Ticker: EXO IM

Price: €63.7

Shares outstanding: 230mn

Market Cap: €14.7bn

Net Cash: €5.1bn

EV: €9.6bn

Current price is 47% below NAV, almost 100% upside

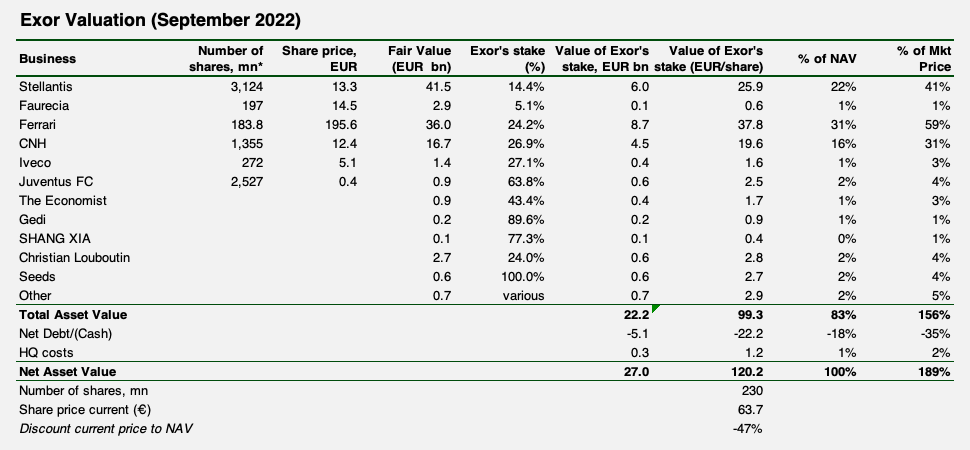

I have updated my valuation of Exor to reflect the latest changes in share prices of listed investments and changes in the company’s portfolio (e.g. disposal of PartnerRe). My new NAV per share estimate is €118.8, which is 4% lower than my November 2021 estimate.

Three investments have dragged down Exor’s NAV: Stellantis (-25%), Faurecia (-68%) and CNH (-19%), while Ferrari’s market cap has remained unchanged.

