1 June 2025

In today’s notes, I share four investment ideas that I found particularly interesting at the Sohn Investment Conference in New York last month.

Lanxess AG

Presenter: David Einhorn, founder of Greenlight Capital

Ticker: LXS GR

Share Price: €27.20

Market Cap: €2.35bn

Net Debt: €2.38bn

Fwd P/E: 14.9x

Fwd EV/EBITDA: 8.2x

Share Price: €27.20

Market Cap: €2.35bn

Net Debt: €2.38bn

Fwd P/E: 14.9x

Fwd EV/EBITDA: 8.2x

Turnaround Case

Lanxess is a German specialty chemicals company operating in three key segments:

- Consumer Protection

- Specialty Additives

- Advanced Intermediate

The company’s products are the global leading brands (Top 1-3) in each category.

Einhorn believes the company represents a compelling turnaround case based on the three major drivers.

1. Cyclical recovery

Historically, Lanxess generated stable EBITDA (€0.8-1bn) until 2022. However, profitability has been severely impacted in recent years by a combination of factors:

- the European energy crisis leading to drastically higher natural gas prices

- operational challenges from implementing an SAP ERP system requiring buffer inventories

- a widespread inventory de-stocking cycle across industries

These issues caused EBITDA to drop significantly by 45% to just €512mn in 2023. Capacity utilisation also fell sharply from 79% in 2021 to a low of 58% in 2023 before rebounding to 67% last year

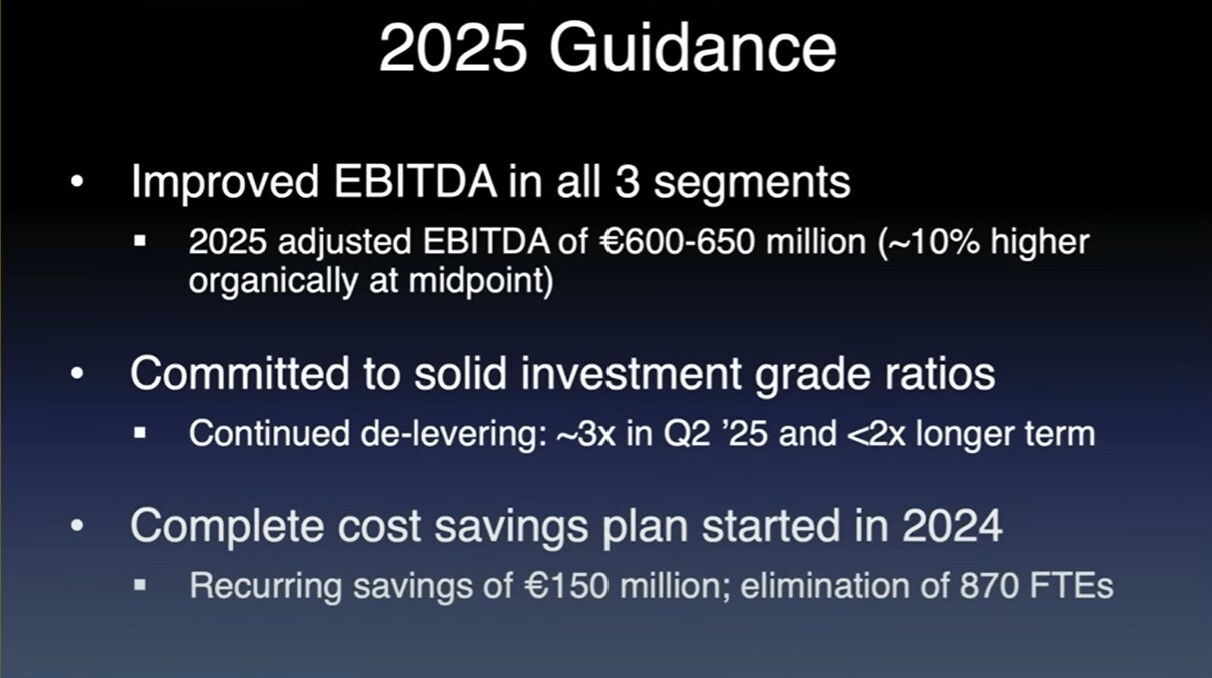

For 2025, Lanxess is guiding for adjusted EBITDA of €600-50mn (pre-exceptionals), which is c. 10% organic growth vs 2024. The company targets further EBITDA growth in the medium term.

Source: David Einhorn’s presentation at Sohn New York 2025

2. Deleveraging

As a result of falling EBITDA and a series of debt-fuelled M&A deals, Lanxess faced a sharp rise in leverage (to almost 5x Net Debt/EBITDA), a credit rating downgrade by Moody’s (to Baa3, the lowest investment grade level) and had to cut its dividends by 90%.

Moreover, to reduce debt, the company prioritised FCF over profits, reducing its gross margins.

However, the company has started to reduce its leverage with an expected net debt position of €2.1bn by the end of 2025 and leverage falling to a more reasonable 3x. In April 2025, Lanxess completed the divestiture of its Urethane business (c. €500mn cash proceeds).

Management is committed to cutting leverage further to 2x in the long term.

3. Transition to less cyclical business

Over the past several years, Lanxess has been reducing its exposure to more cyclical commodity-driven businesses such as polymers and acquiring more stable, higher-quality specialty chemical assets (e.g. Chemours's clean and disinfect business), Chemtura (flame retardants, lubricant additives), Emerald Kalama (preservatives, aroma chemicals), and IFF's microbial solutions.

The strategic goal was to achieve more stable returns, higher margins, and command a higher multiple. The portfolio is now less complex and has lower asset intensity, with a greater focus on cash generation.

