25 June 2025

Last week, I took part in CFA UK’s Value Investing Annual Stock Slam competition for the first time.

Four contestants pitched their best ideas. Three of them were clear value stocks. The fourth one, presented by me, was much more of a growth stock but still trading considerably below its intrinsic value, given the inflexion point in profitability. To my surprise, the Trustpilot idea got the most votes. Being the last presenter may have helped me.

I found all three ideas quite interesting:

I decided to take a closer look at Avis. I analysed its financials going back to 2010 and reviewed the latest earnings calls to understand its business model and value drivers.

Below are the most critical points based on my analysis.

Four contestants pitched their best ideas. Three of them were clear value stocks. The fourth one, presented by me, was much more of a growth stock but still trading considerably below its intrinsic value, given the inflexion point in profitability. To my surprise, the Trustpilot idea got the most votes. Being the last presenter may have helped me.

I found all three ideas quite interesting:

- Avis Budget Group by Phil Porrat. Phil first submitted his idea in April and the stock has more than doubled since. It is also the best performer since the CFA event.

- Scorpio Tankers by Rohit Anand. Scorpio owns oil product tankers is majority-owned by the founding Lauro family. The founder’s grandson, Emanuele Lauro, is the chairman and CEO of the company. According to Rohit, the company has been a good capital allocator, taking advantage of market volatility. It is also an active buyer of its own stock, retiring c. 10% of its shares in 2024. The company trades at just 6.2x fwd P/E, although actual earnings are highly volatile and sensitive to tanker rates.

- Noah Holding by John Putzfeld. Noah Holding is one of the largest Chinese wealth managers. Wealth managers generally have sticky customers with high lifetime value. Noah Holdings trades below cash and, with a 35-50% payout ratio, offers close to a double-digit dividend yield. The company was founded in 2005 by two partners who continue to run the business and own a 25.4% interest. The shares are listed in NY, HK and Shanghai.

I decided to take a closer look at Avis. I analysed its financials going back to 2010 and reviewed the latest earnings calls to understand its business model and value drivers.

Below are the most critical points based on my analysis.

Avis: beneficiary from trade tariffs

Introduction

Avis is the world's second-largest car leasing company with a 695k car fleet. 75% of the car fleet is in the Americas (predominantly the US). The region accounts for 78% of revenue and about 88% of the company’s EBITDA (based on the 2022-24 average).

The market is highly concentrated, with the top 3 players accounting for over 90% of the market share (in the US). The biggest company is a privately held Enterprise (close to 2 million cars), followed by Avis and Hertz (publicly listed with over 500k vehicles).

The industry benefits from economies of scale. The more cars a company owns, the wider its geographic coverage is, so customers can pick up and drop off cars in different locations. This increases car utilisation. Besides, large leasing companies have stronger negotiation power when purchasing new cars, repairing, insuring and selling cars.

A play on used car prices, not a travel stock

Avis’s revenue is driven by leisure demand and is highly correlated with the general macro conditions. However, profitability is much more sensitive to used car prices. The point is that while the market may be concerned by weaker macro due to higher tariffs, these tariffs will push used car prices higher as producers will struggle to maintain supply at the previous levels.

