23 March 2025

Introduction

This month, a small Swedish investment company called Röko was listed in Sweden. It immediately drew my attention for the following reasons:

We have profiled Lifco together with 31 other European holding companies in our last year’s report.

Röko‘s focus on high-quality companies, long-term investment horizon, fast decision-making and minimal bureaucracy (just 8 employees in its head office) makes it similar to Berkshire Hathaway. Although, the latter now finds itself in a more challenging position due to its size and limited investment options.

There are also some major differences between the two companies. Röko does not have an insurance business (a significant source of funding with a negative cost for Berkshire) and does not invest in public securities. Unlike Berkshire, Röko does not hold a net cash position.

In this short piece, I review the company’s investment approach, track record, key financials, and valuation. In the end, I conclude whether I would buy the stock.

- Capital allocation. As long-time readers would know, I consider capital allocation skills to be a rare competitive advantage that is not easy to spot using basic screening tools (unlike P/E or dividend yield) and, hence, a source of alpha and long-term wealth creation.

- Strong insider ownership and long-term mindset. The two founders control the company with a 54% interest and plan to hold the acquired companies forever.

- Focus on Europe. Unlike the US, the European M&A market in small and mid-cap space is less competitive. There is simply less capital chasing deals. At the same time, with a weaker economy and geopolitical headlines, European assets usually trade at a substantial discount to their overseas peers.

- Past track record. The co-founder and CEO of Röko, Fredrik Karlsson, is a former CEO of Lifco, one of the most successful serial acquires. During 2006-2024, Lifco increased sales and EBITA at 14% and 18% annually, delivering 28% compound annual shareholder returns over the past 10 years from price appreciation alone (excluding dividends).

We have profiled Lifco together with 31 other European holding companies in our last year’s report.

Röko‘s focus on high-quality companies, long-term investment horizon, fast decision-making and minimal bureaucracy (just 8 employees in its head office) makes it similar to Berkshire Hathaway. Although, the latter now finds itself in a more challenging position due to its size and limited investment options.

There are also some major differences between the two companies. Röko does not have an insurance business (a significant source of funding with a negative cost for Berkshire) and does not invest in public securities. Unlike Berkshire, Röko does not hold a net cash position.

In this short piece, I review the company’s investment approach, track record, key financials, and valuation. In the end, I conclude whether I would buy the stock.

What is Röko?

Röko is a serial acquirer focused on small, high-quality businesses, primarily in Europe.

