12 January 2025

This is the forth edition of the free HVG Investment Notes, where I share the most interesting points that caught my attention during the week. This could be one or two interesting stocks, a thought-provoking article, a research paper, an interview, a chart and other points.

I. 2025 Trends

There is no lack of market forecasts, especially at this time of the year. I am generally sceptical as forecasts are more often wrong than right. Besides, they distract us from focusing on business fundamentals and valuation, which drive long-term performance.

Nevertheless, it is occasionally helpful to put aside an annual report and look around.

I found this Top 10 Trends for 2025 by Ruchir Sharma in the FT quite interesting.

I suspect we will have to wait more than a year for some of those trends to play out, but I would rather wait longer than get caught up in euphoria.

I imagine many value investors will find this quote comforting:

Nevertheless, it is occasionally helpful to put aside an annual report and look around.

I found this Top 10 Trends for 2025 by Ruchir Sharma in the FT quite interesting.

I suspect we will have to wait more than a year for some of those trends to play out, but I would rather wait longer than get caught up in euphoria.

I imagine many value investors will find this quote comforting:

The trends of the past 15 years are stretched thin amid the growing manias for America and AI, which are supercharged by excessive US stimulus, the gamification of investing and the rise of algorithmic trading and passive money managers.

Here are the top ten trends to watch in 2025, according to Ruchir Sharma:

- Return of the contrarians

- Momentum Crashes

- Punishing Deficits

- Less [US] exceptionalism

- The next stars [‘Many countries now languish in the shadows — but that is where the next stars are usually found’]

- Investable China

- AI undercuts Big Tech

- Trade without America

- Private excess

- No magic injection [on the limited potential of weight-loss drugs]

II. Matthew McLennan: Investing in a high-risk world

I enjoyed this episode of Wealthtrack by Consuelo Mack with Matthew McLennan, a PM at First Eagle Fund who succeeded a legendary value investor, Jean-Marie Eveillard.

He noted that there are long-term structural drivers for US outperformance such as flexible labour market, vibrant educational system and, of course, the tech sector. However, according to McLennan, they do not fully explain the outperformance.

He noted that there are long-term structural drivers for US outperformance such as flexible labour market, vibrant educational system and, of course, the tech sector. However, according to McLennan, they do not fully explain the outperformance.

In truth, part of the reason the US has done better is that we've had a great deal of fiscal stimulus, even though we don't have a recession.

Similar to Ruchir Sharma, McLennan has also pointed out the extreme weight of the US stock market in the global index, which is higher today than during the 1990s and in the 1960s (during the Nifty Fifty bubble). He also emphasised the explosion of AI investments in the US, with every large tech company spending more on capex than ExxonMobil, the largest operator in one of the most capital-intensive industries.

Therein lies the problem for investors, because it's one thing to say that the US economy has been doing better than, say, Europe or parts of Asia or Latin America. But on the other hand, it's not going to help you as an investor if that's already being well and truly priced into the market.

With the US market trading at 22-23x P/E (4.5% earnings yield), the rest of the world is valued more attractively at over 7% yield. McLennan believes there is about a 1% difference in productivity and growth between the US and the rest of the world, but the valuation gap is much wider, reflecting much more pessimistic views baked into the value of international stocks.

One of the stocks he recommended was a European-listed Prosus, which is best known for its 23% interest in Tencent (which accounts for 76% of Prosus’ NAV). Tencent is the leading Chinese payment and social media platform with a strong global gaming business and various VC investments. Prosus owns stakes in other exciting companies such as the “leading online food distributor in Brazil, the leading online classifieds business, OLX, in Eastern Europe, and a leading online payments business, PayU, in India.”

The company trades at a 42% discount to its NAV. Since 2022, it has launched an open-ended buyback programme and has so far repurchased $22.5bn worth of shares.

I profiled Prosus in our European Family Holdings report last year.