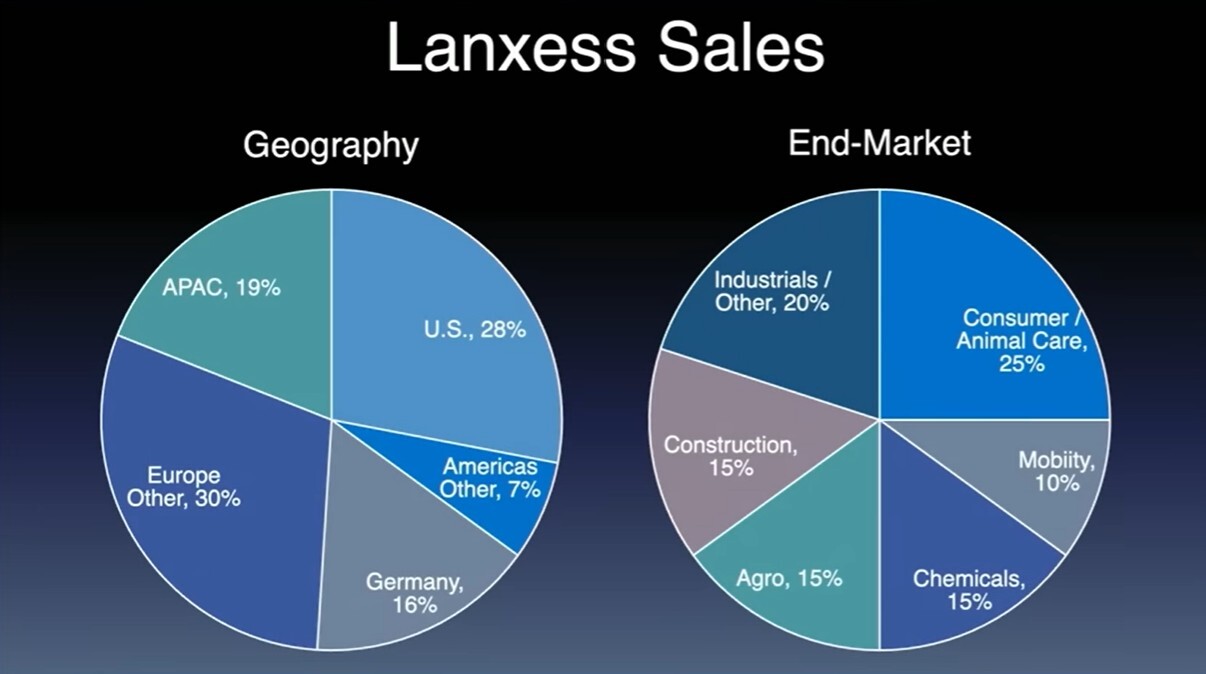

On top of this, the company has also increased its US presence significantly, with 35% of sales in America (28% in the US) compared to 46% in Europe and 19% in Asia-Pacific. Its end markets are now more balanced, with mobility representing only 10% of sales, down from almost 40% eight years ago.

Source: David Einhorn’s presentation at Sohn New York 2025

Management

The current CEO, Matthias Zachert, returned to the company in 2014. He had been the CFO at the time of the spinout in 2004. He has been instrumental in transforming Lanxess from a collection of disparate cyclical businesses to a more streamlined company with a higher share of stable, high-return businesses.

Valuation

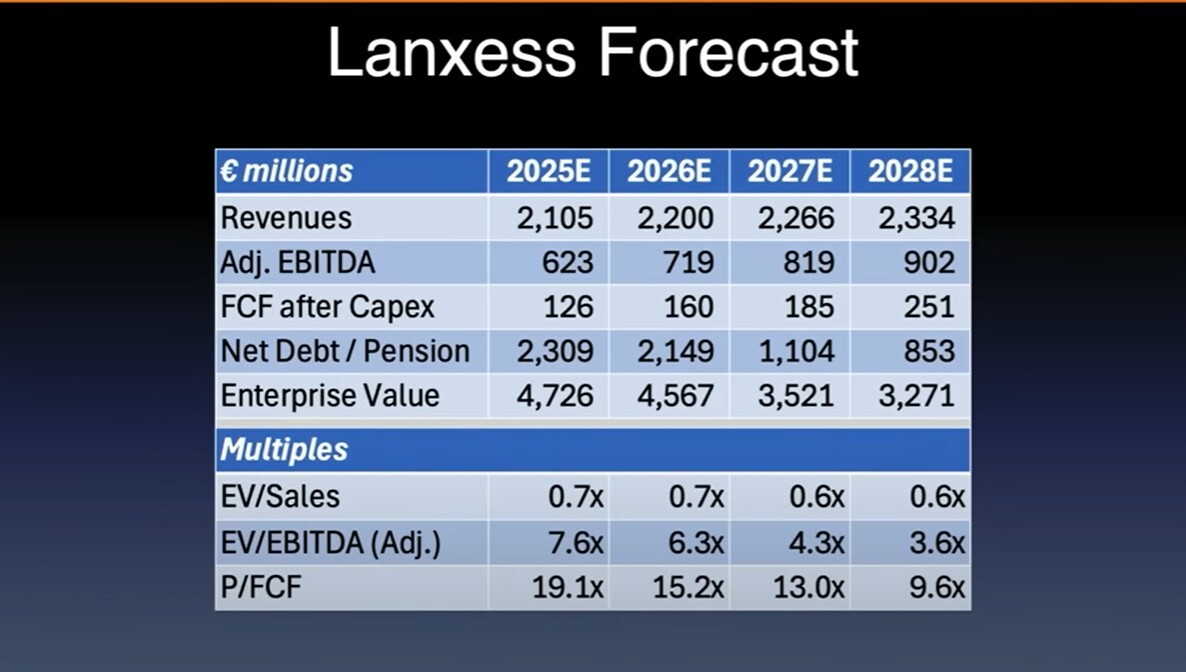

The market currently values Lanxess at around 5x-6x EBITDA.