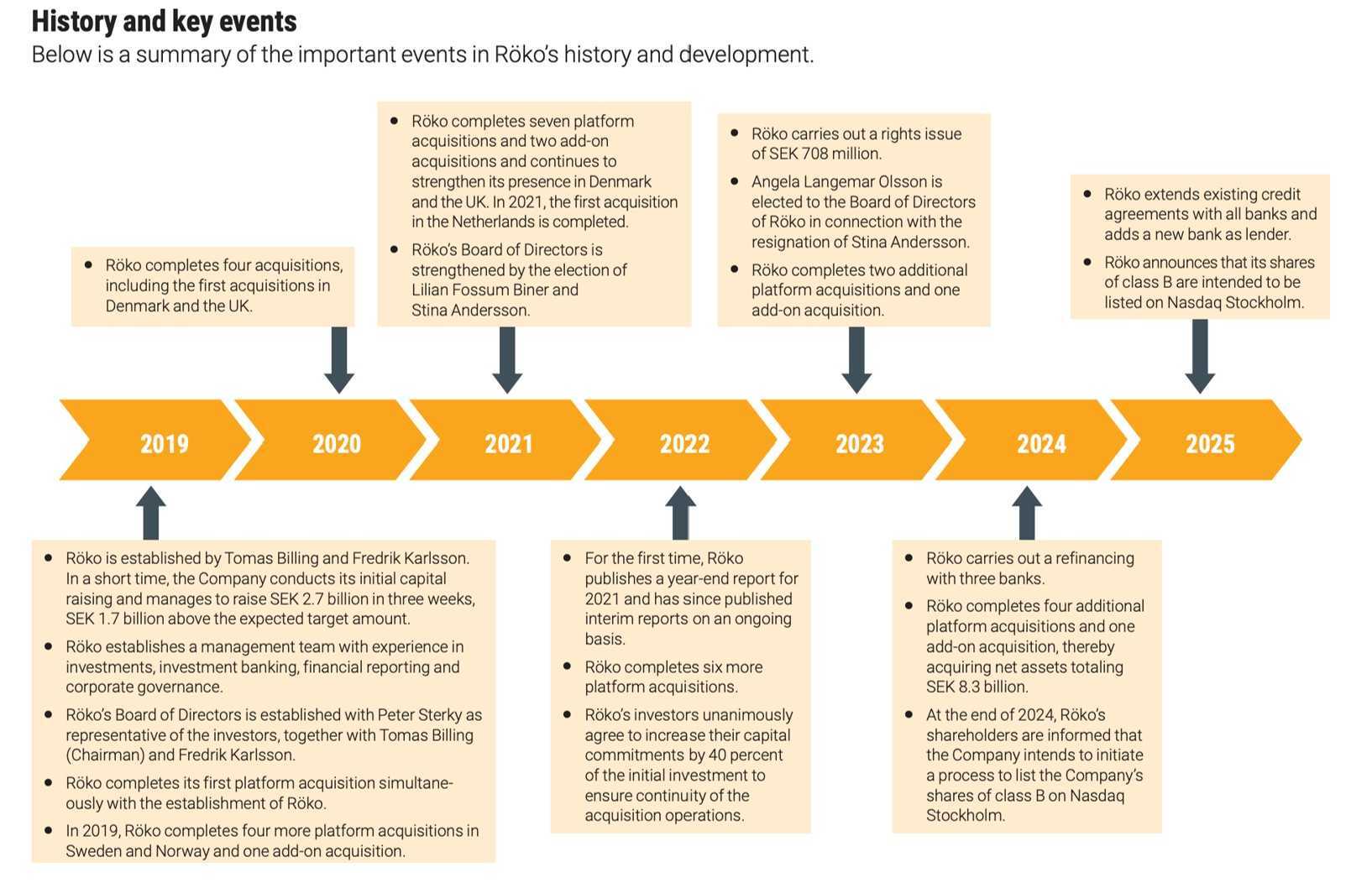

The company was listed on NASDAQ Stockholm on 11 March 2025.

Its current market cap is SEK30.7bn (€2.8bn). The company’s latest net financial debt (31 Dec 2024) is SEK2.9bn (€268mn).

Röko was founded by Tomas Billing and Fredrik Karlsson in 2019 (27.2% voting and 9.0% economic interest for both). The two co-founders remain chairman and CEO of Röko today.

Fredrik Karlsson, with a background in management consulting (BCG), is a former CEO of Lifco, one of the most successful European serial acquirers.

The company was listed on NASDAQ Stockholm on 11 March 2025.

Its current market cap is SEK30.7bn (€2.8bn). The company’s latest net financial debt (31 Dec 2024) is SEK2.9bn (€268mn).

Röko was founded by Tomas Billing and Fredrik Karlsson in 2019 (27.2% voting and 9.0% economic interest for both). The two co-founders remain chairman and CEO of Röko today.

Fredrik Karlsson, with a background in management consulting (BCG), is a former CEO of Lifco, one of the most successful European serial acquirers.

Source: Google

M&A Strategy focused on Quality and Price

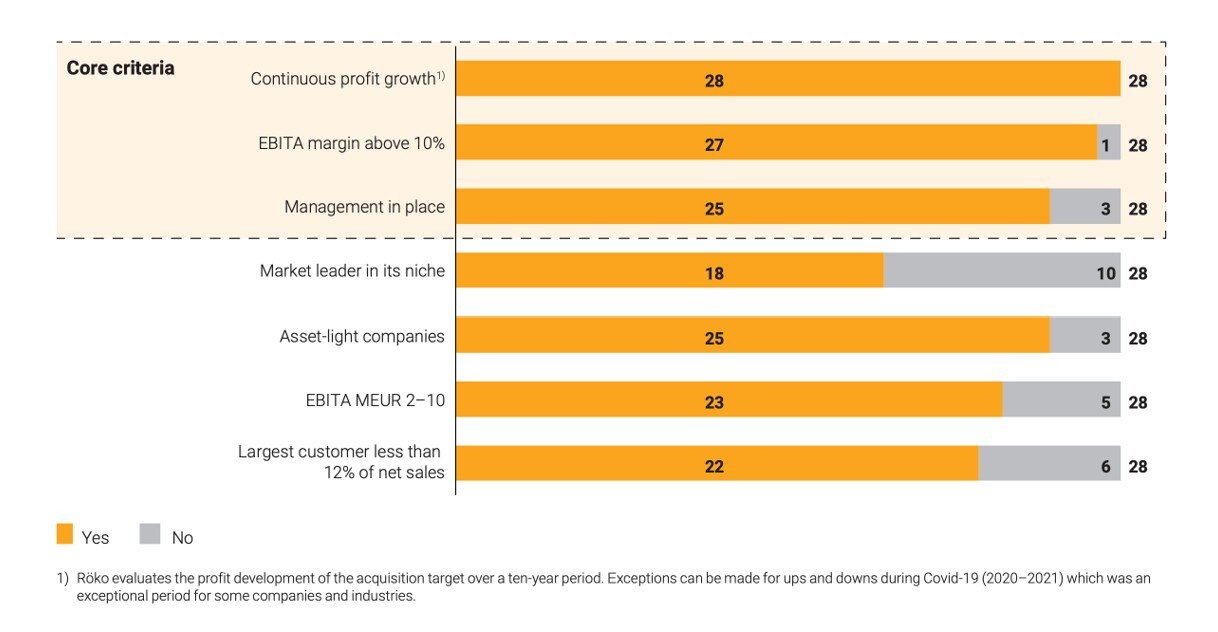

The company applies seven criteria to evaluate prospective acquisitions.

