14 May 2023

Content:

I. The stock price is close to my Bear Case scenario

II. Rolling the dice?

III. The importance of the new strategy

IV. I am down about 50%. What did I get wrong?

Content:

I. The stock price is close to my Bear Case scenario

II. Rolling the dice?

III. The importance of the new strategy

IV. I am down about 50%. What did I get wrong?

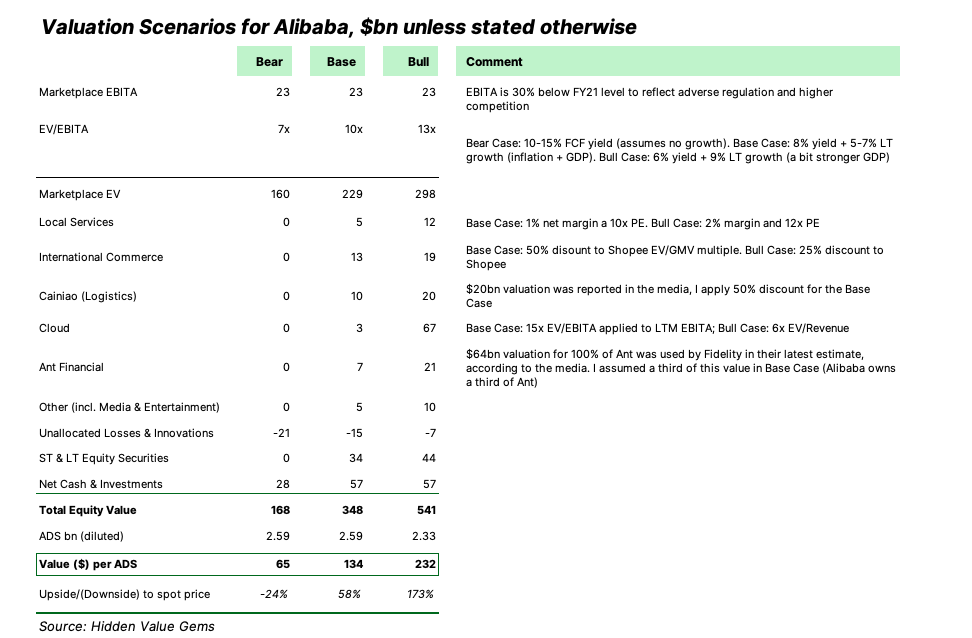

Estimating Alibaba's intrinsic value should not intend to yield an exact three-digit figure. Such precision may engender misplaced confidence and complacency. Rather, I am interested in understanding what market assumptions are baked into the stock and where my own view may diverge. The range of potential bear-case and bull-case values is my preferred way of understanding the risk/reward that the stock offers. There is little math and a lot of judgement.

Unsurprisingly, the simple fundamental analysis of Alibaba indicates that the stock is appealing. However, assessing whether China is still “investable” and what would happen to Taiwan is much harder. My basic calculations suggest the risk may be worth taking. The market assigns a 40-50% probability to the Worst Case scenario (Alibaba’s US-listed ADS become worthless), which looks too conservative. There is about a 24% downside and over 170% upside.

The company is trading at about 11x forward-looking PE multiple, which is clearly low, but it is insufficient to conclude that it is a great investment opportunity. There are too many moving parts. So let’s unpack Alibaba’s business and its value drivers.

Unsurprisingly, the simple fundamental analysis of Alibaba indicates that the stock is appealing. However, assessing whether China is still “investable” and what would happen to Taiwan is much harder. My basic calculations suggest the risk may be worth taking. The market assigns a 40-50% probability to the Worst Case scenario (Alibaba’s US-listed ADS become worthless), which looks too conservative. There is about a 24% downside and over 170% upside.

The company is trading at about 11x forward-looking PE multiple, which is clearly low, but it is insufficient to conclude that it is a great investment opportunity. There are too many moving parts. So let’s unpack Alibaba’s business and its value drivers.

