27 April 2025

In this note I provide a summary of 5 stocks with significant Net Cash positions, highlighting their investment theses, business models, key shareholders and prospects for shareholder returns.

Costain Plc

Ticker: COST (AIM)

Share Price: £1.04

Market Cap: £279.5mn

Net Cash: £132.7mn

EV: £121.0mn

EV/EBIT: 2.6x

P/E: 7.5x

Share Price: £1.04

Market Cap: £279.5mn

Net Cash: £132.7mn

EV: £121.0mn

EV/EBIT: 2.6x

P/E: 7.5x

Costain is a UK-focused infrastructure engineering company operating in two main segments: Transportation (Highways, Rail and Aviation) and Natural Resources (Water, Energy and Defence). As the company has evolved, consulting and maintenance revenues have grown to 30% of group revenues.

Among its recent projects are the completion of the Paddington Elizabeth Line station and the upgrade of the Gatwick Airport station.

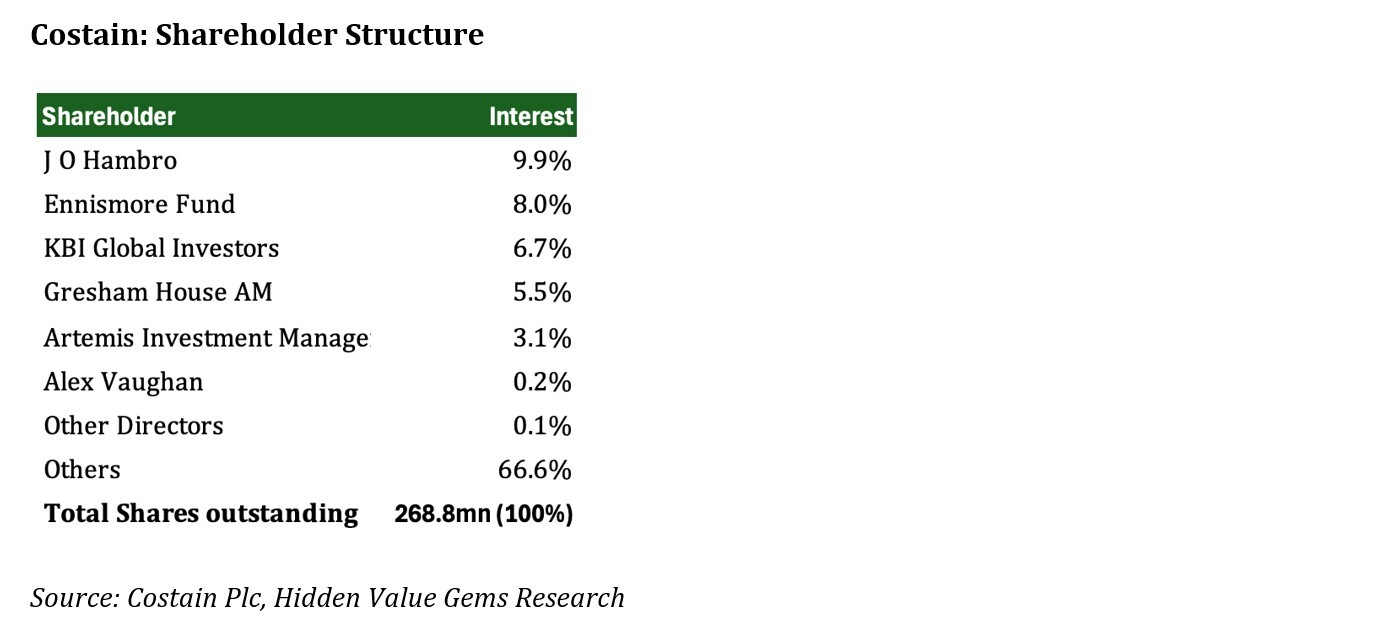

The company was founded in 1865 by Richard Costain as a small jobbing business. UK-focused institutional investors are the company's largest shareholders, with the CEO and Directors holding just 0.3% interest.

Among its recent projects are the completion of the Paddington Elizabeth Line station and the upgrade of the Gatwick Airport station.

The company was founded in 1865 by Richard Costain as a small jobbing business. UK-focused institutional investors are the company's largest shareholders, with the CEO and Directors holding just 0.3% interest.

