27 July 2025

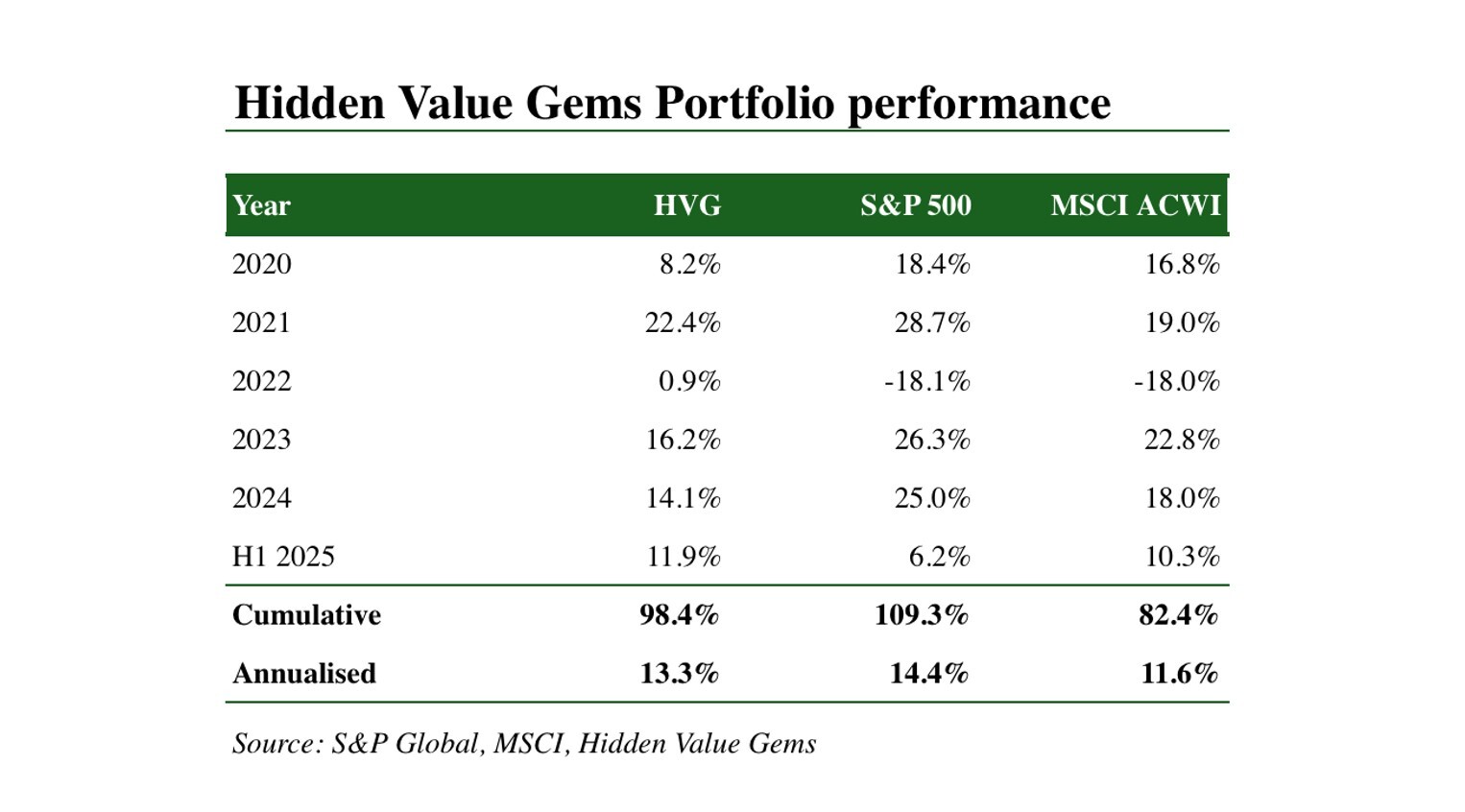

The HVG Portfolio returned 11.9% in H1 2025, supported by non-US stocks. Since 2020, the portfolio is up 98.4%, outperforming MSCI World (82.4%) but lagging behind the S&P 500 (109.3%).

This is a fair outcome given that I hold 5-15% cash, which reduces portfolio risks as well as a number of relatively ‘safe’ compounders such as Berkshire, Exor and Loews. This helps HVG to avoid large losses during weaker periods but leads to underperformance during the bull markets.

As mentioned, I plan to focus mostly on UK/European stocks. With falling equity research coverage of European mid-caps, most money still flowing into US large caps and collapsing holding period, I see a wide area of neglected companies. Many of those companies have a long history of operations, often good products and high insider ownership. Many companies are becoming better at capital allocation, often prioritising generous shareholder returns in the absence of attractive growth options. There is also a continued strategic interest, especially towards the UK companies. Activist shareholders are also taking note of extreme valuations (e.g. Swatch Group).

