Summary

Date: 13 March 2022

Ticker: BABA US

Share price: $86.7

Market Cap: $235bn

EV: $132bn

EV/LTM EBITA: 6.2x

I have finally finished analysing Alibaba’s latest quarterly results (Dec-2021).

While results were generally weak, I think the latest share price performance is unwarranted, and the stock is cheap pricing in a very pessimistic scenario.

18% drop in share price since the start of March (the last two weeks) has more to do with market concerns about delisting in the US, potential conflict over Taiwan and possible sanctions on China if it does not comply with the US sanctions on Russia. Russia’s dramatic actions in Ukraine may have also reminded investors of business risks in non-democratic nations.

These are very tough issues to have a strong view on. Some risks cannot be hedged entirely or avoided in the market. My Alibaba position is now about 4% of the total portfolio. I plan to revisit the case if and when it reaches 3% or if there are first signs of a turnaround. If the share price drops below $75 (15% decline), below my Bear case valuation, I will also review the case. Provided that the risks of a global war, major sanctions on China and other similar disasters remain minimal, Alibaba would be offering a lot of value.

Notably, the company has not changed its previous guidance of 20-23% full-year revenue growth. Its revenue has increased by 22.5% YoY during the first nine months of FY-22, implying a 13-25% growth rate in the last quarter of the FY-22 year if Alibaba meets its guidance. This is faster than the 10% recorded in the past quarter.

Valuation

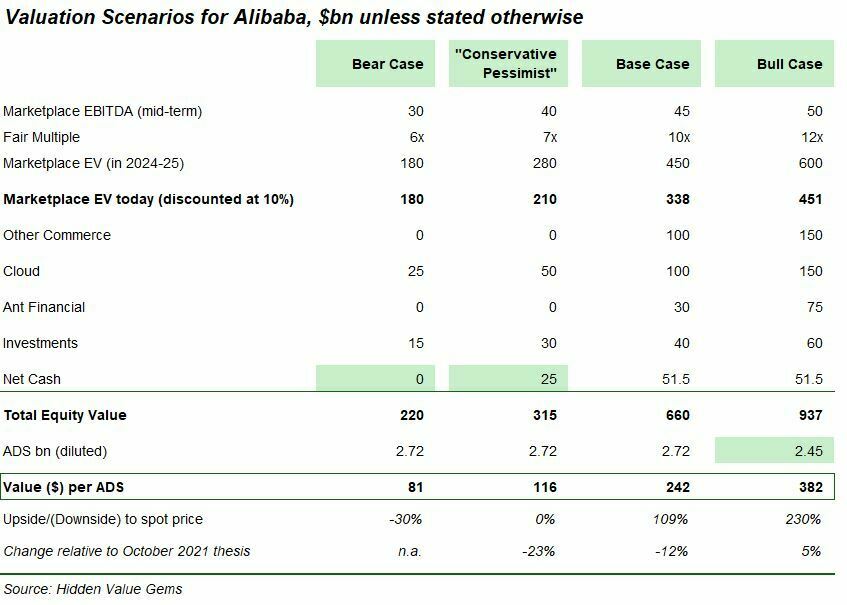

Here are my previous valuation scenarios for Alibaba from December 2021 post.

I am comfortable with the valuation of the core commerce segments in a Bear and Conservative scenarios. The values in the Base and Bull cases are debatable, but since they represent 179% and 341% upside, even if I am off by 50%, there is enough upside to hold on to the stock.

In the Bear case, I assign 6x EV/EBITDA multiple to a mid-term EBITDA of $30bn for the Marketplace business alone. This multiple assumes a mature business with a growth rate in line with GDP and inflation (not more than 10%) and conservative operating margins due to continued competitive pressure.

$30bn EBITDA for the Marketplaces also looks quite conservative. China’s Core Commerce business has generated over $23bn in EBITA for the nine months (March-December 2021). Assuming $2bn in Depreciation, the business should have generated $25bn in EBITDA. Adding another quarter to estimate a full-year EBITDA comfortably leads to a number close to $30bn (and possibly more over the medium-term).

This conservative valuation already implies $66/ADS (76% of the latest share price of $87).