The stock price is close to my Bear Case scenario

I have looked at three potential valuation scenarios for Alibaba.

In my Bear Case, I assume that Alibaba remains just an e-commerce platform in China and assign no value to other businesses. I even apply a 50% discount to the company’s net cash position ($57bn), reflecting the risks of value-destructive projects. I also assume its stock investments ($34bn) are worthless. In addition, I deduct the present value of the losses in Unallocated and Innovations segments, although they can be cut if the company focuses solely on maximising near-term profits.

With this set of quite conservative assumptions, I arrive at a $65 valuation for 1 ADS (24% below the market price).

Here is a simple approach I took to value the Marketplace.

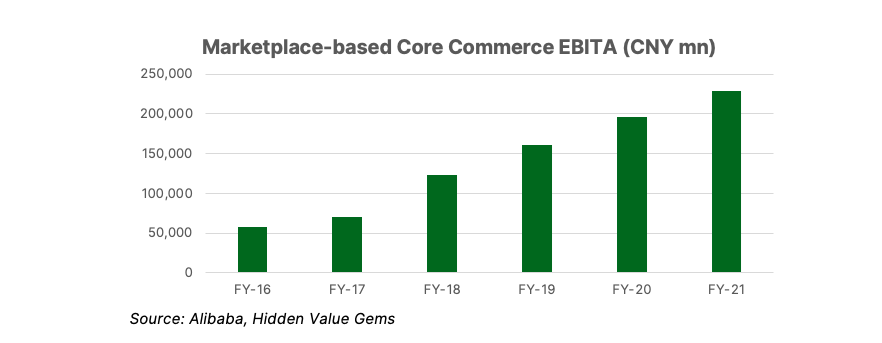

Alibaba has stopped disclosing the profitability of its Chinese online marketplaces from 2021. During FY-16 to FY-21 period (or about 2015-20, as Alibaba’s financial year ends on 31 March), the company’s Marketplace-based Core Commerce EBITA increased by 3.9x to CNY 229bn (or $35bn).

With this set of quite conservative assumptions, I arrive at a $65 valuation for 1 ADS (24% below the market price).

Here is a simple approach I took to value the Marketplace.

Alibaba has stopped disclosing the profitability of its Chinese online marketplaces from 2021. During FY-16 to FY-21 period (or about 2015-20, as Alibaba’s financial year ends on 31 March), the company’s Marketplace-based Core Commerce EBITA increased by 3.9x to CNY 229bn (or $35bn).

Considering regulatory pressure and higher competition since 2021, I have used a 30% lower EBITA for my valuation purposes. So, contrary to a typical assumption, not only did I assume that EBITA would not rise (either due to sales growth or margin expansion), I actually explicitly reduced it by 30%.

I then applied a 7x EV/EBITA multiple, roughly translating into a 10-15% FCF yield. I think such yield is appropriate in a situation of no growth. Simply put, the FCF yield should match your future return if the business doesn’t grow.

The only issue I have with this approach is the absolute level of EBITA. The last reported number is based on the company’s own adjustments. Specifically, management separated a few business lines which it does not view as related to the e-commerce operations. However, if the market proposition is evolving and becoming more sophisticated, then maybe these smaller loss-making segments are inevitable expenses that Alibaba has to take to stay relevant to Chinese consumers.

Could it lose market share otherwise?

Given the latest trend of the falling market share of Alibaba, it is fair to assume that EBITA margins may be lower than historically. To remind, I did cut the last available number by 30%. Also, a 7x EV/EBITA multiple is quite conservative.

Suppose Alibaba closes its business tomorrow and distributes the cash and securities it holds on its balance sheet. In this case, we will receive about $35 per share (assuming all businesses are worth nothing at all).

In other words, at the current share price of $85, the market assumes all of Alibaba’s businesses are worth $50 per share. With 2.59bn shares (ADS) outstanding, the total value of the operations comes up to $129.5bn. I cannot prove this mathematically, but this value looks low intuitively, given that we are still dealing with the largest e-commerce player in China, which also owns a leading payment provider in the country.