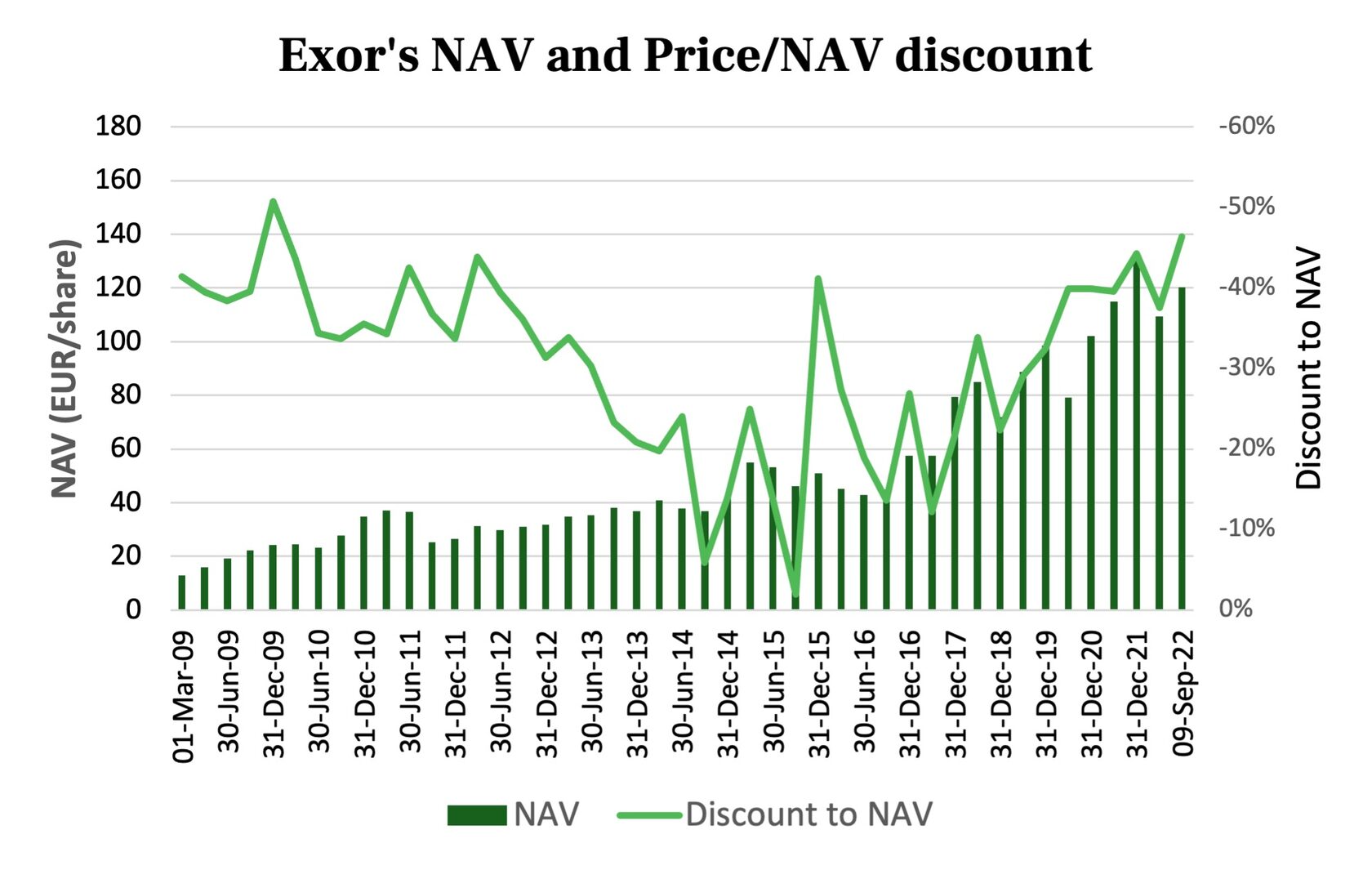

Exor is trading at the widest discount in more than ten years. Even in March-April of 2020, the discount was smaller (40%, on my estimate).

Exor's historical NAV and Price-to-NAV discount

Moreover, I have used market values for the investments listed on stock exchanges and included values of new investments ‘at cost’. Listed businesses such as Stellantis and CNH are down 22-19% YTD, trading at 3.1x and 8.4x forward PE multiples, respectively, which arguably already reflects a dire economic outlook. A fair multiple applied to normalised earnings would lead to a higher valuation.

Possible reasons for such a high discount

I can see at least four reasons why the market is applying such a high discount to Exor’s portfolio. Most of them are due to a short-term focus of investors, and I am confident that the discount would narrow in the next 2-3 years, with the growth in the underlying assets providing an additional upside.

1. Exposure to Italy and Europe

Exor is domiciled in the Netherlands, while its flagship companies (Fiat and Ferrari) have originated in Italy.

Italy is going through new elections, which adds to economic uncertainty. Its Debt to GDP is around 150%, with a budget deficit running at 7% of GDP. Not surprisingly, the Italian stock market has delivered lacklustre results: flat since 2018 and down -21% YTD (vs S&P 500 -19%).

FTSE MIB Index – last five years

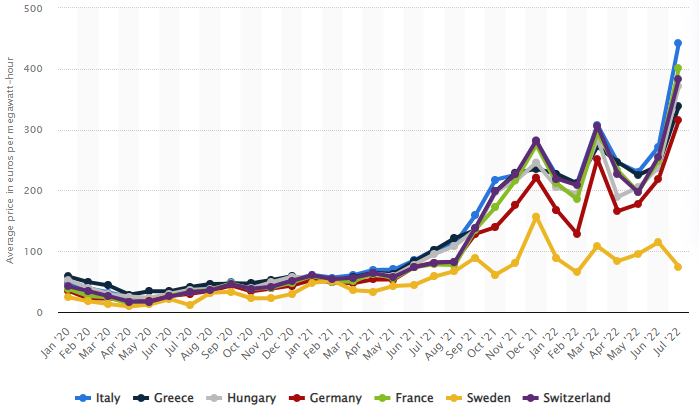

The overall European market has also been weak recently due to the war in Ukraine and rising energy prices.

