CNH Industrial is the second-largest manufacturer of agricultural equipment worldwide and a leader in construction equipment. The company competes primarily with Deere, AGCO, and Kubota in agriculture. CNH is 30% owned by Exor.

Source: Koyfin

Why it is interesting?

1. Improving Profitability: New management is driving structural efficiency gains in agriculture, leading to higher EBIT margins despite the current down cycle. The market may be too focused on the cycle and overlooking this fundamental improvement.

2. Technical Undervaluation: The NYSE sole listing led to forced selling, potentially creating a buying opportunity. Poor screening due to its finance arm may also cause analysts to miss it.

3. Shareholder Focus: Management is committed to returning all excess free cash flow via dividends (around 3.5% yield) and buybacks (around 6-7% annually). This provides a return while waiting for the market to recognise the value.

4. Precision Agriculture Upside: CNH is investing heavily to catch up with Deere in precision agriculture, which could significantly boost margins. The market may be sceptical of their success.

5. Cyclical Recovery: The agricultural market is cyclical, and an upturn is expected around 2026-2028. The market might be overly pessimistic about the current downturn.

2. Technical Undervaluation: The NYSE sole listing led to forced selling, potentially creating a buying opportunity. Poor screening due to its finance arm may also cause analysts to miss it.

3. Shareholder Focus: Management is committed to returning all excess free cash flow via dividends (around 3.5% yield) and buybacks (around 6-7% annually). This provides a return while waiting for the market to recognise the value.

4. Precision Agriculture Upside: CNH is investing heavily to catch up with Deere in precision agriculture, which could significantly boost margins. The market may be sceptical of their success.

5. Cyclical Recovery: The agricultural market is cyclical, and an upturn is expected around 2026-2028. The market might be overly pessimistic about the current downturn.

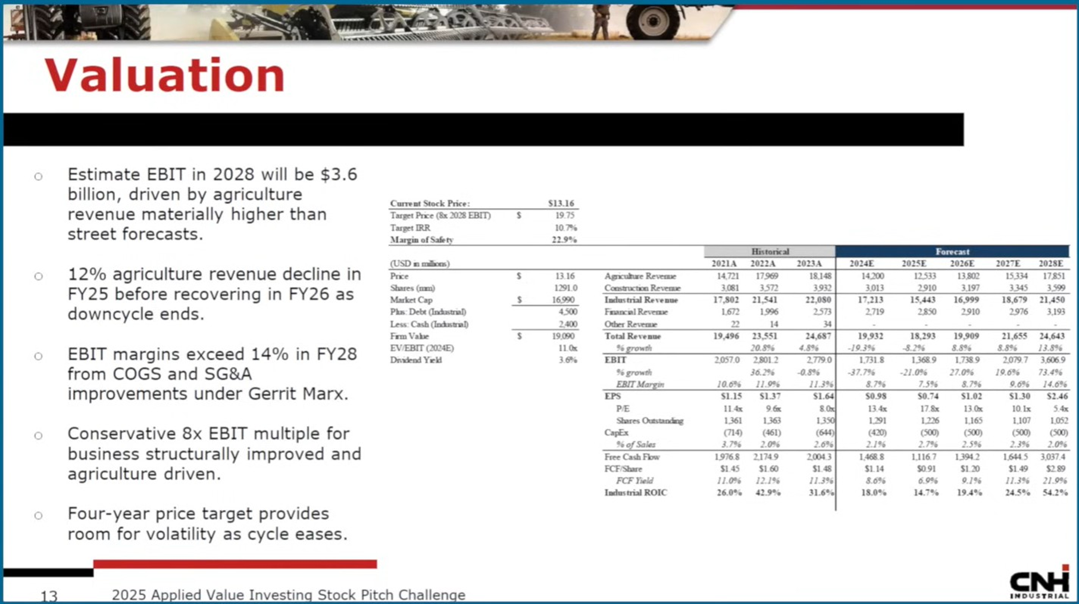

Valuation

- The presenter used a conservative eight times EBIT multiple for valuation by 2028.

- They aimed for a target price of $19.75, representing a potential upside of 22.9% with a 10% discount rate.