For comparison, the population of Korea is less than 3% of Chinese, and its GDP is about 10% of the size of the Chinese economy. Yet, its local e-commerce platform, Coupang, has a market cap of $30bn - a quarter of Alibaba. Coupang has been losing money at the operating level (reporting negative operating income for the past three years).

As long as the downside looks moderate, let’s take a look at the potential upside.

In my Base Case, I still use a 30% lower EBITA for the core marketplace business but apply a higher (10x) valuation multiple. A simple way to justify a higher multiple is to suggest that the business can grow faster. In this case, I think a 5% long-term growth is possible, which should match inflation (2-3%) and conservative GDP growth (2-3%). No gaining market share or improving profitability is assumed.

This method gives me a $229bn valuation for the marketplace. I also used a 5% lower share count (2.46bn) to reflect the ongoing buyback operations. On my estimates, the marketplace could be worth $93 per share in the Base Case.

The upside comes from the value of cash ($57bn) and investments ($34bn), or $37 per share.

Besides, I gave some credit to other businesses, including $7bn to Alibaba’s 33% stake in Ant Group, which is a third of the value estimated by Fidelity in one of its recent portfolio reviews. You may recall that before Ma criticised the Chinese government, Ant Group planned to go public at a valuation of around $300bn!

I assumed a $10bn value for the logistics business, Cainiao. This is based on a 50% discount to the $20bn valuation mentioned in the press recently.

International commerce is a number of marketplaces, including Lazada in South East Asia with over $21bn of GMV, Trendyol in Turkey (around $10bn of GMV), Aliexpress (Europe and some Emerging Markets) and Daraz (Pakistan and South Asian countries excluding India). To estimate the value of these operations, I applied EV/GMV multiple of Shopee and a 50% discount on top.

I assumed a 1% net margin for Local Services and a 10x PE multiple. However, it may be worth zero if these services are critical for the customer experience. In fact, they may represent a negative value too. Importantly, this segment is too small to move the needle either way.

Assuming losses at Unallocated & Innovation segments are reduced by 30%, my final value per share in the Base Case comes at $134 (58% upside to the spot price).

You can view my Bull Case assumptions in the table (above). One point I would add is that I never assumed higher a higher EBITA of the Marketplace. This possibility should not be disregarded, though. Alibaba’s core business model is based on providing a platform that connects merchants (goods sellers) with buyers. Alibaba charges merchants commission which accounts for about 4% of the transaction value. Alibaba reports this fee as its revenue from the Marketplace. Most other marketplaces outside of China charge merchants much higher fees, closer to 10%.

The final fee depends on the level of services offered to merchants, especially around logistics (warehouse and delivery). Even though Alibaba has historically focused on matching buyers and sellers, providing minimal other services to merchants, I think a 4% commission rate is conservative.

Given the high share of fixed costs, even a slight increase in commission rate (to 5% or 6%) can materially boost Alibaba’s profitability (by 40-70%). Consider this a Blue Sky scenario (with above zero probability).

To sum up, based on my assumptions, the range of potential returns is between a negative 24% to a possible gain of over 170%.