Euro Stoxx 600 has underperformed S&P 500

Average monthly electricity wholesale prices in select countries in the EU

2. Exposure to the cyclical sectors

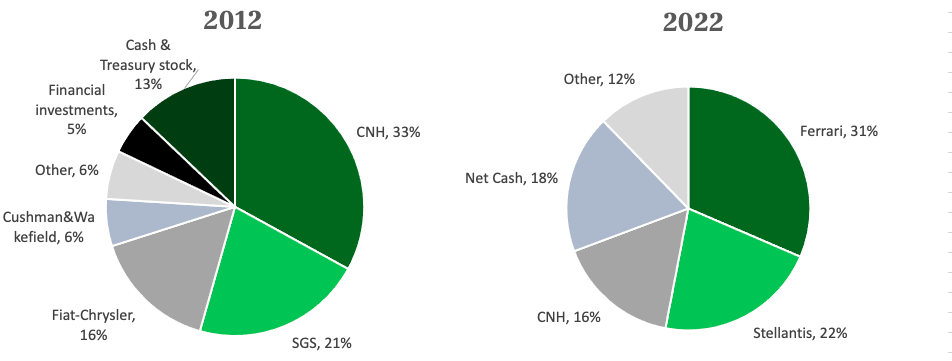

There is a market perception that Exor has too much exposure to cyclical sectors, and with a recession looming in Europe and the US, cyclicals is not the sector you want to be in. This perception comes from Exor’s history. It has been the holding company for the Agnelli family, the founders of FIAT – the flagship Italian car manufacturer.

However, this perception does not accurately reflect reality. Exor has been actively expanding through acquisitions of new businesses. I estimate that truly cyclical companies in its portfolio (Stellantis, CNH, Iveco, Faurecia) currently account for just 41% of its NAV. The most significant share of its NAV is attributable to Ferrari, formally a car manufacturer, but it is a real luxury-goods business.

One more vital point to make here is that following the sale of PartnerRe to Covea for $9.3bn in cash, Exor’s financial position has turned into net cash (i.e. its total cash exceeded its financial liabilities), which on my estimates reached €5.1bn (34% of its market cap). With such a high share of net cash, Exor’s business is much less sensitive to changes in the macro environment as the value of cash remains the same.

At its latest Investor Day on 30 November 2021, Exor’s management stated that it planned to grow its operations in the Healthcare and Luxury Goods segments – both are known to be resilient industries that are not very sensitive to macro changes.

I have compared the structure of Exor's Gross Asset Value (GAV) by key asset in 2012 and today. In 2012, Fiat and CNH together contributed 49% to the GAV, while today their joint contribution is 38%

Exor's Gross Asset Value breakdown by key asset: 2012 vs 2022

Source: Exor, Hidden Value Gems

3. Negative surprises (e.g. Tax settlement and investigation of FC Juventus)

Exor’s unexpected settlement with the Italian tax authorities was another reason for this year’s weak share price performance. On 18 February 2022, Exor agreed to pay €746mn to the Tax authorities as part of the settlement agreement, even though it remained convinced it had followed the relevant tax laws. The issue goes back to 2016 when Exor S.p.A. (an Italian entity) was merged with its Dutch subsidiary Exor Holding N.V. to create today’s Exor, fiscally domiciled in the Netherlands. The issue was about the exit tax to be paid by Exor on this transaction.

The settlement amount paid by Exor represents c. 5% of its market cap.

Another negative factor was the situation around FC Juventus. While a minor contributor to the overall NAV (2%, on my estimates), it is still disappointing to see the club raise first €300mn in 2020 and then an additional €400mn in 2021. The football club has also recently struggled in the National Championship (Serie A) and the Champions League. In late 2021, Italian authorities launched an investigation on how Juventus booked the transfer of its players (in particular, the gains from the sale of such rights and the costs of acquiring them). The investigation is still ongoing.

4. Not an ‘exciting’ story

Exor does not have one breakthrough technology that ‘can change the world’. Its CEO is not a celebrity adored by Reddit groups. No short squeeze is coming, like in Bad, Bath and Beyond, and GameStop.

In short, there is ‘little’ exciting about its stock. As a result, the universe of investors looking at Exor is much narrower, and the stock is unlikely to stage 100%+ rallies in a short time.

Of course, this is not a problem for me as I have patience and look at stocks as shares of the business. If a company can grow its earnings organically and through M&A, the price of its shares will eventually reflect higher earnings.

Why I continue to hold Exor

I own Exor for three main reasons.

- It is cheap. It is trading at a 47% discount to its NAV, close to the historical record.

- Such a discount comes from a few misconceptions about the stock, not because of serious issues with the underlying businesses or their management.

- Strong capital allocation. Exor has been extracting value from its old legacy assets and redirecting more capital to fast-growing businesses. It follows a clear, value-focused investment philosophy. Exor has grown its NAV by 19.8% since 2009, and I expect this rate to be maintained in the mid-term.

