21 May 2023

I sold all my position in EPAM on 8 May at about $242 price, taking a small profit of about 15% in 14 months.

Here are the reasons behind my decision.

Original thesis

My original thesis was based on the belief that the company’s business model would not be disrupted by the war in Ukraine. To remind, Ukraine, Belarus, and Russia accounted for 21%, 16% and 15% of EPAM’s total personnel, respectively. The three countries hosted 30,738 employees at the end of 2021.

By March 2022, the stock was down 71% since the start of 2022.

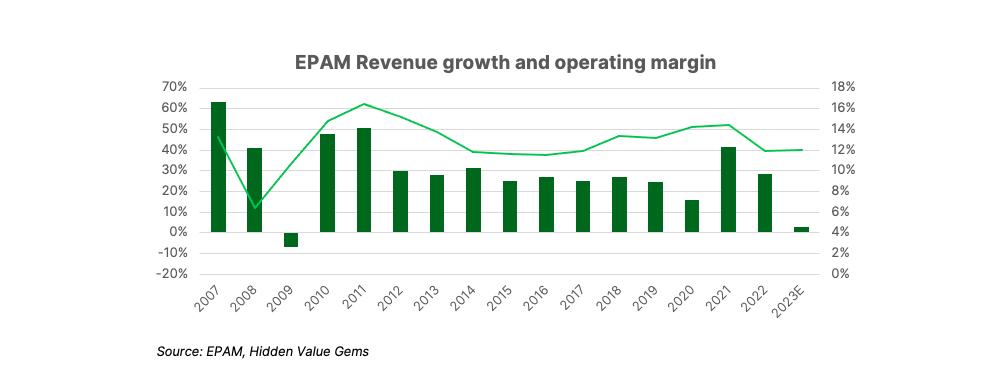

Yet, EPAM has been growing its revenue and earnings at 29% CAGR during 2010-21. On normalised earnings, the company was valued at about 15x PE multiple and a 10x PE based on 2025 earnings (assuming a 30% growth rate was maintained after 2022).

My edge was in having evidence that the EPAM operations were fairly robust.

I was proven right initially. In just six months, the stock was up over 100%.

By March 2022, the stock was down 71% since the start of 2022.

Yet, EPAM has been growing its revenue and earnings at 29% CAGR during 2010-21. On normalised earnings, the company was valued at about 15x PE multiple and a 10x PE based on 2025 earnings (assuming a 30% growth rate was maintained after 2022).

My edge was in having evidence that the EPAM operations were fairly robust.

I was proven right initially. In just six months, the stock was up over 100%.

What has changed

While I cannot be 100% certain, there are signs that the business is not as robust as I thought. My original thesis was as follows: “A 30%-compounder available at 10-15x normalised PE due to issues that can be overcome.”

The new thesis is: “A business growing under 10% priced as a 30%-compounder.” I don’t have enough confidence to believe the business will return to its previous growth trajectory fast enough.

The new thesis is: “A business growing under 10% priced as a 30%-compounder.” I don’t have enough confidence to believe the business will return to its previous growth trajectory fast enough.

It looks like its personnel relocation led to some customer losses. The macro slowdown is definitely affecting EPAM.

I have not fully understood the business model, specific products, differentiating features, and why customers choose EPAM over alternative options. Without this knowledge, it becomes more of a gamble to me.

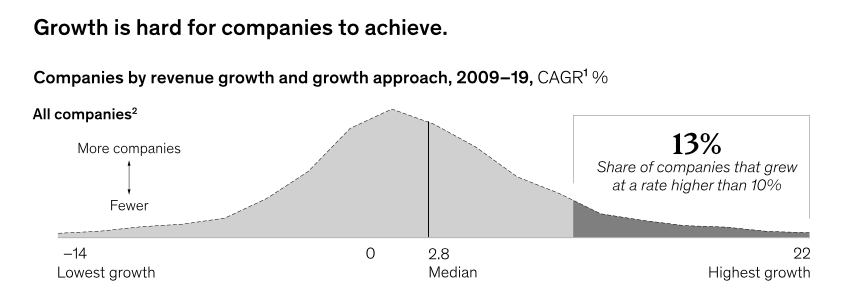

Finally, I should note that historically, very few companies can sustain sales growth above the 10% level for a long time. McKinsey estimates that the median annual growth rate for 5,000 companies they have studied was just 2.8%! And only 13% of companies grew faster than 10% during 2009-19. High growth is not a norm.

I have not fully understood the business model, specific products, differentiating features, and why customers choose EPAM over alternative options. Without this knowledge, it becomes more of a gamble to me.

Finally, I should note that historically, very few companies can sustain sales growth above the 10% level for a long time. McKinsey estimates that the median annual growth rate for 5,000 companies they have studied was just 2.8%! And only 13% of companies grew faster than 10% during 2009-19. High growth is not a norm.

Such growth is really an exception, and holding EPAM in light of the current slowdown would require me to have strong reasons to argue why EPAM is not like most other companies. I am afraid I lack the critical edge to do it.

For reference, I listed eight conditions that would make me sell the stock in my original thesis.

The third condition was the Degrading of the business:

For reference, I listed eight conditions that would make me sell the stock in my original thesis.

The third condition was the Degrading of the business:

DISCLAIMER: This publication is not investment advice. The primary purpose of this publication is to inform and educate readers about the stock market. Readers should do their own research before making decisions and always consult with professional advisors. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. Please read the full version of the Disclaimer here.