Summary

General recovery across Loews' key businesses continued during 3Q21, although CNA negatively was impacted by higher-than-usual CAT losses. Surprised to see acceleration of buyback (Loews spent $333mn to purchase 6.2mn shares) which was one of the highest in history on a quarterly basis (in 2Q21, Loews spent $219mn on 3.9mn shares). Loews still remains undervalued relative to its net cash + assets, however, discount has narrowed compared to a year ago to 23% from 30%, on my estimates. Key sources of future upside: 1) revaluation of CNA from c. 10x PE to a more reasonable 15x, rising interest rates and fewer catastrophes should help (+$18/share); 2) completion of key growth projects (10% growth) by Boardwalk Pipelines, deleveraging (-10%) and revaluation from 9x EV/EBITDA to 10x (+$11/share); 3) expansion of operations at Loews Hotel and Altium Packaging by c. 25% from current levels (+$3/share). Combined, these three factors add about $31 to company's NAV (+55% to the latest share price).

Key highlights

Group

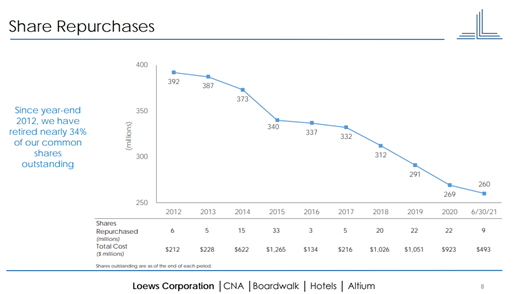

Loews earned $220mn in net income, up 58% YoY. EPS ($0.85) increased even more impressively (by 70%) due to reduction in share count (down -8.2%). Book Value Per Share (BVPS) ex AOCI increased by 11.6% YoY to $69.5 from $62.3 in 3Q20 and 2% on QoQ basis. Loews received $92mn in dividends from subsidiaries, similar to a year ago ($90mn in 3Q20). The company spent $333mn on buyback repurchasing 6.2mn shares. Net cash position declined by $0.3bn to $1.3bn from the previous quarter, although it remains broadly unchanged since the start of the year ($1.3bn vs $1.2bn in 4Q20). I attribute this QoQ decline in net cash to higher buyback ($114mn), higher capex ($48mn) and increased working capital needs.

CNA

Net earned premiums increased 5% YoY in 3Q21 (+7% in 9M21). Core net income was 23% higher in 3Q21 ($237mn) and +110% in 9M21 ($841mn). Combined ratio ex catastrophes continued to decline and reached 91.1% in 3Q21 (92.6% in 3Q20), 91.5% in 9M21 (93.1% in 9M20). Full combined ratio (including CAT losses) was 100.0% in 3Q21 (100.9% in 3Q20) and 97.4% in 9M21 (102.4% in 9M20). Expense ratio in the P&C segment continued to decline and reached 13-year low of 31.6% (compared to mid-30s a few years back).

- Interestingly, during the conference call management was quite open about how ‘cheap’ CNA’s stock was. According to Loews’ CEO and co-shareholder, James Tisch, CNA’s share price is below where it was at the end of 2017 ($53), yet CNA is much stronger than 3.5 years ago: it has reduced its expense ratio, has made steady improvement in its underlying loss ratio, has built a deep underwriting culture, optimised distribution by expanding its broker network, and continued to attract, develop, and retain top talent. In addition to that, the company maintains a robust balance sheet through its conservative capital structure and debt profile.

- My take is that CNA will likely remain undervalued as long as its ROE remains sub 10%. A lot has to do with interest rates (1% extra return on its $50bn portfolio would generate pre-tax profit of $0.5bn, a 40% boost to LTM earnings of $1.2bn). Lower negative impact from Long-term Care segment should also help to generate better returns.