Core Criteria

1. Continuous profit growth (assessed on the last 10 historical years)

2. EBITA margin above 10%

3. Management in place and willing to stay in place after the acquisition is completed

Other Criteria

4. Market leader in its niche

5. Asset-light companies (Capex <5% of sales and with proven ability to control working capital)

6. Operating profit (EBITA) of €2–10mn

7. Largest customer accounts for less than 12% of net sales

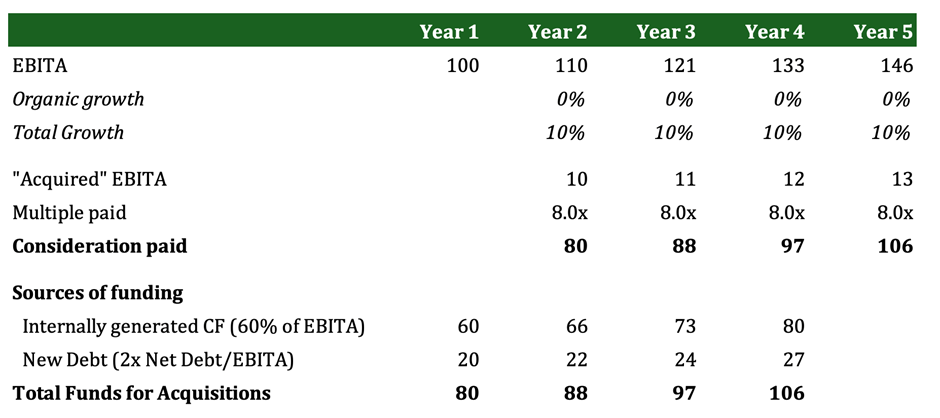

Historically, Röko paid an average multiple of 8x EV/EBITA. Simply put, this allows the company to grow at 10% even without the organic growth of acquired businesses. The following example illustrates the growth potential of such an acquisition strategy. It assumes 60% cash conversion, and that debt is partially used to fund new deals (up to 2x Debt/EBITA).

Core Criteria

1. Continuous profit growth (assessed on the last 10 historical years)

2. EBITA margin above 10%

3. Management in place and willing to stay in place after the acquisition is completed

Other Criteria

4. Market leader in its niche

5. Asset-light companies (Capex <5% of sales and with proven ability to control working capital)

6. Operating profit (EBITA) of €2–10mn

7. Largest customer accounts for less than 12% of net sales

Historically, Röko paid an average multiple of 8x EV/EBITA. Simply put, this allows the company to grow at 10% even without the organic growth of acquired businesses. The following example illustrates the growth potential of such an acquisition strategy. It assumes 60% cash conversion, and that debt is partially used to fund new deals (up to 2x Debt/EBITA).

Growth through acquisitions: illustrative example 1

Source: Hidden Value Gems analysis

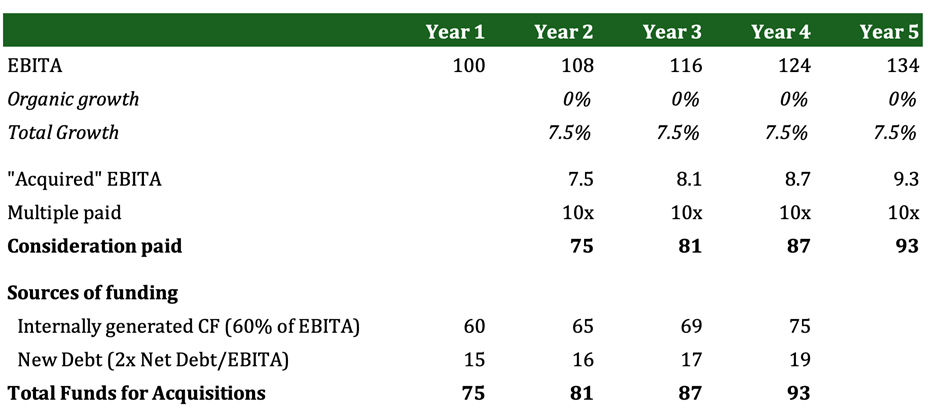

On the other hand, should the multiple be higher (10x EV/EBITA), the company would grow at a slower rate of 7.5%.

Growth through acquisitions: illustrative example 2

Source: Hidden Value Gems analysis

Röko usually evaluates around 500 companies annually. They focus on the European market, with most opportunities coming from the markets in which Röko already operates. Röko completes, on average, between five and ten acquisitions per year.

Europe is an attractive hunting ground for potential investors, especially the SME segment, which contributes c. €7 trillion to Europe’s GDP (almost 30%). The number of companies in Röko’s segment (under €50mn sales) is estimated at 12 million companies (in the larger European markets).

Europe is an attractive hunting ground for potential investors, especially the SME segment, which contributes c. €7 trillion to Europe’s GDP (almost 30%). The number of companies in Röko’s segment (under €50mn sales) is estimated at 12 million companies (in the larger European markets).

Other Key Principles

- Decentralised approach - Röko lets subsidiaries operate independently with minimal interference. Unlike PE firms, it does not force acquired companies to carry out aggressive cost-cutting. However, like Lifco, it encourages (but does not impose) them to raise prices and provides necessary guidance on best practices. Monthly reporting is limited to income statements and balance sheets, keeping bureaucracy low. Just 8 people are working in the company’s HQ office in Stockholm.

- Minority retention model – Röko usually buys 70-80% of a company, ensuring that founders and management stay invested. This prevents the "cash-out and disengage" issue seen in 100% acquisitions.

- Sector agnostic with a wide range of potential sectors to increase chances for finding high-quality businesses led by great managers/founders.

- Competitive deal execution - Röko has a high close rate because they conduct thorough due diligence before signing a Letter of Intent (LOI). Unlike many buyers, they do not renegotiate terms after LOI, which builds trust with sellers.