Exor is cheap

Exor's market cap is €14.7bn, of which net cash is €5.1bn. This leaves €9.6bn for the value of all businesses in its portfolio. Note that just Exor's stake in Ferrari is worth €8.7bn, which implies that the market is valuing all other assets almost at zero.

At the current price of €63.7, investors in Exor only pay for a 24.2% interest in Ferrari (€37.8), net cash (€22.2), Seeds and Other minor investments, while all other businesses in Exor’s portfolio come on top of this for free (including 14.4% stake in Stellantis worth €25.9 at current prices, 26.9% interest in CNH - €19.6 as well as stakes in Iveco, Juventus, The Economist, Gedi, Shang Xia and Christian Louboutin).

Moreover, most of its publicly listed businesses are trading at discounted multiples and are down about 30% from their peaks. This offers an additional upside.

Exor’s current discount to its NAV is 47%, on my estimate. Historically, Exor has traded at an average discount of 30% to the NAV, with the discount being as low as 2% in 2015 and as high as 51% in 2009.

It is typical for holding companies to trade at a discount which often reflects deferred tax liabilities and some ‘bulk discount’. An investor may not want to own exactly the same assets as Exor holds. For example, he may not want to own FC Juventus, so he would buy Exor shares as long as they are cheaper than buying each asset at a full market price.

One other reason for the discount has to do with different liquidity in shares. Exor's subsidiaries, such as Ferrari, Stellantis and CNH, are much more liquid with listings in both - Europe and US, compared to their parent company.

What the market is getting wrong

I have briefly mentioned potential market concerns about Exor, and I will try to explain why the market is wrong.

Europe / Italy

Exor indeed has historical roots in Italy. Still, its businesses are global, with no large company in its portfolio selling more than 50% of its products in Europe (see above geographical breakdowns for key companies).

