This is a long overdue update on Exor’s NAV estimate and a summary of key developments. I am going to skip operational and financial results of its key operating subsidiaries which have expectedly benefited from the recent economic recovery and which can be easily tracked via their respective websites. Exor’s share price has appreciated by c. 70% since April 2020 (when I posted my first thesis) reaching my original per-share valuation (EUR84) and is on track to reach my ‘normalised’ valuation of EUR102. My updated valuation (EUR124) is c. 20% higher than the previous ‘normalised’ estimate and I continue to view Exor to be still significantly undervalued (discount of current market price to NAV is 31%). I am a little puzzled by the decision to divest PartnerRe and look forward to learning more about this deal and overall strategic priorities of the company at Exor’s future Investor Day (previously scheduled for 30 Nov 2021).

High level view on Exor

Before going into specific details, I would like to take a moment to appreciate what transformation Exor has achieved over the past decade. Starting as an investment vehicle behind the Agnelli’s family which held its century-old stake in Fiat, Exor has transformed into a diversified holding with growing presence in Luxury Goods and Venture Capital (VC) / Technology sectors. I find it important to highlight that the share of a cyclical auto sector in Exor’s NAV has declined from almost 100% in 2010 to about 40% now. I expect this share to decline further as VC-backed businesses and Luxury Goods will likely grow faster.

While previous value creation at Exor was mostly driven by turnaround and value unlocking at Fiat (including two strategic mergers and several spin-offs), the next decade will likely be around growing businesses in the Luxury Goods as well as Technology sectors and integrating them with existing assets in company’s portfolio. There is, of course, no guarantee that Exor's team will be equally successful in the future, but at current conservative valuation (31% discount to NAV) and with good track record, I think that chances are reasonable.

Valuation

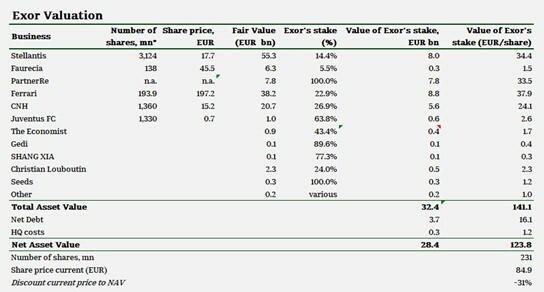

To value, Exor I use market prices for its stakes in publicly listed subsidiaries . These listed businesses account for 70% of Exor’s asset value (EUR100.5) which limits subjective element in this valuation. I use transaction values for other assets with PartnerRe being the biggest ($9bn based on new Covea acquisition price or EUR33.5 per share of Exor).

Surely, market values of listed subsidiaries can fall negatively impacting the NAV estimate. But all key subsidiaries seem to be valued reasonably relative to peers and their own fundamentals. Besides, they benefit from strategic involvement of Exor which should help them grow their value over the long run. Former Fiat (later transformed into Fiat-Chrysler or FCA) is a good example of this strategic value creation. My assumption is that if market values exceed intrinsic values of those assets, then Exor will take advantage of this situation through mergers, share sale or extra cash distributions. This is one of the benefits of partnering with family-run companies with good track record in capital allocation.

Key upside comes from the following factors:

· Narrowing down of the discount of the market price to the NAV (e.g. if the discount drops from 31% to 10% and NAV stays the same then the share price would appreciate by 30%).

· Increase in intrinsic value of key subsidiaries (this could vary but should not be less than 10% which broadly reflects long-term return on capital and also matches GDP growth, inflation and some operational expansion). Some value can also be created through corporate optimisation (e.g. at Stellantis post FCA-Peugeot merger or a forthcoming break-up of CNH).

· Faster growth of early-stage investments such as businesses backed by Exor Seeds (c. $250mn of actual investments and fair value of EUR324mn). 30% of businesses backed by Seeds have valuations over $1bn, according to Exor, with another 34% of businesses valued at $100-1bn.

· Capital allocation which includes new investments, partnerships, divestments as well as share buyback. This can now play a key role Exor’s value creation in the next 5-10 years as previous 10 years were mostly around unlocking value at former Fiat through simplification of shareholder structure, deleveraging, mergers, spin-offs and special dividends. Now, if acquisition of PartnerRe by Covea goes through, Exor will have $9bn of cash (27% of its NAV) to deploy.