According to Einhorn, valuation multiples do not fully reflect the completed transformation, the recovery potential, or the value of Lanxess’ stake in the Envalior JV.

Source: David Einhorn’s presentation at Sohn New York 2025

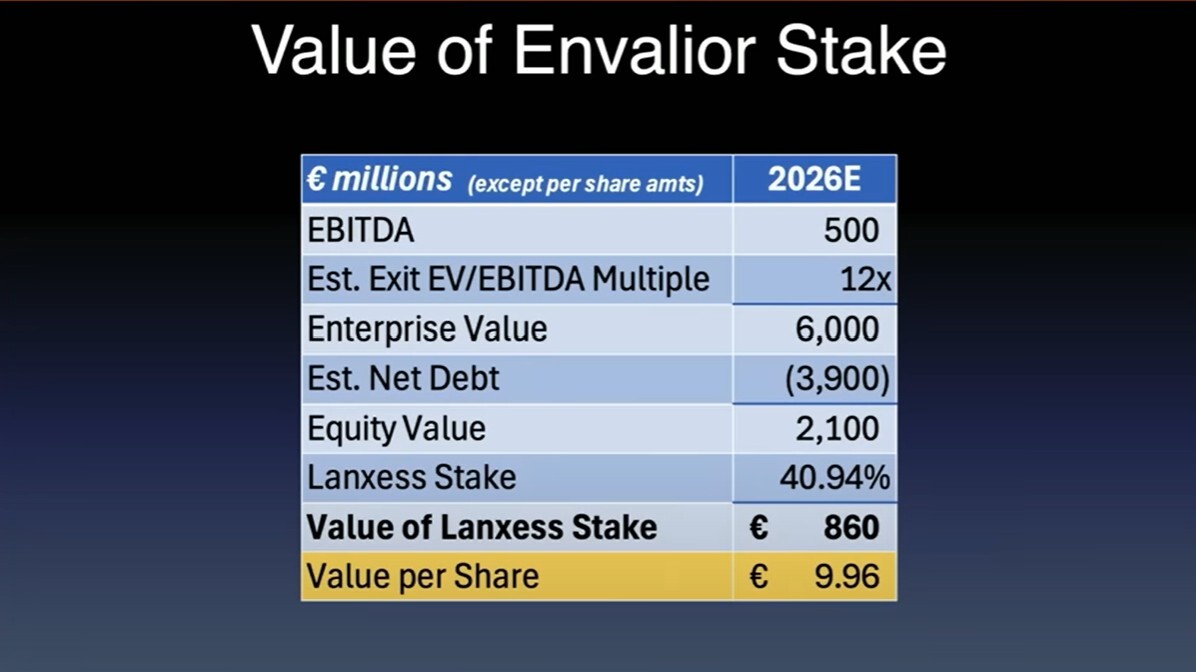

Lanxess retains a 41% stake in the Envalior JV and holds a valuable put option, allowing it to sell this stake back to Advent starting next year. Based on external credit analysis estimates for Envalior's EBITDA in 2026 and the put option terms (around 12x trailing EBITDA), Lanxess could potentially sell its stake for approximately €860mn by early 2027. This represents over one-third of Lanxess's current market capitalisation and is not reflected in Lanxess's current reported results.

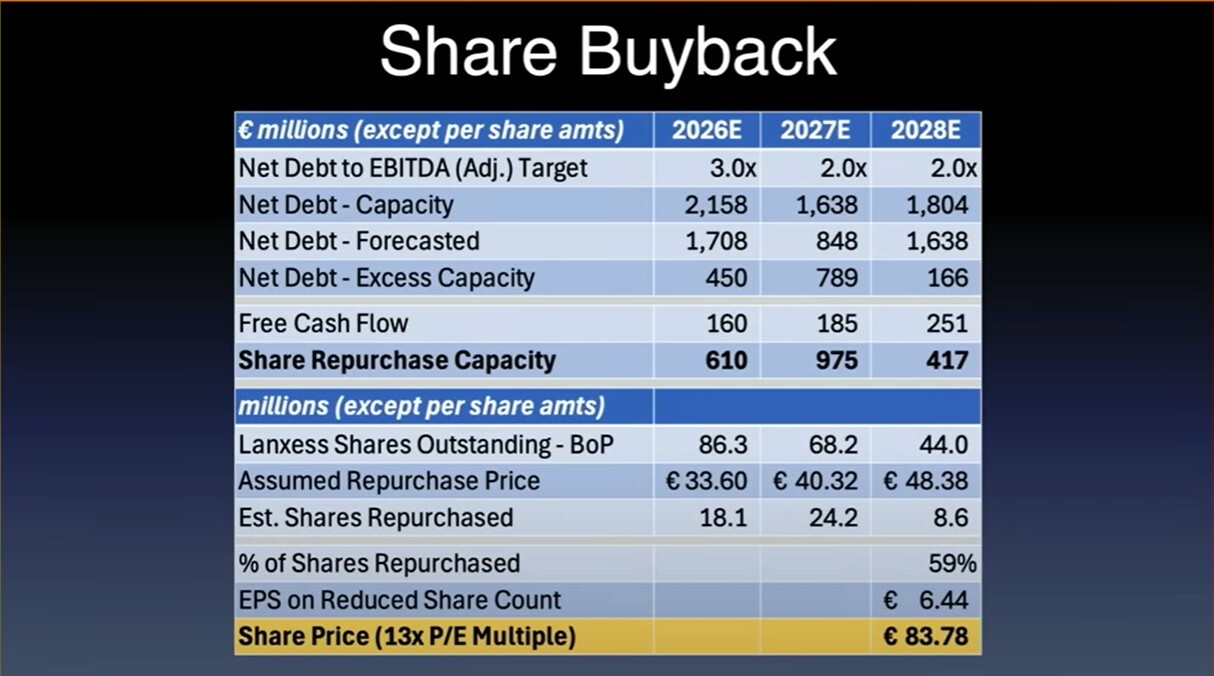

Assuming improved capacity utilisation from 67% towards more typical levels, Lanxess could potentially generate over €900mn of adjusted EBITDA in 2028 (according to Einhorn). Applying a modest 6x multiple leads to c. €50/share valuation by late 2027/early 2028.