As mentioned, I plan to focus mostly on UK/European stocks. With falling equity research coverage of European mid-caps, most money still flowing into US large caps and collapsing holding period, I see a wide area of neglected companies. Many of those companies have a long history of operations, often good products and high insider ownership. Many companies are becoming better at capital allocation, often prioritising generous shareholder returns in the absence of attractive growth options. There is also a continued strategic interest, especially towards the UK companies. Activist shareholders are also taking note of extreme valuations (e.g. Swatch Group).

What I find interesting today

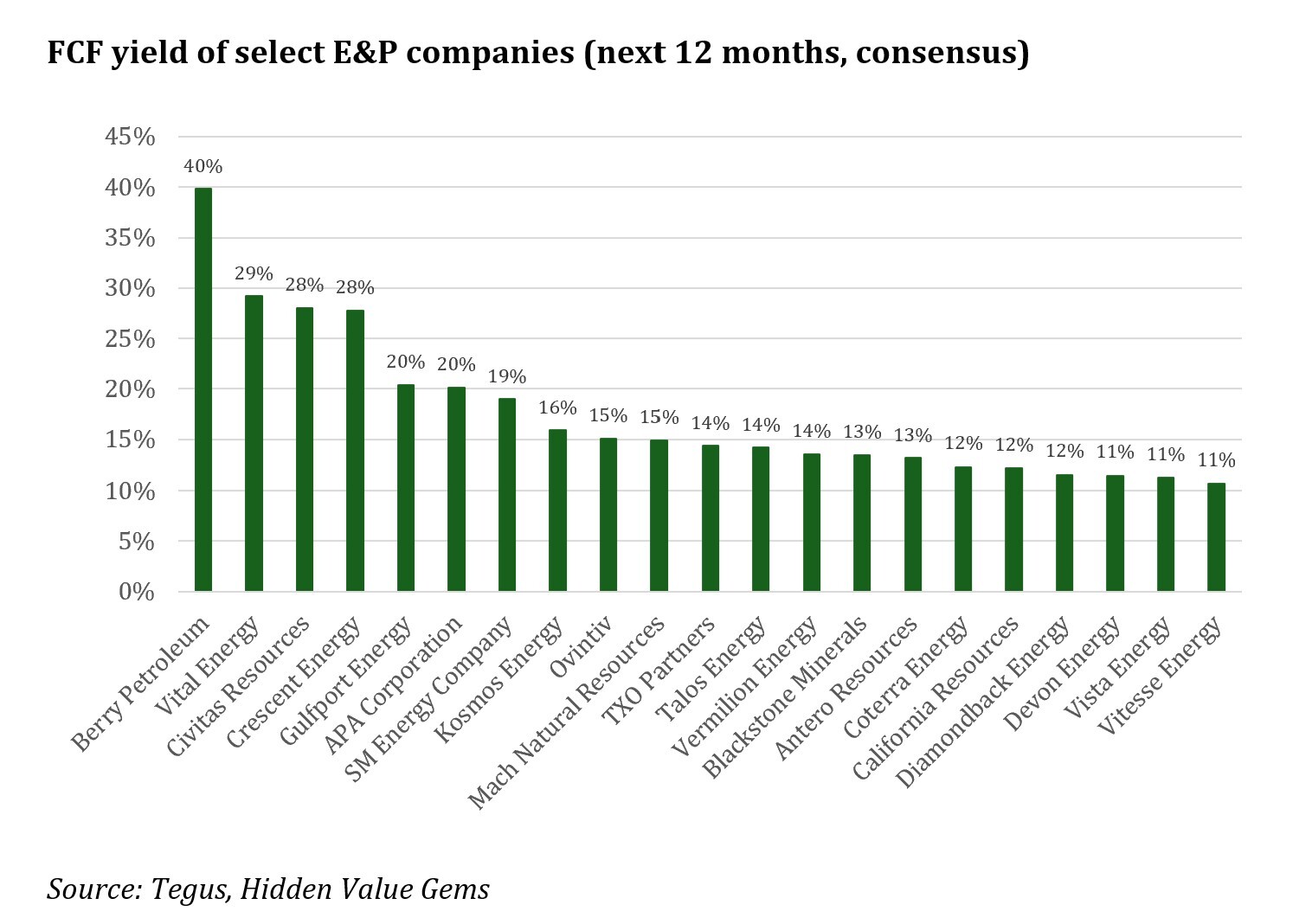

I think select names in the oil & gas space start looking more attractive now. In general, I am cautious about investing in the sector, as it has notoriously high capital intensity and the ultimate project economics depends on the oil price which is beyond our control.

However, the sector has generally shifted from pure growth strategy to focusing on returns for shareholders, leading to stronger FCF and less leverage. Despite that, valuations are more attractive than 10-15 years, while the weight of the sector in major indices is close to all-time lows.