M&A Track Record

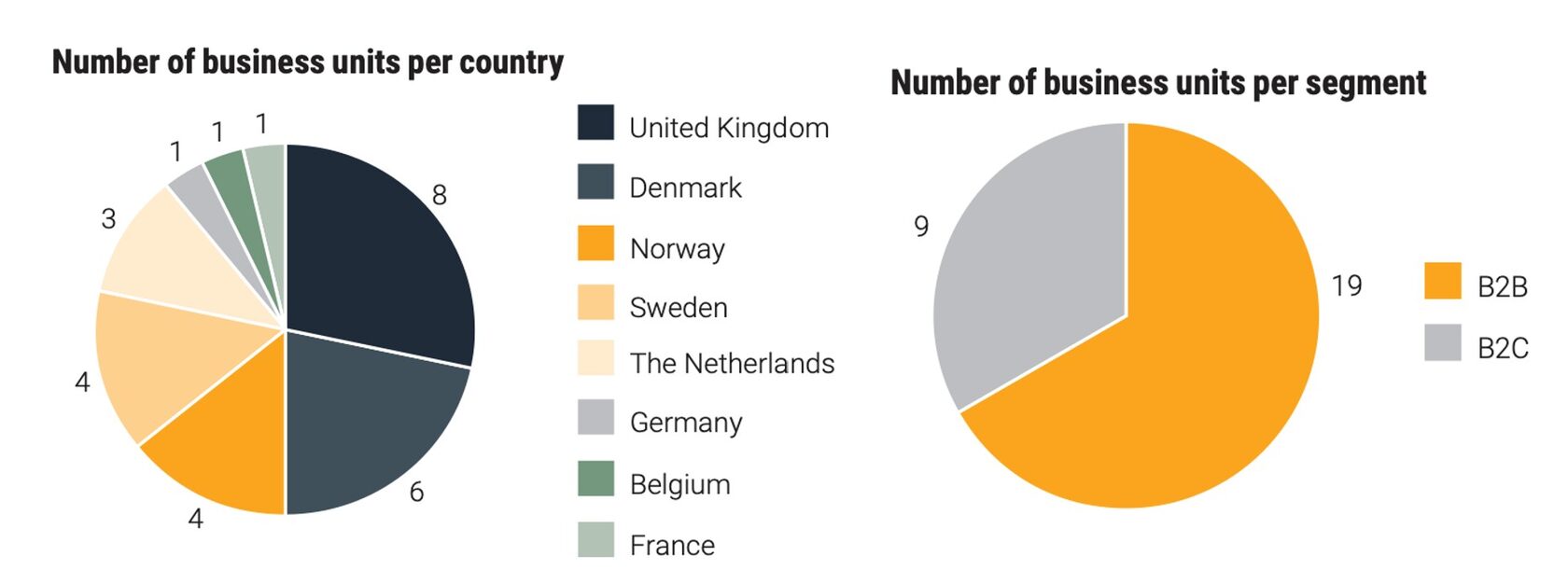

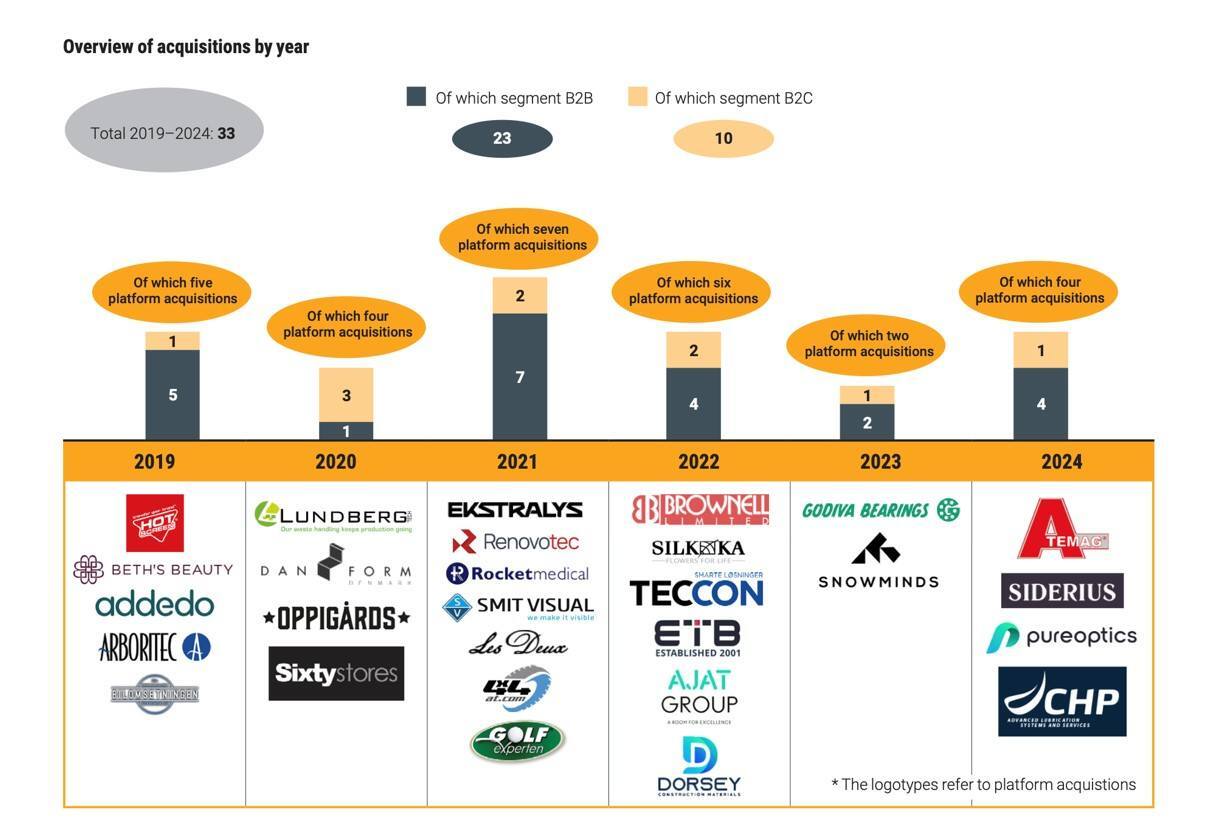

In the first 5 years since its launch, Röko has completed 33 deals in 8 countries, growing its EBITA from zero to SEK1,227mn (2024). Most businesses operate in the B2B segment, although there are also B2C companies, and management is open to deals in both segments.