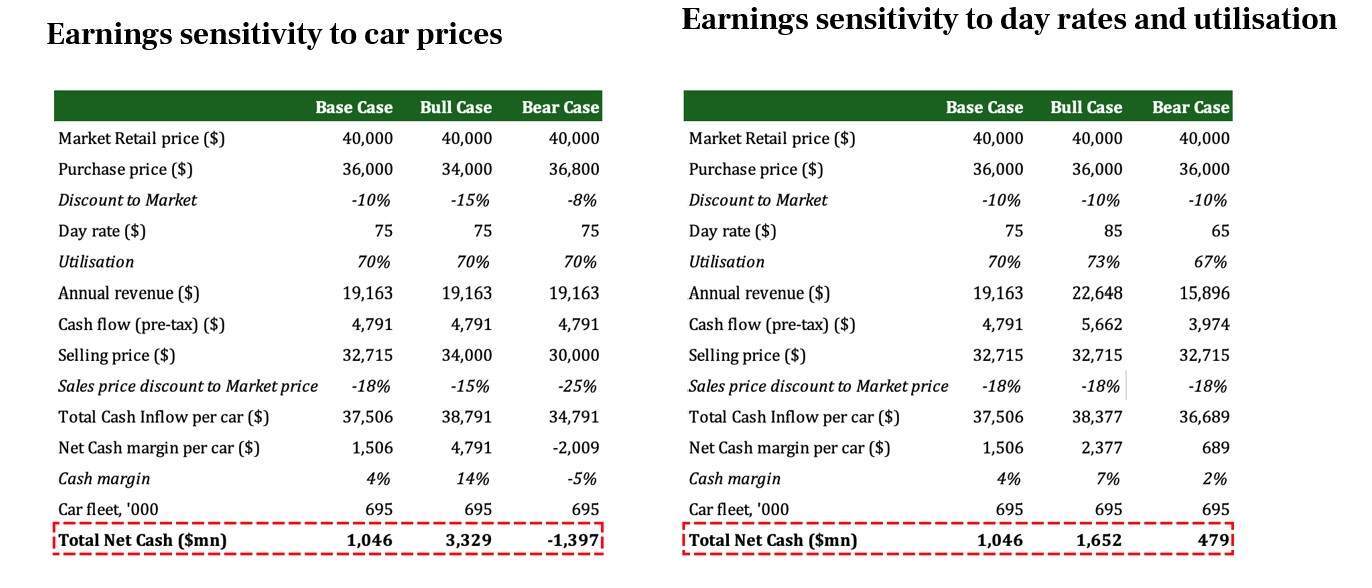

A simple economics for Avis is as follows. Let us assume that the average retail price of a car is c. $40k and Avis can purchase it at a 10% discount (Base Case). The car is rented out 70% of the time for 12 months at an average daily rate of $75. In 12 months, a car will earn $19,163 revenue and $4,791 pre-tax cash profit (25% margin).

The remaining act is for Avis to sell its car (usually after 6-18 months of operations). A car typically loses 20% of its value within a year. Assuming Avis is able to sell its cars at an 18% discount to the market price ($32,715), its total cash proceeds from rent and car disposal would amount to $37,506 in one year from a typical car. Taking into account $36,000 purchase price, Avis should earn about $1.5k per car in net cash. With a fleet of 695k cars, this equates to c. $1bn of net cash flow.

Source: Hidden Value Gems

The crux of the issue is how sensitive their cash flows are to changes in car price assumptions. In a highly optimistic scenario, when Avis can maximise the discount on a new car and then re-sell it at just 15% discount, its net cash per car could reach $4.791 ($3.3bn annually), while it can also incur losses of $2k per car ($1.4bn annually) in less favourable scenario (only 8% discount on a new car and a 25% discount for a car sale price).