However, the sector has generally shifted from pure growth strategy to focusing on returns for shareholders, leading to stronger FCF and less leverage. Despite that, valuations are more attractive than 10-15 years, while the weight of the sector in major indices is close to all-time lows.

In the US, in particular, the rise of AI data centres has led to a spike in electricity demand which is now expected to grow at double rate (3%) compared to historical 1.5% annual pace. While renewable sources have been the primary source of new electricity, it still fails to deliver the stable power supply which is needed for data centres.

Nuclear power is the best option, but any plant takes more than 5 years from permitting to completion, so nuclear is hardly an option before 2030. Gas-fired generation could be the fastest incremental source of electricity with about half CO2 emissions compared to coal generation.

On top of this, US export LNG capacity is about to rise by 50% in the next 2-3 years, which should help reduce the discount between domestic natural gas prices and international markets (c. 50-70% currently).

These factors make me particularly interested in revisiting US gas producers.

Below is a short review of some companies from the services space that caught my attention.

Nuclear power is the best option, but any plant takes more than 5 years from permitting to completion, so nuclear is hardly an option before 2030. Gas-fired generation could be the fastest incremental source of electricity with about half CO2 emissions compared to coal generation.

On top of this, US export LNG capacity is about to rise by 50% in the next 2-3 years, which should help reduce the discount between domestic natural gas prices and international markets (c. 50-70% currently).

These factors make me particularly interested in revisiting US gas producers.

Below is a short review of some companies from the services space that caught my attention.