Key developments over the past 12 months

There have been four major developments at Exor over the past 12 months which are 1) a new $9bn deal to sell PartnerRe to Covea; 2) completion of the FCA-Peugeot merger and creation of Stellantis; 3) increased exposure to Luxury Goods and China; and 4) growth of Tech investments and rising importance of Exor Seeds. Exor seems to have continued taking steps to move away from being mainly a cyclical auto holding company to a more modern company with exposure to new fast-growing sectors of the economy. In short, I am quite satisfied with the progress at Exor and its future outlook.

New PartnerRe deal

This looks to be the biggest development based on the immediate monetary impact. On 28 October 2021, Exor agreed to sell PartnerRe to Covea for $9bn. The deal is expected to close in mid-2022. Even though this transaction served to highlight the value of one of Exor’s key assets (and caused its share price to rise 13% in just two weeks after the news came out), as a long-term partner I am less excited about it unless I can see how this deal creates value.

The price looks attractive given PartnerRe’s Book Value of $7bn as of 1H21 and translates into 29% premium to Book Value. PartnerRe earned c. $0.6bn of net income excluding COVID-19 related losses in 2020 and c. $303mn of net income in 1H21 (excluding FX losses). Acquisition price translates into c. 15x PE multiple which looks healthy for a business generating sub-10% ROE.

It is also worth noting that Exor purchased PartnerRe for $6.72bn in March 2016. After receiving $9bn together with $711mn actual dividends paid to Exor so far, the latter would make 45% total return on its original investment. Taking into account 5.5-year holding period, annualised returns are actually quite low (just about 7%).

One aspect of Exor’s business model which attracted me was its strategy to use insurance float as a source of capital for new investments borrowing from Buffett’s playbook. It is thus somewhat puzzling to see Exor’s reversing its course now.

I look forward to better understanding the true motivation behind this deal, but so far my explanation is as follows.

Insurance is a much more challenging business than it first appears. Even though Warren Buffett has been quite vocal about the benefits of running an insurance company, few recent ventures have actually succeeded. Mohnish Pabrai spoke in spring 2020 on the challenges he faced after launching an insurance business and how relieved he was after selling it.

It is generally a commodity-like business in which it is very hard to differentiate on quality of the product with price becoming the key factor. A group of ‘dumb’ competitors could try to win new business by offering much cheaper policies stealing your business. Moreover, the extent of problems will not be known for a while and only a few years later these competitors may start to struggle to meet rising claims left with insufficient funds.

So, I think, one reason for this decision could have been related to this challenge, namely not being able to run this business efficiently enough. In its latest shareholder letter (published in April 2021), Exor’s CEO and Chairman, John Elkann, partially admitted this writing that “despite this progress in creating a much leaner organization and achieving top quartile investment results, PartnerRe’s underwriting profitability is still far from where we want it to be”. To remind, since Exor took over PartnerRe combined ratio in the Non-life segment has been below 100% only once (94% in 2016). The ratio was 106% and 100% in 2020 and 2019, respectively, and 102% in both 2017 and 2018.

I think another reason for going ahead with this transaction is Exor’s ability to utilise insurance float in its investment process even after closing the deal. According to a joint press-release issued on 28 October 2021, Exor and Covea plan to continue their reinsurance cooperation “with Exor acquiring from Covea interests in special purpose reinsurance vehicles managed by PartnerRe for approximately $725mn. These vehicles will invest in property catastrophe and other short-tail reinsurance contracts underwritten by PartnerRe. Covea, Exor and PartnerRe would also continue to invest jointly in Exor-managed funds with reinforced alignment of interests”.

If a deal could make PartnerRe stronger as part of a larger entity (scale matters a lot in ability to win business in the reinsurance business as has been flagged by Buffett) and let Exor transfer core insurance responsibilities to a sector player while focusing on what it can do better (investing), then, perhaps, such deal is worth pursuing.

