7 May 2023

This is Part I of my update on Alibaba. You can check my original thesis and updates on the company in the Portfolio section of the website.

In this post, I explain why I would still buy Alibaba today and what major risks I see for the business. In Part II, I will discuss my valuation approach, when I would sell the stock and the lessons learned from this investment I have held for over 18 months now.

Content:

I. Why I would buy Alibaba today

- Jack Ma and the CCP: from conflict to compromise?

- Reorganisation of Alibaba and potential listing of its subsidiaries

- Shifting focus: from empire building to maximising profits

- Chinese economy is opening up

- Softbank has sold almost its entire stake

II. Risks

- Domestic competition

- Less involvement of Jack Ma, less alignment of interests

- China's policy pivot

- Taiwan

III. Conclusion

- Jack Ma and the CCP: from conflict to compromise?

- Reorganisation of Alibaba and potential listing of its subsidiaries

- Shifting focus: from empire building to maximising profits

- Chinese economy is opening up

- Softbank has sold almost its entire stake

II. Risks

- Domestic competition

- Less involvement of Jack Ma, less alignment of interests

- China's policy pivot

- Taiwan

III. Conclusion

Why I would buy Alibaba today

Ticker: BABA US

Share price: $83

Market Cap: $215bn

EV: $158bn

Forward PE: 10.9x

EV/EBITA (LTM): 7.7x

Share price: $83

Market Cap: $215bn

EV: $158bn

Forward PE: 10.9x

EV/EBITA (LTM): 7.7x

Alibaba is a quality business that is currently facing temporary challenges.

It is the largest online marketplace in China.

Its share price is down 73% from the all-time-high price ($310) it reached in October 2020. Its current price ($83) is only 22% above the IPO price in 2014 ($68).

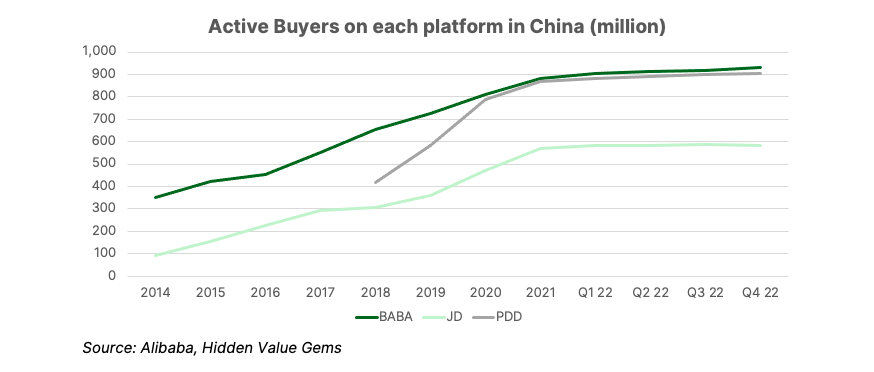

Since its IPO, Alibaba has increased its active customer base in China by 2.7x (to 930mn), revenue by 11.3x (to $130bn) and profits by 4.7x (to $24.3bn).

It is the largest online marketplace in China.

Its share price is down 73% from the all-time-high price ($310) it reached in October 2020. Its current price ($83) is only 22% above the IPO price in 2014 ($68).

Since its IPO, Alibaba has increased its active customer base in China by 2.7x (to 930mn), revenue by 11.3x (to $130bn) and profits by 4.7x (to $24.3bn).

While it is true that Alibaba will not grow as fast as it did previously and is now facing much stiffer competition, I think its valuation broadly reflects these increased risks. The company trades at a forward PE of less than 11x and a 9% FCF yield.

Besides, the company has recently shifted its focus to profits and has reduced non-core spending. I also think its plan to split the group into six independent businesses should increase efficiency further and bring the market’s attention to the significant discount of Alibaba’s market valuation relative to its Sum-of-the-Parts value.

The market is concerned with two main issues: geopolitical risks and the weakening positions of Alibaba in the domestic market.