Hotels

Occupancy rate at Hotels reached 72% (35% in 1Q21 an 58% in 2Q21) mostly due to resort hotels, while urban locations lagged. YTD, parent company invested $32mn into Hotels business, but it has now turned cashflow positive and management does not plan to investment cash any longer.

- In October, construction of a new Hotel & Convention Center in Arlington (Texas) was launched. When it opens in the early 2024, the hotel will have 888 rooms and over 250,000 square feet of meeting and event space. Unlike most peers, Loews acts as both owner and operator of this project. Loews Hotels remains focused on 1) growing in ‘immersive’ destinations such as Orlando (20-year partnership with Universal Orlando); and 2) owning and operating of 300+ keys hotels with ample meeting space and strong group business.

Boardwalk Pipelines

Natgas transportation throughput increased by 11% YTD (9M21), revenue was up 7% (+6% in 3Q21 on YoY basis), EBITDA was up 11% in 9M and 3Q, net income increased by +38% in 9M21 ($170mn) and by +90% in 3Q ($38mn). According to management, “demand for natural gas is increasing and Boardwalk is well positioned to take advantage of this change. We see the increased demand coming from both increased domestic consumption and from international markets via LNG exports. Boardwalk transports natural gas under fixed fee, take or pay contracts with mostly investment grade customers which limits its commodity and volumetric risk. The company currently has $9 billion of revenue backlog with a weighted average contract life of seven years”.

- Management believes strongly in rising demand for gas in the future (as well as US gas output) and views it as an important source of energy over the long-term.

- Management is also convinced that inflation is not transitory and that long-term rates will rise.

Updated NAV and my latest thoughts

Loews used to be a ‘no-brainer’ type stock 12-18 months ago – sold off almost 50%, run by a family with strong track record and enjoying a net cash position. Clearly, there is less upside now. However, despite this I am happy to remain a shareholder of Loews. Firstly, I do not see too many easy alternatives in the current environment, secondly, I still see some undervaluation and growth at Loews businesses.

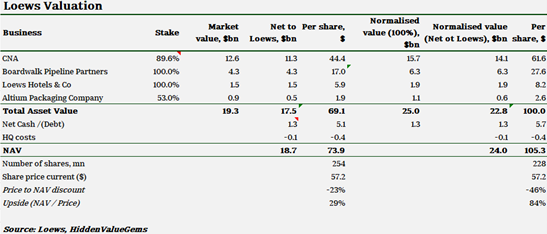

Below is a summary of my NAV calculations.

Market value of Loews’ stake in its listed insurance subsidiary CNA is $11.3bn (1x P/B), while its net cash position is $1.3bn ($12.6bn combined). In addition to that, it fully owns Loews Hotel and Boardwalk pipelines as well as a 53% stake in Altium Packaging. With a market cap of $14.5bn, implied value for these three businesses is $1.9bn. Combined pre-tax profit of just two businesses (Pipelines and Hotels) is $420mn (4.5x PE). Boardwalk Pipelines should be generating c. $320mn pre-tax profits this year ($290mn in 2020 and $240mn in 9M21), while Loews Hotel can generate c. $100mn next year assuming normal travel conditions ($18mn of pretax profit in 3Q21 at 72% occupancy). GIC paid $420mn for 47% stake in Altium in April 2021, which suggests that Loews’ remaining 53% interest can be valued at $474mn (53% x $420mn / 47%).

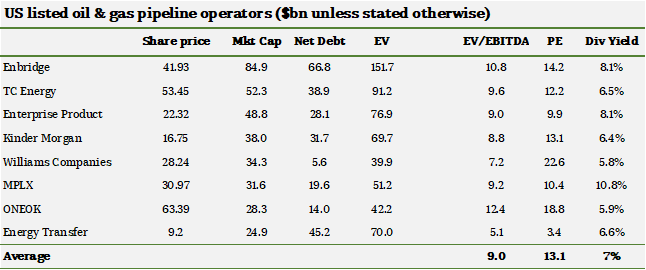

I estimate that in a Base Case, Loews’ NAV per share is about $74 which is 29% higher than the current share price. I use market cap of CNA, apply 9x EV/EBITDA to value Boardwalk Pipelines (based on valuation multiples of other publicly listed pipeline operators) and deduct its net debt of $3.2bn and apply 15x PE multiple to Loews Hotels business. My estimate of Altium Packaging is based on the recent transaction with GIC.

