17 September 2023

As a shareholder of Exor, I am happy to flag that the company announced €750mn tender offer for its shares as part of a new €1bn buyback programme. During the conference call, the CFO of Exor, Guido de Boer, said that the tender offer mechanism was chosen due to its speed. In other words, it would take Exor about three years if it spent the same amount buying shares on the open market. The offer opened on 14 September 2023 and will end on 12 October 2023. Qualifying shareholders will be able to select the price at which they wish to tender their ordinary shares in a price range extending from a discount of 3% up to a premium of 10% over the reference volume-weighted average price (VWAP). You can find all the details of the offer in the announcement.

Slightly disappointing, however, was the announcement that Giovanni Agnelli BV would tender €250mn worth of shares “with the objective of reducing its net debt position”.

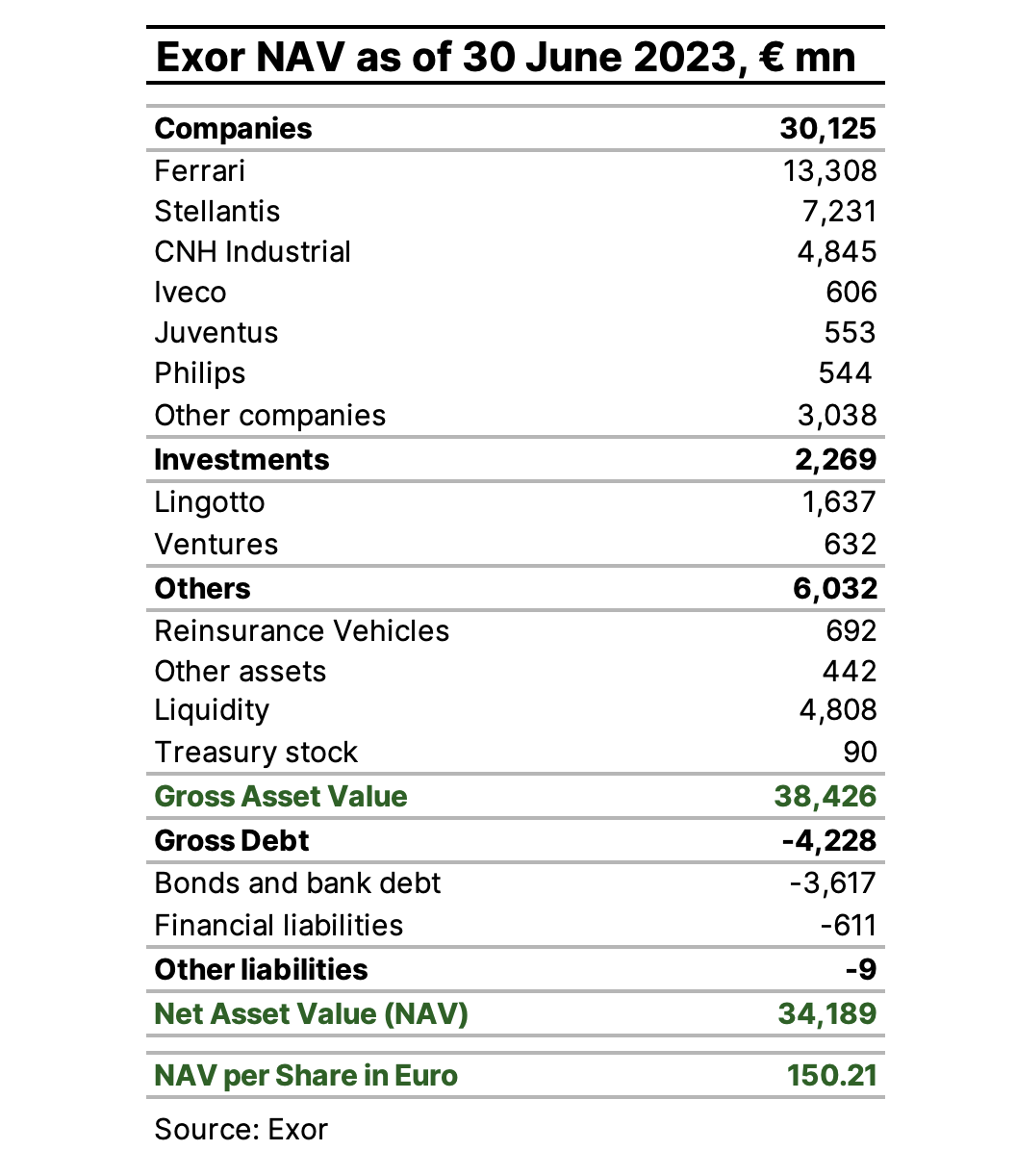

In general, Exor continues to trade at a significant discount (over 40%) to its NAV.

Slightly disappointing, however, was the announcement that Giovanni Agnelli BV would tender €250mn worth of shares “with the objective of reducing its net debt position”.

In general, Exor continues to trade at a significant discount (over 40%) to its NAV.

Interestingly, the company has been quickly transforming over the past few years. Even though the auto sector makes up the bulk of its portfolio, it no longer owns PartnerRe (reinsurance business). It has spent over €1.6bn to expand in the healthcare sector. Management remains committed to investing in three key sectors: Healthcare, Luxury and Tech.

In short, Exor deserves a more detailed review and a fresh take on valuation.

In short, Exor deserves a more detailed review and a fresh take on valuation.

DISCLAIMER: This publication is not investment advice. The primary purpose of this publication is to inform and educate readers about the stock market. Readers should do their own research before making decisions and always consult with professional advisors. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. Please read the full version of the Disclaimer here.