I include two more assets in my Bear case: Cloud and Investments. I have assumed that net cash completely disappears ($62bn as of 31-Dec-2021).

The value of the Cloud business is perhaps the hardest to estimate. On the one hand, it is a fast-growing business with market-leading positions in China and globally. On the other hand, it still generates negligible profits and has recently lost a large customer. Previously, I was wrongly concerned that Alibaba’s Cloud business is just its core Marketplace which provides additional services to merchants. Under such logic, if Marketplace faces a slowdown, it inevitably affects the Cloud operations.

However, I was relieved to learn that Cloud has diversified beyond e-commerce (revenue from non-Internet services accounted for 52% of the business in the last quarter, see the following section).

Cloud has generated $8.7bn revenue in the past nine months ($11.6bn annualised) and would likely generate $20bn in three years if it continues to grow at 20% a year (the growth rate it delivered in the past quarter).

From this perspective, the $25bn value that I assume in the Bear case looks conservative.

Long-term Investments had a book value of $40.7bn on 31-Dec-21, while I take a further 63% haircut assuming Investments are worth only $15bn.

Having reviewed my Bear case assumptions, I believe they are too negative (unless there is a military conflict in Taiwan or another large-scale war).

My Conservative case looks more reasonable in the current environment ($116 value per share).

If the stock continues to drop and I am comfortable with the War risks, I may add to Alibaba.

