Summary

Loews’s strong recovery continued in 4Q21. My quick assessment of Loews’ NAV suggests that the stock remains undervalued, trading at about a 23% discount to the Base Case NAV estimate (the same as a 23% discount in November 2021). In a Bull Case scenario, the discount is higher (46%), and the upside offered by the stock is 84%. As I mentioned in my latest updates, I think the main upside in Loews now comes from the operating progress at key subsidiaries (organic growth) rather than the closing of a valuation discount. Back in spring 2020, when the discount to NAV was 30% in a Base Case and 62% in the Bull Case, the stock had an additional under-valuation upside.

I would not exclude one more source of upside currently, which is capital allocation. Loews’ management has a good track record of delivering value for shareholders through prudent purchasing and selling assets, including buying back its shares. This upside would be easier to achieve in a weak market environment. The lower the share price falls, the more a dollar spent on buying back its shares would reduce Loews’ share count (and the higher the interest of remaining shareholders will be).

I am happy to continue holding Loews’ shares, especially in a period of increased macro uncertainty and rising inflation. Its Hotel and Pipeline businesses, as well as Insurance, are well-positioned to benefit from rising inflation.

Valuation

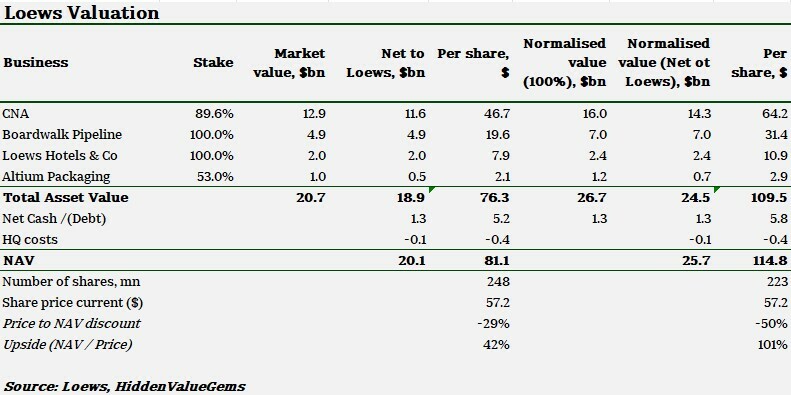

I have two valuation scenarios: Base Case and Upside Case.

Base Case Value of $81 per share

In the Base Case, I use the market valuation of CNA Financial ($12.9bn, or $11.6bn net to Loews) and assign valuations for private businesses based on average sector multiples. I apply 9x EV/EBITDA multiple to Boardwalk Pipelines, 15x PE to Loews Hotels and 10% premium to the transaction value of Altium Packaging (GIC paid c. $420mn for 47% interest in Altium last year). 10% premium reflects growth, including inflation of that business since then.

I also add the value of net cash position ($1.1bn) to my Base Case valuation and deduct HQ costs ($0.4bn). My Base Case value of Loews is about $80 per share (30% above the current market price). Put differently; the current share price equals the sum of key assets except for Boardwalk Pipelines. So at the current price, you can buy Loews and get Boardwalk Pipelines for free.

Upside Case ($115)

I think there is additional upside in Loews that is not captured in the Base Case. In particular, CNA trades at 1x P/B following a challenging period of low-interest rates and higher than usual payouts related to COVID and other unusual events. Over time, its value would rise as earnings recover and benefit from higher rates and stronger macro conditions. I add a 25% premium to CNA’s market cap to reflect this view.

Note that in the Upside Case assuming 25% premium valuation to CNA’s current market cap, buying Loews shares at $62, you just pay for CNA, not even paying for the net cash position ($4.4-4.9/share).

I apply a better multiple of 10x EV/EBITDA for Boardwalk and raise its EBITDA estimate by 10% to reflect the ongoing expansion of the business.

I also raise the value of Loews Hotels by 25% as the business continues to add new hotels and, more importantly, it has not fully recovered from COVID with just 70% occupancy rates in 3Q and 4Q of last year.

The same 25% premium is also applied to Altium to reflect its organic growth.

Finally, I reduce the share count by 10% as the company continues to repurchase its shares from the market.

My new NAV estimates in Base and Upside cases are 10% higher compared to 3Q21 valuation as I now use a lower share count, higher market cap for CNA and a higher earnings base for Boardwalk Pipelines.