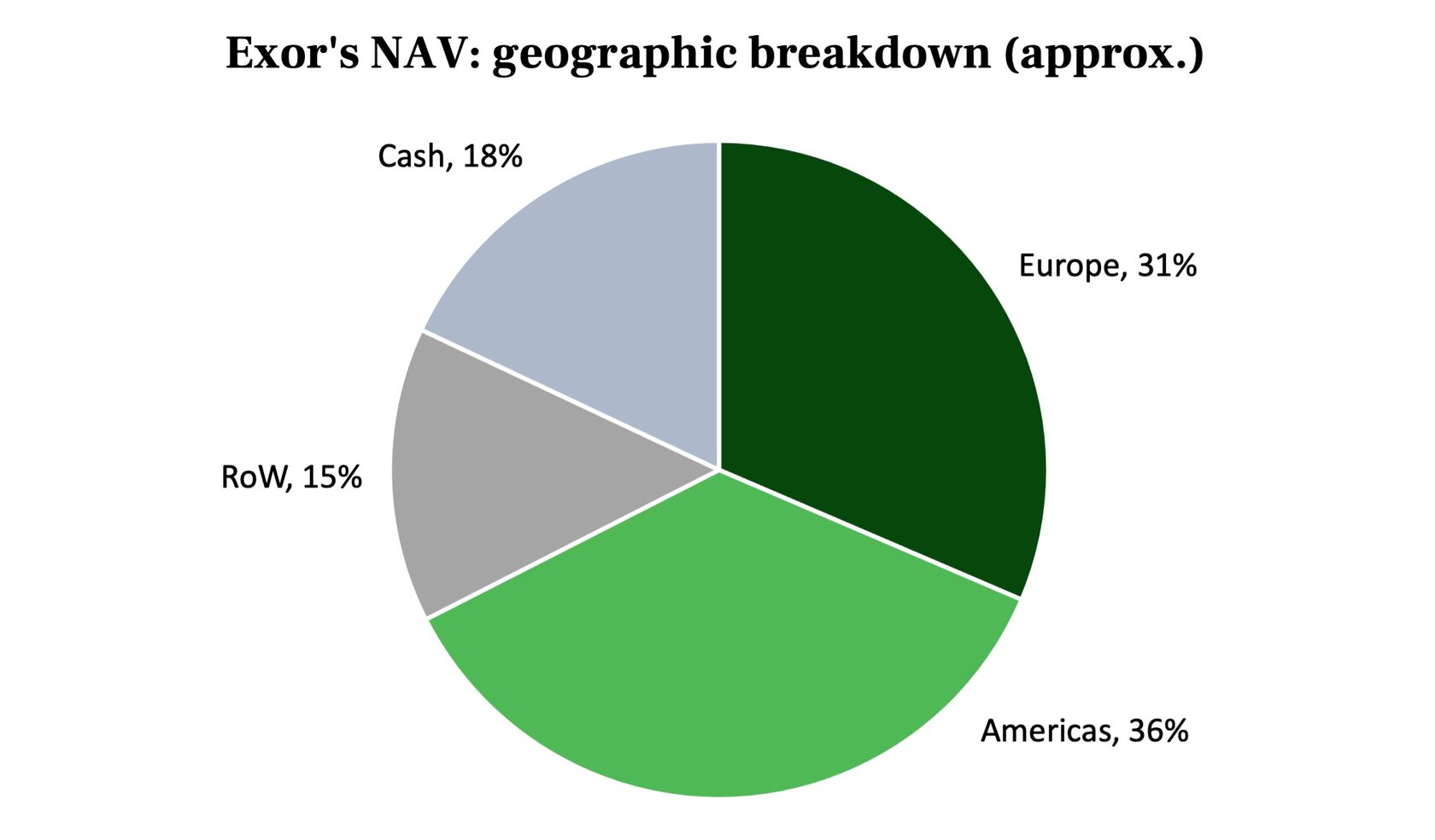

On my estimates, less than a third of the company’s NAV is attributed to Europe, with the Americas being the primary region (36%). 18% of the NAV remains in net cash, which I have not allocated geographically.

In July 2022, Exor announced that it had decided to transfer its listing from Milan to Amsterdam. This would allow the company to align its legal status as a registered entity in the Netherlands with the listing and simplify organisation structure and regulatory oversight. A single country regulatory authority will oversee Exor.

Lastly, I think having a European business is not an issue per se. Currently, it may struggle due to high power prices, but this is a temporary issue and widely known (hence, priced in). Longer term, its success depends on how well it is managed. Europe has solid industrial traditions; it is the leader in fashion and luxury goods; if anything, its global potential has not been fully utilised.