Completion of FCA-Peugeot merger

The deal between FCA and Peugeot first announced in October 2019, faced several obstacles not least because of COVID-19 pandemic. At some point media reported that FCA’s special dividend was challenged by the Italian government which provided loan guarantee to FCA and which wanted the company to invest more in Italy (in the end, special dividend was cut from $5.5bn to $2.9bn).

Taking into account that a previous attempt to merge with another European auto company (Renault) failed, it was quite encouraging to see the deal with Peugeot closing in January 2021.

Both companies have European roots and ties to their founding families – a combination which makes for a good cultural fit. There are, of course, many questions about the future strategy especially in the EV segment. Decision-making speed and M&A activity may also change as two families will try to find consensus.

Luxury Goods and China

In the past year, Exor has increased its focus on Luxury Goods segment which has been facing multi-decade trend in rising consumption driven by rising global wealth and changing consumer patterns in Emerging Markets. This segment is known for exceptionally high margins and returns on capital which provide good conditions for generating shareholder value. It is not surprising that one of the world’s richest man, Bernard Arnault, is the controlling shareholder of the world’s largest fashion conglomerates (LVMH).

Exor has already had presence in this segment through its 22.9% interest in Ferrari – one of the rare businesses where customers have to wait months to have the right to buy a luxury car worth $1mn and above. I have listed key steps undertaken by Exor in growing its exposure to the Luxury Goods industry:

· In September 2021, Exor and Ferrari teamed up with a former Apple’s designer (and a close friend of Steve Jobs), Jony Ivy to explore a range of creative projects in the business of luxury.

· In June 2021 Exor and The World-Wide Investment Company Limited (“WWICL”), Hong Kong’s oldest family office, created a partnership between two multi-generational entrepreneurial families to invest in and support the global development of medium-sized Italian companies specialising in consumer goods excellence. The new company, called NUO S.p.A., contributed equally by its founders, will be endowed with initial permanent capital of EUR300mn.

· In March 2021, Exor agreed to invest EUR541mn for a 24% stake in Christian Laubutin, a founder led French luxury goods company with retail presence in 30 countries. Exor plans to help the company to accelerate its growth.

· In December 2020, Exor acquired 77.3% interest for EUR80mn in SHANG XIA, a leading Chinese luxury lifestyle brand which was founded by the Chinese designer Jiang Qiong Er and Hermes 10 years ago. Exor’s strategy is to try to take this Chinese brand globally.

It is important if Exor’s exposure to the Luxury Goods segment will remain just at an investment level or will go deeper into cooperation with Ferrari and other portfolio brands allowing for synergies and development of new products.

Tech / VC

Exor founded Exor Seeds in 2017 to invest in early-stage businesses which is similar to a Venture Capital (VC) model. In September 2021, Exor appointed Diego Piacentini as Adviser and Chairman of its Seeds business. Piacentini previously worked at both Apple (1987-2000) and Amazon (2000-2016) and could bring important experience in building new technology companies.

To quote from Elkann’s 2021 Letter to Shareholders:

“In creating Exor Seeds we have acted like a start-up in making early assumptions about how we can play a valid and valued role in relation to these early-stage companies and then to learn and iterate quickly. We discovered that founders appreciated Exor’s purpose, values and our history as owner operators. Our permanent capital, global reach and public markets insight (both as investors and as operators) also give us an edge over traditional VC funds in an increasingly competitive market”.

“Looking ahead, 2021 will be a pivotal year for Exor Seeds. We are starting to see a positive ‘flywheel’ effect from the domain expertise and deep relationships that we have built with founders, VC investors and our companies. Although deal flow slowed with the onset of the pandemic, it picked up through the second half of 2020 and has since accelerated. Private companies have raised twice as much capital since the start of the year compared to the same period last year, driven by the speed of adoption and evolution of technology across industries. We are now focusing on higher conviction ideas within our “strike zone”.

We are particularly excited about the expanding opportunities in mobility, fintech and healthcare. These sectors are undergoing massive structural shifts that we believe will create new, large category winners. For example, within mobility, electric vehicles, next-generation air and space transport, drone delivery, fleet digitization, autonomy and all the underlying infrastructure tied to it (renewables, batteries, grid infrastructure etc.) are upending, and in some cases revitalizing, legacy industries. As the largest shareholders in Stellantis and Via Transportation, we are at the heart of this change and have a unique opportunity to participate in it over the next decade.