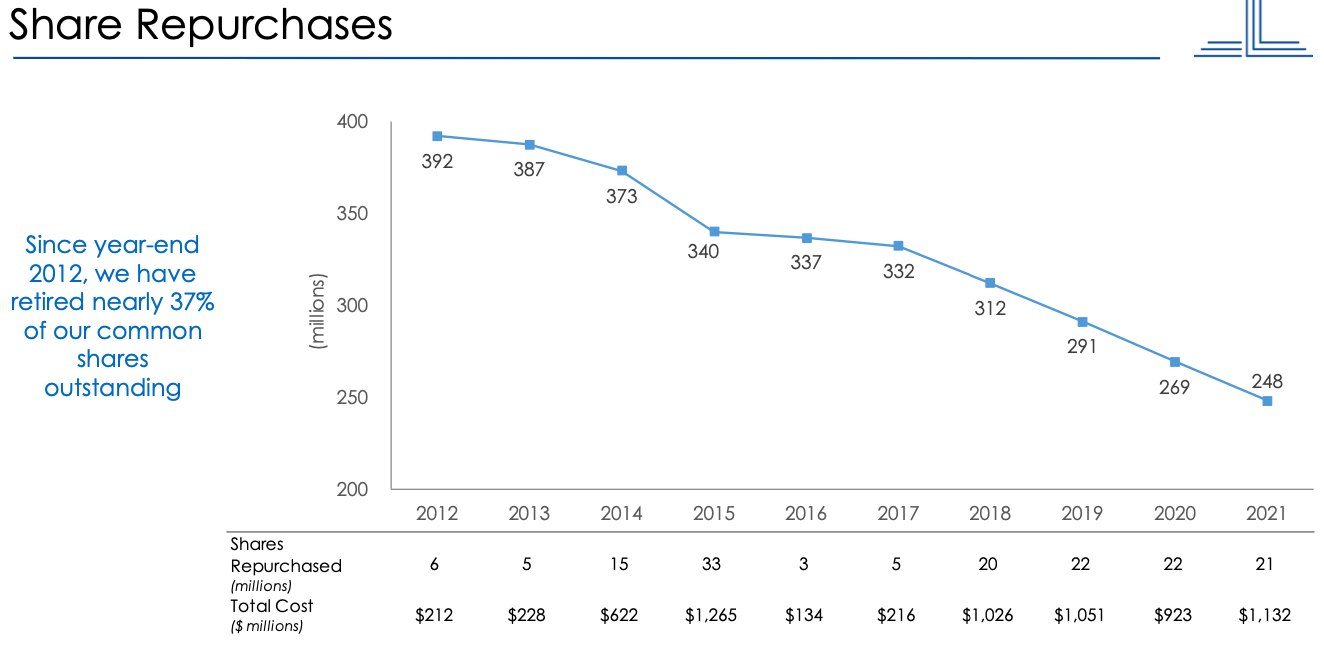

Buyback

In 2021, the company repurchased over 21mn shares for about $1.1bn, representing almost 8% of the outstanding shares at the beginning of the year. Over the past four years, Loews has decreased its shares outstanding by 25%. During the ten years (from January of 2012 through December of 2021), Loews has spent $6.8 billion on repurchases, retiring about 37% of our common shares outstanding at the beginning of 2012. A holder of Loews shares would have seen his interest in the company rise by 59% since 2012.

Source: Loews Investor Presentation

To illustrate the impact of this share reduction, assume that you owned 10% of Loews (c. 32mn shares) in early 2018 and your proportionate share in their profits was $63.6mn (or approx. $2 per share).

For 2021, Loews earned $1.14bn normalised earnings (excluding one-off non-operating items), and its share count by year-end was 248.2mn. If you did not sell your initial block of shares (32mn), your interest in the business has increased from 10% at the beginning of 2018 to 13%. Even if the company had not grown its earnings since 2018, your earnings per share would have increased by 30% (from $2/share to $2.56/share). Your total gain in annual profits would have been $18mn without any additional spending on new purchases by you.

The good news is that Loews has also raised its total profits to $1.14bn, and its normalised EPS grew to $4.6, over 100% growth.