Other stocks mentioned by McLennan:

One of the stocks he recommended was a European-listed Prosus, which is best known for its 23% interest in Tencent (which accounts for 76% of Prosus’ NAV). Tencent is the leading Chinese payment and social media platform with a strong global gaming business and various VC investments. Prosus owns stakes in other exciting companies such as the “leading online food distributor in Brazil, the leading online classifieds business, OLX, in Eastern Europe, and a leading online payments business, PayU, in India.”

The company trades at a 42% discount to its NAV. Since 2022, it has launched an open-ended buyback programme and has so far repurchased $22.5bn worth of shares.

I profiled Prosus in our European Family Holdings report last year.

Other stocks mentioned by McLennan:

- Medtronic PLC (MDT)

- IPG Photonics Corporation (IPGP)

- Haleon PLC ADR (HLN)

- FEMSA: Fomento Economico Mexicano SAB de CV ADR (FMX)

- Coca-Cola FEMSA, S.A.B. de C.V. ADR (KOF)

III. Howard Marks: are we in a bubble?

Howard Marks, a co-founder of Oaktree Capital and an author of two books, asked this question in his latest memo. His first memo, bubble.com, published 25 years ago, clearly highlighted the signs of a bubble and was 100% correct.

Today, however, he sees some signs of overheating but is not ready to call the market a bubble.

He admits a few things to worry about, such as strong market performance over the past two years (The S&P 500 was up 26% in 2023 and 25% in 2024), above-average valuations, high market concentration (Mag7 account for c. 33% of the market, while the US market represents c. 70 of the MSCI World Index).

But he also lays out the counterarguments:

One of my lessons from investing is never relying on someone’s opinion. While considering various arguments, it is important to maintain your own strategy and focus. Mine is to find quality companies that may be mispriced for the wrong reasons.

Today, however, he sees some signs of overheating but is not ready to call the market a bubble.

He admits a few things to worry about, such as strong market performance over the past two years (The S&P 500 was up 26% in 2023 and 25% in 2024), above-average valuations, high market concentration (Mag7 account for c. 33% of the market, while the US market represents c. 70 of the MSCI World Index).

But he also lays out the counterarguments:

- “The p/e ratio on the S&P 500 is high but not insane”

- “The Magnificent Seven are incredible companies, so their high p/e ratios could be warranted”

- “I don't hear people saying, "There's no price too high”

- “The markets, while high-priced and perhaps frothy, don't seem nutty to me.”

One of my lessons from investing is never relying on someone’s opinion. While considering various arguments, it is important to maintain your own strategy and focus. Mine is to find quality companies that may be mispriced for the wrong reasons.

IV. Business Breakdown: Kering

In the context of an expensive US market in contrast with the out-of-favour European stocks, this recent Business Breakdown podcast on Kering is worth your time. The podcast guest is Jonathan Eng, a 30-year investment professional currently with Causeway Capital Management.