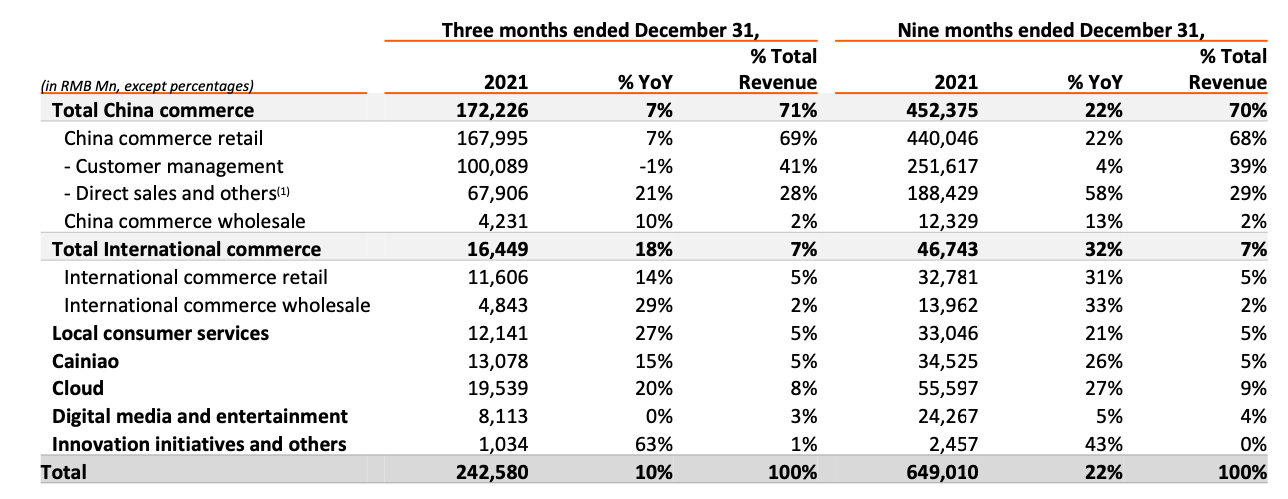

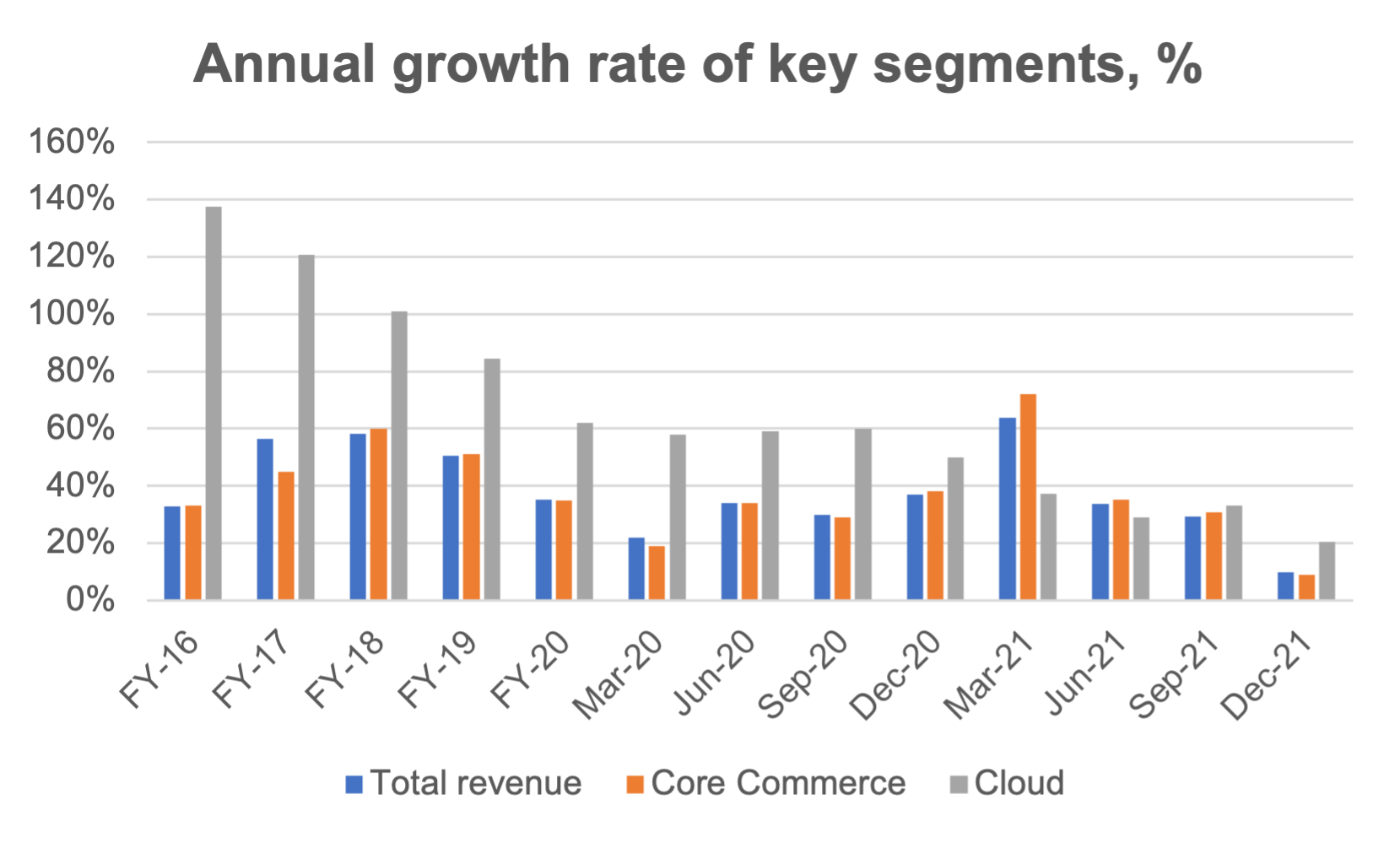

Business performance in 4Q21 (FY21-3Q)

