3 April 2022

Last month, I became a shareholder in two new businesses. I have not done much with my portfolio since buying Alibaba during September - October 2021.

Rising rates and commodity prices have triggered rotation from growth to value stocks. Many businesses that used to be viewed as exceptional have declined 50% and more. I am keen to add such companies to my portfolio at reduced prices rather than chase cyclical commodity producers for a short-term gain. Besides, I already have a few companies in the commodity space (e.g. Glencore, NOV, CNX, ET).

Today, I am going to share my thesis on EPAM. I have deliberately added a section on what would make me sell the stock. It is essential to state this at the start as our psychology often prevents us from thinking rationally when real trouble comes (i.e. we find excuses to keep an ailing company, sitting on rising losses and missing new opportunities).

My investment thesis on EPAM

Latest share price (1 April 2022): $287

Shares outstanding: 56.9 million

Market Cap: $16.3bn

Net Debt/(Cash): $1.4bn

EV: $14.9bn

Normalised earnings (Year 3): c. $1bn

Price to Normalised earnings: 14.9x

Shares outstanding: 56.9 million

Market Cap: $16.3bn

Net Debt/(Cash): $1.4bn

EV: $14.9bn

Normalised earnings (Year 3): c. $1bn

Price to Normalised earnings: 14.9x

What is EPAM?

EPAM is a fast-growing IT company helping corporate customers in digital transformation. It has a unique business model - providing complex solutions at considerably lower costs than its major competitors. Its critical services include consulting, product development and design, automation and optimisation. The company has historically relied on engineers from the ex-USSR region, and in that regard, it is similar to some leading IT companies that rely on Indian IT engineers (Wipro, Infosys, Tata Consultancy, Cognizant).

However, it has been providing more complex and innovative solutions (especially in software product development), allowing it to compete and collaborate with the likes of SAP, IBM, Alphabet, and Salesforce.

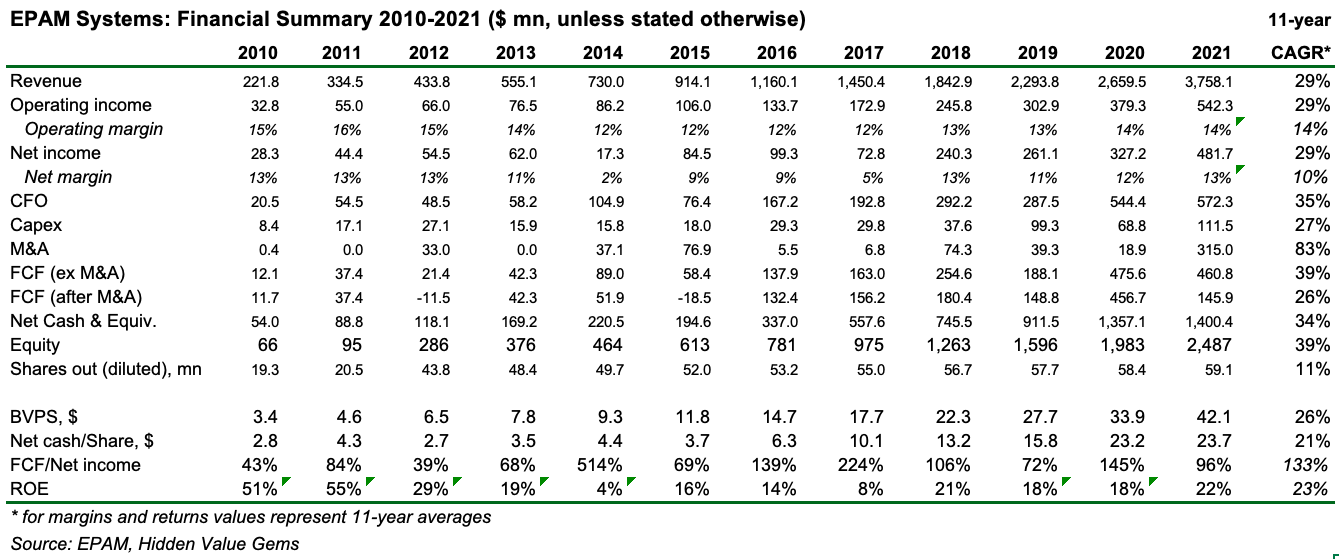

By providing customers with better and more complex solutions at lower costs, EPAM has grown its sales by 25-35%, on average (11-year revenue CAGR - 29%), faster than many traditional IT outsourcing companies who compete on costs (10-20%).