Indeed, geopolitics is the most obvious and most prominent risk. Also, regulation and domestic policy remain the risk, especially with the new focus on common prosperity, self-reliance in technology and developing an advanced industrial base. The new policy seems to radically differ from the previous policy started by Deng Xiaoping in the 1980s, which focused on economic growth and less on ideology.

I don’t know a better way of addressing these (geo)-political risks than by keeping the size of the position relatively low. I would not make Alibaba my largest position. I would probably be faster to take profits than in the case of companies operating in more market-friendly jurisdictions.

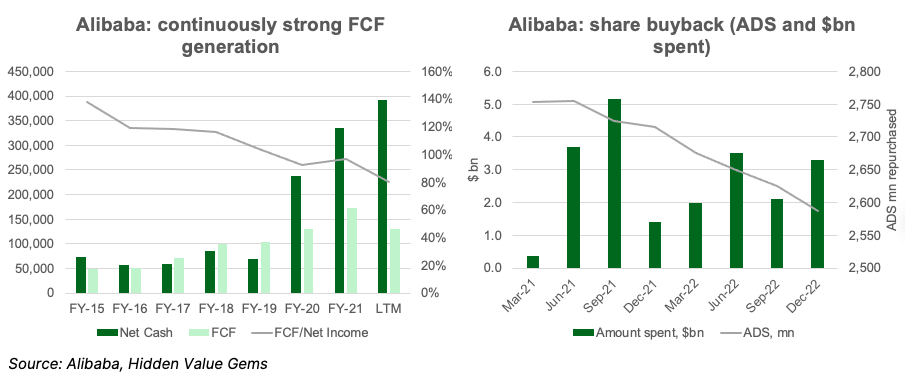

If my thesis that Alibaba is still a quality company is correct, then its buyback programme averaging $3bn a quarter should increase the value of its shares and at least partially mitigate the country discount.

Finally, I would like to highlight an additional technical factor behind Alibaba’s share price weakness. In addition to a broad outflow of funds from China from 2019 until 2022 (over $400bn, according to EPFR), Alibaba’s stock was under pressure from Softbank’s decision to cut its stake in the company from 34% to just 3.4% now. The sale in the past 18 months saw $36.2bn of Alibaba stock offered to the market from just one seller (17% of its market cap).

Disclosure: at the time of writing this post, I had a position in Alibaba shares representing just over 3% of my overall portfolio. This post is not investment advice. It is not a recommendation to buy or sell any security.

Besides, the company has recently shifted its focus to profits and has reduced non-core spending. I also think its plan to split the group into six independent businesses should increase efficiency further and bring the market’s attention to the significant discount of Alibaba’s market valuation relative to its Sum-of-the-Parts value.

The market is concerned with two main issues: geopolitical risks and the weakening positions of Alibaba in the domestic market.

Indeed, geopolitics is the most obvious and most prominent risk. Also, regulation and domestic policy remain the risk, especially with the new focus on common prosperity, self-reliance in technology and developing an advanced industrial base. The new policy seems to radically differ from the previous policy started by Deng Xiaoping in the 1980s, which focused on economic growth and less on ideology.

I don’t know a better way of addressing these (geo)-political risks than by keeping the size of the position relatively low. I would not make Alibaba my largest position. I would probably be faster to take profits than in the case of companies operating in more market-friendly jurisdictions.

If my thesis that Alibaba is still a quality company is correct, then its buyback programme averaging $3bn a quarter should increase the value of its shares and at least partially mitigate the country discount.

Finally, I would like to highlight an additional technical factor behind Alibaba’s share price weakness. In addition to a broad outflow of funds from China from 2019 until 2022 (over $400bn, according to EPFR), Alibaba’s stock was under pressure from Softbank’s decision to cut its stake in the company from 34% to just 3.4% now. The sale in the past 18 months saw $36.2bn of Alibaba stock offered to the market from just one seller (17% of its market cap).

Disclosure: at the time of writing this post, I had a position in Alibaba shares representing just over 3% of my overall portfolio. This post is not investment advice. It is not a recommendation to buy or sell any security.