Trican

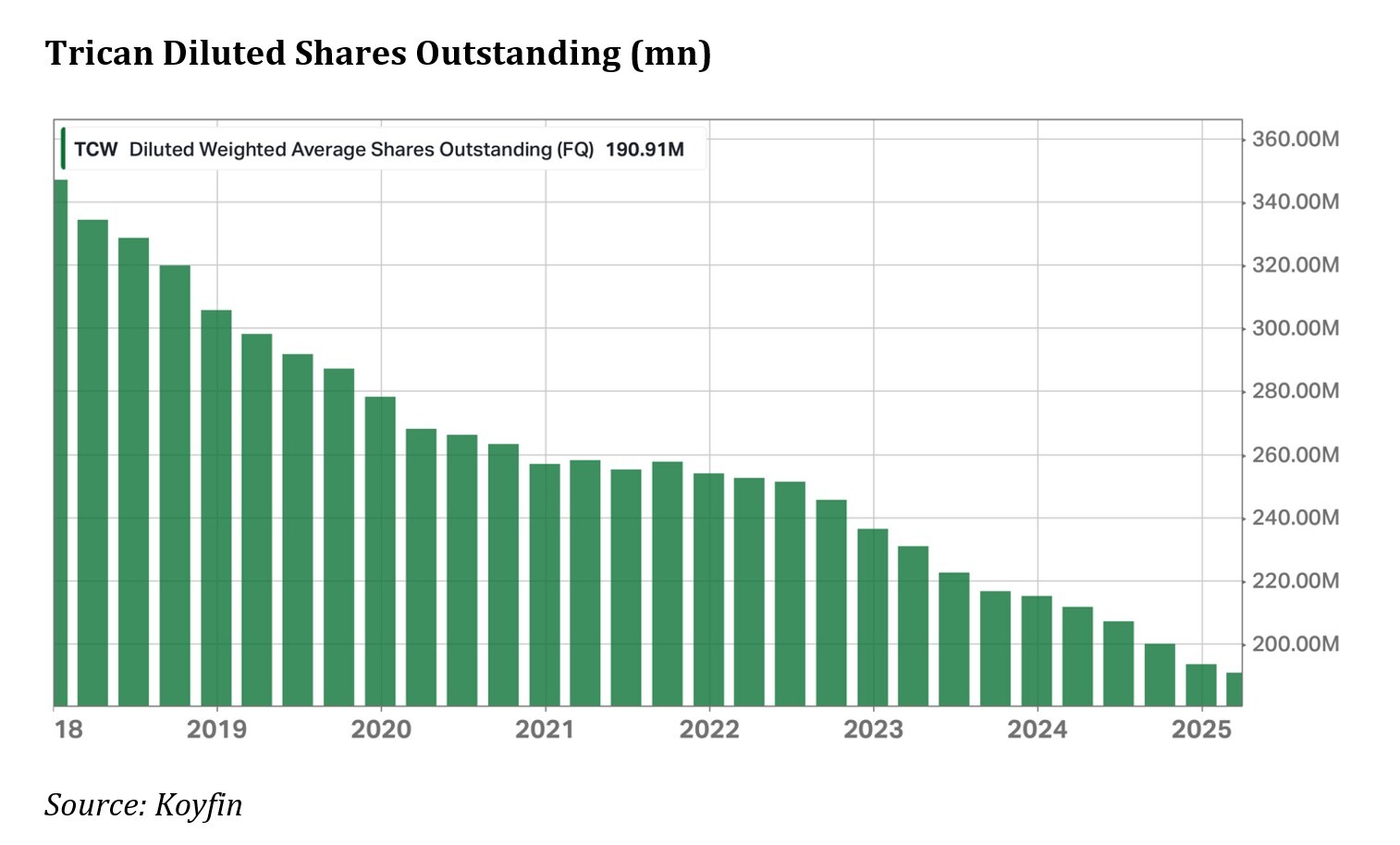

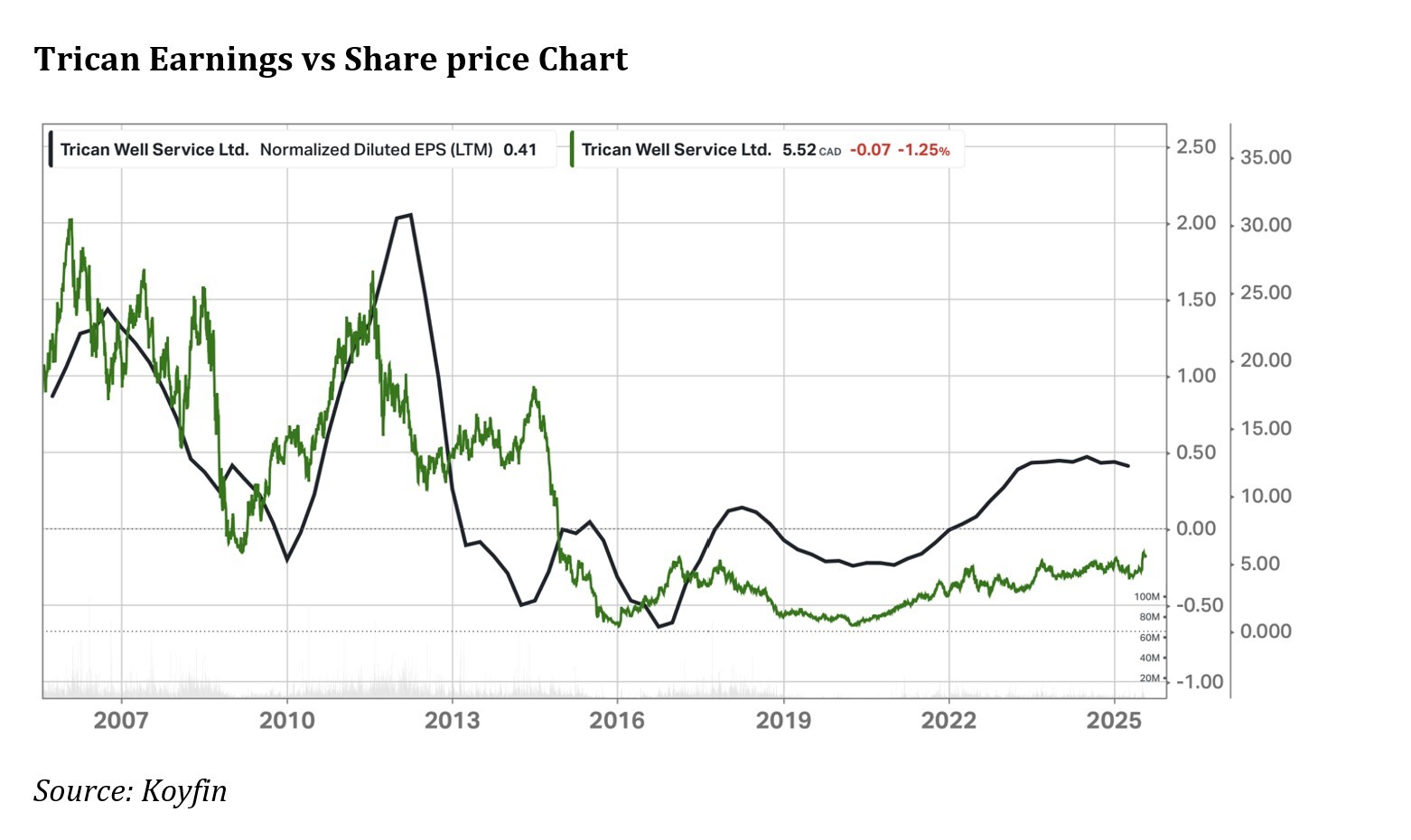

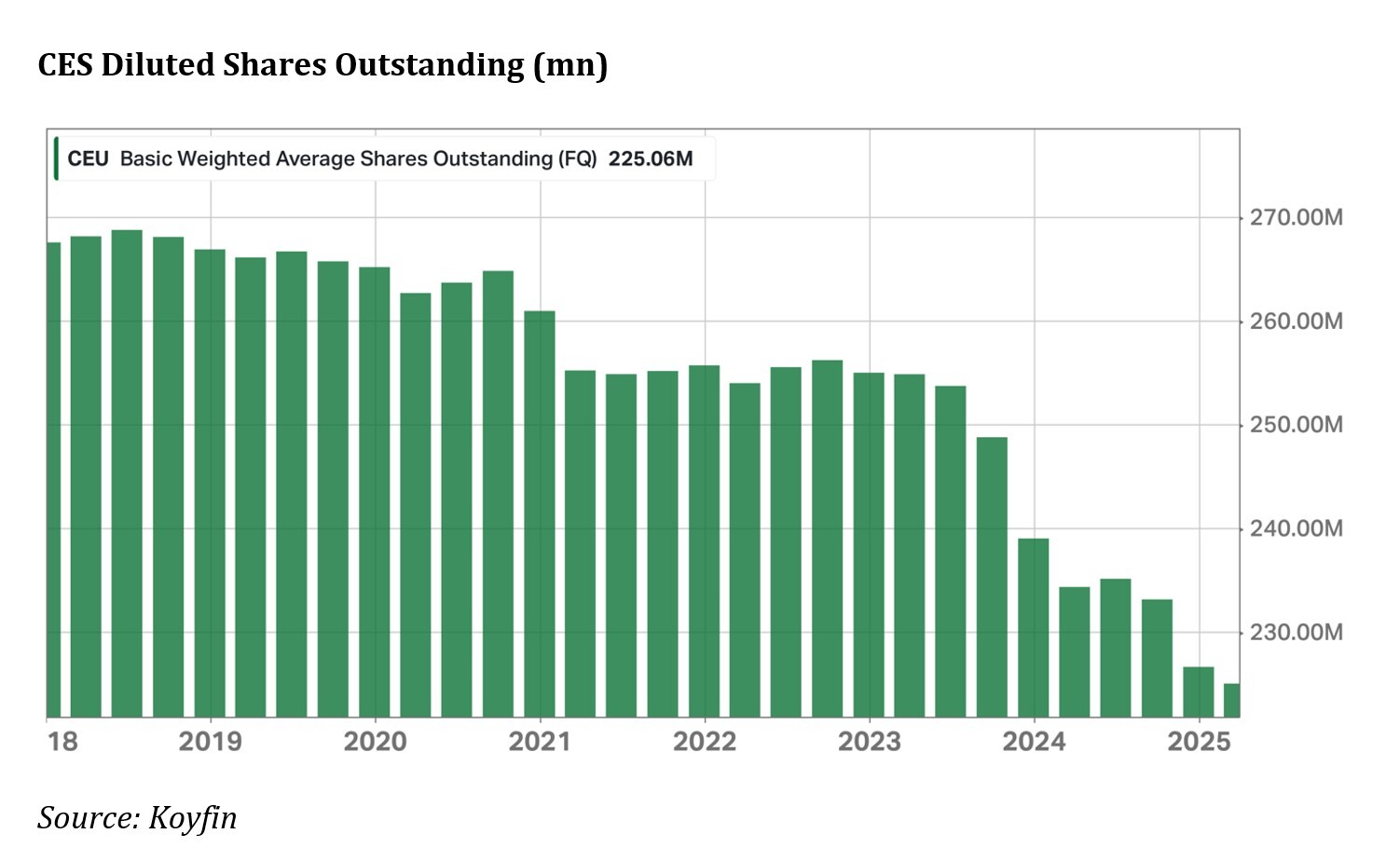

Trican is the largest provider of fracturing and other completion services in Canada. With a Mkt Cap of C$985mn and a low Net Debt of just C$9.5mn, the company trades at forward P/E of 9.5x and a consensus FCF yield of 12.9%. What is particularly attractive about Trican is that it has reduced its share count by 45% since 2018. In addition to that, the company pays a progressive quarterly dividend (C$0.055, an annualised yield of 3.9%).