Source: Röko Listing Prospectus 2025

It has spent over SEK1.1bn on those acquisitions (excluding potential earn-outs, paying, on average, 8x EV/EBITA. The EV includes potential future liabilities related to earn-outs and put/call options.

Source: Röko Listing Prospectus 2025

The underlying performance of individual businesses within Röko’s portfolio is quite diverse. One of the takeaways is that exceptional businesses remain exceptional after being acquired, while poor-performing businesses continue to struggle. According to the company, the three best-performing subsidiaries in the Group breached, on average, less than one of the investment criteria at the time of acquisition, while the three worst-performing subsidiaries breached three criteria (on average).

The best-performing businesses delivered EBITA growth 3x higher than the worst-performing ones since those businesses have been acquired by Röko.

The best-performing businesses delivered EBITA growth 3x higher than the worst-performing ones since those businesses have been acquired by Röko.

Source: Röko Listing Prospectus 2025

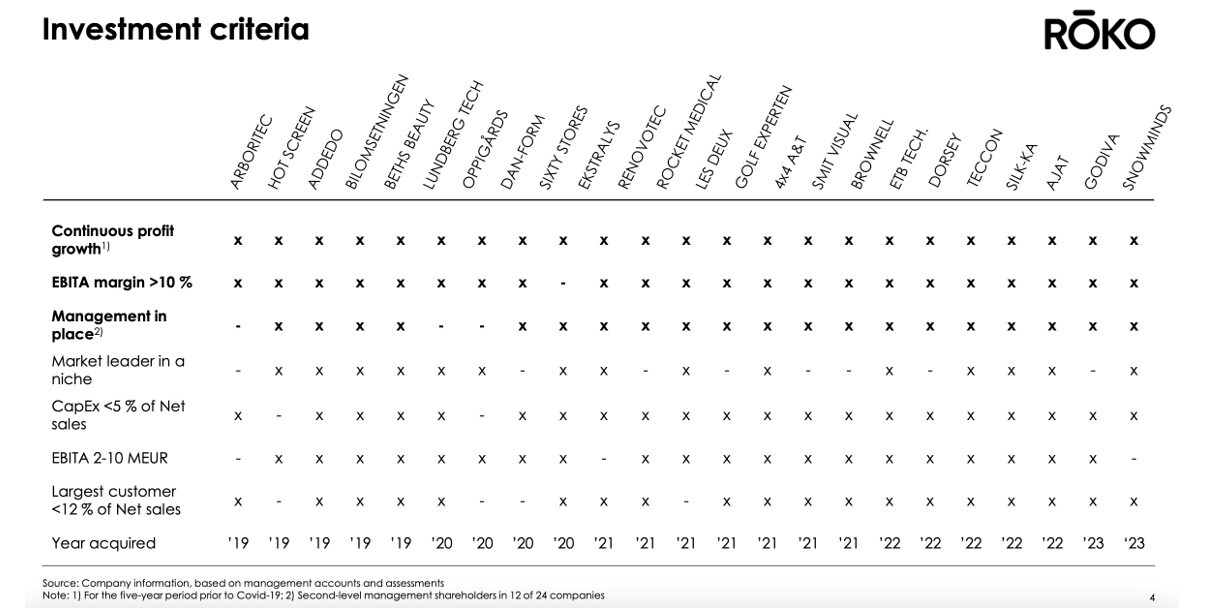

Below is a more detailed summary of how the acquired companies fit the company’s 7-criteria investment approach in the past (up to 2023).