1. Jack Ma and the CCP: from conflict to compromise?

The troubles at Alibaba started after Jack Ma openly criticised Chinese financial regulators in his speech at the Bund Summit in Shanghai on 24 October 2020. He has not been seen in public since then. Occasionally, he was spotted in Spain, Japan, Thailand and Hong Kong.

The problems did not stop there. Ant Group, the financial arm of Alibaba, had to hold off on its planned IPO.

The parent company, meanwhile, had to pay a $2.8bn penalty for alleged market abuses, including prohibiting merchants from opening stores on other competing platforms,

However, on 27 March 2023, various media reported that Jack Ma visited the school he founded, Yungu, in Hangzhou, where Alibaba is headquartered, to meet with the school’s teachers.text

The problems did not stop there. Ant Group, the financial arm of Alibaba, had to hold off on its planned IPO.

The parent company, meanwhile, had to pay a $2.8bn penalty for alleged market abuses, including prohibiting merchants from opening stores on other competing platforms,

However, on 27 March 2023, various media reported that Jack Ma visited the school he founded, Yungu, in Hangzhou, where Alibaba is headquartered, to meet with the school’s teachers.text

He has not made public statements during his visit. Nevertheless, I find it quite symbolic that he visited the private school he had founded in a communist country. I agree with the interpretation that this may signal the reverse in China’s policy. The former China head at the IMF, Eswar Prasad, noted:

“Beijing seems eager to show that prominent entrepreneurs like Jack Ma, once hailed as visionaries and then vilified by the government, are now welcome back in China.”

Three weeks later, Reuters reported that “Chinese regulators are expected to fine Ant Group about a quarter less than the more than $1 billion initially planned and downgrade their charges against it, sources said, as they seek to end a years-long crackdown on marquee technology firms.”

“Beijing seems eager to show that prominent entrepreneurs like Jack Ma, once hailed as visionaries and then vilified by the government, are now welcome back in China.”

Three weeks later, Reuters reported that “Chinese regulators are expected to fine Ant Group about a quarter less than the more than $1 billion initially planned and downgrade their charges against it, sources said, as they seek to end a years-long crackdown on marquee technology firms.”

2. Reorganisation of Alibaba and potential listing of its subsidiaries

The next day, when Jack Ma visited the Yungu school, Alibaba announced a corporate reorganisation splitting its group into six independently run companies that could seek separate IPOs. The goal of the reorganisation is to make operations more flexible and nimble.

While it is too early to say whether the changes will be successful, I view this as a step in a positive direction. Firstly, management admits the challenges and is looking at addressing them. Secondly, new independently run business divisions could not rely on indirect funding from the core cash engine - domestic marketplaces. Besides, it should allow management to sharpen its focus on the marketplaces, which have faced slower growth and lower take rates due to much stronger competition from local rivals.

With plans for an IPO and being unable to tap the ‘free’ money, smaller business segments at Alibaba will likely be forced to cut losses and come up with a clear path to creating shareholder value.

While it is too early to say whether the changes will be successful, I view this as a step in a positive direction. Firstly, management admits the challenges and is looking at addressing them. Secondly, new independently run business divisions could not rely on indirect funding from the core cash engine - domestic marketplaces. Besides, it should allow management to sharpen its focus on the marketplaces, which have faced slower growth and lower take rates due to much stronger competition from local rivals.

With plans for an IPO and being unable to tap the ‘free’ money, smaller business segments at Alibaba will likely be forced to cut losses and come up with a clear path to creating shareholder value.

Alibaba Eco-system

Source: Alibaba Investor Presentation

3. Shifting focus: from empire building to maximising profits

Alibaba never had one moonshot project like Facebook’s Metaverse. Still, its willingness to build an all-encompassing eco-system with many complimentary businesses around e-commerce (such as entertainment, health, education and others) raised questions about the efficiency of such a strategy. The core business was slowing down while consolidated profits remained under pressure.