CES Energy Solutions

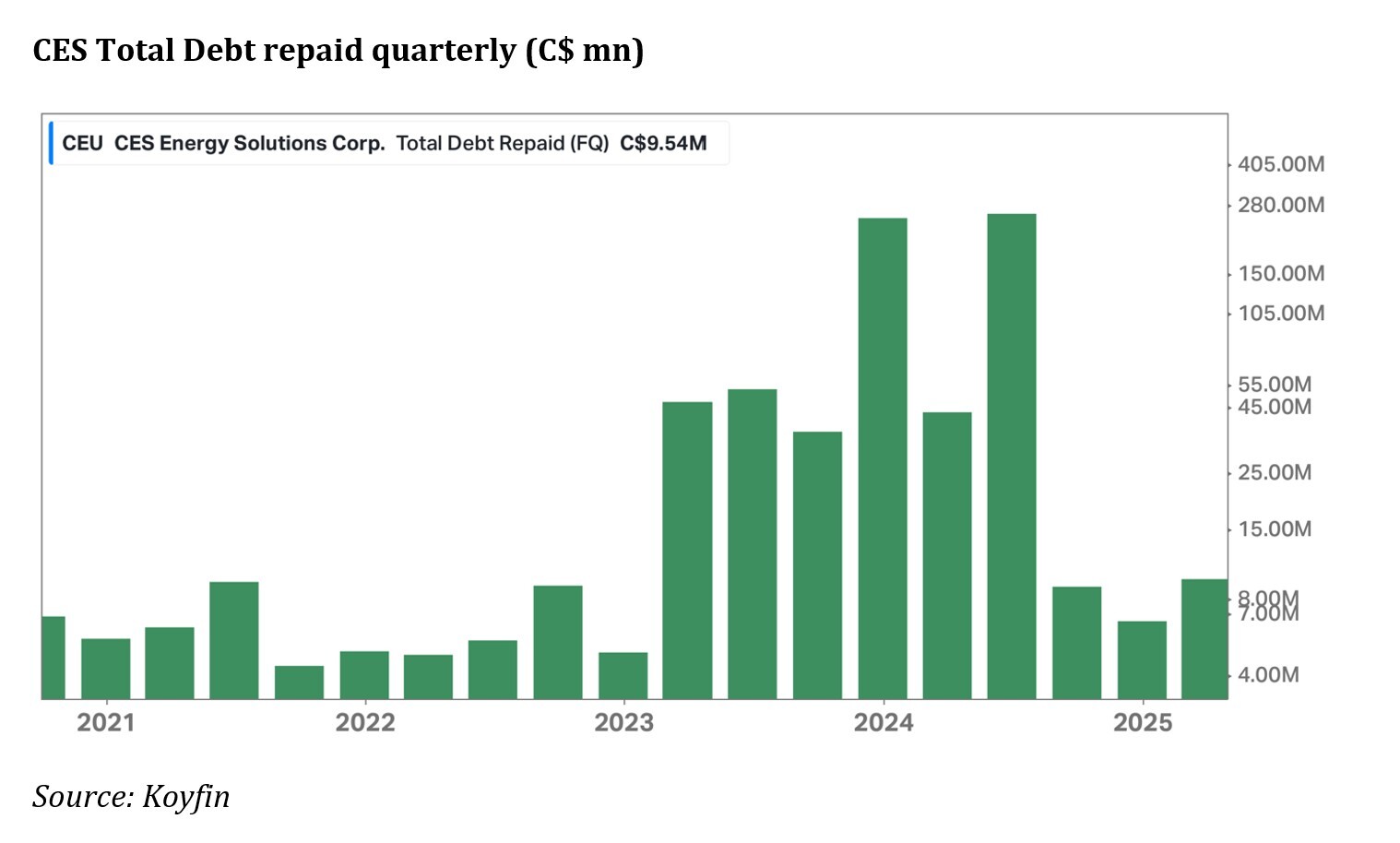

CES is also a Canadian services provider focused on supplying chemicals for drilling and competition operations in the oil & gas production. The company has a Mkt Cap of C$1.6bn and a Net Debt of C$0.4bn. It trades at 8.6x forward P/E and consensus FCF yield of 14.8%.

The company has been repaying debt and recently increased buyback programme to C$100mn annually.

The company has been repaying debt and recently increased buyback programme to C$100mn annually.