Why I Bought It?

EPAM is a great business that experienced a temporary setback and became available at a very attractive price. At my cost price of $210 per share, I estimate that I paid 10x for EPAM’s earnings in Year 3 (assuming 30% revenue growth and 10% net margin).

It is a founder-led business. The company is run by its founder, Arkadiy Dobkin, an exceptionally talented engineer who emigrated from Belarus to the US in 1993 to found EPAM.

EPAM has grown its revenue by 29% per year since 2010 (16x growth), with an average EBIT and a net margin of 14% and 10%, respectively. Its Book Value per share (BVPS) has increased by 26%, on average, since 2010. Net cash per share has grown by 21% over the same period. EPAM has an exceptional cash conversion (FCF/Net income) of 133% (average for 2010-2021) and average ROE of 23%.

ROE is artificially reduced due to a high net cash balance ($1.4bn, or 8.6% of the Market Cap). Over half of EPAM’s BVPS ($42.1) is net cash ($23.7).

While EPAM’s historical dependence on the talent from the former USSR looks to be a challenge today, I think the company can overcome this issue.

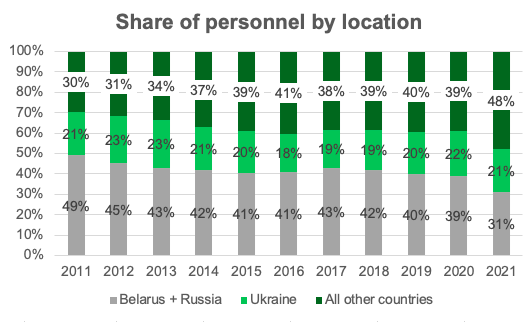

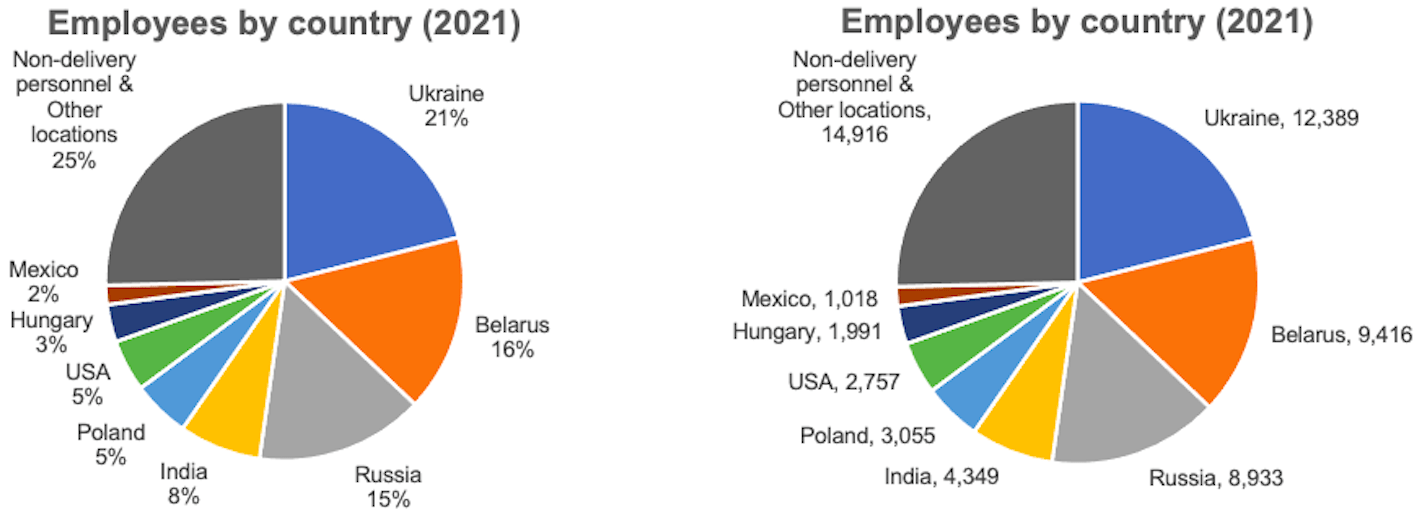

EPAM’s talent pool has become more diversified

Historically, almost half of the company’s employees were based in Belarus and Russia (in 2011, 37% were in Belarus alone). However, the situation has reversed over time, with 69% of personnel located in other countries. The largest number of EPAM employees are based in Ukraine (12.4k out of 58.8k). The company has been actively developing new centres in Central Europe (Poland and Hungary), Asia (India and China), the US, Mexico, UK and others. Belarus and Russia account for 31% of personnel now (Russia - 15%).

Source: EPAM, Hidden Value Gems