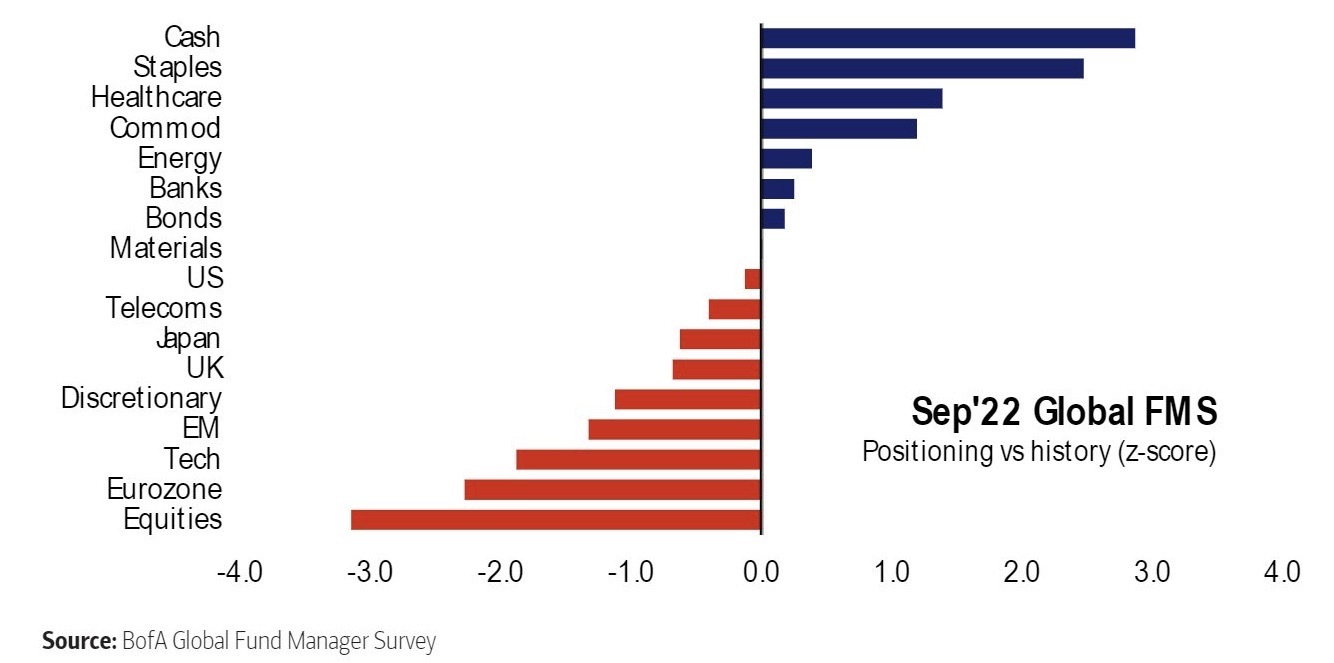

Below is the BofA investor survey on positioning relative to historical levels. According to this survey, equities and European assets have the lowest weight in investors' portfolios relative to historical averages.

Investors are long Cash / Defensives, short Equities / Europe

Cyclicals

I disagree with the view that Exor has too high exposure to the cyclical sectors of the economy.

Firstly, its net cash position (35% of the market cap) and a 24.2% interest in Ferrari (59% of the market cap) collectively account for 94% of Exor’s market cap (35% of its NAV).

Secondly, Exor has been diversifying its portfolio away from traditional car manufacturing towards luxury goods, healthcare and various early-stage tech startups. The company has spent about €2bn on acquisitions in these sectors, including its latest €833mn investment into the French family-owned Institut Merieux healthcare business.

On top of this, Exor has been pursuing a high dividend payout policy at its major cyclical businesses, such as Stellantis. In this way, Exor has been taking capital out of cyclical companies and re-investing it into more secular businesses.

Finally, with so much doom and gloom around, I would not be surprised if it is soon time to actually buy into the cyclicals as they would be the biggest beneficiaries during the economic recovery phase. As markets are forward-looking, stocks may bottom out a few months before a recovery in the real economy.

Negative surprises

It is disappointing to learn about the tax settlement payment as well as police probes at FC Juventus. However, these are relatively marginal issues. The tax payment represents 2.5% of the company’s NAV (5% of its market cap), while FC Juventus accounts for 4% of Exor’s market cap and contributes 2% to the overall NAV.

Not every business in one’s portfolio can be successful. Warren Buffett discussed this in his 2018 shareholder letter. In this section called Focus on the Forest - Forget the Trees, Buffett wrote:

“Investors who evaluate Berkshire sometimes obsess on the details of our many and diverse businesses – our economic “trees,” so to speak. Analysis of that type can be mind-numbing, given that we own a vast array of specimens, ranging from twigs to redwoods. A few of our trees are diseased and unlikely to be around a decade from now. Many others, though, are destined to grow in size and beauty. Fortunately, it’s not necessary to evaluate each tree individually to make a rough estimate of Berkshire’s intrinsic business value.”

What really matters is how management allocates capital over the long term and whether it backs more winners than losers. Occasionally disappointing headlines happen, unfortunately, even with the best companies.

'Not an exciting story'

The lack of compelling headlines around Exor is an issue only for those hoping to sell the stock quickly. I think winning in such a game on a consistent is impossible.

As a holder of Exor’s shares, I consider myself a business partner of the company and its management. I am interested to see how Exor can grow the value of its existing businesses, identify new investment opportunities and take advantage of occasional weakness in its share price through buyback.

As long as the underlying profits of portfolio companies continue to grow over time, Exor’s shares will reflect this growth eventually. It may just take a little longer.

Interestingly enough, on 8 March 2022, Exor announced the launch of a new buyback programme for up to €0.5bn until 2024. So far this year, the company has spent €139mn on the buyback and has acquired 2.1mn shares (0.9%). Exor had carried out share repurchases in the past. During 2018-2020, it spent €0.3bn on buying back 5.5mn shares (2.3% of issued share capital). This is not a high buyback pace, but two points are worth considering.

Firstly, 52% of shares are held by the founder’s family and another 10% by long-term value investors (Harris Associates, Baillie Gifford and Southeastern AM). The liquidity of the company’s shares is also not that high for a €14.7bn market cap business.

Secondly, share repurchases can only create value in the short term. Without the growth in underlying businesses, Exor’s NAV will not rise. So, I am glad that Exor is not spending too much capital on buyback or dividends and focuses on growing existing businesses and making new acquisitions.