- A judge suggested using a revenue multiple based on average EBIT margins through a cycle, suggesting a potential undervaluation.

Risks

- Prolonged Agriculture Down Cycle: If the current down cycle lasts longer than anticipated (historically it has been around three to five years), returns could be delayed, and earnings would remain depressed.

- Delinquency Rates in Financial Services: An uptick in delinquency rates in their financial services arm, although currently managed conservatively, could pose a risk, particularly in volatile regions like Latin America. The availability of financing is crucial for their sales.

- Failure to Close Precision Agriculture Gap: If CNH fails to effectively integrate Raven and catch up with Deere in precision agriculture, the margin disparity will persist, limiting earnings growth.

- Dependence on Dealer Network: CNH relies on an independent dealer network (e.g., Titan Machinery), and their performance and destocking efforts can directly impact CNH's sales.

- Cyclical Nature of the Industry: The inherent cyclicality of the agricultural equipment market means earnings will fluctuate with farm incomes and interest rates.

Global Payments ($GPN)

- Ticker: GPN (NYSE)

- Share Price: $11.9

- Market Cap: $24.8bn

- Net Debt: $13.7bn

- EV: $38.5bn

Global Payments is a top five merchant acquirer in the US, providing payment processing capabilities to over 5 million merchants across 40+ countries. They connect merchants to card networks and issuing banks, processing trillions of dollars in payment volume annually.

Why it is interesting?

1. Market Overreaction and Misunderstanding: The market seems to view Global Payments as a legacy business vulnerable to digital disruption. However, the company has demonstrated an ability to grow revenues and earnings, maintain market share amongst legacy players, and achieve double-digit growth in its e-commerce segment.

2. Significant Capital Return Potential: Management has outlined a plan to return $7.5 billion in cash to shareholders over the next three years through share repurchases, which could reduce the share count by approximately 20%.

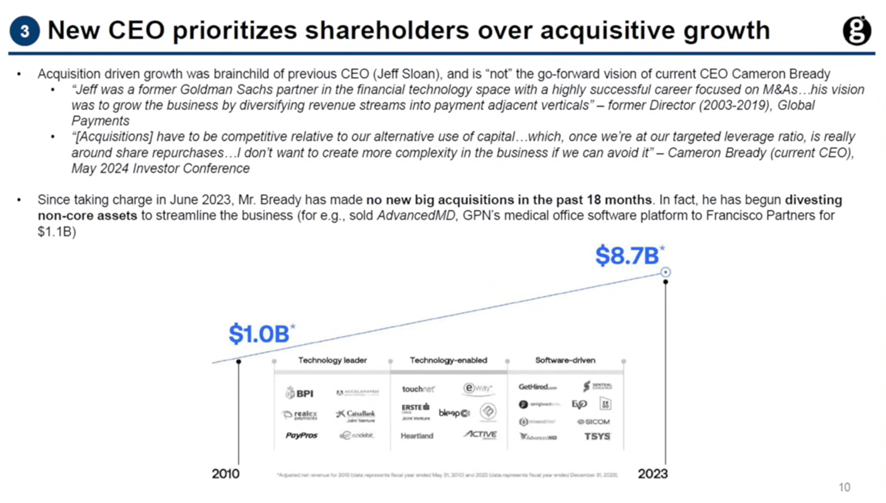

3. Shift in Management Focus: The new CEO is prioritising shareholder value and limiting acquisitions, a departure from the previous strategy that involved debt-financed acquisitions at premium multiples.

4. Feasible Financial Engineering: The company has a strong cash balance and generates significant levered free cash flow, making the planned capital returns achievable.

5. Undervaluation Relative to Earnings: Trading at around 10x adjusted operating income, the valuation appears depressed compared to historical premiums.

2. Significant Capital Return Potential: Management has outlined a plan to return $7.5 billion in cash to shareholders over the next three years through share repurchases, which could reduce the share count by approximately 20%.

3. Shift in Management Focus: The new CEO is prioritising shareholder value and limiting acquisitions, a departure from the previous strategy that involved debt-financed acquisitions at premium multiples.