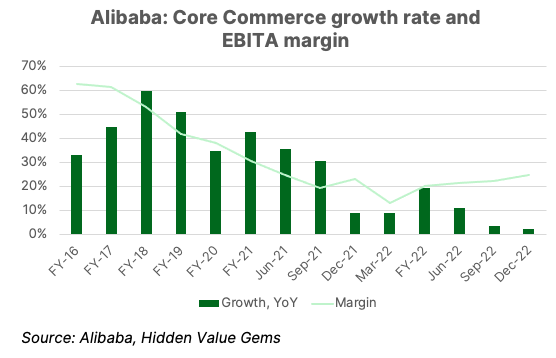

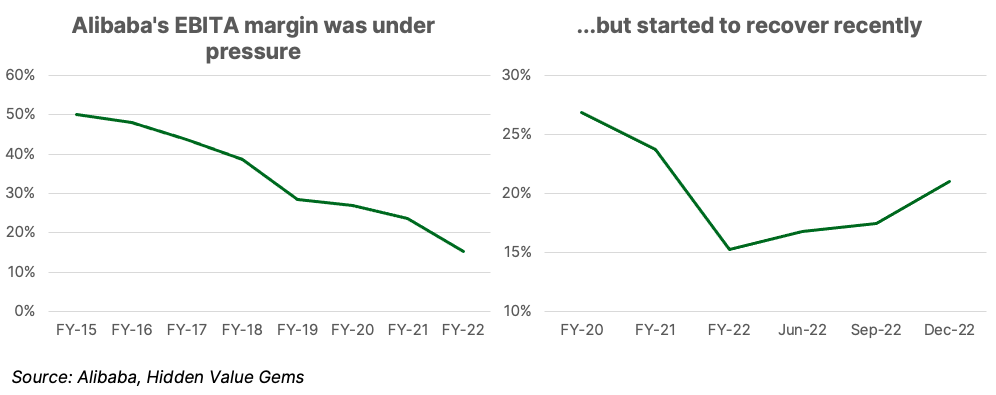

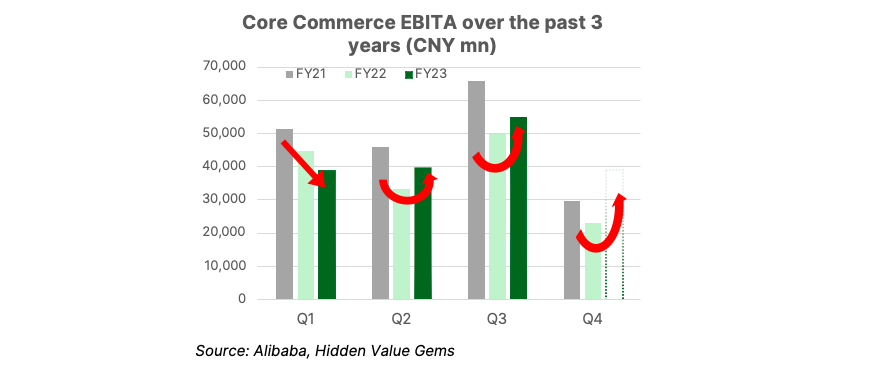

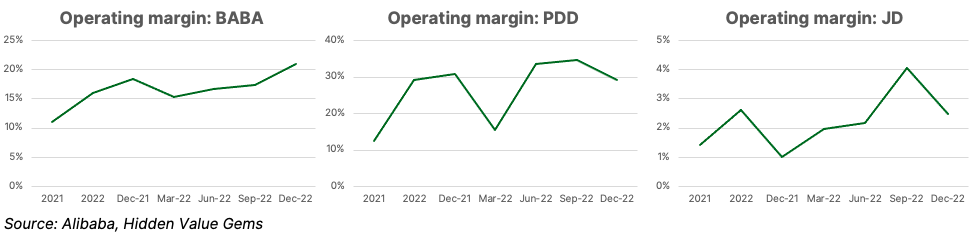

The company’s EBITA margin had been continuously declining from 50% in FY-15 (fiscal year ended on 31 March, 2015) to as low as 15% in FY-22. However, over the past two years, its profitability has started to improve, reaching 21% in Dec-22 quarter.