Source: Röko Annual Report 2023

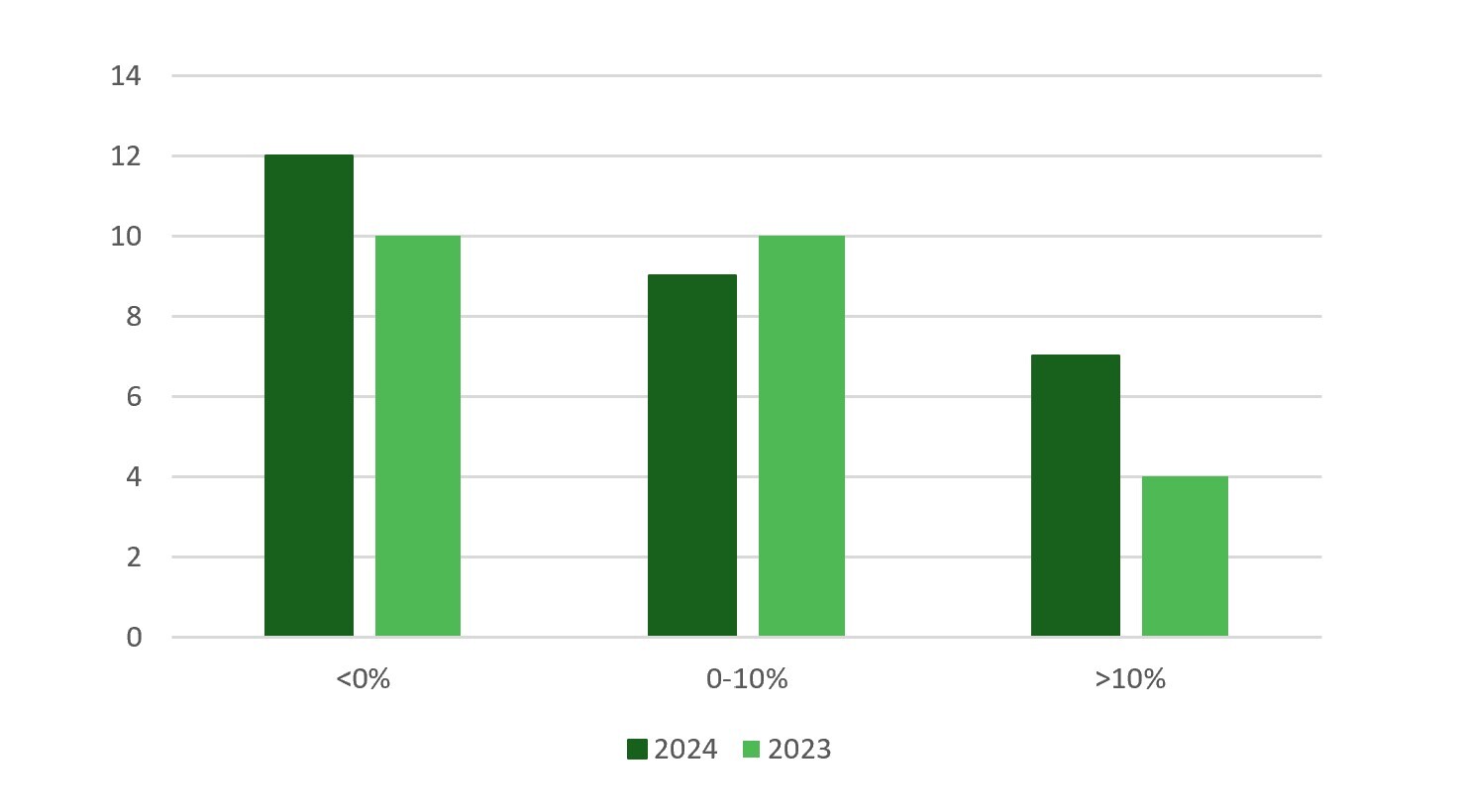

In 2023-24, 58% and 57% of Röko’s subsidiaries delivered positive organic growth. Here is a simple distribution of subsidiaries by growth rate in the past two years.

Distribution of Röko’s subsidiaries by organic growth rate (number of companies)

Source: Company’s filing, Hidden Value Gems analysis

Financial Targets and Dividends

Röko’s financial targets include:

Röko’s dividend policy is to distribute up to 20% of profits as dividends.

The company has not paid dividends to shareholders yet. The Board of Directors intends to propose the first dividend at the 2026 annual shareholders' meeting for the 2025 financial year.

- Growth: Adj. EBITA growth" every single year

- Profitability: Adj. EBITA margin above 15% at the group level (after costs for Group-wide functions)

- Leverage: Net debt (Net debt / Adj. EBITDA) should be below 3.0x but may exceed 3.Ox in the short term as a result of acquisitions

Röko’s dividend policy is to distribute up to 20% of profits as dividends.

The company has not paid dividends to shareholders yet. The Board of Directors intends to propose the first dividend at the 2026 annual shareholders' meeting for the 2025 financial year.