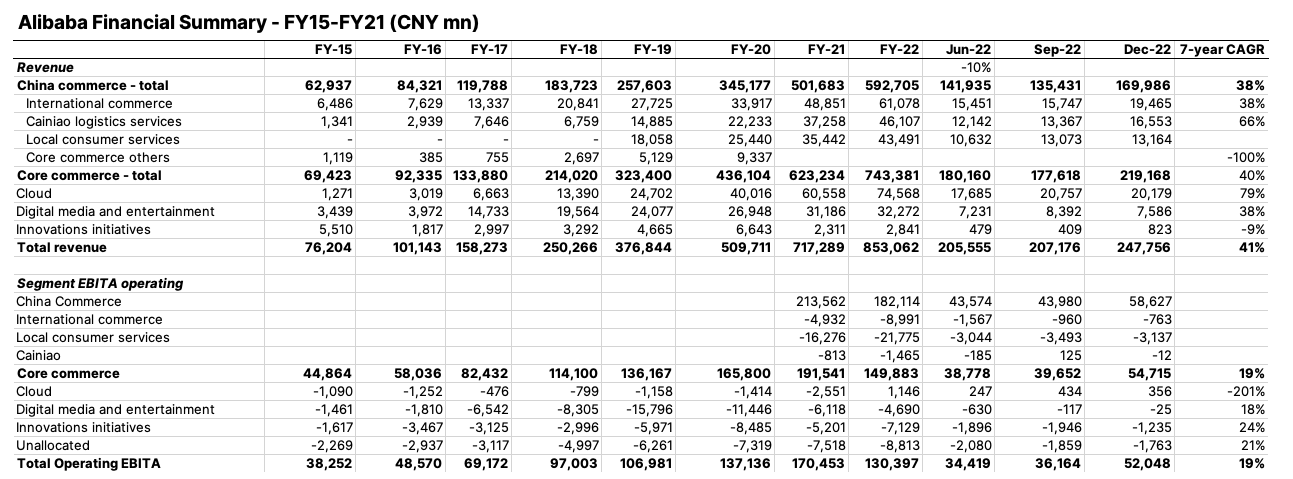

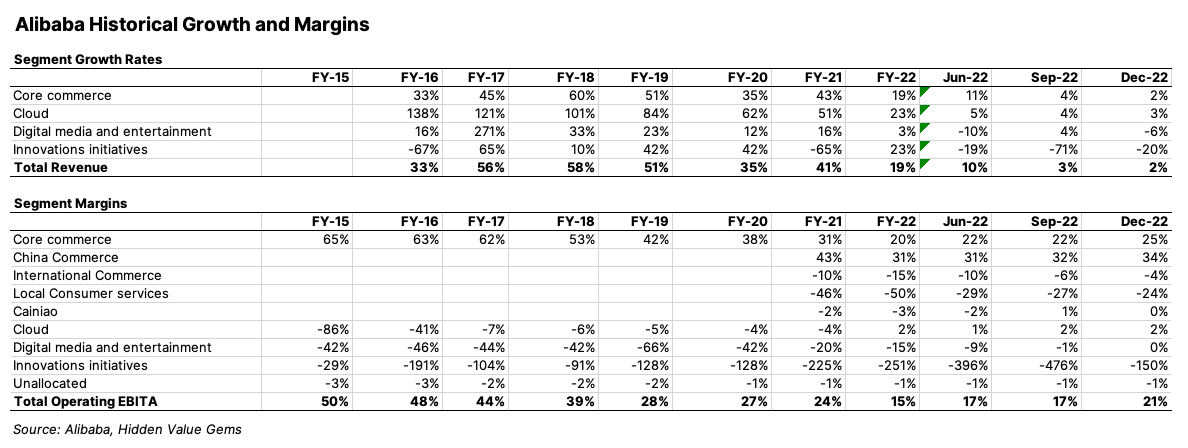

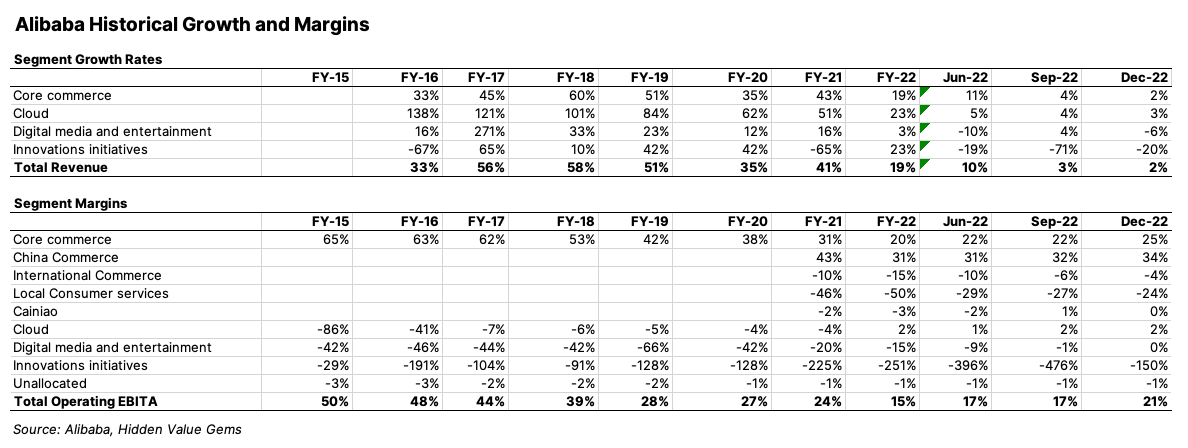

I have provided a summary of Alibaba’s historical financials for reference:

I then applied a 7x EV/EBITA multiple, roughly translating into a 10-15% FCF yield. I think such yield is appropriate in a situation of no growth. Simply put, the FCF yield should match your future return if the business doesn’t grow.

The only issue I have with this approach is the absolute level of EBITA. The last reported number is based on the company’s own adjustments. Specifically, management separated a few business lines which it does not view as related to the e-commerce operations. However, if the market proposition is evolving and becoming more sophisticated, then maybe these smaller loss-making segments are inevitable expenses that Alibaba has to take to stay relevant to Chinese consumers.

Could it lose market share otherwise?

Given the latest trend of the falling market share of Alibaba, it is fair to assume that EBITA margins may be lower than historically. To remind, I did cut the last available number by 30%. Also, a 7x EV/EBITA multiple is quite conservative.

Suppose Alibaba closes its business tomorrow and distributes the cash and securities it holds on its balance sheet. In this case, we will receive about $35 per share (assuming all businesses are worth nothing at all).

In other words, at the current share price of $85, the market assumes all of Alibaba’s businesses are worth $50 per share. With 2.59bn shares (ADS) outstanding, the total value of the operations comes up to $129.5bn. I cannot prove this mathematically, but this value looks low intuitively, given that we are still dealing with the largest e-commerce player in China, which also owns a leading payment provider in the country.

