Summary

- Loews published 1Q21 results on 3 May 2021. The most important event was the sale of its 47% interest in Altium to GIC for $420mn cash consideration. Together with $200mn dividends that Altium paid to Loews in early 2021, Loews has fully recouped its original investment of $600mn (total deal consideration of $1.2bn was 50/50 funded by debt and equity) which was made in 2017 and continues to own 53% of the business valued at $476mn. This translates into 16% IRR (closer to 20% if the effect of buyback at Loews is taken into account). In other words, Loews increased equity value of Altium by 50% in 4 years after the acquisition (and grew its total EV by 67% to $2bn).

- Key subsidiaries improved their financial performance further during the period, current operations / demand is strong, according to management.

- Pace of buyback slowed down to $274mn during (compared to just $420mn in 4Q20) which accounts for 1.9% of total outstanding shares (7.4% annualised). Shares outstanding are down 9.3% since the start of 2020, 20.5% since the start of 2018, 33% since the start of 2013 (in 8 years).

- Net cash increased to $1.7bn (taking into account $400mn net cash proceeds from sale of a stake in Altium).

- Book value per share at $65.5, up from $64.2 in 4Q20 and down slightly from last year ($65.9 in 4Q19). P/B ratio increased to 0.9x (from 0.7x in the previous quarter).

- Discount of Loews’ share price to its NAV has narrowed down to 10% (about 32% based on more optimistic valuation of subsidiaries), future upside in shares will be primarily coming from value creation through capital allocation and growth at subsidiaries. Still confident in holding the stock in my portfolio especially in the current inflationary environment. I expect stronger performance of Hotel business as well as growth in Boardwalk Pipelines capacity by about 17% in the next 18 months. I also think that potentially higher interest rates should benefit Loews’ insurance business. Investment case has shifted from purely a valuation discount (statistically cheap) to value creation over the long-term.

Segment results

CNA Financial

- Higher than usual cat losses from the Texas freeze, but basic business continued to perform well. Underlying combined ratio of 91.9 improved nearly 2 points over the prior year quarter of 93.7, with a 1.6 percentage point improvement in the expense ratio.

- Rates continue to be strong with an 11% increase in the quarter (12% growth in the previous quarter).

- Over the long term, higher interest rates will be beneficial to CNA, allowing it to invest its cash flow at higher rates than today.

- Book value per share at $43.8 (+2% QoQ including $1.13 special dividend), CNA trades at 109% of its Book Value (compared to 10-20% discount during 2020).

- Regular quarterly dividend declared at $0.38 (flat QoQ, +3% YoY), 3.2% dividend yield (not including special dividend).

Boardwalk Pipelines

Revenue and EBITDA up 9% and 13% YoY, respectively in 1Q21. Net income grew 31% YoY to $85mn. Contract backlog over $9bn (similar to the previous quarter), annual revenue is covered by backlog by over 6x.

Loews Hotels

23 of 27 hotels were open at the end of 1Q21 (22 in Q4). Company expects to have hotels open in all its markets by the end of the second quarter. Continued improvement in occupancy trends and room rates. The average daily room rate increased by 25% to $234. Management expects to contribute less than $80mn to its Hotels business in 2021 ($150mn in 2020) of which $32mn has been already provided this year.

Other

During the Q&A session, management highlighted growing evidence of inflation coming from both – supply and demand-side factors. Expect to see higher inflation in the future, consider FED to be too slow to react. Expect growth to remain strong for at least few more quarters, mentioned that ‘economy is booming’.

Valuation

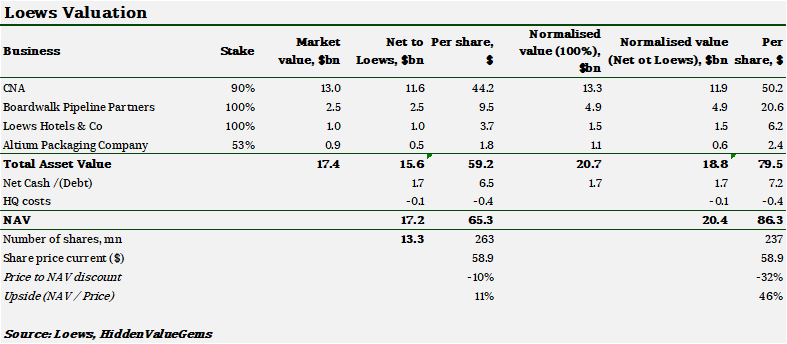

I have updated my valuation of Loews since it has been in my portfolio for about a year now. The stock has increased by about 84% over the past 12 months, its NAV has increased by 45% over the same time period. As a result, Loews’ discount to NAV has narrowed to 10% from 30% a year ago.

Loews’ current market is $15.5bn, while its net cash ($1.7bn) and market value of its 89.5% interest in CNA ($11.6bn) have combined value of $13.3bn. This implies that Loews Hotels, Broadwalk Pipelines and Altium (53% interest) are worth $2.2bn.

On my estimates, these three businesses are worth at least $4bn and up to $6.9bn in the Upside case.

I estimate that company’s NAV per share based on market price of CNA and conservative valuation of private businesses is $65 (11% premium to the current price), while in a more positive scenario it is worth $86 (46% above the current market price).

DISCLAIMER: this publication is not investment advice. The main purpose of this publication is to keep track of my thought process to better assess future information and improve my decision making process. Readers should do their own research before making decisions. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. The author held a position in the stock discussed above at the time of writing. Please read the full version of Disclaimer here.