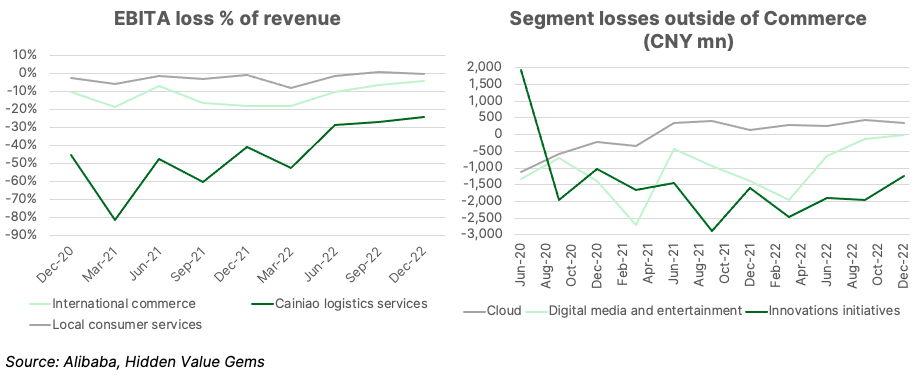

One reason behind this improvement is the company's decision to scale back investments in non-core businesses and focus on the efficiency of its traditional retail operations. As a result, losses as a share of revenue of its new segments have been gradually declining.

The company has been continuously generating FCF, growing its net cash position and, since March 2021, repurchasing its shares. It has spent $21.5bn on buyback over the past two years, reducing its share count by 6%.

Even the core Commerce segment has started to deliver stronger profits despite strong domestic competition.

If you followed the Meta case last year, it was “one hell of a ride”, as they say. Similar to Alibaba, Meta’s stock was under pressure due to concerns over business slowdown and willingness to build Metaverse with unclear payback and potentially huge costs. However, once the founder and the largest shareholder, Mark Zuckerberg, announced the new focus on efficiency and profitability, effectively paring back its metaverse ambitions, the share price rallied. It is up 93% YTD and 164% from November lows.

A slightly different but relevant case happened in 2015 when Google's CFO, Ruth Porat, announced the creation of a new segment called "Other Bets". This represented management's effort to separate investments in new projects unrelated to the core Search business and its profitability. The market welcomed the efforts, sending the share price over 70% higher in two years after the news.

4. Chinese economy is opening up

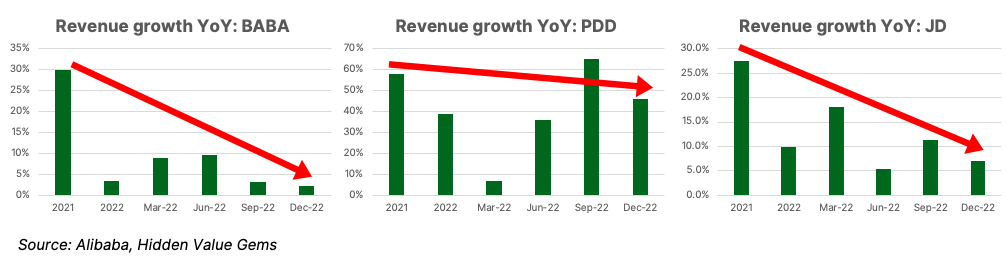

Three main factors drove the company’s profits lower: ecosystem building, domestic competition and regulatory changes, and economic slowdown due to COVID-19.

The first factor seems to be addressed and should not be an issue going forward.

Domestic competition is still the biggest challenge, but the company is gradually adjusting. This factor has slowed Aliababa’s growth and affected its margins, resulting in a much lower valuation. I would argue it is partially in the price and represents lower risk from now onwards.