For comparison, the population of Korea is less than 3% of Chinese, and its GDP is about 10% of the size of the Chinese economy. Yet, its local e-commerce platform, Coupang, has a market cap of $30bn - a quarter of Alibaba. Coupang has been losing money at the operating level (reporting negative operating income for the past three years).

As long as the downside looks moderate, let’s take a look at the potential upside.

In my Base Case, I still use a 30% lower EBITA for the core marketplace business but apply a higher (10x) valuation multiple. A simple way to justify a higher multiple is to suggest that the business can grow faster. In this case, I think a 5% long-term growth is possible, which should match inflation (2-3%) and conservative GDP growth (2-3%). No gaining market share or improving profitability is assumed.

This method gives me a $229bn valuation for the marketplace. I also used a 5% lower share count (2.46bn) to reflect the ongoing buyback operations. On my estimates, the marketplace could be worth $93 per share in the Base Case.

The upside comes from the value of cash ($57bn) and investments ($34bn), or $37 per share.

Besides, I gave some credit to other businesses, including $7bn to Alibaba’s 33% stake in Ant Group, which is a third of the value estimated by Fidelity in one of its recent portfolio reviews. You may recall that before Ma criticised the Chinese government, Ant Group planned to go public at a valuation of around $300bn!

I assumed a $10bn value for the logistics business, Cainiao. This is based on a 50% discount to the $20bn valuation mentioned in the press recently.

International commerce is a number of marketplaces, including Lazada in South East Asia with over $21bn of GMV, Trendyol in Turkey (around $10bn of GMV), Aliexpress (Europe and some Emerging Markets) and Daraz (Pakistan and South Asian countries excluding India). To estimate the value of these operations, I applied EV/GMV multiple of Shopee and a 50% discount on top.