Financial Results & Valuation

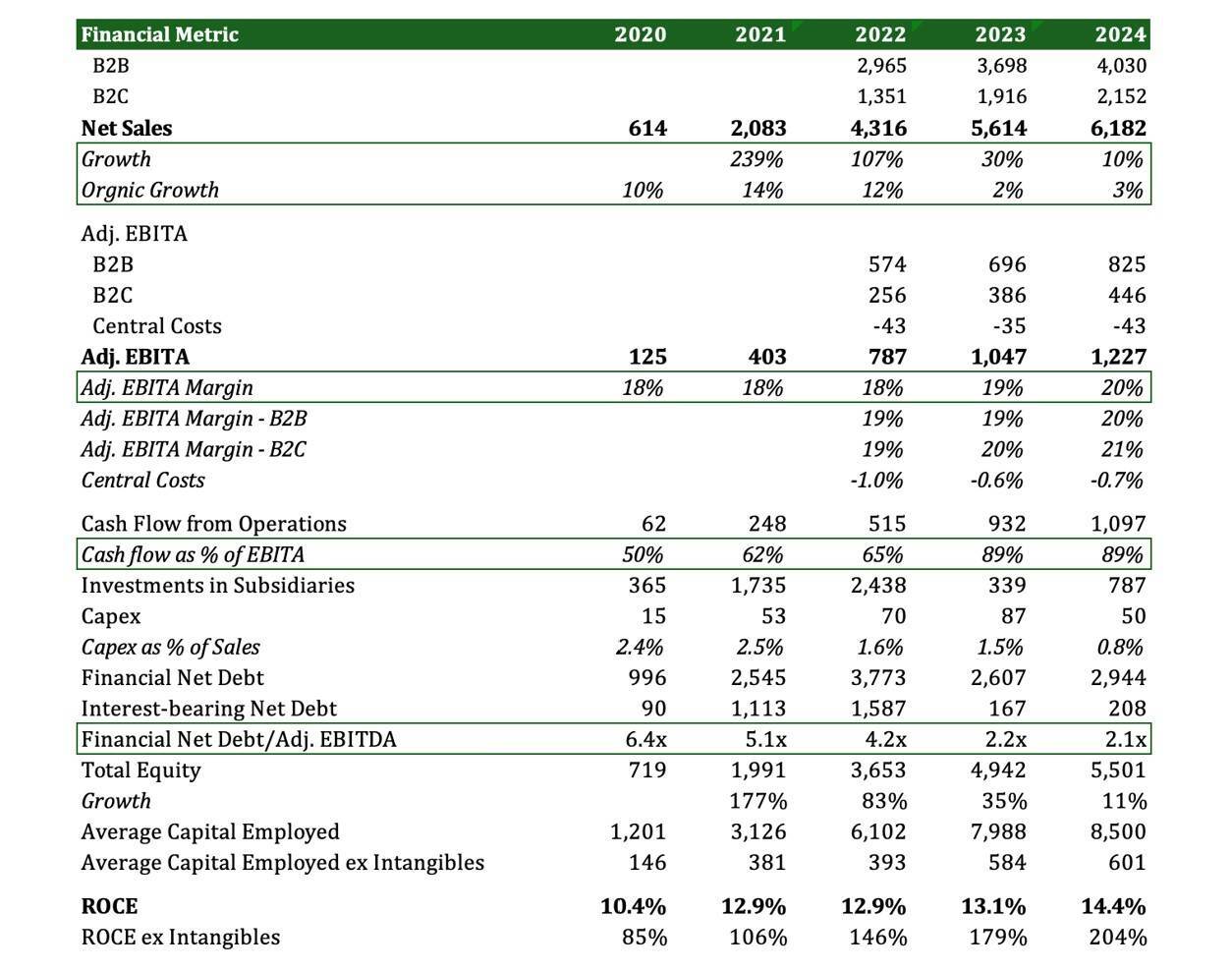

Röko’s financial history is relatively short to make long-term conclusions about its business. So far, the results have been quite strong.

- The company grew its sales by 10x in just 5 years (2020-24), a 78% annualised rate, although the growth in the past two years slowed down to 30% and 10%, respectively. The organic growth rate has been positive throughout the period (over 10% in 2020-22 and 2-3% in 2023-24).

- EBITA margin has improved from 18% in 2020-21 to 20% in 2024. So did cash conversion with Operating cash flow / EBITA growing from 50% in 2020 to 89% in 2023-24.

- Growing sales, improving margins and cash conversion have led to a reduction in leverage (Net Financial Debt/EBITDA), which has declined from 6.4x in 2020 to 2.1x in 2024.

- The company’s ROIC has also improved from 10.4% in 2020 to 14.4% in 2024.

- For comparison, Lifco’s EBITA margin was 23.2% and 22.6% in 2023-24, while its ROCE was 22.6% and 20.9%, respectively. Lifco is a more mature business with 257 subsidiaries in 34 countries. Its sales (SEK 26.1bn) are more than 3x higher than Röko’s.

Röko Financial Summary (SEK mn)

Source: Company’s filing, Hidden Value Gems analysis

The biggest challenge for me is valuation. With an EV of SEK 33.7bn and EBITA of SEK 1.2bn (2024), Röko trades at 27.4x. Assuming 20% annual growth, forward-looking multiples become more reasonable – 22.9x and 19.0x for 2025 and 2026, respectively.

Still, I find it hard to justify paying this price today for a business that has 10% potential growth (in a conservative scenario with zero organic growth) and probably more like 15% (assuming organic growth and some moderate improvement in margin (e.g. improved pricing and optimised costs).

Lifco earned SEK 5.9bn EBITA in 2024 (22.6% margin), which puts it at 30.9x EV/EBITA (2024). Based on consensus, 14-15% expected profit growth in 2025-26, the multiple drops to 26.8x and 23.2x.

So, Röko is c. 20% cheaper than Lifco, with arguably more growth potential due to its smaller scale and currently lower profitability. However, the current valuation multiples look high to me.

I would prefer to pay a multiple closer to the potential growth rate, even though this is an oversimplified approach. I could relax this rule if I see more unique strengths in Röko or more significant growth potential that could be achieved later on.

I will add Röko to my watchlist and will wait for a significant pullback in the stock (or material improvement in earnings without the corresponding share price appreciation). Such opportunities almost always present themselves in the future. It could be a general macro slowdown or just an extended period without many acquisitions, which would temporarily slow Röko’s growth and cause its valuation multiple to compress.

Still, I find it hard to justify paying this price today for a business that has 10% potential growth (in a conservative scenario with zero organic growth) and probably more like 15% (assuming organic growth and some moderate improvement in margin (e.g. improved pricing and optimised costs).

Lifco earned SEK 5.9bn EBITA in 2024 (22.6% margin), which puts it at 30.9x EV/EBITA (2024). Based on consensus, 14-15% expected profit growth in 2025-26, the multiple drops to 26.8x and 23.2x.

So, Röko is c. 20% cheaper than Lifco, with arguably more growth potential due to its smaller scale and currently lower profitability. However, the current valuation multiples look high to me.

I would prefer to pay a multiple closer to the potential growth rate, even though this is an oversimplified approach. I could relax this rule if I see more unique strengths in Röko or more significant growth potential that could be achieved later on.