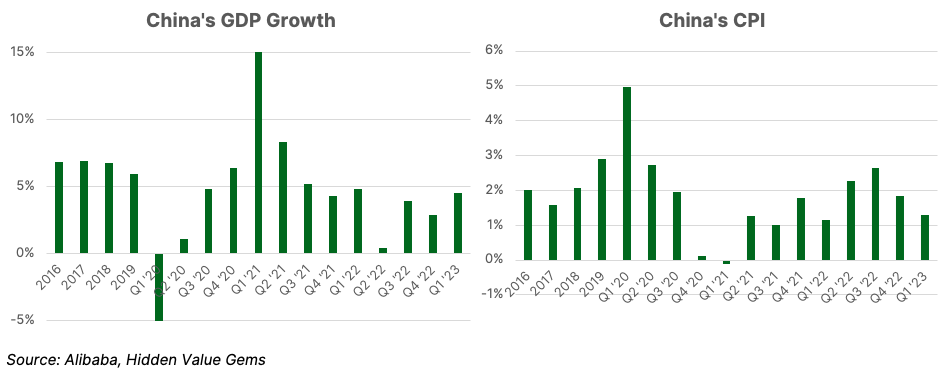

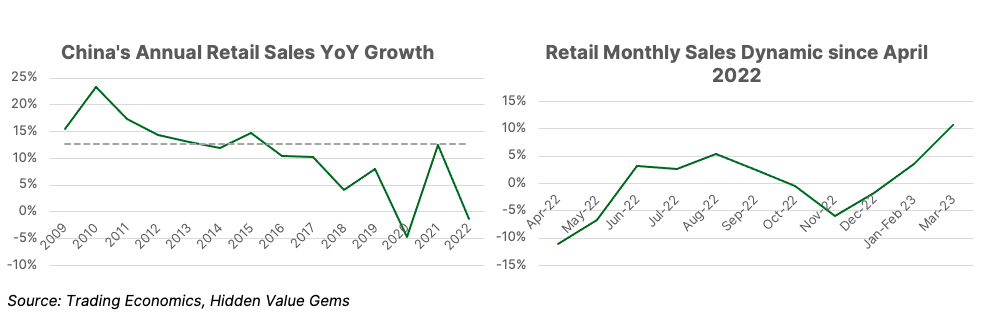

Finally, the macro factor has been a big issue for Alibaba. China has been the fastest-growing economy for decades, delivering nearly 10% GDP growth. Fast urbanisation and the rise of the middle class have been additional factors behind the phenomenal growth of consumer demand.

China was the first large country to abolish COVID-19 lockdowns in 2020, which helped it minimise negative economic consequences in 2020 and achieve a solid GDP growth rate of 8.1% in 2021. However, the victory over COVID turned out to be premature as new cases started to rise in 2022, and the government introduced new lockdowns in various cities last year.

As a result, China’s economic activity has plunged, affecting business performance.

The first factor seems to be addressed and should not be an issue going forward.

Domestic competition is still the biggest challenge, but the company is gradually adjusting. This factor has slowed Aliababa’s growth and affected its margins, resulting in a much lower valuation. I would argue it is partially in the price and represents lower risk from now onwards.

Finally, the macro factor has been a big issue for Alibaba. China has been the fastest-growing economy for decades, delivering nearly 10% GDP growth. Fast urbanisation and the rise of the middle class have been additional factors behind the phenomenal growth of consumer demand.

China was the first large country to abolish COVID-19 lockdowns in 2020, which helped it minimise negative economic consequences in 2020 and achieve a solid GDP growth rate of 8.1% in 2021. However, the victory over COVID turned out to be premature as new cases started to rise in 2022, and the government introduced new lockdowns in various cities last year.

As a result, China’s economic activity has plunged, affecting business performance.

5. Softbank has sold almost its entire stake

Softbank, led by the famous tech investor, Masayoshi Son, was the early backer of Alibaba, providing the first $20mn to Jack Ma. It owned a 34% stake until recently before it started reducing it. In 2022, Softbank cut its interest from 24% to 15% selling $29bn worth of Alibaba shares. This year, Softbank sold $7.2bn worth of shares reducing its stake further to just 3.4% through a series of forward sales, as was reported by FT on 13 April.

For comparison, Alibaba spent $21.5bn on share repurchases in two years, from 2021 until the end of 2022. Softbank sold $36.2bn worth of shares in about a year.