I assumed a 1% net margin for Local Services and a 10x PE multiple. However, it may be worth zero if these services are critical for the customer experience. In fact, they may represent a negative value too. Importantly, this segment is too small to move the needle either way.

Assuming losses at Unallocated & Innovation segments are reduced by 30%, my final value per share in the Base Case comes at $134 (58% upside to the spot price).

You can view my Bull Case assumptions in the table (above). One point I would add is that I never assumed higher a higher EBITA of the Marketplace. This possibility should not be disregarded, though. Alibaba’s core business model is based on providing a platform that connects merchants (goods sellers) with buyers. Alibaba charges merchants commission which accounts for about 4% of the transaction value. Alibaba reports this fee as its revenue from the Marketplace. Most other marketplaces outside of China charge merchants much higher fees, closer to 10%.

The final fee depends on the level of services offered to merchants, especially around logistics (warehouse and delivery). Even though Alibaba has historically focused on matching buyers and sellers, providing minimal other services to merchants, I think a 4% commission rate is conservative.

Given the high share of fixed costs, even a slight increase in commission rate (to 5% or 6%) can materially boost Alibaba’s profitability (by 40-70%). Consider this a Blue Sky scenario (with above zero probability).

To sum up, based on my assumptions, the range of potential returns is between a negative 24% to a possible gain of over 170%.

I have provided a summary of Alibaba’s historical financials for reference:

Rolling the dice?

The sceptics may point out that my Bear Case is not bearish enough because I am not looking at the Elephant in the room, which is a potential military conflict. If this were to happen, holders of US-listed Alibaba ADS could lose 100% of their money.

To address this risk, I suggest we apply various probabilities to the three outcomes. Let’s assume that there is a 50% probability of a Base Case ($134), in which case the Worst Case ($0) will have a probability of 42.5% for the weighted-average price to match the market ($85).

If we assume the probability of the Base Case is 33%, then the implied probability of the Worst Case is 50%. The Bull Case ($232) will have a probability of 17%.

Either way, it seems that the market is focusing too much on the worst outcome and overweighs the Worst Case.

Military conflicts happen much less often than we think. According to ChatGPT, the last time China was in military conflict with 100+ casualties was in 1979 (44 years ago). This is about a 2% base rate. I am not an expert in geopolitics, and maybe the situation points to a higher risk today, but I think the probability of 42.5-50% is a bit too high.

To address this risk, I suggest we apply various probabilities to the three outcomes. Let’s assume that there is a 50% probability of a Base Case ($134), in which case the Worst Case ($0) will have a probability of 42.5% for the weighted-average price to match the market ($85).

If we assume the probability of the Base Case is 33%, then the implied probability of the Worst Case is 50%. The Bull Case ($232) will have a probability of 17%.

Either way, it seems that the market is focusing too much on the worst outcome and overweighs the Worst Case.

Military conflicts happen much less often than we think. According to ChatGPT, the last time China was in military conflict with 100+ casualties was in 1979 (44 years ago). This is about a 2% base rate. I am not an expert in geopolitics, and maybe the situation points to a higher risk today, but I think the probability of 42.5-50% is a bit too high.

The importance of the new strategy

The main weakness of my valuation approach is that it assumes each key segment could be run independently and be profitable. In reality, of course, it may be that the segments which we view as non-core are essential for Alibaba to remain competitive and stay in business.

Firstly, even if extra investments are needed (beyond the Core Commerce segment), I doubt they should be at such a scale. Until recently, Alibaba’s management was obsessed with building the largest consumer ecosystem in China and entering various new market niches.

Secondly, and more importantly, is the importance of the recently announced corporate reorganisation. If, indeed, management follows through on its plans to split the business into six independent segments, it could be a game changer for Alibaba’s valuation.