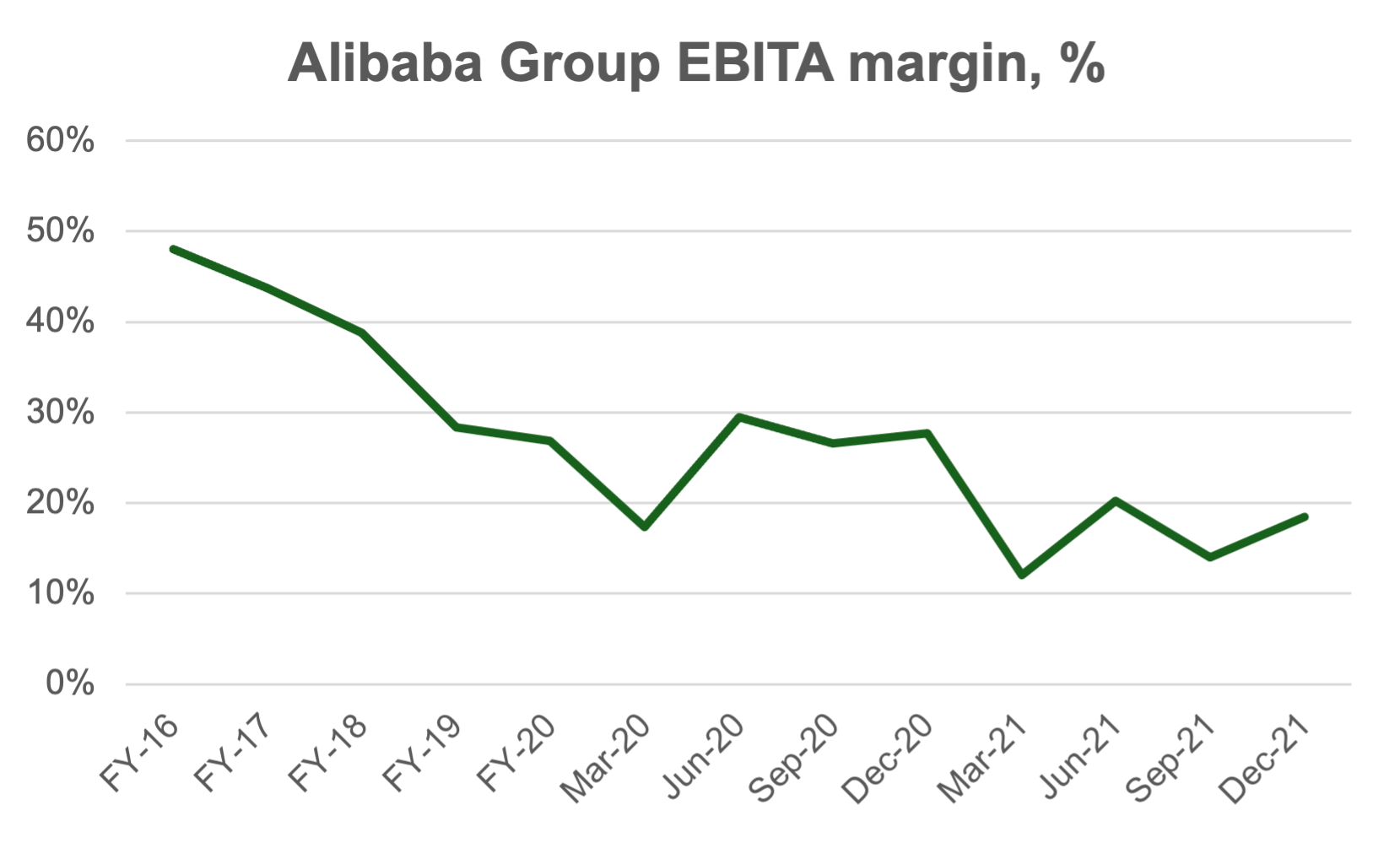

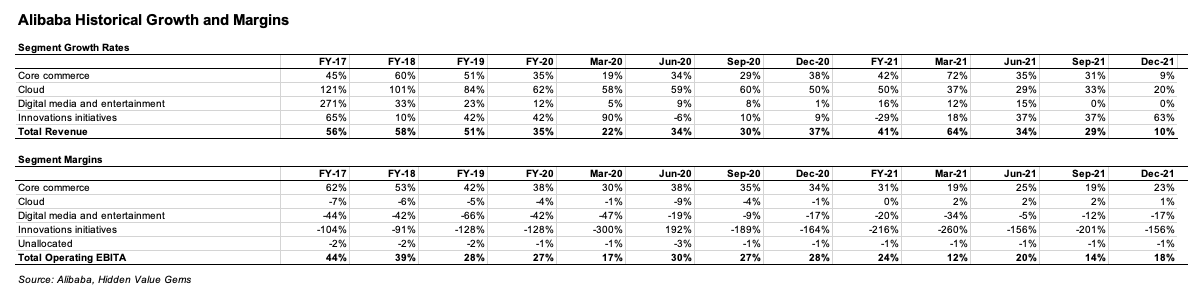

In general, there was a significant deceleration in growth and declining profitability across all key segments during the past quarter. The key reasons include a combination of the economic slowdown in China, rising competition and regulatory changes. The latter are weakening some of the earlier moats around Alibaba’s businesses. I still believe that most of these factors are cyclical, and with a strong corporate culture, the company should be able to overcome the ongoing challenges. I expect a moderate improvement in growth rates, and more significant progress in profitability as early-stage businesses stop burning cash.