If the market were to rerate Lanxess as a higher-quality specialty chemicals company and apply a multiple closer to peers (7x-8x EBITDA, which is still a discount to some peers like Akzo Nobel and Croda), the implied share price could be in the €60-70 range.

Additionally, share repurchases funded by free cash flow and potential Envalior proceeds could add further value, estimated at another €15 per share under certain assumptions.

Source: David Einhorn’s presentation at Sohn New York 2025

Source: David Einhorn’s presentation at Sohn New York 2025

You can watch this entire presentation here.

nCino

Presenter: Connie Lee, Founder and CIO of Felis Advantage

Ticker: NCNO (NASDAQ)

Share Price: $27.88

Market Cap: $3.21bn

Net Debt: $45mn

Fwd P/E: 38.1x

Fwd EV/EBITDA: 26.5x

Share Price: $27.88

Market Cap: $3.21bn

Net Debt: $45mn

Fwd P/E: 38.1x

Fwd EV/EBITDA: 26.5x

nCino provides a cloud-based platform for banks built on Salesforce, specifically for managing the complex loan issuance process.

Key characteristics of nCino's business:

- The business has high barriers to entry due to regulatory complexity

- Over 90% of revenue is recurring, with 40% incremental margins

- nCino has a strong pricing power, taking typical price increases of 5 points annually, and recently 7% with no customer pushback

- It operates in a large ($18bn TAM), underpenetrated market.

Lee believes nCino is seen as an "AI winner" due to its unique position at the nexus of lending and compliance workflows, enabling it to train AI models on deep data pools.

Financial Performance

Based on consensus estimates, nCino will generate roughly $580mn in revenue this year. While growth has slowed recently (+8% last year) due to factors like a pricing model transition, declining loan officers and mortgage volumes, and bank failures (totalling ~4% of revenue), leading indicators suggest reacceleration. Last quarter's billings grew 22% YoY (vs 12% prior year), and backlog grew 18% (vs 6% previous year), representing the fastest growth in seven quarters.

Valuation

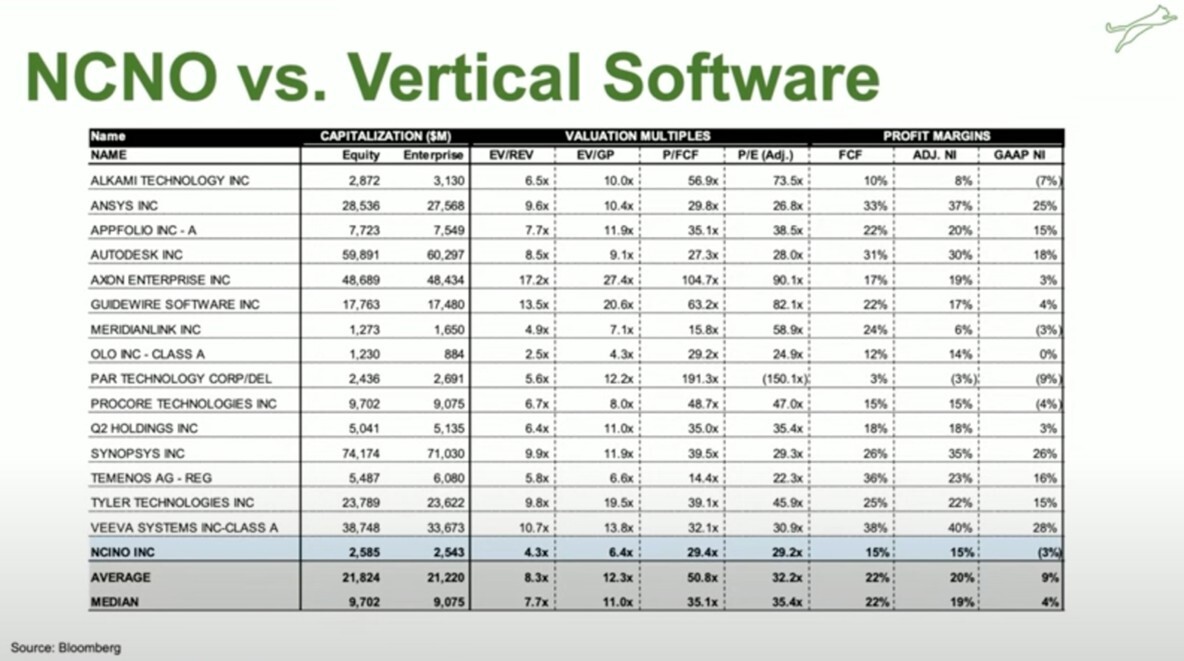

nCino trades at a steep discount relative to peers and historical private equity buyout prices. It trades at 4x Revenue and 6.5x Gross Profit, a 50% discount to vertical software peers, which trade at 8x revenue and 11x Gross Profit.

The current price is also 35% below where private equity sponsors have taken out software companies recently. This valuation provides unique downside protection. Even assuming conservative 7% growth and no macro improvement, the valuation becomes a mid-single-digit multiple of Free Cash Flow in 4-5 years.

Connie suggests a realistic case could yield 2.5x the money over three years, even with no macroeconomic improvement. If macro conditions improve, the outcome could be a lot better.