Not only could this lead to higher overall profitability as each segment will focus on achieving better efficiency and cutting unnecessary expenses, but it would also help investors see the value of the underlying businesses.

There will be more certainty about the normalised, sustainable level of investments and operating margins, especially in the largest business segment, the online marketplace.

With more confidence and visibility, I would expect Alibaba’s business to be valued at a more attractive multiple, assuming geopolitical risks do not escalate further.

Firstly, even if extra investments are needed (beyond the Core Commerce segment), I doubt they should be at such a scale. Until recently, Alibaba’s management was obsessed with building the largest consumer ecosystem in China and entering various new market niches.

Secondly, and more importantly, is the importance of the recently announced corporate reorganisation. If, indeed, management follows through on its plans to split the business into six independent segments, it could be a game changer for Alibaba’s valuation.

Not only could this lead to higher overall profitability as each segment will focus on achieving better efficiency and cutting unnecessary expenses, but it would also help investors see the value of the underlying businesses.

There will be more certainty about the normalised, sustainable level of investments and operating margins, especially in the largest business segment, the online marketplace.

With more confidence and visibility, I would expect Alibaba’s business to be valued at a more attractive multiple, assuming geopolitical risks do not escalate further.

I am down about 50%. What did I get wrong?

Having thought a lot about my experience with Alibaba since October 2021, when I built an 8% position in it at about $169, I have found at least four major mistakes that I have made in my original analysis and execution:

1. Started with a narrative. Todd Combs and Ted Weschler, co-PMs at Berkshire Hathway, both talk about the importance of avoiding narratives in the analysis of stocks. Unfortunately, I did precisely that. I viewed Alibaba as an excellent business with a strong moat (over 50% market share), run by an exceptionally talented founder and operating in a fast-growing economy.

Such a narrative led me to assume higher long-term growth and better margins in my valuation scenarios, with my Bull Case value at $365 per share and Base Case at $274.

The subsequent events have shown that Alibaba has been losing market share to more innovative competitors, while regulatory changes put pressure on its commission and forced it to increase costs to offer more value to its customers.

While it is still a solid business, sustainable earnings and growth potential are lower than I expected.

COVID lockdowns and an economic slowdown triggered by the problems in the real estate sector were two additional headwinds that put more pressure on the company’s financial performance. The good thing about those issues is that they are temporary.

The wrong narrative led me to use relatively high valuation metrics still prevalent in the market at that time (2021 was the NASDAQ peak). Subsequent interest rate hikes led to the massive de-rating of many technology and online businesses, which further pressured Alibaba’s shares.

2. Focused on just one question. I focused too much on the likelihood of a complete crash of Alibaba due to regulatory pressure. I had the impression that the market viewed it as the "Yukos of China", which I disagreed with. Ultimately, I was right. Regulatory changes happen, and Alibaba is too large of a business to disappear just because its founder had a rift with the government.

However, it was not the most important question to answer. The critical question was Alibaba's new long-run profitability and growth potential following regulatory changes and in light of stronger domestic competition.

3. Overestimated my edge. It is embarrassing to admit, but I suffered from an Overconfidence bias. I have started to pay much more attention to behavioural biases recently. The point is that Alibaba is one of the most widely traded, widely followed listed companies in a complex country.

4. Started with too high initial position weight. Value investment strategy, unlike momentum investing, never leads to 100% success, especially right after you purchase a stock. A company selling at a low price is often facing some difficulties which do not disappear the moment you buy a stock. By deliberately avoiding predictions about when the market sentiment will change, value investors take the risk of losing money in the short term. This is our price for picking up undervalued businesses and, hopefully, generating above-average returns in the long term.

Still, I should have started with a smaller position and probably build it over time. I would have a lower cost and earn a better return in the end.

1. Started with a narrative. Todd Combs and Ted Weschler, co-PMs at Berkshire Hathway, both talk about the importance of avoiding narratives in the analysis of stocks. Unfortunately, I did precisely that. I viewed Alibaba as an excellent business with a strong moat (over 50% market share), run by an exceptionally talented founder and operating in a fast-growing economy.