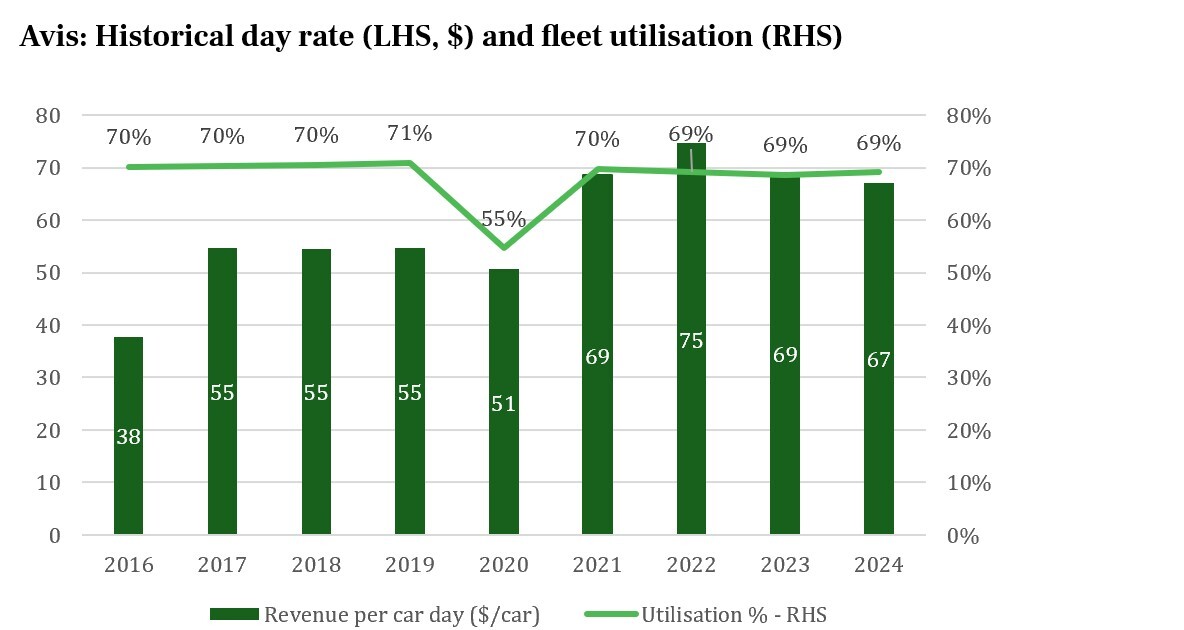

The table to the right shows how much more stable Avis’ profits are under different assumptions for car day rates and utilisation rates. Historically, Avis enjoyed stable utilisation of its fleet, averaging 69-70%, with the lows (55%) reached in 2020 and the highs (71%) in 2019.

Daily revenue per car has been more volatile, especially within each year, depending on the season (usually higher in summer than in winter months). After COVID, the day rate has been more stable, averaging $70.

The table to the right shows how much more stable Avis’ profits are under different assumptions for car day rates and utilisation rates. Historically, Avis enjoyed stable utilisation of its fleet, averaging 69-70%, with the lows (55%) reached in 2020 and the highs (71%) in 2019.

Daily revenue per car has been more volatile, especially within each year, depending on the season (usually higher in summer than in winter months). After COVID, the day rate has been more stable, averaging $70.

Source: Company’s filings, Hidden Value Gems

2024 was an exceptional year for Avis in terms of fleet costs (Leasing & DD&A), which have averaged $12 per day per car ($4.3k per car) compared to $8 per day over the past 9 years. In Q1 2025, fleet costs came in at $351 per month ($11.7 per day), below management’s guidance of $400 ($13.3 per day).

Avis expects these costs to continue falling to $325 on a monthly basis in the current quarter and to $300 by the start of Q4 2025.

Avis expects these costs to continue falling to $325 on a monthly basis in the current quarter and to $300 by the start of Q4 2025.