Finally, Exor is not popular among sell-side analysts, with only two bulge-bracket banks (BofA and UBS) covering the company, while other analysts represent mostly mid-sized European or local Italian brokers. This is in stark contrast with the Big Tech names like Apple or Google covered by 50 or so analysts.

Research coverage of Exor

Capital allocation

The company’s capital allocation policy is the third reason I have invested in Exor and continue to hold its shares. Since 2009, management has compounded capital at a 19.8% rate, and its NAV per share has increased 7.9x from €17 in 2009 to €132 at the end of 2021 (€120 currently).

There are strong reasons to expect a similar rate in the medium-term.

The company has much dry powder to spend on new assets, and falling stock prices / rising interest rates are an excellent environment to deploy fresh capital. The company has a strong network of contacts in Europe and other regions that should help it to secure exciting deals. Exor is a relatively small company compared to a more established compounder such as Berkshire. With a smaller size, Exor can find more attractive assets that would be material enough to change its NAV.

Unlike in 2009, Exor’s portfolio has more early-stage growth companies and VC investments.

Finally, the company has a strong alignment of interests with a long-term focus, which are essential for long-term growth. This is how Exor’s CEO and largest shareholder, John Elkann, defines the company’s strategy:

Our purpose is to build great companies, while providing opportunities for our people to grow, make a positive contribution to society and deliver superior returns to our investors.

Great companies perform to the highest standards, seek renewal and change, are distinctive in what they do, and act responsibly.

To build a great company we appoint leaders who walk the talk and foster a culture with clarity of purpose and shared values. We also define a governance that ensures alignment of culture and actions.

To achieve this, we remain true to our values of:

1. Ambition & Humility: We set high aspirations but remain grounded.

2. Curiosity & Focus: We seek new ideas while prioritising what matters.

3. Patience & Drive: We take a long-term perspective but are relentless in getting things done.

4. Courage & Responsibility: We take bold actions while being mindful of their consequences.

When I would sell and other final thoughts

In conclusion, I would like to briefly discuss the conditions under which I would sell Exor. From my experience, the inability to admit choosing the wrong stock or changing your views on the company is one of the major factors behind weak investment results. It is impossible to bet on winners all the time, and in fact, it is not necessary to achieve great results (10-20% return a year).

Realising that a company you invested in does not fully meet your criteria (return on capital is lower, competition in the sector is higher, management’s competence and integrity are questionable etc.) is very important. And it is critical forcing yourself to part with such a company rather than find reasons to expect some turnaround or use valuation as an argument (‘undemanding valuation makes up for sub-average returns on capital’).

Writing down all possible circumstances in which you would sell a stock helps to have the necessary discipline.

Here are the three main red flags that would trigger reviewing the Exor case:

1. Changes in capital allocation. Exor starts buying businesses outside of its area of competence with no clear strategic rationale (e.g. a minority stake in a US grocery chain) or continuously pays high prices for small businesses or loss-making businesses with no prospects for profitable growth.

2. Changes in alignment of interests. If Elkann reduces his interest in Exor or the company starts issuing new shares. If Elkann keeps his stake but steps down from the CEO role. If compensation for Exor’s management rises dramatically without a link to the share price performance. If Exor provides loans and other funds to related parties.

3. Valuation. I will consider reducing my position in Exor if its price starts trading at over 50% premium to NAV, although a lot will depend on alternative investment options and portfolio composition.

To be fair, I think for Exor to start performing better, it has to have more growth businesses in its portfolio. Companies that offer a unique product or service in a growing market and can deliver this with great economics (high margins and low capital needs). Ferrari has exceptional economics, but its growth options are limited. Stellantis has been a tremendous value stock with great cash returns for Exor and other shareholders, but it cannot deliver 20%+ returns over the long term. It is a highly competitive business with razor-thin margins and a high pace of technological changes (high R&D needs).

I think the current portfolio has the potential to grow at up to a 10% annual rate over the mid-term, but to achieve higher growth in profits and value, Exor has to add new sizeable businesses. I hope to achieve better returns as, on top of the business growth, Exor's stock can reduce its discount to NAV.

I have not been adding to my original position for two main reasons. Firstly, because of the limited growth potential of the current portfolio and, secondly, because the current position already has a 15% weight in my portfolio.

DISCLAIMER: this publication is not investment advice. The main purpose of this publication is to keep track of my thought process and improve my decision-making process. Readers should do their own research before making decisions. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. The author held a position in the stock discussed above at the time of writing. Please read the full version of Disclaimer here.