One interesting observation that I would like to share is about the share count. Loews’ latest number of shares outstanding is 253.7mn which is almost the same as the number I used in May 2020 for my Bull Case scenario (back then I assumed that Loews would reduce its share count by 10% over time). So, in addition to improving performance and better valuation multiples shareholders have benefited from decreased amount of shares as their interest in the company has increased (by about 10% in 18 months).

I think there is further upside if we assume that a fair multiple for CNA is not 10x (used by the market), but rather 12.5x (25% higher). Potentially higher investment income from higher interest rates is an additional upside which I do not take into account in this valuation. At 12.5x PE, CNA alone could be worth $62 per Loews share – more than its current share price.

I would prefer to see value rising from increasing revenue (more customers, higher prices) and earnings rather than just re-rating of valuation multiple which is more subjective. However, since Loews’ management is active with buying back its own shares, this relative undervaluation of CNA helps to generate more shareholder value for Loews shareholders. In a way, as a partner in Loews business I benefit more from the fact that CNA is not a popular stock trading at a conservative multiple. Without spending more on repurchasing its own stock, Loews can reduce its share count more substantially thanks to a low valuation of CNA.

The benefit of partnering with family-run businesses is that they can be quite good at taking advantage of dislocations in the market especially with regards to investments in their own subsidiaries which they know much better than an average participant in the stock market.

To an extent, the same logic applies to other businesses which seem to be significantly undervalued by the market.

In my Upside Scenario, I also apply 10x EV/EBITDA multiple to Boardwalk Pipelines and assume 10% growth in EBITDA as well as further deleveraging. My Upside value for this business is $27.6/share.

In case of two other businesses (Hotels and Altium), I assumed 25% growth in value relative to my Base Case as both have growth opportunities and could possibly benefit further in case of higher inflation.

I also assumed a further 10% reduction in share count.

All in all, my NAV estimate in the Bull Case is $105/share which is 84% above the current share price.

Clearly, this is not the upside to be expected in the next 6 or 12 months. Most projects will take 2-3 years to be completed. Besides, no one can control market sentiment and how investors would want to value those assets at any given point of time.

But I think that as long as economy continues to grow, management remains focused on execution and market opportunities (including buyback), then such valuation can be achieved over the medium term.

Most investment cases also discuss risks. They are, of course, also present in Loews case, although since it is valued quite conservatively by the market, its overall risk profile is lower, in my view. But it is still worth mentioning risks of general economic slowdown, insurance losses and possible investment losses of the insurance portfolio, succession at Loews as some executives from older generation step down (e.g. Loews’ president Andrew Tisch announced his resignation from the post last month, although he would remain co-Chairman and Board member of CNA). Clearly, if interest rates remain lower for longer while asset prices continue to rise, Loews will find it more difficult to increase its NAV in such environment.

An investor who decides to buy Loews now expecting to see just a rising share price from here is making a mistake. Loews share price can easily be lower 10-20% and even more than that as has been the case in the past. But it is critical to separate changes in share prices from changes in intrinsic value. And then take one step further to break down cyclical factors (mostly related to macro economy) from more company specific, fundamental drivers such as long-term growth of individual business and capital allocation at the parent level.

DISCLAIMER: this publication is not investment advice. The main purpose of this publication is to keep track of my thought process to better assess future information and improve my decision making process. Readers should do their own research before making decisions. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. The author held a position in the stock discussed above at the time of writing. Please read the full version of Disclaimer here.