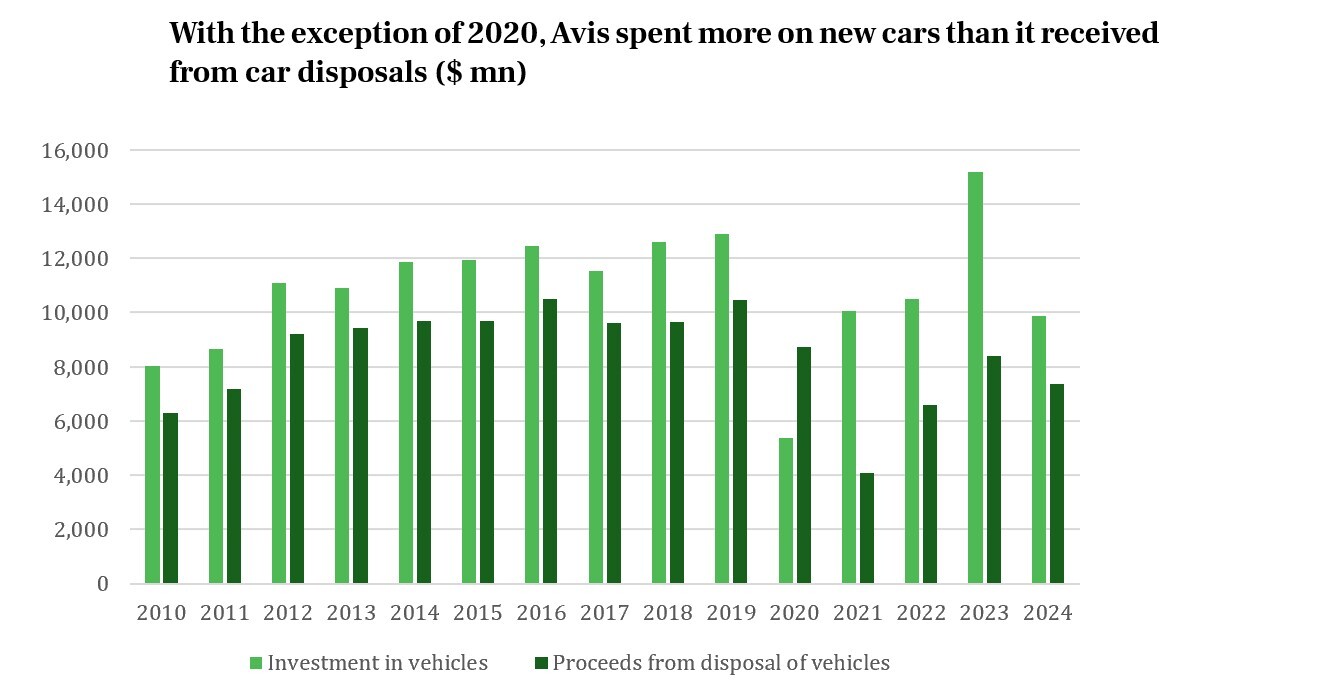

Below is Avis’ historical cash used on purchasing new cars relative to proceeds from car sales.

Source: Company’s filings, Hidden Value Gems

The full-cycle cash flow has been historically quite volatile. This is the cash earned by Avis on renting its cars and proceeds from car disposals, minus cash spent on new car purchases. Despite the volatility, Avis earned a cumulative cash of $3.2bn from 2010 until 2024 (68% of its market cap).

Source: Company’s filings, Hidden Value Gems

A significant advantage of Avis’ business model is that it is capital-light, as most of the purchases are financed with financial leases and securitised. Avis does not require much of its own capital to run the business. In fact, it has been running a negative equity since 2020.

The flip side is that there is inherent leverage in the business. However, with a short holding period (6-18 months), Avis does not own cars for too long and has been able to utilise them successfully at attractive rates, thanks to its scale and operational efficiencies.

So while the business looks to be asset-heavy, the company’s ability to keep its fleet busy and a short ownership cycle make its operations more profitable.

A new player entering the sector who may want to buy several cars using lease finance would face much higher risks, as it may struggle to rent its cars at attractive rates due to a lack of brand power and will likely achieve lower utilisation, as cars could be left in much less popular places.

Avis offers most of its cars in airports (67%). The company is present in most of the world’s large airports. These strategic locations and relationships developed with airports over many years create a critical barrier to entry. In total, 9,280 locations globally offer Avis or Budget car rental services.

A significant advantage of Avis’ business model is that it is capital-light, as most of the purchases are financed with financial leases and securitised. Avis does not require much of its own capital to run the business. In fact, it has been running a negative equity since 2020.

The flip side is that there is inherent leverage in the business. However, with a short holding period (6-18 months), Avis does not own cars for too long and has been able to utilise them successfully at attractive rates, thanks to its scale and operational efficiencies.

So while the business looks to be asset-heavy, the company’s ability to keep its fleet busy and a short ownership cycle make its operations more profitable.

A new player entering the sector who may want to buy several cars using lease finance would face much higher risks, as it may struggle to rent its cars at attractive rates due to a lack of brand power and will likely achieve lower utilisation, as cars could be left in much less popular places.

Avis offers most of its cars in airports (67%). The company is present in most of the world’s large airports. These strategic locations and relationships developed with airports over many years create a critical barrier to entry. In total, 9,280 locations globally offer Avis or Budget car rental services.

Shareholder-friendly capital allocation track record