Source: EPAM, Hidden Value Gems

It is not clear what happens to the Russian employees. I think some may be transferred into a separate company that will continue to work on the local market but which would cut ties with EPAM. Russia accounts for 4% of EPAM’s revenue. Some employees could probably relocate to other geographies. Various estimates suggest that between 100,000 and 200,000 IT professionals have left Russia already.

EPAM could also hire more IT professionals in new countries to replace some of its Russian workforce.

Russia has faced a sharp rise in demand for IT specialists before the war, with an average monthly salary rising to $2-3k (in IT), similar to wages in the CEE region. So removing the Russian workforce should not drastically raise EPAM’s costs.

Signs of a ‘great business’

The founder and CEO of EPAM receives a meagre salary compared to industry standards, c. $600k, and an extra $600-900k cash bonus. However, he receives c. $3mт in stocks and options. He also holds 1,256,361 shares of EPAM and 436,189 vested shares (2.9% interest in EPAM). With almost $0.5bn of his net worth in EPAM shares, I think Arkadiy Dobkin’s interests are well aligned with other shareholders.

EPAM has one of the lowest attrition rates in the sector (voluntary attrition rate was 13.3%, 10.8%, and 13.3% in 2021, 2020 and 2019, respectively). Cognizant, for example, suffered over a 30% attrition rate in 2021.

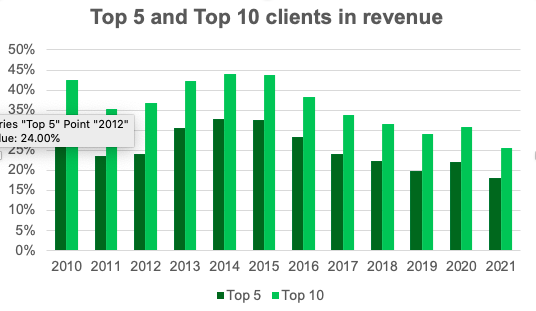

53.8% and 26.5% of EPAM’s revenues in 2021 came from customers who had used its services for at least five and ten years.

EPAM has been rapidly growing its customer base and increasing diversification.

Source: EPAM, Hidden Value Gems

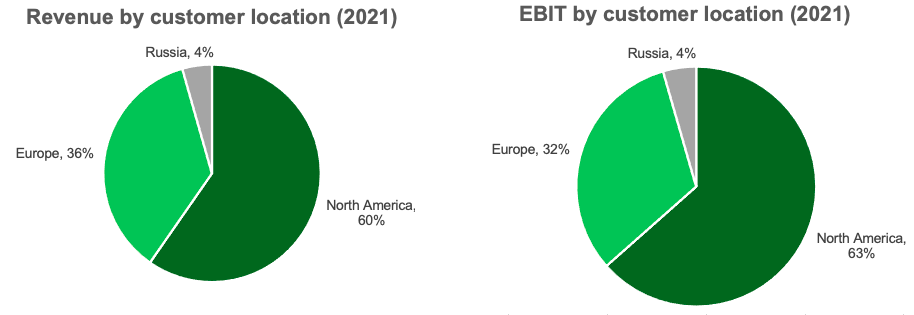

EPAM generates 60% of its revenue in North America and 36% in Europe.