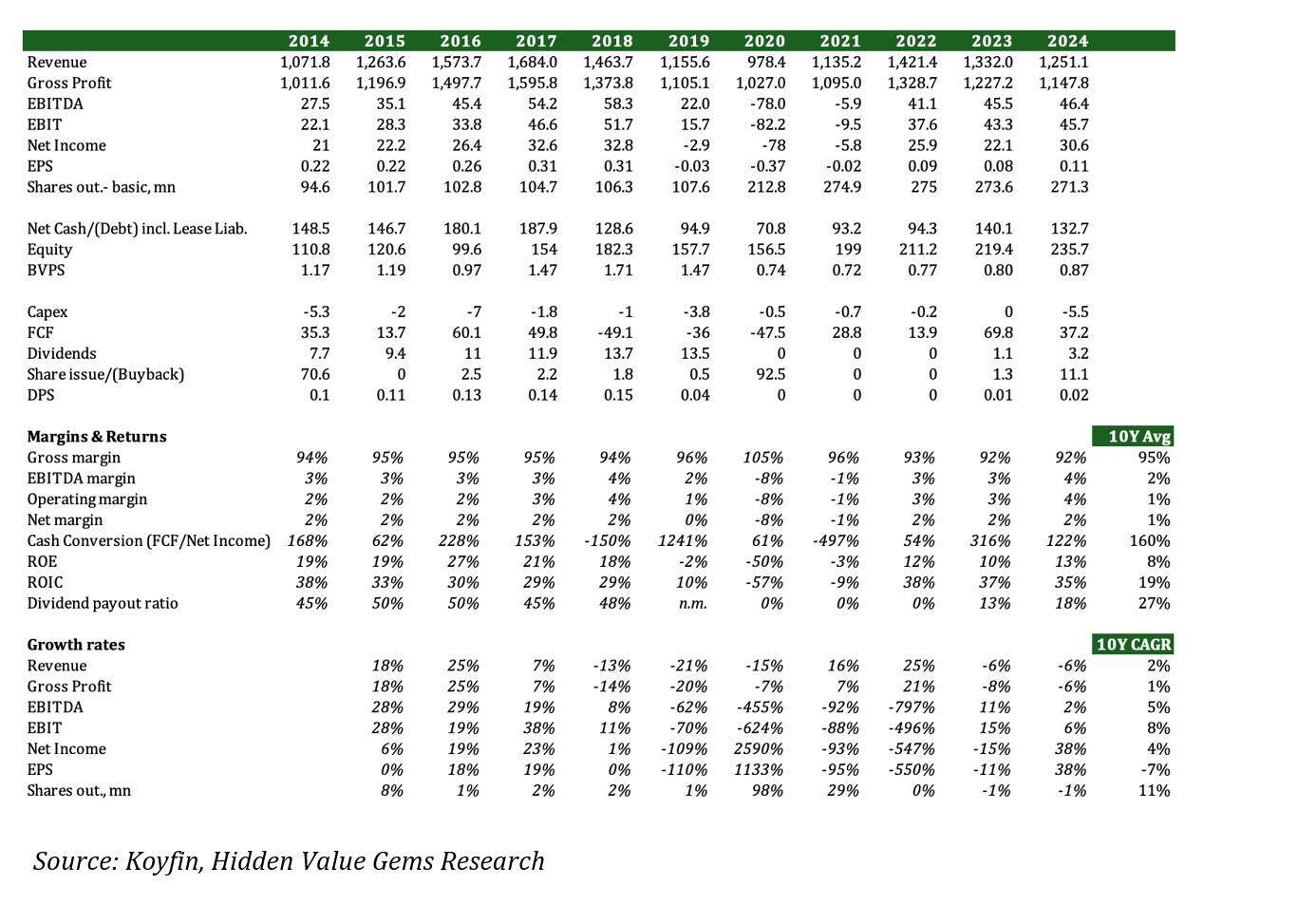

Historically, the company has not delivered exceptional results, as seen from the 10-year financial summary below.

However, a few particular factors make Costain very attractive today.

- Revenue and Net Income have grown by just 2% and 4%, respectively, over the past 10 years.

- The company’s profit margins have historically been low, averaging 1-2%.

- Moreover, Costain has been a net share issuer, with the shares outstanding rising by 11% on average over the past 10 years. It doubled its share count in 2020 as it sought additional funds for working capital and future growth.

- Historically, the company has distributed just 27% of its earnings on dividends.

However, a few particular factors make Costain very attractive today.