Such a narrative led me to assume higher long-term growth and better margins in my valuation scenarios, with my Bull Case value at $365 per share and Base Case at $274.

The subsequent events have shown that Alibaba has been losing market share to more innovative competitors, while regulatory changes put pressure on its commission and forced it to increase costs to offer more value to its customers.

While it is still a solid business, sustainable earnings and growth potential are lower than I expected.

COVID lockdowns and an economic slowdown triggered by the problems in the real estate sector were two additional headwinds that put more pressure on the company’s financial performance. The good thing about those issues is that they are temporary.

The wrong narrative led me to use relatively high valuation metrics still prevalent in the market at that time (2021 was the NASDAQ peak). Subsequent interest rate hikes led to the massive de-rating of many technology and online businesses, which further pressured Alibaba’s shares.

2. Focused on just one question. I focused too much on the likelihood of a complete crash of Alibaba due to regulatory pressure. I had the impression that the market viewed it as the "Yukos of China", which I disagreed with. Ultimately, I was right. Regulatory changes happen, and Alibaba is too large of a business to disappear just because its founder had a rift with the government.

However, it was not the most important question to answer. The critical question was Alibaba's new long-run profitability and growth potential following regulatory changes and in light of stronger domestic competition.

3. Overestimated my edge. It is embarrassing to admit, but I suffered from an Overconfidence bias. I have started to pay much more attention to behavioural biases recently. The point is that Alibaba is one of the most widely traded, widely followed listed companies in a complex country.

4. Started with too high initial position weight. Value investment strategy, unlike momentum investing, never leads to 100% success, especially right after you purchase a stock. A company selling at a low price is often facing some difficulties which do not disappear the moment you buy a stock. By deliberately avoiding predictions about when the market sentiment will change, value investors take the risk of losing money in the short term. This is our price for picking up undervalued businesses and, hopefully, generating above-average returns in the long term.

Still, I should have started with a smaller position and probably build it over time. I would have a lower cost and earn a better return in the end.

Lessons learnt

The lessons from my Alibaba experience so far are as follows:

In September 2022, in an interview with William Green, a famous value investor, Tom Russo, quoted Warren Buffett. Buffett said:

- It pays to focus on less followed names (e.g. European small and mid-caps).

- Forget the narrative. Start by looking at fundamentals and consider how you could lose money from this investment. Write a pre-mortem.

- When a company or an industry is in trouble, things usually take longer to turn around.

- You can start with a small position to get involved and add when you have more conviction, or the risk/reward opportunity becomes more attractive.

In September 2022, in an interview with William Green, a famous value investor, Tom Russo, quoted Warren Buffett. Buffett said:

"The interesting thing about investing, it's not like the Olympics. You don't get any extra points for the fact that something's very hard to do. So you might as well just step over one-foot bars, instead of trying to jump over seven-foot bars."

Russo was explaining his view on Alibaba, which he purchased in 2020 but later sold because its investment case was becoming more political, and it was harder to make a call.

In a way, the currently tense geopolitical situation could have drastic consequences for Alibaba shareholders. Perhaps I am making a similar mistake today by chasing too difficult a case.

Time will tell. Since I have not added anything since October 2021, my original 8% position has diminished to a low single-digit, which seems like a low risk even if I lose 100%.

In a way, the currently tense geopolitical situation could have drastic consequences for Alibaba shareholders. Perhaps I am making a similar mistake today by chasing too difficult a case.

Time will tell. Since I have not added anything since October 2021, my original 8% position has diminished to a low single-digit, which seems like a low risk even if I lose 100%.

DISCLAIMER: This publication is not investment advice. The primary purpose of this publication is to keep track of my thought process to assess future information better and improve my decision-making process. Readers should do their own research before making decisions. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. The author held a position in the stock discussed above at the time of writing. Please read the full version of the Disclaimer here.