With the overhang risk from the largest shareholder largely over, the pressure on the stock should be less profound, and the buyback programme should have a more material impact on the share price performance.

For comparison, Alibaba spent $21.5bn on share repurchases in two years, from 2021 until the end of 2022. Softbank sold $36.2bn worth of shares in about a year.

With the overhang risk from the largest shareholder largely over, the pressure on the stock should be less profound, and the buyback programme should have a more material impact on the share price performance.

Risks

Domestic competition

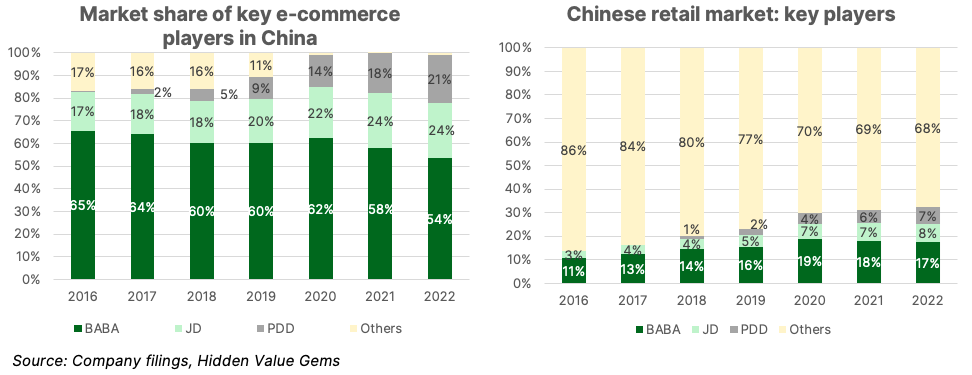

Alibaba’s dominant market position has been shaken by new contenders who came up with different solutions to improve customer experience. While Alibaba was the first retailer to reach one billion customers in China, its scale has not transformed into a wide enough moat to protect its profit margins.

It is worrying to see Alibaba's market share in Chinese e-commerce erode from 65% in 2016 to 54% last year. Still, it remains the dominant player, especially in the overall retail market of China, where the relative strength of its smaller competitors like JD.com and PDD is less visible.

It is worrying to see Alibaba's market share in Chinese e-commerce erode from 65% in 2016 to 54% last year. Still, it remains the dominant player, especially in the overall retail market of China, where the relative strength of its smaller competitors like JD.com and PDD is less visible.

The need to continuously innovate is one of the challenges that makes the future of Alibaba less clear. Every company has to innovate to remain in business. But the pressure is arguably higher in China than in more mature markets.

This risk is partially reflected in a lower valuation.

Its major competitor JD.com is also facing a slowdown in revenue growth, while its margin improvement is not as smooth as at Alibaba. PinDuoDuo maintains faster growth, but it has come down below market expectations, and the company is not able to improve its margins.

This risk is partially reflected in a lower valuation.

Its major competitor JD.com is also facing a slowdown in revenue growth, while its margin improvement is not as smooth as at Alibaba. PinDuoDuo maintains faster growth, but it has come down below market expectations, and the company is not able to improve its margins.

Besides, Alibaba still remains the largest marketplace in China. The growth of PDD's active buyers is slowing down.

Less involvement of Jack Ma, less alignment of interests

A lot has been said about the departure of Jack Ma and the resilient culture of the company. I have not seen signs that company’s operations or services have been affected since his departure. However, the risk is that without the active involvement of its founder, the company could make the wrong strategic choice later.

China's policy pivot

Markets have been concerned by the shift in China’s policy from a pragmatic focus on economic growth to a more ideology-driven strategy with ambitious foreign affairs goals.

I am not an expert on China, but my assumption has been that the country’s leadership remains rational and avoids decisions that cause instability and weaken the economy. I may be wrong. A lot has been said about Jack Ma's departure and the company's resilient culture. I have not seen signs that the company’s operations or services have been affected since his departure. However, the risk is that without the active involvement of its founder, the company could make the wrong strategic choice later.