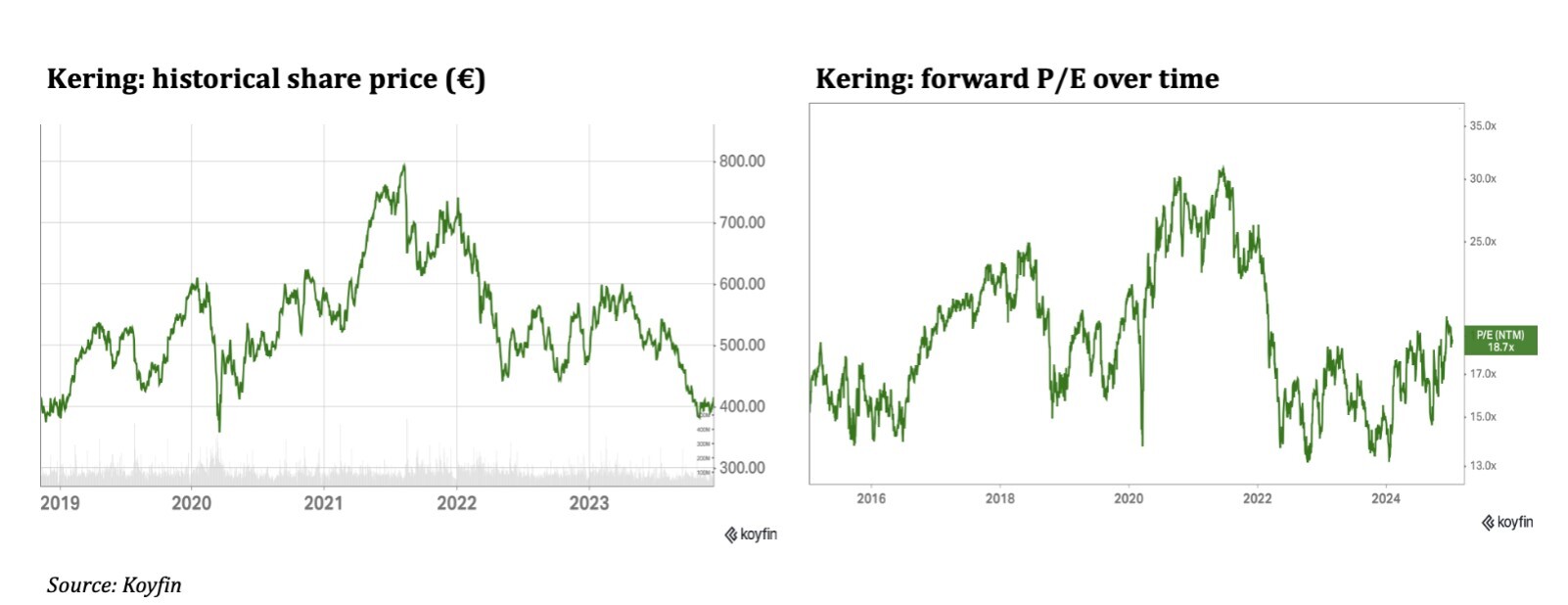

I have followed the company since 2022, when the stock had fallen over 40% from its 2021 all-time high of €450. After a short rebound, it made new lows, and today, it is trading at around €230. The same level it traded in 2017!

I have followed the company since 2022, when the stock had fallen over 40% from its 2021 all-time high of €450. After a short rebound, it made new lows, and today, it is trading at around €230. The same level it traded in 2017!

The obvious factors that can attract value investors to Kering include the business's economics, which is characterised by high margins and high returns on capital.

Kering’s 2010-2023 operating margin has averaged 21.5%, while ROIC - 13%.

The company has increased its sales and net income by 5% and 11% annually during 2010-2023.

The founding Pinault family owns 42% of the company.