The company did not disclose its GMV other than reporting a single-digit growth rate. At the same time, Customer Management fees have dropped 1% YoY, suggesting that the take-rate continued to decline too. Alibaba noted that apparel and consumer accessories saw a weaker growth compared to food and other categories. Alibaba has historically had more significant exposure to the first two segments and thus experienced a sharper slowdown.

Alibaba: Revenue Breakdown by Segment

The company’s profits have also declined by 27% YoY due to a fall in margins (28% to 18%). This was driven mainly by the lower profitability of the Core Commerce business. Segment EBITA margin dropped to 23% in the Dec-21 quarter compared to 34% in the same period a year ago. Apart from various incentives provided to merchants (by Alibaba) and strategic reductions in selected service fees, this decline was also driven by expansion in Tier 3 and 4 regions with a lower-income population and more challenging logistics.

The International Commerce segment reported a 37% YoY growth in active customers, but only 25% YoY growth in Order Volume and 18% YoY growth in revenue (-9% drop in order density).

Cloud

The performance of the Cloud segment was quite disappointing. Its revenue increased by just 20% YoY, while operating margin dropped to 1% (from 2% in the previous three quarters). According to management, Cloud saw robust growth from financial and telecommunication industries, partially offset by the continuing impact of a top cloud customer’s decision to stop using its overseas cloud services for its international business due to non-product related requirements and slowing demand from customers in the Internet industry such as online entertainment and education.

On a positive note, Alibaba Cloud’s revenue is becoming more diversified, with non-Internet industries’ contribution steadily increasing. Revenue from non-Internet sectors accounted for 52% of Alibaba Cloud’s post-inter-segment elimination revenue for the quarter ended December 31, 2021

I do not discuss other businesses because, frankly, they are irrelevant at this stage. It would be good if they helped Alibaba strengthen its ecosystem, raise customer engagement, improve loyalty and customer acquisition costs. Hopefully, they do not remain a cash drain for too long. In the Base and Bull cases, these other segments represent additional values, but for the stock to stop falling and start recovering, I think the two core ones should start delivering better growth and growing margins. At least the current trend of continuous deterioration should come to a halt.