4. Feasible Financial Engineering: The company has a strong cash balance and generates significant levered free cash flow, making the planned capital returns achievable.

5. Undervaluation Relative to Earnings: Trading at around 10x adjusted operating income, the valuation appears depressed compared to historical premiums.

Valuation

- The company is trading at c. 10x EV / Operating Income (adj).

- Historically, the stock traded at a premium to the S&P 500 multiple but now trades below it.

- A future price target of $174 by FY27 was presented, implying c. 17% IRR.

Risks

- Increased competition from digital-first payment processors eroding market share over the long term.

- Failure of management to execute the planned share repurchase program effectively or consistently.

- Potential for a reversion to an acquisition-focused growth strategy, which the market has historically viewed negatively.

- Slower than anticipated growth in the overall electronic payments market.

- The company's debt burden of approximately $18 billion.

- Potential for margin compression if the competitive landscape intensifies or if the benefits from cloud migration are delayed or less significant than expected.

Ibotta ($IBTA): Investment Pitch Summary

By Kit Popolo (Columbia Business School)

- Ticker: IBTA (NYSE)

- Share Price: $37.5

- Market Cap: $1.15bn

- Net Cash: $348mn

- EV: $0.8bn

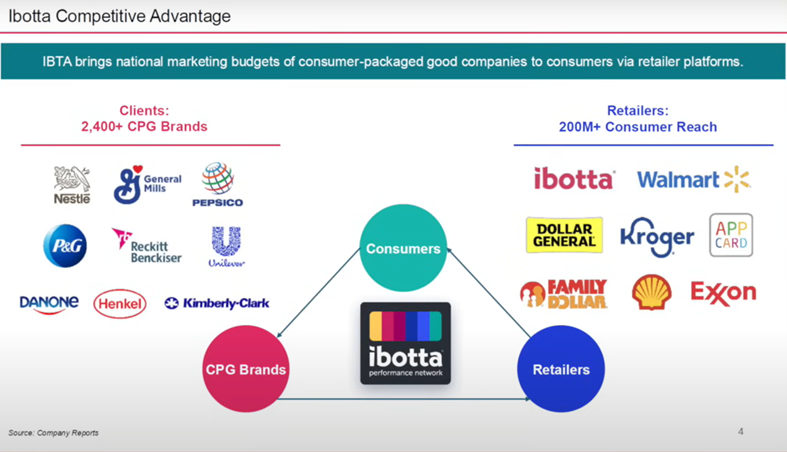

A digital couponing app, acting as a network that connects CPG brands with retailers to provide cashback deals to consumers. They earn fees on redeemed offers and have a small ad segment.

Why it is interesting?

Ibotta isa recently public company with significant growth potential obscured by short-term market focus and misunderstanding.

1. Underappreciated Growth Drivers: The market seems to be overlooking the substantial TAM and Ibotta's ability to capture more CPG marketing spend, which is currently allocated to less efficient methods. The recent partnerships with Walmart (the largest grocer) and Instacart (a leading online delivery platform) represent significant untapped growth opportunities that consensus estimates appear to be ignoring.

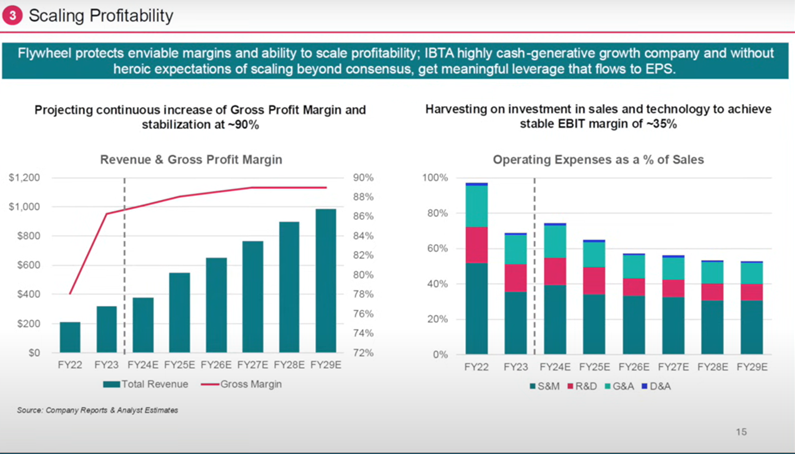

2. Retail Partner Flywheel: Ibotta's strategy of white labelling its product for retailers creates a powerful flywheel, expanding its reach to more consumers without significant customer acquisition costs.