The stock appears to offer a particularly asymmetric risk/reward. The primary risks are execution and the possibility of a private equity buyout before the full upside is realised.

Source: Connie Lee’s presentation at Sohn New York 2025

You can watch this pitch here.

Adobe (ADBE)

Presenter: William Heard, CEO and CIO of Heard Capital

Ticker: ADBE (NASDAQ)

Share Price: $410.9

Market Cap: $175.1bn

Net Cash: $1.8bn

Fwd P/E: 19.7x

Fwd EV/EBITDA: 15.1x

Share Price: $410.9

Market Cap: $175.1bn

Net Cash: $1.8bn

Fwd P/E: 19.7x

Fwd EV/EBITDA: 15.1x

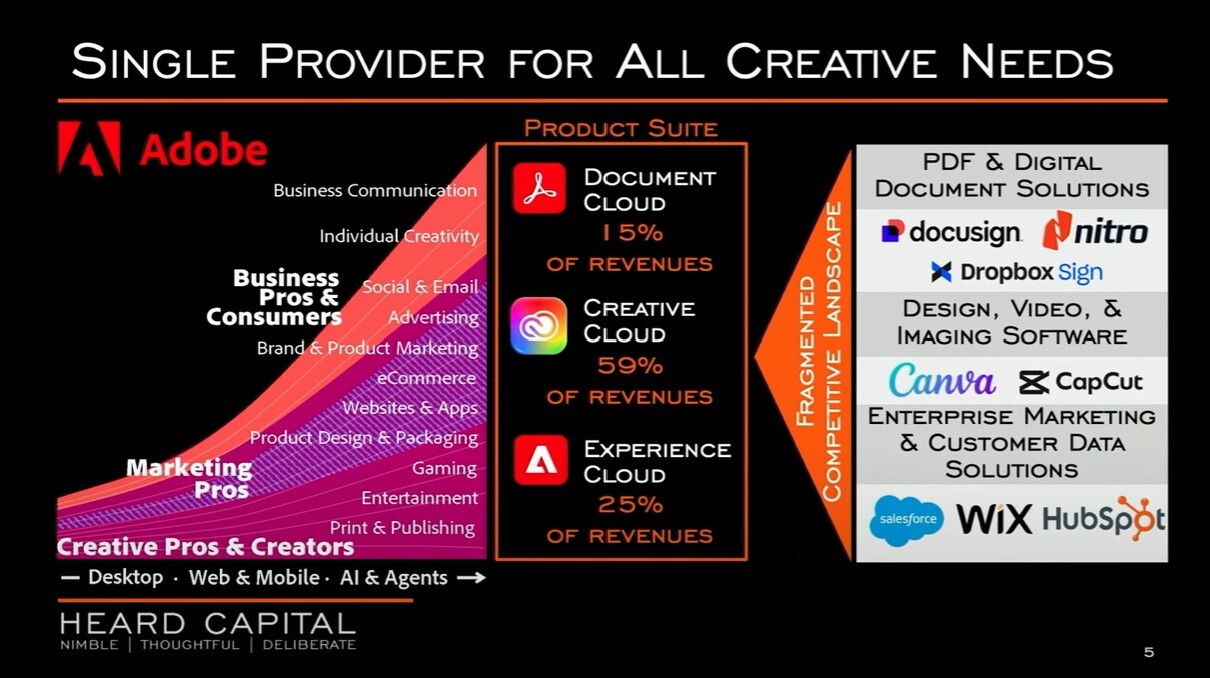

Adobe is a leader in digital content with three main segments:

- Creative Cloud

- Document Cloud, and

- Experience Cloud

The company runs all services on a subscription model.

The presenter argues that despite the rise of AI-generated content, Adobe's precision editing tools remain essential for refining raw AI output into competitive IP. He also points out that their GenAI model, Firefly, is trained on licensed data, ensuring commercially viable outputs.

The creative market is viewed as expanding rather than zero-sum, with Adobe being deeply embedded in nearly every aspect of the creative process.

Source: William Heard’s presentation at Sohn New York 2025

Financial Performance

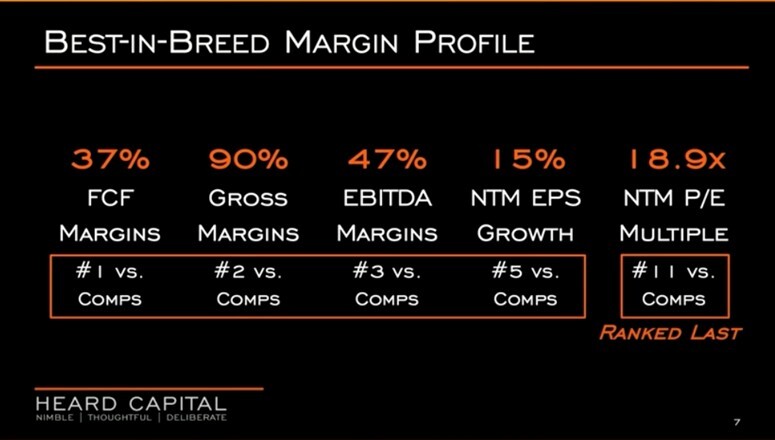

Adobe ranks at or near the top of its peers for profitability measures like free cash flow, gross margin, and EBITDA margin. Adobe’s two metrics from the ‘Rule of 40’ (Growth + Profit Margin) come at 58%.