Saipem SpA

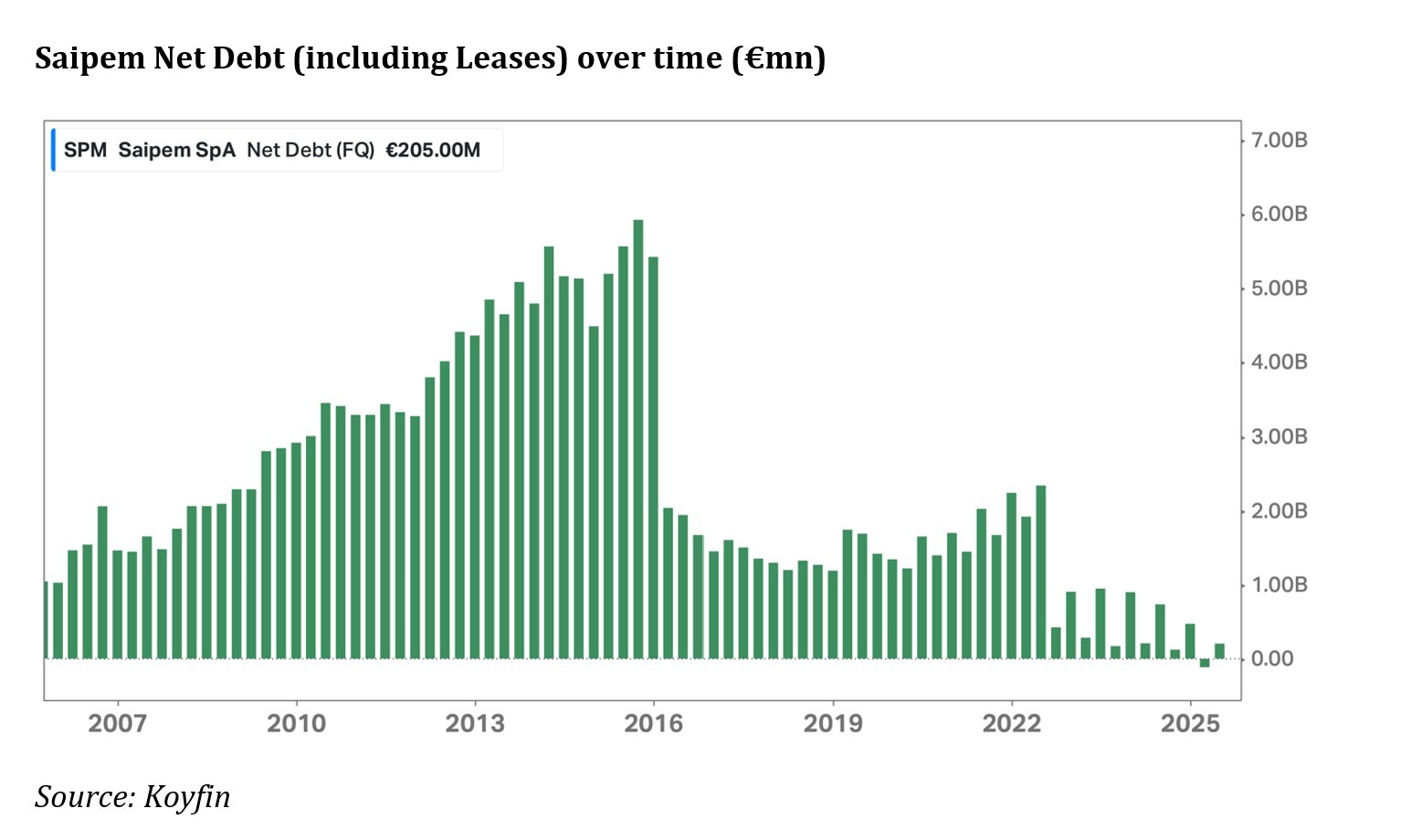

Saipem is an Italian oilfield service company focused on pipeline construction and building and maintenance of offshore structures. The company has a Mkt Cap of €4.5bn. Excluding lease liabilities, it has a Net Cash of €854mn, or a Net Debt of €205mn if lease is included.

The company targets at least €500mn FCF (after lease repayments) in 2025. Consensus estimates suggest a higher FCF of €656mn and €826mn in 2025 and 2026, accordingly (14.6% and 18.4%).

In 2024, Saipem’s order backlog reached an all-time high of €34bn (Book-to-revenue of 2.3x).

In February 2025, the company came out with a 4-year plan that envisages the following targets:

Saipem has also raised dividend shareholder distributions to at least 40% of FCF.

The company’s credit rating is currently below investment grade (BB+ by S&P and Ba1 by Moody’s). Saipem plans to achieve an investment grade credit rating in the medium-term.

Saipem has been actively reducing debt over the past several years.

The company targets at least €500mn FCF (after lease repayments) in 2025. Consensus estimates suggest a higher FCF of €656mn and €826mn in 2025 and 2026, accordingly (14.6% and 18.4%).

In 2024, Saipem’s order backlog reached an all-time high of €34bn (Book-to-revenue of 2.3x).

In February 2025, the company came out with a 4-year plan that envisages the following targets:

- Revenue of at least €15.0bn in 2028 (flat relative to 2025)

- EBITDA of approx. €2.0bn in 2028 (vs €1.3bn in 2024 and €1.6bn target for 2025)

- Operating Cash Flow (after the repayment of lease liabilities) of at least €3.7bn (cumulated on 2025-2028)

- Capex of approx. €1.5bn (cumulated on 2025-2028)

- FCF (after the repayment of lease liabilities) of at least €2.2bn (cumulated on 2025-2028)

Saipem has also raised dividend shareholder distributions to at least 40% of FCF.

The company’s credit rating is currently below investment grade (BB+ by S&P and Ba1 by Moody’s). Saipem plans to achieve an investment grade credit rating in the medium-term.

Saipem has been actively reducing debt over the past several years.