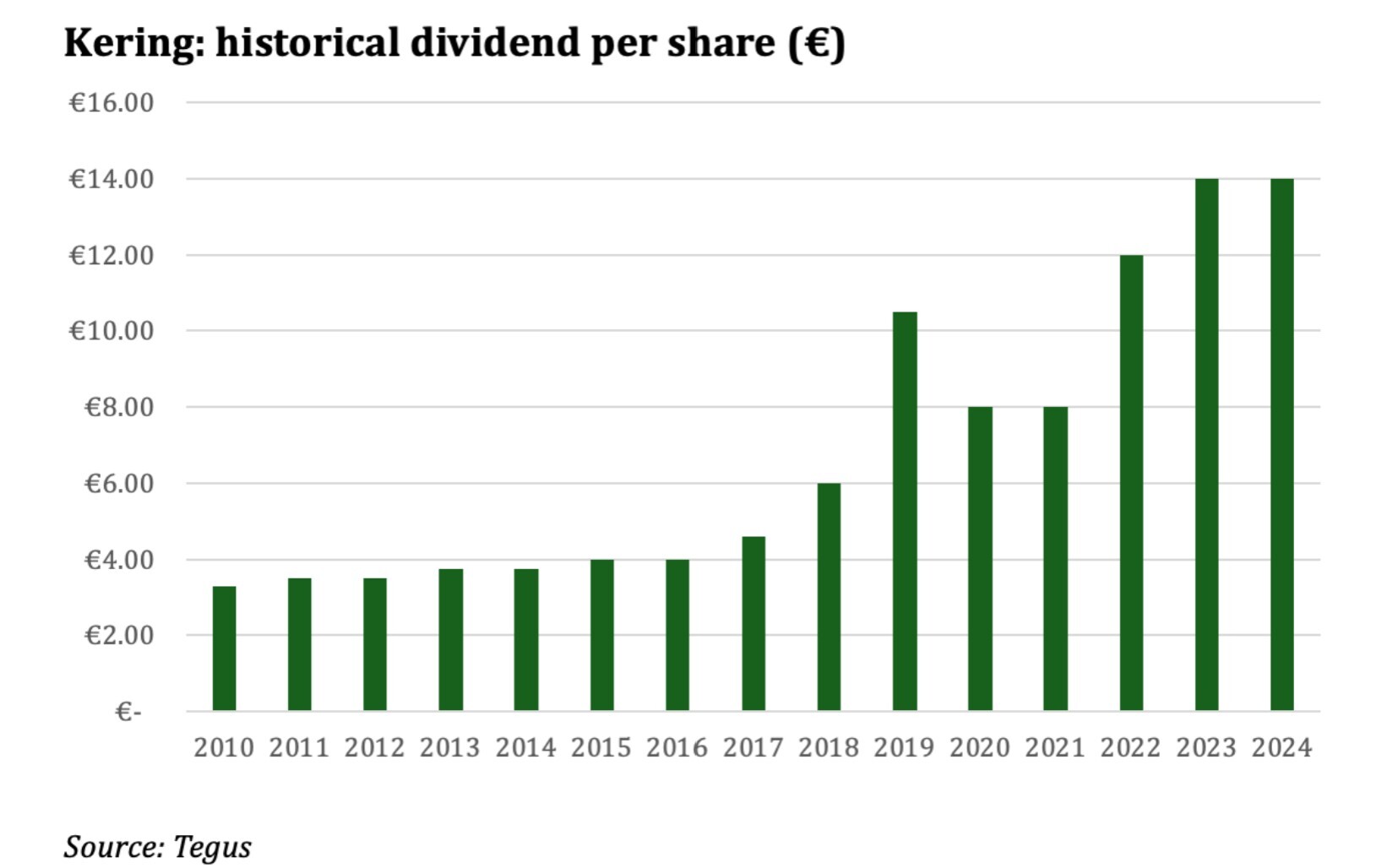

Kering is a regular dividend payer, complementing its dividends with buybacks. From 2010 to 2024, its DPS increased by 10% annually.

Kering’s 2010-2023 operating margin has averaged 21.5%, while ROIC - 13%.

The company has increased its sales and net income by 5% and 11% annually during 2010-2023.

The founding Pinault family owns 42% of the company.

Kering is a regular dividend payer, complementing its dividends with buybacks. From 2010 to 2024, its DPS increased by 10% annually.

The stock trades at a forward P/E of 17x, compared to 20-50x for other luxury brands. However, Gucci, the brand that accounts for roughly half of sales and profits, has seen its sales and margins decline as it changed designers. The brand had an operating margin of 30% with €4bn sales and 40% with €10bn in the past compared to just a 20% margin today.

If Gucci’s profitability improves to at least 30% and with €7.5bn sales, Kering would be worth less than 10x P/E.

The podcast discusses other important issues such as Kering’s history, Gucci’s turnaround efforts, luxury sector M&A, the supply chain, and risks.

If Gucci’s profitability improves to at least 30% and with €7.5bn sales, Kering would be worth less than 10x P/E.

The podcast discusses other important issues such as Kering’s history, Gucci’s turnaround efforts, luxury sector M&A, the supply chain, and risks.