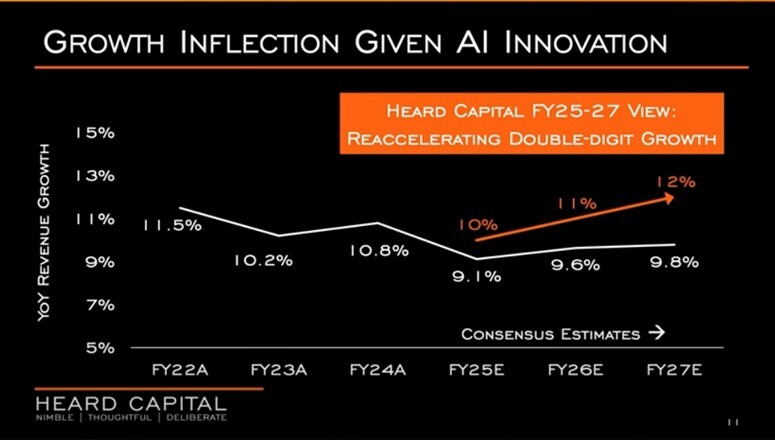

Creative Cloud growth is accelerating significantly from 6% in 2023 to 24% this year, seen as proof of Adobe's AI rollout working. Adobe has disclosed over $3.5bn in AI-influenced Annual Recurring Revenue (ARR), indicating AI's positive impact on retention, usage, and upgrades. Growth is believed to be at an inflexion point, with consensus estimates potentially too low as most AI products are less than a year old.

Source: William Heard’s presentation at Sohn New York 2025

Source: William Heard’s presentation at Sohn New York 2025

Management

The CEO, Shantanu Narayen, has led Adobe for about 17 years, overseeing growth from $27bn to $170bn Mkt Cap and buying back roughly 54% of the company’s shares during his tenure.

Valuation

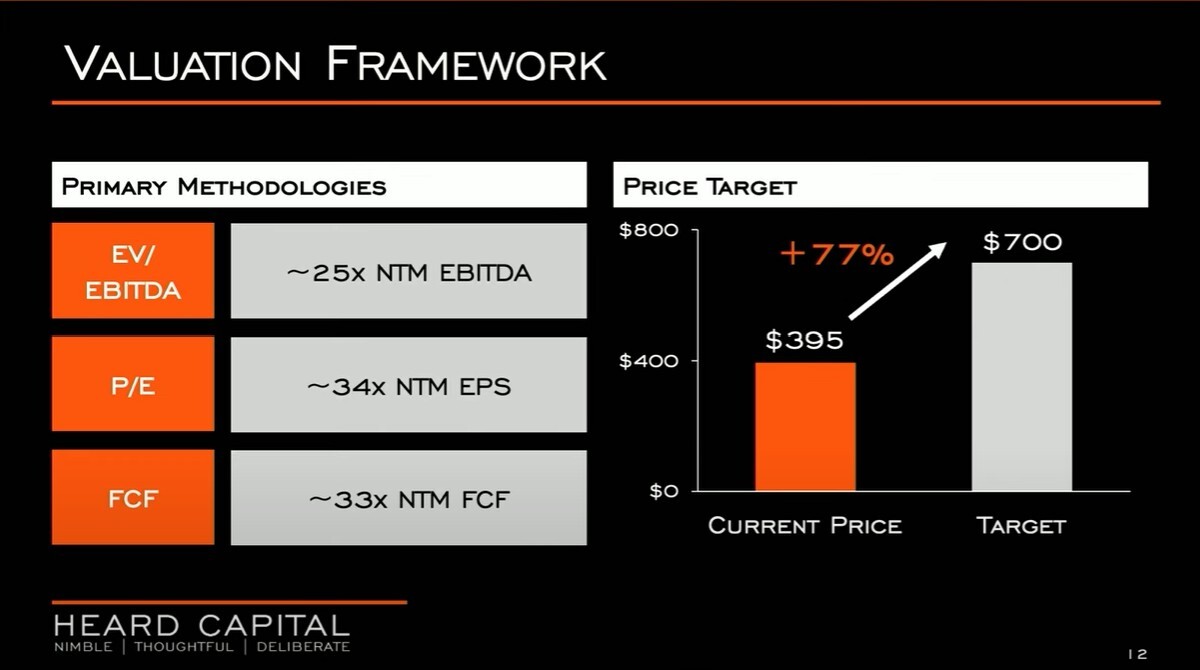

Source: William Heard’s presentation at Sohn New York 2025

Despite strong fundamentals, Adobe trades at trough multiples (19x PE) relative to its 10-year average (33x), reflecting concerns over muted growth. The market is giving full credit to the substantial 45 million+ subscriber install base and assuming AI is disruptive rather than beneficial.

Heard estimates the fair value at $700 per share, implying a 77% upside to the current share price.

You can watch this pitch here.

National Vision Holdings (EYE)

Presenter: Jonathan Lennon, Founder and CIO, PLP Funds

Ticker: EYE (NASDAQ)

Share Price: $19.6

Market Cap: $1.6bn

Net Debt: $0.7bn

Fwd P/E: 28x

Fwd EV/EBITDA: 12.5x

Share Price: $19.6

Market Cap: $1.6bn

Net Debt: $0.7bn

Fwd P/E: 28x

Fwd EV/EBITDA: 12.5x

National Vision Holdings operates a network of roughly 1,200 value-oriented eye care retail stores under major banners like America's Best and Eyeglass World. 60% of revenue comes from cash-pay, uninsured customers, positioning them as the lowest-price offering in the market. This allows them to take market share when customers lose insurance or seek value, offering resilience in weak economic environments. The remaining 40% comes from managed care customers.