Nabors Industries

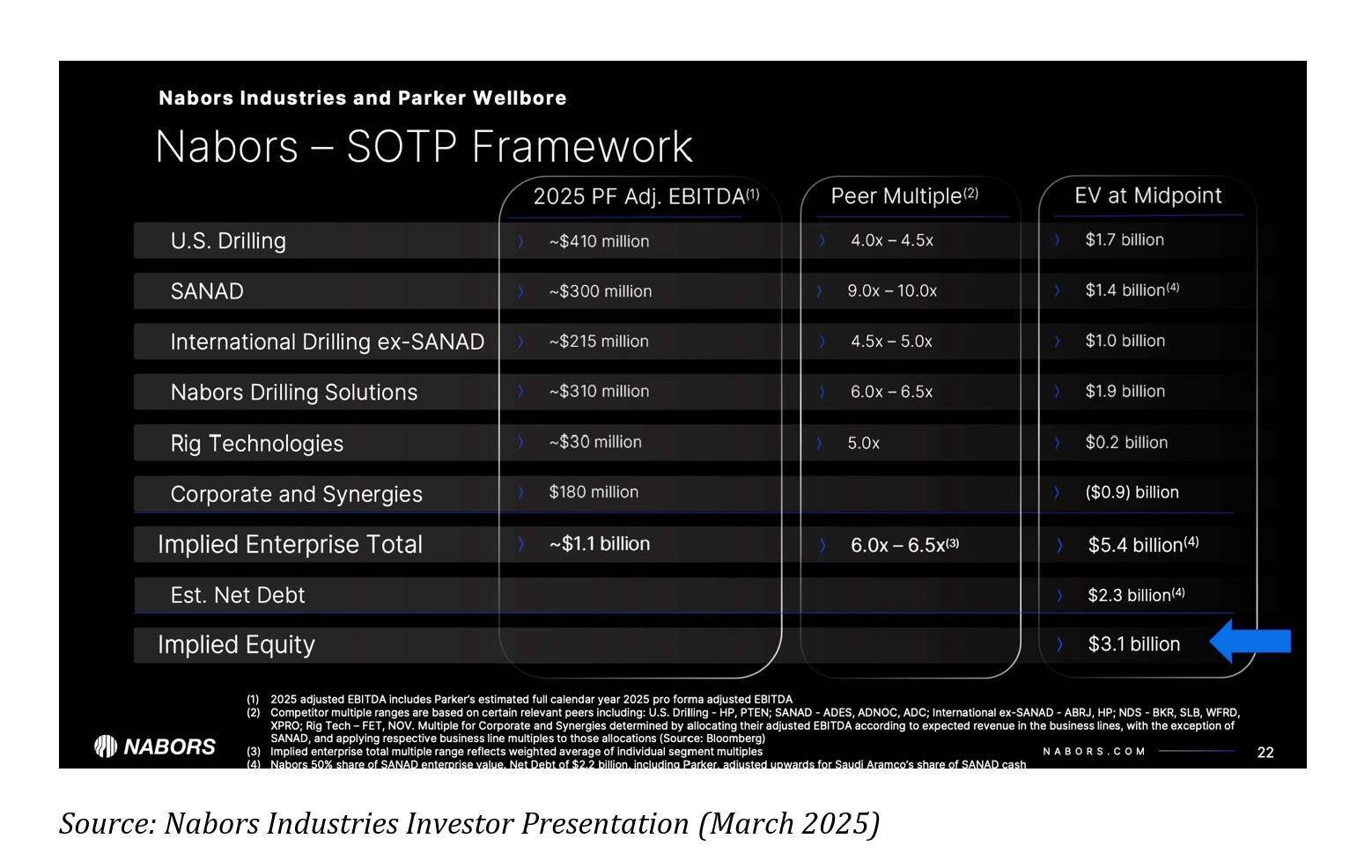

This is more of a speculative opportunity due to the company’s high leverage. Nabors Mkt Cap is $520mn while its net debt stands at $2.3bn. In March 2025, The company completed acquisition of a major competitor (Parker) which should lead to c. 24% higher EBITDA on a pro-forma basis.

Management argues that there is c. 6x upside on the Sum-of-the-Parts basis. Here is a table from their recent Investor Presentation.

Management argues that there is c. 6x upside on the Sum-of-the-Parts basis. Here is a table from their recent Investor Presentation.

For 2025, the company expects $150mn FCF excluding investments into the Saudi Arabia Nabors Drilling JV (SANAD). This implies 30% FCF yield.

Miller Value’s Portfolio Manager, Dan Lysik, estimates that Nabors trades below 1x forward cash flow and the only other period it traded lower was during COVID. which I find quite interesting. You can read his commentary on the stock here.

Miller Value’s Portfolio Manager, Dan Lysik, estimates that Nabors trades below 1x forward cash flow and the only other period it traded lower was during COVID. which I find quite interesting. You can read his commentary on the stock here.