During the latest call, the company’s CEO, James Tisch, has re-iterated that Loews would continue to actively repurchase its shares from the market as long as its market price is below the intrinsic value. However, I was a little surprised that the company’s repurchases since the start of 2022 have been ‘negligible’. While this could have been linked to a ‘quiet’ period, I think this has more to do with rising share price and a narrowing discount to NAV.

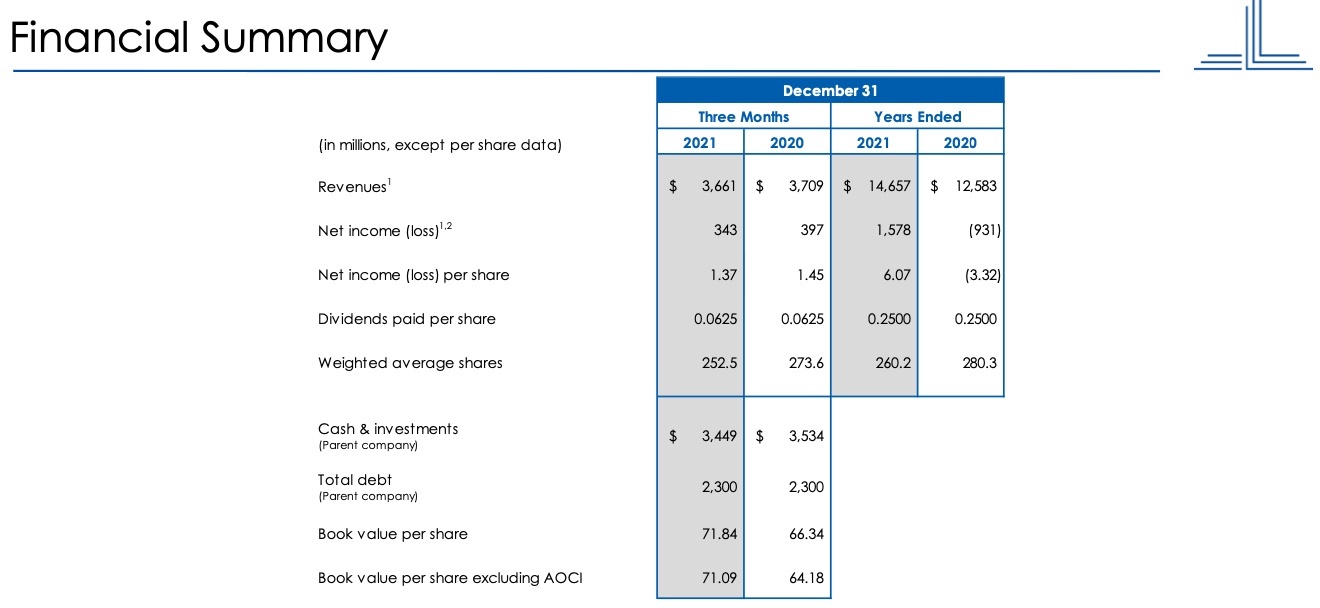

Key points from 2021 results

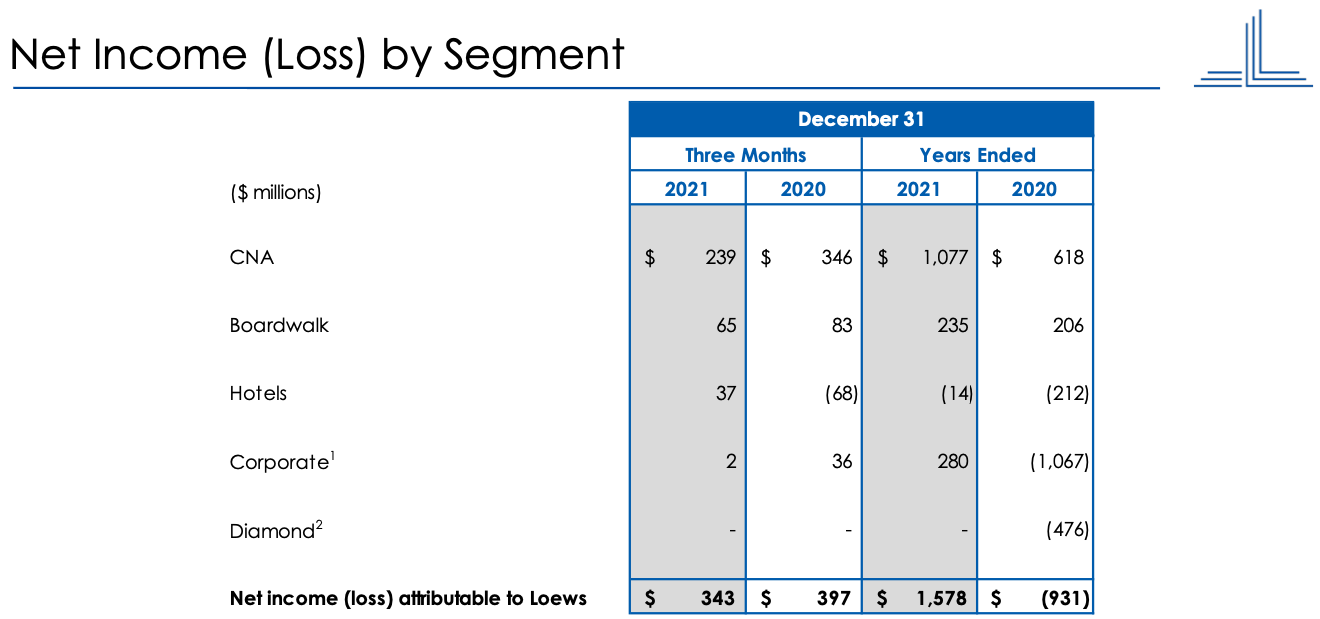

The core P&C insurance business experienced strong earned premium growth and a combined ratio of 96.2%, almost 4 points better than the prior year. The decline in the combined ratio was driven by a 1.5-point improvement in the expense ratio and lower catastrophe losses. The underlying combined ratio improved 1.7 points to 91.4%.

Boardwalk Pipelines contributed $235 million to the 2021 net income, up from $206 million in 2020. Excluding the $26 million customer bankruptcy settlement proceeds received last year, Boardwalk's net income contribution increased $55 million year-over-year.

Boardwalk's EBITDA was $843 million in 2021 versus $785 million last year, excluding the settlement proceeds. Boardwalk's year-over-year earnings improvement, excluding the settlement proceeds, was driven by an over 6% increase in net operating revenues against a 4% increase in operating expenses, including depreciation and amortisation.

Loews Hotels saw its dramatic improvement over 2020. Adjusted EBITDA, which excludes all these nonrecurring items, swung from a loss of $103 million in 2020 to earnings of $135 million in 2021. Adjusted EBITDA was negative $13 million in Q1, followed by a positive $25 million in Q2, $59 million in Q3 and $64 million this past quarter. While occupancy remained at 70% in both 4Q and 3Q 2021, the average room rate increased 6% QoQ.