Source: EPAM, Hidden Value Gems

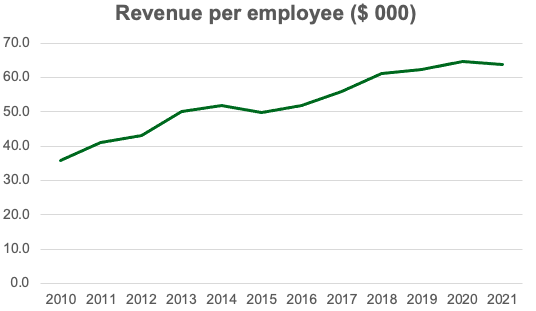

EPAM has almost doubled its revenue per employee for the past ten years which is a sign of its rising pricing power and increasing complexity of projects.

Source: EPAM, Hidden Value Gems

The company has also been executing an efficient M&A strategy paying reasonable prices for small businesses to expand its services and enter new markets. This has added a few percentage points to the overall growth of EPAM.

The company has not relied on debt and maintains a very conservative capital structure with $1.4bn in net cash.

EPAM has not reported a loss since at least 2006 (the earliest available accounts).

What is my edge?

My first edge is patience and the ability to withstand near-term volatility (I will not sack myself for one or two weak quarters), the advantage that many professional money managers do not have.

I have also listened to several lengthy interviews with the founder of EPAM in Russian and got a sense that he has a true passion for building a leading IT business globally and is a very talented engineer. While many CEOs speak at length publicly these days, many of them have learned the art of presentation and say things that their audience wants to hear. The interviews I watched with Dobkin were less about making the right impression. I think I learned essential aspects of the company’s culture and strategy from them.

Finally, and perhaps most important, I know a person who works at EPAM who is very happy with his employer, culture, level of tasks, compensation etc. I also spoke to a person working for a leading global IT company (business software) who provided very positive feedback on EPAM. The latter carries out specific projects for that global IT company.

What would make me sell the stock?

1. ‘Silly valuation’

A PE multiple of 50x or more (when estimated using normalised earnings in Year 3). It would also depend on the growth trajectory of EPAM at that moment.

2. Better alternatives

If I see a materially better business at a lower valuation, I may consider trimming my position in EPAM.

3. Degrading of the business

Feedback from customers on the poor quality of EPAM. A material slowdown in growth and margins.

Relocating personnel and reducing dependence on Russia/Belarus would be short-term pain. The company would lose at least 4% of its revenues (share of Russia). It also risks losing international customers due to its links to Belarus and Russia. During its February earnings call (before the war), EPAM’s CEO said that few customers have started to review their relationships with EPAM.

4. Deteriorating corporate governance. CEO leaving, large and expensive M&A deal, rising leverage.

5. Scandal, corruption. Sounds obvious, but it is still crucial to flag this at the early stage. Usually, when a stock falls on the first news of a potential scandal, you are tempted to dismiss the information. To avoid taking a loss, you start convincing yourself that the new reduced price already reflects potential risks and that it may be better to continue holding the stock until the situation improves. However, this would be a grave mistake since the core of my thesis (the reason I bought EPAM) is that this is a great business that will continue growing. A potential scandal would be strong evidence that the company is not as good as I initially thought. The price may look more attractive after a hypothetical correction, but it was not the low price that attracted me to EPAM.

6. Weak two-three quarters ahead. I expect the company to report much weaker growth in the following quarters (probably around 25-30% in the second quarter) and higher costs due to relocation and more emergency hiring. However, as long as the company maintains its long-term growth potential due to its unique capabilities - it should remain an attractive investment.

7. Scale. Something to keep an eye on as EPAM transitions from a niche to a global player aiming to achieve the $10bn revenue mark in the medium-term (vs $3.8bn in 2021.

8. M&A. EPAM has been active in small-scale acquisitions completing a few deals of $50-200mn size every year. As the company expands, the scale and pace of deals may accelerate, increasing the risk of integration and poor execution.

Financial summary

I hope there was something useful for you in this note. I would appreciate your feedback, any comments or ideas – please feel free to send them at ideas@HiddenValueGems.com.