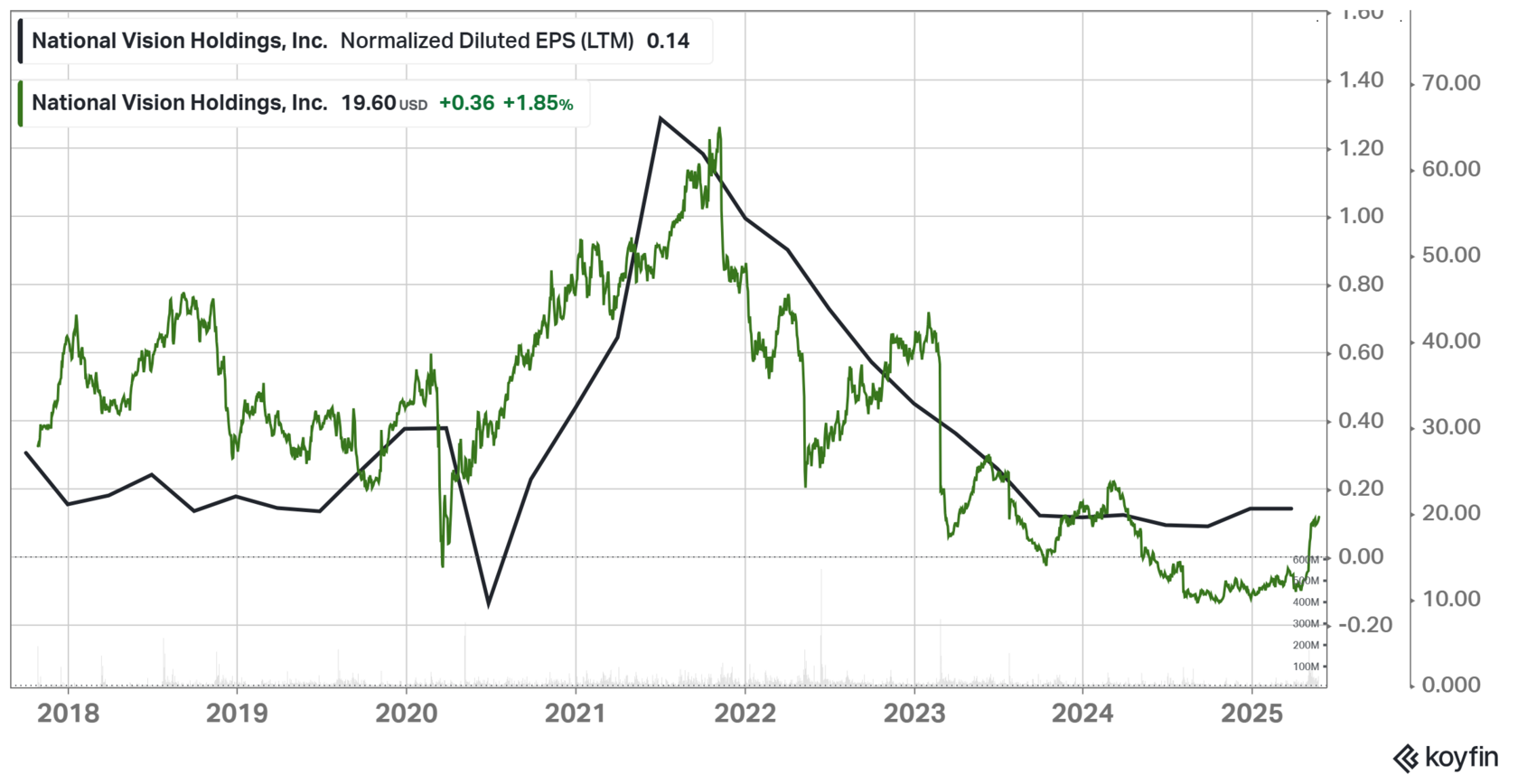

Financial Performance

The eye care industry faced disruption from COVID-19, with strong growth in 2021 (21%) followed by a collapse in transaction volumes in 2022 and 2023 due to demand pulled forward and the historical 2-3 year replacement cycle is disrupted. This significantly impacted EYE's EBITDA and stock price, which fell from $60 to $16 per share. Historically, the stock traded at around 14x EV/EBITDA but recently traded at 6x EV/EBITDA.

However, according to the presenter, there is a meaningful industry inflexion in transaction volumes occurring now. This is supported by data from private competitors (near 100% directional consistency with EYE revenue) and credit card data, both showing a very significant inflexion in transactions in Q1 and especially Q2 2024.

Consensus EBITDA for 2026 is $193mn, but the investment thesis projects this can reach $350mn based on three key drivers:

- transaction volume recovery

- managed care monetisation

- cost structure improvements

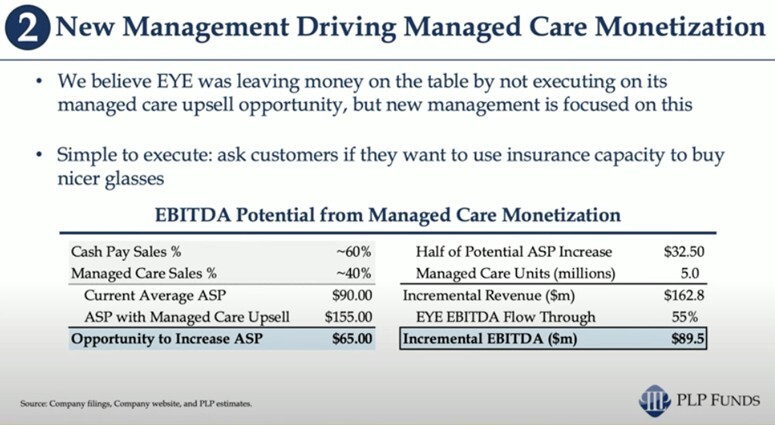

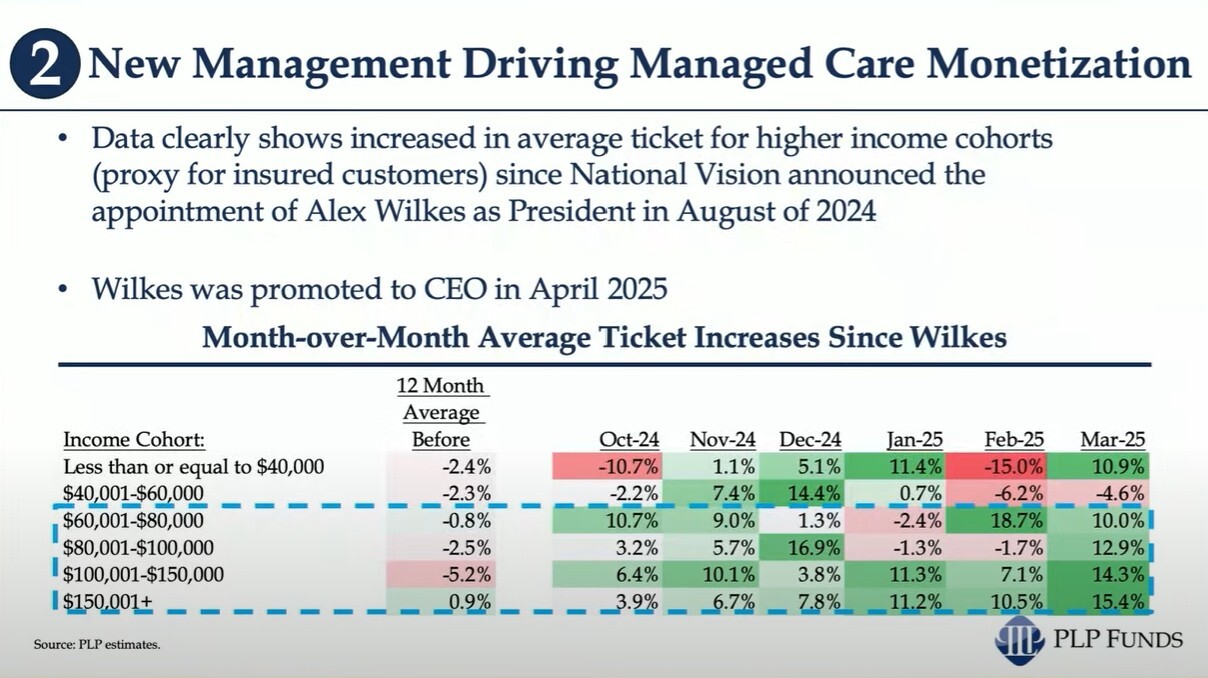

The second point is particularly interesting due to the recent changes. According to Lennon, the company has been leaving ‘money on the table’ by not monetising its managed care customer base. EYE focused on the low-income segment without medical insurance while missing value-oriented customers who had insurance but did not consider EYE.

The idea is that insurance companies cover eyeglasses for up to $155, while EYE’s average sales price (ASP) is just $90. The company is planning to sell more add-ons to increase its ASP for the insured customers. The increase in the ASP will almost entirely flow to the bottom line (100% incremental EBITDA margin).

Source: Jonathan Lennon’s presentation at Sohn New York 2025

Management

The company has recently hired a new President, Alex Wilks (August 2024), focused on driving managed care monetisation, and a new CFO, Christopher Laden (March 2025), focused on the cost structure.

Source: Jonathan Lennon’s presentation at Sohn New York 2025

Valuation

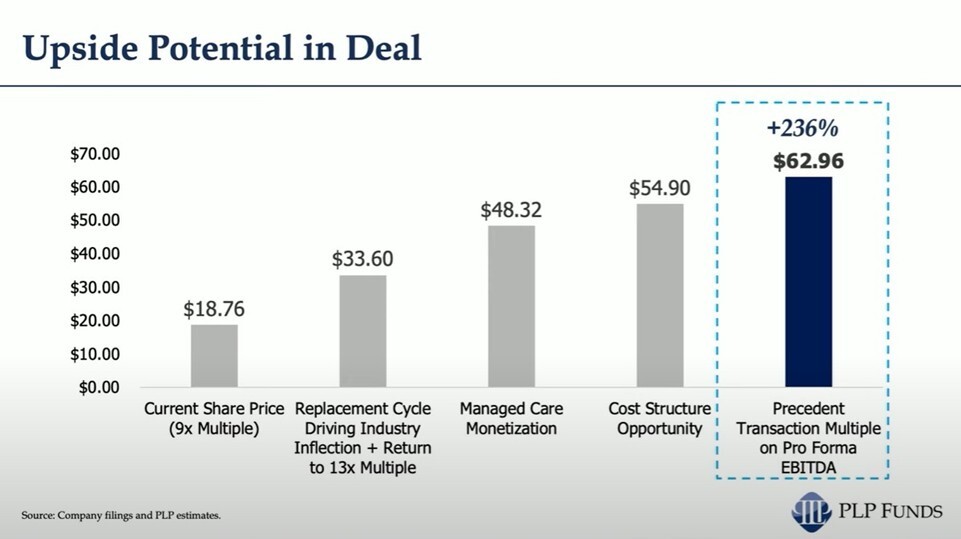

Based on the projected 2026 EBITDA of $350mn (80% above consensus), capitalised at their historical average multiple of 13x, the thesis suggests an almost 200% upside, targeting approximately $55 per share.

The optical space also has a history of M&A, with 11 transactions in the past decade at an average acquisition multiple of 14.8x. If the company were acquired based on the projected EBITDA, the potential upside could exceed 200%, approaching $63 per share.

Other Considerations

- Strategic Interest & M&A: The sector's attractiveness for M&A, with a history of transactions at favourable multiples, could provide a floor for the stock price.

- Countercyclical Resilience: The value proposition allows EYE to perform well and take market share in economic downturns, providing resilience.

- Limited Tariff Exposure: Less than 10% of costs are subject to tariffs. Competitors' supply chain tariffs could actually be a net benefit to EYE's competitive position.

You can watch this pitch here.