I am not an expert on China, but my assumption has been that the country’s leadership remains rational and avoids decisions that cause instability and weaken the economy. I may be wrong. A lot has been said about Jack Ma's departure and the company's resilient culture. I have not seen signs that the company’s operations or services have been affected since his departure. However, the risk is that without the active involvement of its founder, the company could make the wrong strategic choice later.

Taiwan

Following Russia’s actions in Ukraine, it is much harder now to disregard China’s invasion of Taiwan. The risk is not zero, but probably not as high as 50% either. Another risk is that the US can impose sanctions on China before the invasion, leading to further deterioration in their relations.

I am actively engaged in the Good Judgement Project as one of the forecasters (it is free to join and is an excellent way to assess your judgement in real situations). The platform also allows you to see what Superforeasters project for select questions. Superforecasters are people who have consistently beaten 90% or more participants in hundreds of questions.

Currently, they assign only a 29% chance that China or Taiwan will accuse each other of using a weapon against its forces before 1 January 2025.

Interestingly, Buffett referred to the geographic location of Taiwan Semiconductor (TSMC) as the main reason for his decision to sell the company's shares in late 2022 (which he purchased just a few months before).

The slight difference between Alibaba and TSMC, though, is that in case of the invasion of Taiwan, Alibaba would probably survive, but TSMC might be nationalised.

If the issue of Taiwan is viewed in the broader context of the increasing rivalry between the US and China, then if the two superpowers learn to co-exist, maybe the conflict could be avoided. In any case, I see this as a real risk and plan to monitor the developments to minimise my further losses. This risk is another reason to keep the weight of Alibaba position in the portfolio low and consider taking some profits in case of a 40-60% rise in the share price.

I am actively engaged in the Good Judgement Project as one of the forecasters (it is free to join and is an excellent way to assess your judgement in real situations). The platform also allows you to see what Superforeasters project for select questions. Superforecasters are people who have consistently beaten 90% or more participants in hundreds of questions.

Currently, they assign only a 29% chance that China or Taiwan will accuse each other of using a weapon against its forces before 1 January 2025.

Interestingly, Buffett referred to the geographic location of Taiwan Semiconductor (TSMC) as the main reason for his decision to sell the company's shares in late 2022 (which he purchased just a few months before).

The slight difference between Alibaba and TSMC, though, is that in case of the invasion of Taiwan, Alibaba would probably survive, but TSMC might be nationalised.

If the issue of Taiwan is viewed in the broader context of the increasing rivalry between the US and China, then if the two superpowers learn to co-exist, maybe the conflict could be avoided. In any case, I see this as a real risk and plan to monitor the developments to minimise my further losses. This risk is another reason to keep the weight of Alibaba position in the portfolio low and consider taking some profits in case of a 40-60% rise in the share price.

Conclusion

I initially viewed Alibaba as an exceptional business with temporary problems available at a knockdown price. Having followed the business and having done more research, I believe Alibaba is not an exceptional business any more and not all problems are entirely temporary.

But extrapolating the most recent trends and concluding the opposite is also a mistake. Alibaba is still the largest e-commerce platform in China which is profitable and runs a net cash position. Most severe problems were caused by COVID-19 restrictions and are thus temporary. While Alibaba will unlikely revert to a 20%+ growth rate in the near term, a combination of 5-10% top-line growth and improving margins should lead to a 10%+ earnings growth rate. The business is available today at less than 11x forward PE.

But extrapolating the most recent trends and concluding the opposite is also a mistake. Alibaba is still the largest e-commerce platform in China which is profitable and runs a net cash position. Most severe problems were caused by COVID-19 restrictions and are thus temporary. While Alibaba will unlikely revert to a 20%+ growth rate in the near term, a combination of 5-10% top-line growth and improving margins should lead to a 10%+ earnings growth rate. The business is available today at less than 11x forward PE.

DISCLAIMER: This publication is not investment advice. The primary purpose of this publication is to keep track of my thought process to assess future information better and improve my decision-making process. Readers should do their own research before making decisions. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. The author held a position in the stock discussed above at the time of writing. Please read the full version of the Disclaimer here.