3. Defensible Margin Profile: Ibotta's fee-based, pay-per-performance model and its position as a central clearinghouse provide a defensible competitive advantage that should translate into attractive margins as the business scales.

4. Transition to Third-Party Redemptions: The shift towards third-party redemption revenue (via retailer apps) is a key driver of future growth and stickiness, embedding Ibotta's technology within major retail ecosystems.

5. Market Overreaction to Conservative Guidance: The post-IPO share price decline appears to be an overreaction to slightly lowered guidance.

1. Underappreciated Growth Drivers: The market seems to be overlooking the substantial TAM and Ibotta's ability to capture more CPG marketing spend, which is currently allocated to less efficient methods. The recent partnerships with Walmart (the largest grocer) and Instacart (a leading online delivery platform) represent significant untapped growth opportunities that consensus estimates appear to be ignoring.

2. Retail Partner Flywheel: Ibotta's strategy of white labelling its product for retailers creates a powerful flywheel, expanding its reach to more consumers without significant customer acquisition costs.

3. Defensible Margin Profile: Ibotta's fee-based, pay-per-performance model and its position as a central clearinghouse provide a defensible competitive advantage that should translate into attractive margins as the business scales.

4. Transition to Third-Party Redemptions: The shift towards third-party redemption revenue (via retailer apps) is a key driver of future growth and stickiness, embedding Ibotta's technology within major retail ecosystems.

5. Market Overreaction to Conservative Guidance: The post-IPO share price decline appears to be an overreaction to slightly lowered guidance.

Valuation

- A 2029 earnings per share target of $7.60 was mentioned.

- A 21x fwd P/E was applied to the 2029 EPS target, which is around the current multiple.

- The Instacart deal is suggested to potentially add a 30% delta to the top line compared to current consensus estimates.

- Implied Return (IRR): 21%

Risks

- Reliance on a major partner like Walmart (80% of third-party redemption revenue) and the potential for changes in that relationship.

- Conservative guidance from management post-IPO.

- Competition in the couponing space, with mentions of Catalina Marketing, Rakuten, and Honey.

- The cost of the cashback offers and Ibotta's cut for the CPG brands.

- The company missing growth expectations out of the gate after its IPO.

- Whether Ibotta can truly become the "backbone" for CPG couponing.

Admiral Group Plc

Insurance is a unique sector, where many traditional financial concepts do not work as expected. I explained here why insurance may be the best industry for building wealth.

Admiral is a low-cost market leader in UK motor insurance, with a founder-led mentality and exceptional capital allocation track record. I bought the stock in September 2022, with the expectation of a strong recovery in cyclically depressed 2022 earnings. I expcted future earnings to benefit from higher interest rates, reduced losses in new businesses (particularly US) and stronger UK insurance market.

The company’s strong 2024 results reported earlier this week have confirmed my original assumptions.

The key earnings drivers were:

Premium subscribers can read the full updated thesis here.

Admiral is a low-cost market leader in UK motor insurance, with a founder-led mentality and exceptional capital allocation track record. I bought the stock in September 2022, with the expectation of a strong recovery in cyclically depressed 2022 earnings. I expcted future earnings to benefit from higher interest rates, reduced losses in new businesses (particularly US) and stronger UK insurance market.

The company’s strong 2024 results reported earlier this week have confirmed my original assumptions.

The key earnings drivers were:

- Reduced frequency claims and market share gains in UK motor

- Stronger investment income (4% yield vs 1.6% in 2022)

- Continued growth in Admiral Money and Home Insurance

- A significant turnaround at US operations

Premium subscribers can read the full updated thesis here.

AerCap

I shared my take on Aercap’s 2024 results and the changes I made to the Aercap position with the Premium subscribers earlier this week. Premium members can read the latest update here.