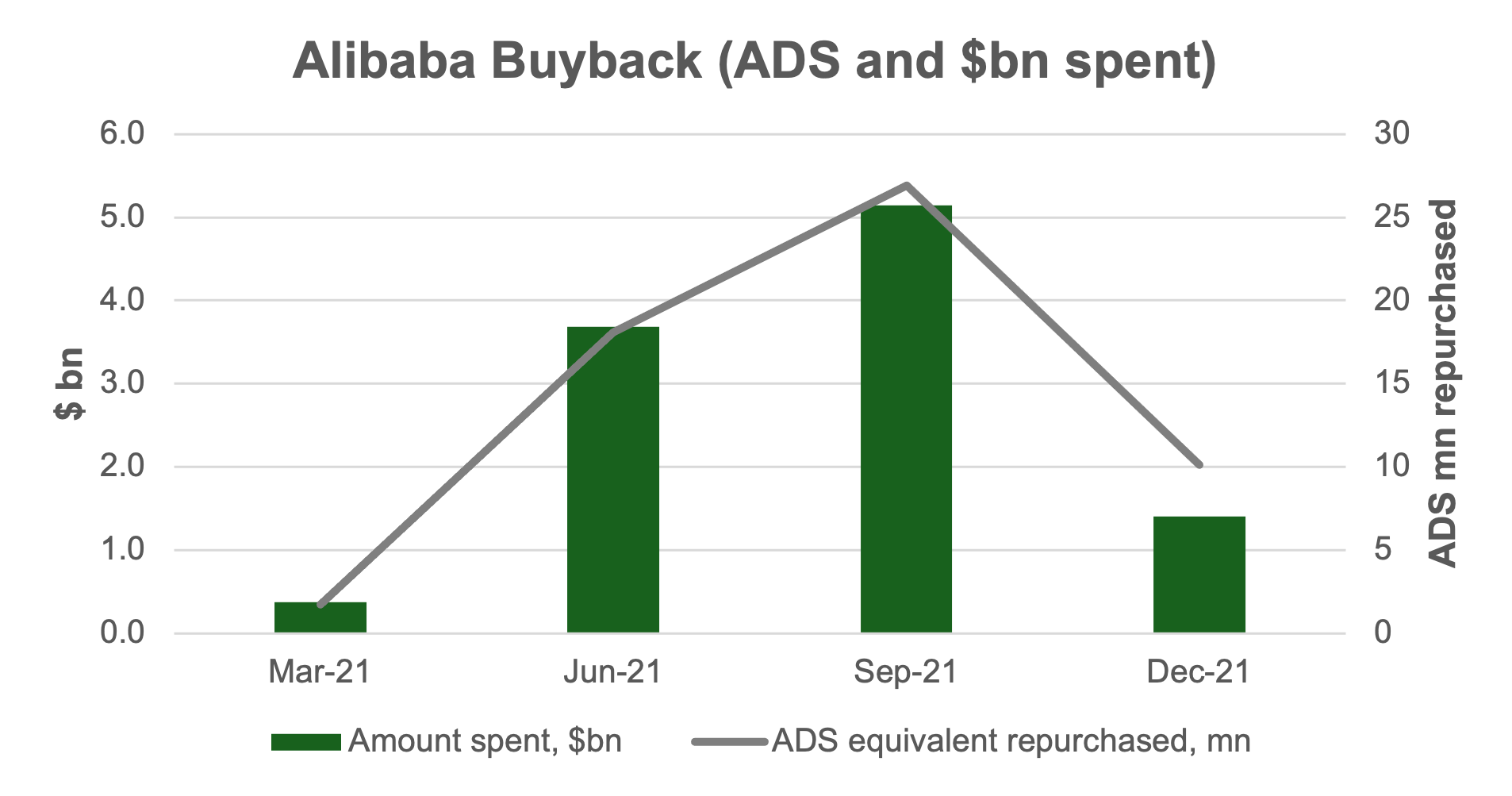

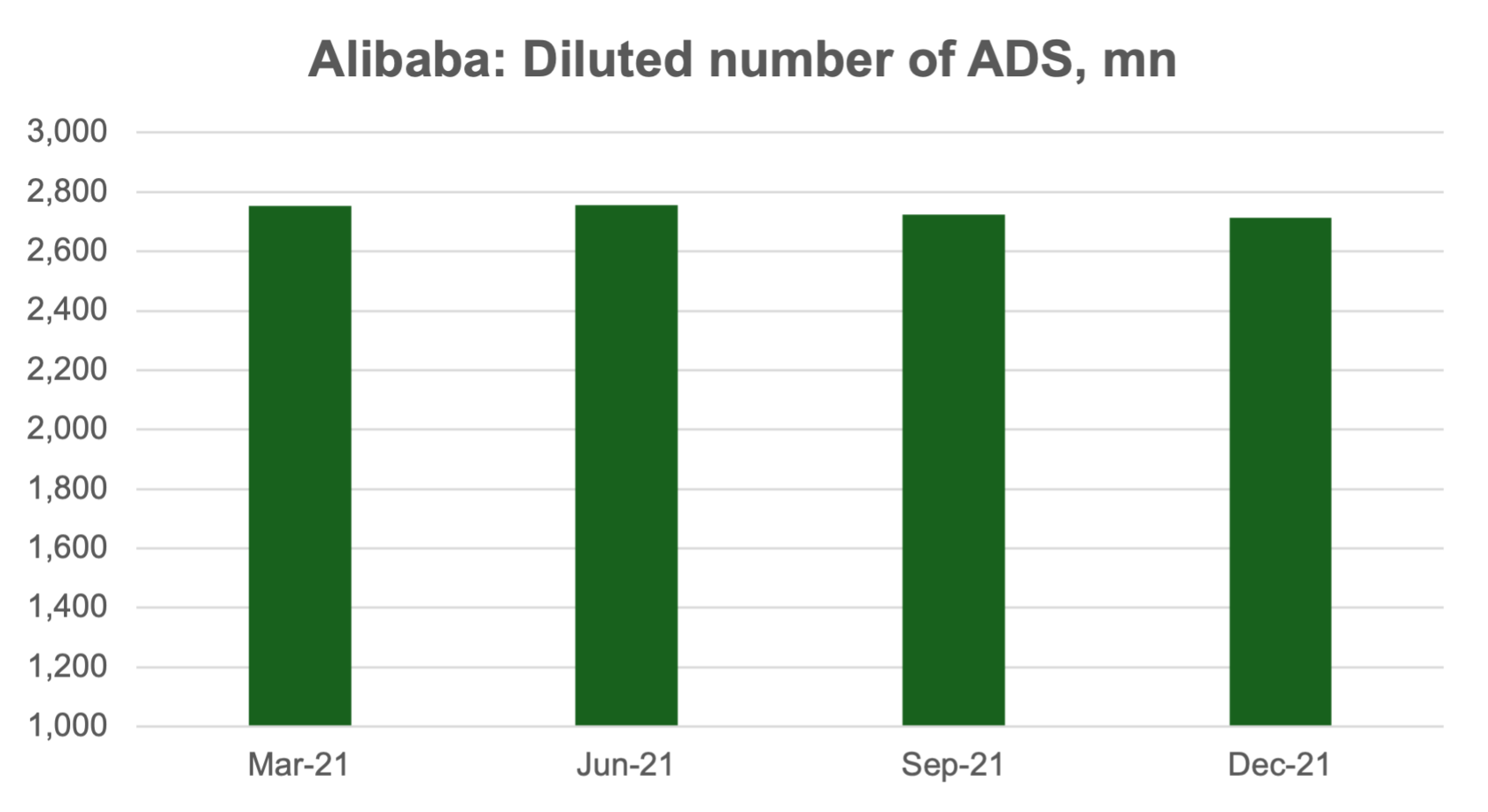

Buyback

Alibaba has reduced the pace of buyback repurchasing just $1.4bn worth of shares during the past quarter. Its share count has declined by a meagre 1.4% since the launch of buyback last spring.

Final thoughts

I was pleased to learn some positive feedback on Alibaba platform from a Twitter friend and a subscriber to my blog. The person uses Alibaba in Europe, highlighting that it offers the lowest prices for high-quality products. He also noted that the B2B service is not fully appreciated/used in Europe. To this, I should add that the two products my daughter purchased on Alibaba are still in good order (electronic watch and two pencil cases).

The second thought is on buying more Alibaba. To remind, the decision to buy more shares should be made in isolation, taking a fresh approach. It may be that Alibaba below $80 would indeed be very attractive, but at the same time, there could be other stocks offering even more upside. In China alone, I would like to learn more about Tencent and related companies such as Naspers, Prosus and Tencent Music.

To remind, shareholder returns come from two primary sources. On the one hand, it is a pure re-rating (e.g. a stock multiple grows from 10x PE to 15x PE); on the other - it is an expansion of the business through reinvestments that lead to higher earnings over time. In the first case, the lack of bad news could be enough to trigger the re-rating. In the second case, time is the critical element as long as the business remains strong and management - focused.

I think Alibaba is now in the first group, but it could also move into the second group. This could be the best outcome.

But enough of wishful thinking.

What is needed now is patience and trust in business fundamentals and management. Of course, avoiding major global conflicts is also critical (although this would affect all stocks to various degrees).

DISCLAIMER: This publication is not investment advice. The primary purpose of this publication is to keep track of my thought process to assess future information better and improve my decision-making process. Readers should do their own research before making decisions. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. The author held a position in the stock discussed above at the time of writing. Please read the full version of the Disclaimer here.