Valuation

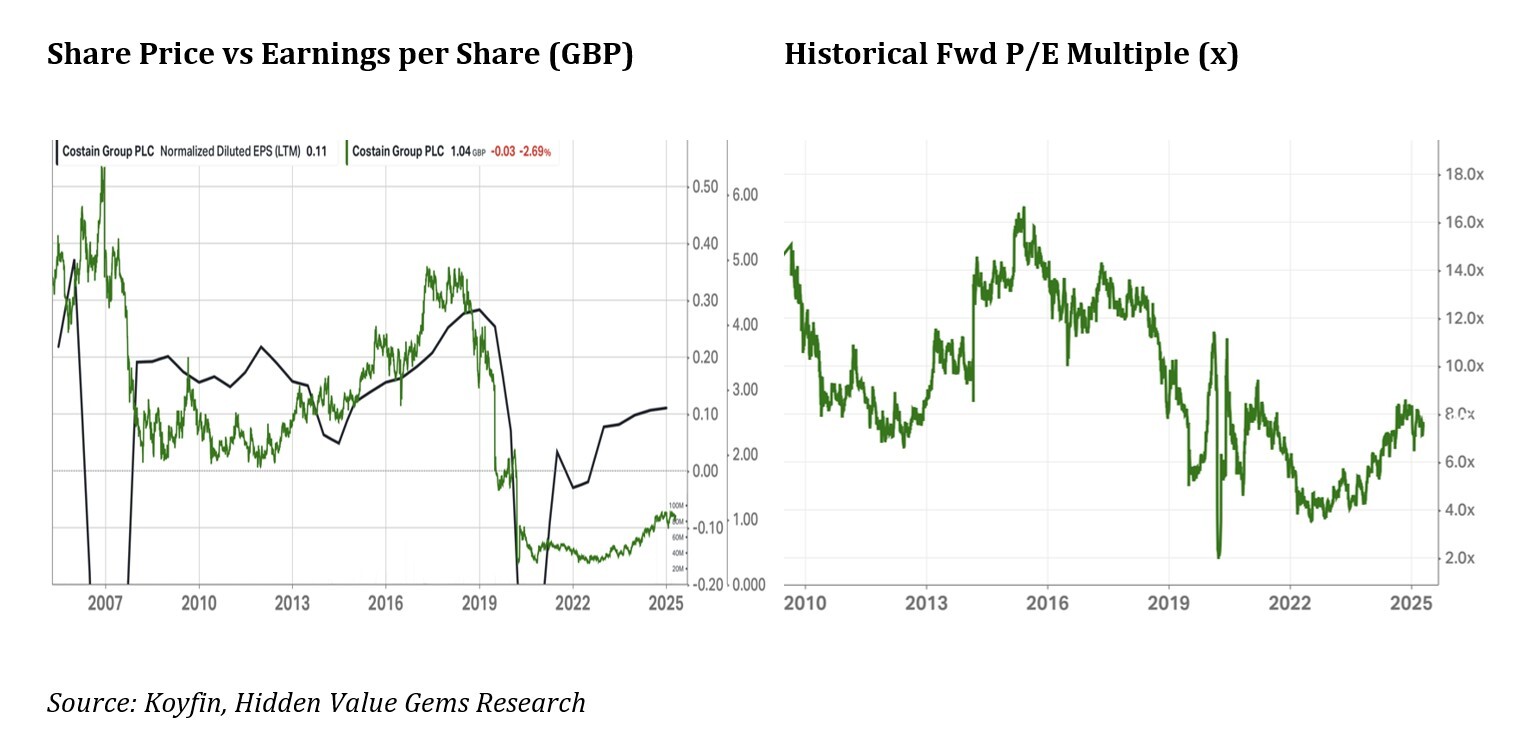

The company’s Net Cash position after deducting Lease liabilities is £132.7mn, or 47% of the market cap. It trades at a forward P/E of 7.5x (or 3.8x if adjusted for the Net Cash position). The company offers more than 10% FCF yield and prospects of a 50% increase in earnings in the next two years on the back of new contract wins.

Prospects of material increase in shareholder distributions as Pension scheme turned into surplus

In the past, the company faced a pension deficit and had to make regular contributions to the company’s pension scheme, reducing cash available for shareholder distributions.

In 2024, the scheme turned into a surplus, as was confirmed during the regulation actuarial assessment. This allowed management to return some of the cash back to shareholders via a £10mn share buyback. The company also doubled its annual dividend to 2.4p in 2024.

Costain carried out another pension scheme assessment in March 2025, with results coming in June. I think it is likely that the scheme will remain in surplus providing management with additional opportunity for special dividends and/or buyback.

In 2024, the scheme turned into a surplus, as was confirmed during the regulation actuarial assessment. This allowed management to return some of the cash back to shareholders via a £10mn share buyback. The company also doubled its annual dividend to 2.4p in 2024.

Costain carried out another pension scheme assessment in March 2025, with results coming in June. I think it is likely that the scheme will remain in surplus providing management with additional opportunity for special dividends and/or buyback.

5-year contracts provide strong revenue visibility

Costain primarily operates in regulated markets, with most customers procuring based on five-year investment plans. The company has a history of obtaining positions on significant frameworks.

The company has recently won several important contracts in the UK Water sector, as well as transport infrastructure. Moreover, the recent approval of the material increase in water investments by the UK regulator should provide a significant boost to the company’s revenue and earnings in the mid-term. The investment plans announced publicly by UK Water utilities and the regulator suggest the next 5-year investments will be almost twice compared to the previous 5 years.

The company has recently won several important contracts in the UK Water sector, as well as transport infrastructure. Moreover, the recent approval of the material increase in water investments by the UK regulator should provide a significant boost to the company’s revenue and earnings in the mid-term. The investment plans announced publicly by UK Water utilities and the regulator suggest the next 5-year investments will be almost twice compared to the previous 5 years.

Changes in Contract terms should lead to stronger margins

Management has been moving away from large fixed-price contracts, adding smaller contracts with flexible prices and more consulting work with much better margins.

The most recent operating margin exceeded the 3.5% target in H2 2024, and management reiterated its expectations for a 4.5% margin in 2025. In the medium term, the company targets 5-6% operating margins.

The most recent operating margin exceeded the 3.5% target in H2 2024, and management reiterated its expectations for a 4.5% margin in 2025. In the medium term, the company targets 5-6% operating margins.

Costain: 10-year Financial Summary