We are also seeing European tech “coming of age” with large public companies like Adyen and Spotify fostering a deep talent ecosystem. New unicorns like Klarna and UiPath among others are emerging as global leaders on a par with companies that historically emerged mostly out of Silicon Valley, as European entrepreneurs are dreaming bigger. We believe this sea-change in attitude and opportunity is in its early stages, and we are actively involved in it. Two of our largest investments in 2021, for example, are building European champions in real estate tech and healthcare. The establishment of Exor Seeds has, therefore, not only given us a seat at the table but more importantly, is connecting Exor and its companies with young and talented founders who share our purpose and values”.

So far, Exor has invested about $250mn in VC-type assets and about 30% of businesses it has backed are valued at $1bn or higher (and 34% have estimated values in $100-$1bn range). During 1H21, Exor invested EUR122mn into Seeds. In addition to that, Exor invested a further EUR126mn in Via Transportation increasing its interest by 8% to 16.9%. Seeds have backed over 40 startups globally.

Clearly, just like in the case of Luxury Goods, actions are welcome but they do not guarantee more value creation. In fact, some money will be inevitably lost. I am particularly sceptical about Via Transportation since it does not have market-leading positions which is critical for such models. I applied a 50% discount to Exor’s value of its stake in Via Transportation (estimated at EUR350mn).

I have used historical transaction values for Luxury Goods and Seeds businesses in estimating NAV of Exor. Their combined value is less than EUR5/share. However, this area could become a meaningful contributor to future NAV growth of Exor if at least some of those investments become successful and especially if Exor succeeds in integrating them its own ‘eco-system’.

Other developments

I would also like to flag that back in 2018 Exor established a Partners Council. The idea was to bring external experience to executives of Exor’s companies especially in evaluating new opportunities. Jony Ive has joined this Partners Council in 2021. The council has also recently added Daniel Ek, founder of Spotify Technology, as well as Ruth Porat, chief financial officer at Google parent Alphabet Inc. Among its other members are Joe Tsai (co-founder of Alibaba) and Jorge Lemann (co-founder of 3G Capital).

This Partners Council is another reason why I decided to invest in Exor. Few investors have such benefit of accessing world's leading executives and entrepreneurs which undoubtedly broadens one's investment opportunities. Of course, there is no guarantee that that meeting those executives will actually allow Exor to generate more value. After all, many great companies were launched in garages, but let us view this, at least, as an option value offered by Exor.

The company also took advantage of record low interest rates and in January 2021 issued 10-year bonds for a nominal amount of EUR500mn with a fixed annual coupon of 0.875%. The company partially refinanced its more expensive and shorter duration debt by repurchasing EUR298mn (out of EUR1.4bn) worth of bonds due in 2022 (2.125% coupon) and 2024 (2.5%).

Finally, I would like to make a short note that Exor has been quite passive with buying back its shares. It made some purchases only in 2H21 in the amount of EUR28.6mn paying on average EUR47.25 per share. The company bought no shares in 1H21. At the same time it spent almost 10x more and bought back its shares at higher price in 2019 (EUR269mn at EUR56.77, respectively).

I guess making more investments into new sectors and countries (discussed above) can partially explain less buyback activity. This is where the difference with Berkshire lies. The latter is c. 30x bigger and finds it more difficult to find acquisition targets that can make a meaningful impact on its NAV, while being smaller and more nimble Exor can probably find more attractive opportunities even in the current environment. Clearly, for shareholders of Exor buyback alone does not matter. What matters is how high returns management generates on new investments. Probably, investing in fast growing sectors could generate better returns than buying back its own stock even if it trades at a discount to its intrinsic value.

DISCLAIMER: this publication is not investment advice. The main purpose of this publication is to keep track of my thought process to better assess future information and improve my decision making process. Readers should do their own research before making decisions. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. The author held a position in the stock discussed above at the time of writing. Please read the full version of Disclaimer here.