Nearly 2/3 of Loews Hotels' rooms are in resort destinations. Since the beginning of 2019, a year in which the company earned adjusted EBITDA of $227mn, Loews Hotels has added about 3,700 rooms to its system (29% growth).

For the full year, Loews received $550mn in dividends from CNA and $102mn from Boardwalk and a $199mn dividend from Altium as part of its recapitalisation. Loews also received net pretax proceeds of $411 million upon the sale of a 47% stake in Altium.

Based on the 4Q21 CNA dividend announcement, Loews will receive a total of $584mn in special and regular dividends from CNA this quarter.

One negative point to keep in mind is the $690mn potential penalty that the Delaware Court issued (in November 2021) based on its decision that Loews breached the Boardwalk partnership agreement. The award was granted to the class of former Boardwalk unitholders who challenged Loews 2018 acquisition of the minority Master Limited Partnership interest in Boardwalk Pipelines. Loews disagrees with the decision and has appealed the ruling to the Delaware Supreme Court.

I don't know the outcome of the ruling, I doubt that Loews will find it easy to avoid paying the award which represents 4.5% of its current market cap. If the Supreme Court rules in favour of Loews then this could be a small upside.

Source: Loews Investor Presentation

Source: Loews Investor Presentation

DISCLAIMER: this publication is not investment advice. The main purpose of this publication is to keep track of my thought process to better assess future information and improve my decision-making process. Readers should do their own research before making decisions. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. The author held a position in the stock discussed above at the time of writing. Please read the full version of Disclaimer here.