I will add Röko to my watchlist and will wait for a significant pullback in the stock (or material improvement in earnings without the corresponding share price appreciation). Such opportunities almost always present themselves in the future. It could be a general macro slowdown or just an extended period without many acquisitions, which would temporarily slow Röko’s growth and cause its valuation multiple to compress.

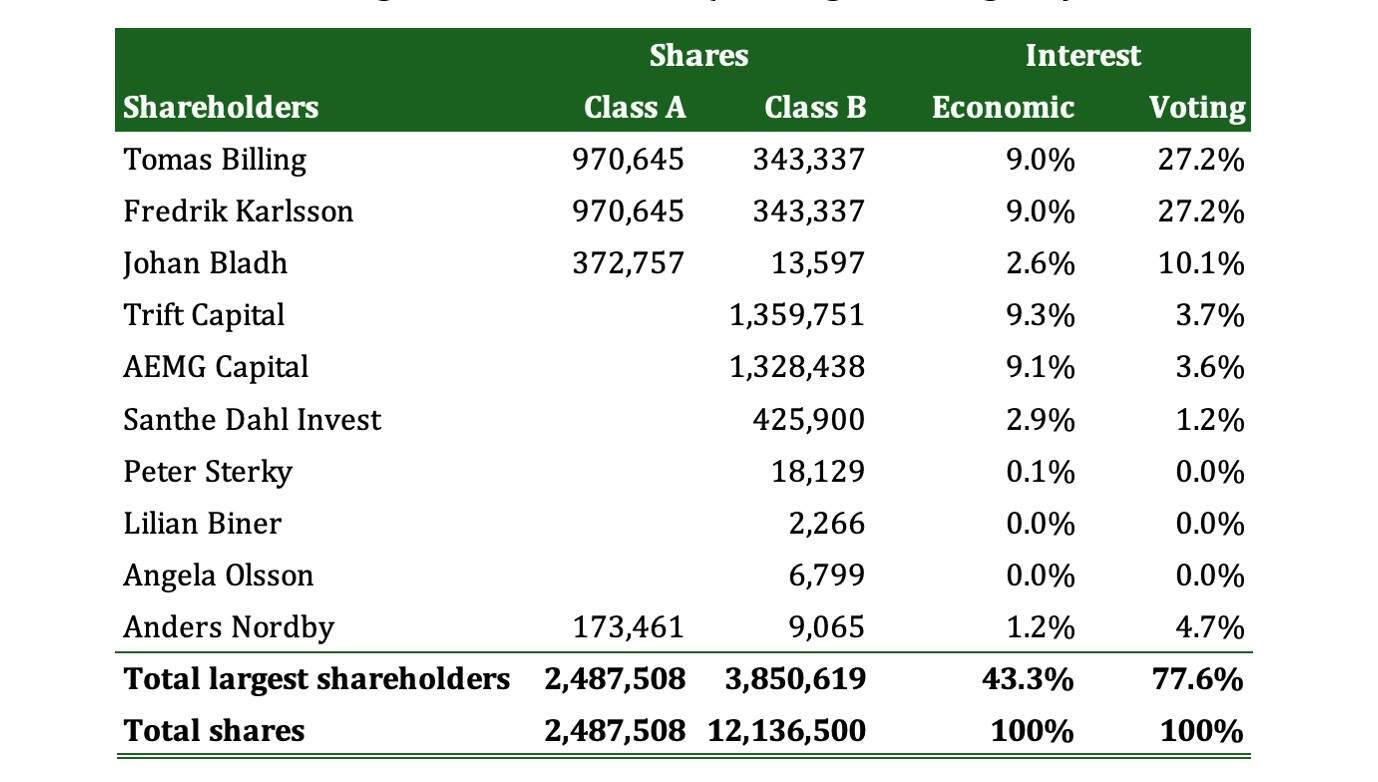

Appendix: Shareholder Structure & History

Röko has two classes of shares, which is quite common in Sweden. Class A has 10 voting rights compared to just 1 vote for each Class B share. Otherwise, both classes have the same economic rights.

Thomas Billing and Fredrick Karlsson, the founders of the company, de facto control it with a combined voting interest of 54.2% (although holding only 18% economic interest).

Thomas Billing and Fredrick Karlsson, the founders of the company, de facto control it with a combined voting interest of 54.2% (although holding only 18% economic interest).

Source: Röko Listing Prospectus 2025

Source: Röko Listing Prospectus 2025

Apart from Annual Reports and Listing Prospectus that are available on Röko’s website, if you are interested in learning more about the company’s investment approach I highly recommend these three interviews with the CEO and CFO of the company.

Röko: Building a Leading Serial Acquirer (21 April 2023)

https://inpractise.com/articles/roko-building-a-leading-serial-acquirer

Röko M&A Strategy, Transaction Structure, & Returns (3 April 2023)

https://inpractise.com/articles/roko-manda-strategy-transaction-structure-and-returns

Röko Interview - the perpetual owner is preparing for an IPO (7 June 2022)

https://www.acquirers.com/post/roko-the-perpetual-owner

Röko: Building a Leading Serial Acquirer (21 April 2023)

https://inpractise.com/articles/roko-building-a-leading-serial-acquirer

Röko M&A Strategy, Transaction Structure, & Returns (3 April 2023)

https://inpractise.com/articles/roko-manda-strategy-transaction-structure-and-returns

Röko Interview - the perpetual owner is preparing for an IPO (7 June 2022)

https://www.acquirers.com/post/roko-the-perpetual-owner